Note, with respect to this article (and others on WattClarity) that all times are in ‘NEM Time’.

Last week experienced price volatility over several days in the week in the NSW region of the National Electricity Market:

1) Monday 14th December was subdued

2) There was a single price excursion in the 12:50 dispatch interval on Tuesday 15th,

3) Wednesday 16th December saw a few discrete excursions (at 08:10, 12:25 and then 13:15 to 13:35),

4) Thursday 17th December was the most volatile day, with a first blip at 14:20 but then a sustained bout of volatility starting 15:35 and continuing to 16:40.

(a) It was a day when Reserve Trader was triggered … certainly a surprise to me!

(b) One of the contributing factors on Thursday was the ‘transformer issue’ at Liddell unit 3 which seriously injured a person, and brought the unit down for a long-term outage.

5) Friday 18th December saw a single price spike at 13:10.

Some of these spikes (but not the largest) also coincided with a jump in QLD prices. These events generated a degree of interest in the mainstream media, and commentary online. It also triggered some questions for me – so, I’ve taken a quick look.

(A) A reminder about complex systems

Let’s start with a reminder that, in a complex system like the National Electricity Market, it’s quite rare that there is a single ‘cause’ to any outcome … such as with the ‘why did we see price volatility last week in NSW?’ question we’ve been asked (and asked ourselves).

Others, perhaps a bit more pointedly, phrase the question in terms of a more inflammatory ‘who can I blame for what happened?’ … and it does not surprise us that these people tend to gravitate to the extreme ends of the Emotion-o-meter. That’s not really where we sit.

I’m posting two separate articles today to address (separately) two of the apparent factors … but keep in mind that there were at least five, in no particular order:

| Factor 1 = Coal Unit Performance |

In another article coincidentally also today, we start to explore some of ways in which coal unit performance in NSW contributed to the volatility outcomes. |

| Factor 2 = Performance of Wind and Large Solar |

In this article today, we highlight what happened with Wind and Large Solar production, in aggregate, across NSW – particularly how it was significantly lower on Tue 15th, Wed 16th and Thu 17th December than in the days before that, or the days that followed. |

| Factor 3 = Constraints on VIC-NSW … and generation in southern NSW |

Guest author, Allan O’Neil, noted in a comment on the end of this short article about Thursday 17th December that one of the factors was: ‘transmission constraints between southern NSW and the rest of the state, due to outages of some important 330kV lines – again I’m not sure if these are planned or forced outages’ Perhaps food for another article, especially in terms of how the particular constraint equations (and bidding behaviour) delivered an outcome where NSW was exporting to VIC at a time of local (relative) supply shortage, and against the inter-regional price differential. |

| Factor 4 = Constraints on QNI (on some occasions) |

On the occasions when the NSW price spiked and the QLD price did not, then constraints on the QNI interconnector were an issue. |

| Factor 5 = Demand in NSW |

Those ez2view clients accessing their copy of this 14-day trend for NSW can see that last week the temperatures rose in NSW particularly on Thursday 17th December, but even in this case the ‘Demand and Non-Scheduled Generation’ figure (an approximation of Operational Demand that works on a dispatch interval basis) only reached 11,000MW … which is 3,500MW or so below the all-time record. However, even though demand was relatively low, the fact that it was higher than it had been forecast to be (as shown with ‘Forecast Convergence’ in this article on Thursday 17th Dec) would be one reason why the price volatility occurred. |

Readers should note that there are almost certainly more than 5 contributing factors. I listed (just) 5 in order to illustrate that there’s clearly more than just a single factor.

(B) Drop in Wind and Large Solar in NSW

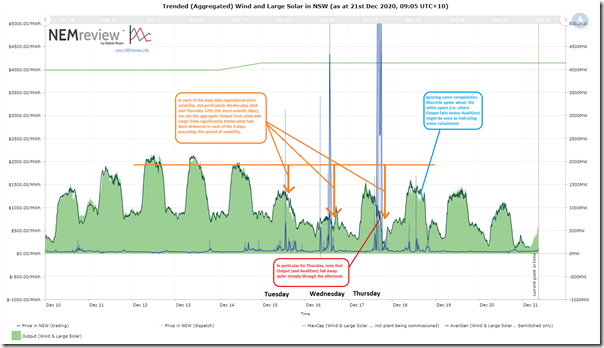

For Wednesday’s article, I included a chart trending aggregate production (and energy-constrained availability) across all Wind and Large Solar plant in NSW through until the Wednesday afternoon price spike. Because Thursday was the more critical period (a longer period of volatility, and because Reserve Trader was triggered) I have included an updated view here (your copy of the original query is here, for those who are licensed to NEMreview):

There’s always a problem in calculating numerical comparisons – because of the need to establish a ‘compared to what’ baseline.

In the chart above we can see that aggregate output was fairly strong and consistent across each of Friday 11th, Saturday 12th, Sunday 13th and Monday 14th. As illustrated on the image, compared to that type of output level, we see:

1) On Tuesday 15th, aggregate production from Wind and Large Solar was at least 500MW lower (i.e. equivalent to the loss of a sizeable coal unit);

2) On Wednesday 16th December, aggregate production was quite poor (worst for the week) … at least 1,000MW lower (roughly two coal units);

3) On Thursday 17th December, aggregate production was better than the day before, but still well off the peak:

(a) it was at least 1,000MW below by the time of the last period of price volatility;

(b) as noted on the chart, on this day it’s noted that the output fell away quite sharply through the afternoon … which unfortunately coincided with when Reserve Trader was being triggered;

4) On Friday 18th December output had recovered somewhat, though still not up to the peak of the prior weekend. This would be one factor leading to reduced volatility on Friday, with only a single spike up above $1,500/MWh.

That’s all I have time for today…

Be the first to comment on "How aggregate production from Wind and Large Solar in NSW dropped last week – one factor contributing to price spikes and Reserve Trader"