With news media focus continuing on the various replacement options on Liddell’s plant, worth a quick note that the AER received an application from AGL Energy noting that they wanted to close unit 3 earlier than previously scheduled … and indeed only 11 months away!

The AER notes:

On 30 April 2021, the Australian Energy Regulator (AER) received an application from AGL Macquarie Pty Limited (AGL) seeking exemption from the generator notice of closure obligations under section 2.10.1 of the National Electricity Rules.

AGL’s application seeks exemption to bring the closure date of Liddell power station Unit 3 forward a year to 1 April 2022. Contingent on exemption being grants AGL will subsequently delay the closure date of Liddell power station unit 4 to 1 April 2023. AGL has indicated that it believes unit 4 to be a more reliable generating unit than unit 3. The AER will publish its decision in July 2021.

With the document here:

This is certainly the first time I can remember seeing a notice like this … though I have noted before some scepticism about the workability of the ‘notice of closure’ requirement initially proposed in the Finkel Review.

(A) What can we see of Liddell unit performance?

Given that we have the electronic copy of the Generator Statistical Digest 2020 close at hand, I thought it would be useful to quickly look at what we see of the 2 units mentioned (i.e. unit 3 (less reliable) and unit 4)

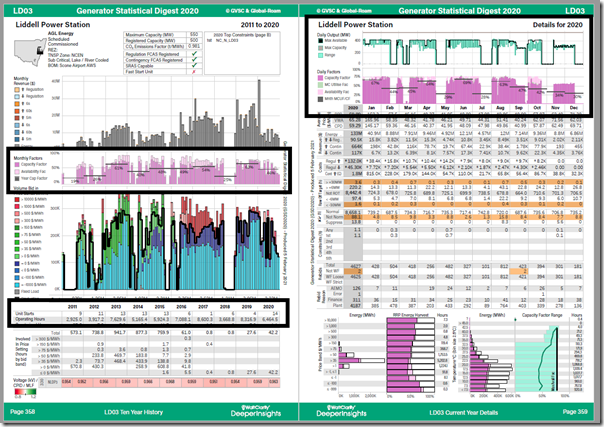

(A1) Liddell Unit 3:

Here’s a full view of what’s presented over both the (10-year) ‘A’ Page and the (1-year) ‘B’ Page from the GSD2020 for Liddell unit 3:

Don’t forget you can click on the image to open a larger view!

I’ve highlighted a few things to look at in particular:

1) 2020 was a particularly bad year – 14 discrete starts (which would be part of the reason why there were ~2,000 hours operated than 2019).

2) Common to all Liddell units, operations are limited well below Maximum Capacity (part of an attempt to get them to run with fewer tube leaks, we believe). This drops the capacity factor achievable (monthly shown on the left and daily on the right).

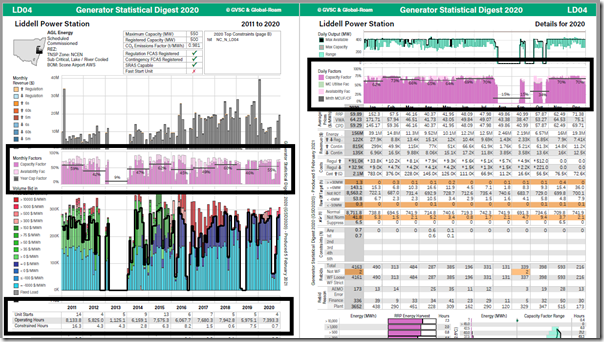

(A2) Liddell Unit 4:

Comparing with Unit 4 we see that the unit certainly did have a better year in 2020:

Still not that great over a 10-year period, though!

(B) Assessing changes in reliability across all 48 x coal units

As we noted in the Generator Report Card 2018, there were 48 x coal-fired units remaining in the NEM at 31st December 2018 … and those units supplied ‘just below 75% of ‘grid energy’ on a 12-month trailing basis at 31st December 2018’.

The Liddell units are closing soon (with Unit 3 possibly sooner than initially thought), and the percentage contribution of coal has declined from that point, though is still dominant.

For that reason, they way they perform in the years ahead (until they all close – whenever that might be) will continue to be critical – hence a significant focus in our upcoming Generator Insights 2021 update (work underway on this particular front already).

Hardly surprising. One of the most difficult engineering challenges is to wind down older coal fired plant ahead of retirement. It involves the application of much good engineering judgement to get right as there will be emerging risks known to those trying to operate the plant. Historic performance is not necessarily indicative of future performance where a particular issue may have been recently identified. No one operating with a commercial mindset is going to retire a pristine plant – maintenance spend is sensibly rationed at the expense of reliability as the plant winds down over several years. The trick is to do it safely. There are big bits of high pressure and temperature kit in a power station and some of it heavy bits spinning at high speed. A healthy dose of conservatism is justified.

The real risk here is that the economics of all coal units around Australia is being seriously damaged by renewables causing their rapidly declining capacity factors. That squeezes available maintenance money and that will inevitably play out as reduced reliability. Someone had better start thinking about how the market signals for firming capacity…..and soon.