I’d started writing this article earlier but see that Dylan McConnell’s also picked up on this here.

—

Hot on the heels of my earlier article from ~07:50 this morning I noticed that (from 08:20 to 08:30) there was a significant drop in Available Generation right across QLD

1) it dropped from 9,037MW to 7,731MW over that 10 minute period

2) which is a total decrease of 1,306MW

3) or a major 14% of what was available at the time.

One more thing that occurred this morning to highlight that this ‘2022 Energy Crisis’ still has a long way still to ride…

(A) The drop in Available Generation

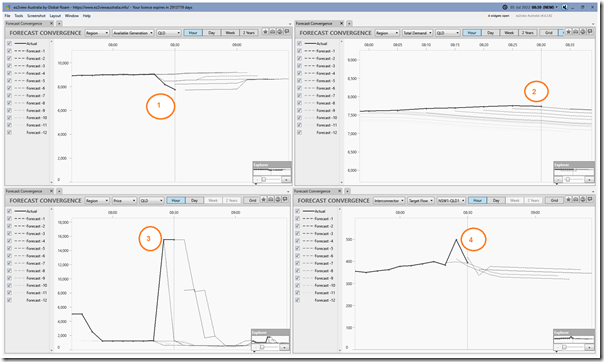

Using four instances of the ‘Forecast Convergence’ widget inside the same window we can highlight a number of different things.

With respect to the numbered annotations we see:

1) The ~1,300MW drop in aggregate Available Generation to 08:30 was not forecast in advance.

2) In a double-whammy we also see that AEMO’s successive forecasts (that ‘Market Demand’ would begin declining at that point) turned out to be incorrect … instead this metric increased from 7,727MW at 08:20 to 7,755MW at 08:25 before dropping to 7,736MW at 08:30:

(a) which is 93MW higher than the 7,643MW forecast produced at 08:20

(b) … but note the forecast produced at 07:35 was that it would be only 7,053MW (i.e. 683MW lower than it actually ended up being at 08:30).

3) These two combined to mean the price spiked to the $15,500/MWh Market Price Cap ‘out of the blue’

4) We see also that imports from NSW over QNI were ~100MW higher than forecast beforehand (discussed more below regarding violation).

I see on Dylan’s thread above that others have speculated that this was due to the shut-down of the Wivenhoe generator – but the size of the drop in Available Generation is significantly more than the aggregate size of the two Wivenhoe units (and there was only one unit running at the time and it did switch off at that time, perhaps to conserve limited water stored in the upper pond).

Hence we conclude that there must have been more than just that factor involved.

(B) Implications of this Drop

Understandably this triggered a few different outcomes, including these two:

(B1) Actual LOR2

From 08:30 the AEMO saw an ‘Actual LOR2’ condition existing in the QLD region … as per Market Notice 99972:

——————————————————————-

MARKET NOTICE

——————————————————————-

From : AEMO

To : NEMITWEB1

Creation Date : 05/07/2022 08:49:26

——————————————————————-

Notice ID : 99972

Notice Type ID : RESERVE NOTICE

Notice Type Description : LRC/LOR1/LOR2/LOR3

Issue Date : 05/07/2022

External Reference : Actual Lack Of Reserve Level 2 (LOR2) in the QLD Region on 05/07/2022

——————————————————————-

Reason :

AEMO ELECTRICITY MARKET NOTICE

Actual Lack Of Reserve Level 2 (LOR2) in the QLD region – 05/07/2022

An Actual LOR2 condition has been declared under clause 4.8.4(b) of the National Electricity Rules for the QLD region from 0830 hrs.

The Actual LOR2 condition is forecast to exist until 0900 hrs.

The forecast capacity reserve requirement is 509 MW.

The minimum capacity reserve available is 401 MW.

AEMO is seeking an immediate market response.

Manager NEM Real Time Operations

——————————————————————-

END OF REPORT

——————————————————————-

This condition was cancelled from 09:20 (notified in MN 99976 at 09:20:14 … so 20 minutes later than forecast above.

(B2) Constraint Violation

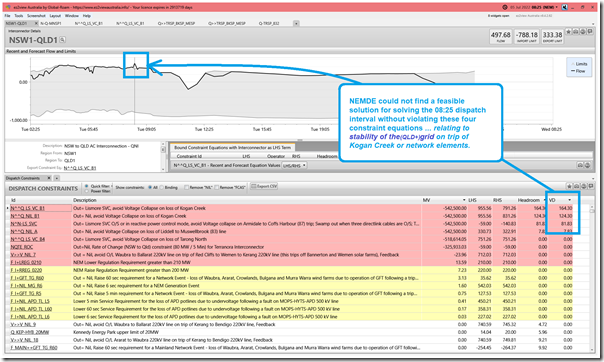

In an earlier article we’ve written about how ‘desperate times call for desperate measures’ with respect to QNI being required to dispatch flows north at a rate greater than AEMO (or NEMDE) would ordinarily be comfortable with … and Allan discussed this further on 17th June. This morning we saw another example of this, with exports (to QLD) over QNI being above what the export limit would normally allow for:

1) these export limits being to reduce the risk of voltage collapse on trip of Kogan Creek or loss of network elements in northern NSW.

… one of them being the ‘N^^Q_LS_VC_B1’ constraint equation featured in other articles recently.

2) hence readers should understand that this is not something AEMO or NEMDE would do lightly.

Here’s a snapshot from ez2view containing two widgets (both ‘Interconnector Details’ and ‘Dispatch Constraints’ widgets) at 08:25:

This is something else to watch out for through the rest of the day, and in the coming days …

(C) Update on the Cumulative Price

As I hit publish (at ~12:55) the Cumulative Price is at $1,284,548 … so just a little more than $100,000 under the increased CPT (which was raised to $1,398,100 for the financial year in conjunction with the increase in the Market Price Cap). Don’t forget you can watch how this trends through the afternoon/evening in this Market Dashboard, for those who are registered.

Be the first to comment on "Significant (~1,300MW) drop in Available Generation in QLD on Tuesday morning 5th July"