Another quick (and incomplete) post today noting a couple things to follow from what happened Tuesday, and then what happened Wednesday.

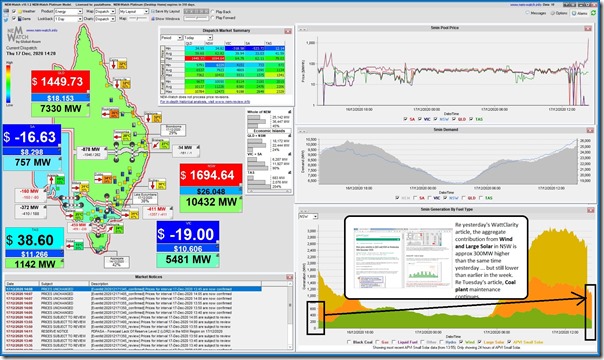

As tweeted earlier, here’s a snapshot from NEMwatch v10 (the (our entry-level dashboard) highlighting the dispatch price spike in NSW (and also QLD) for the 14:20 dispatch interval on Thursday 17th December 2020:

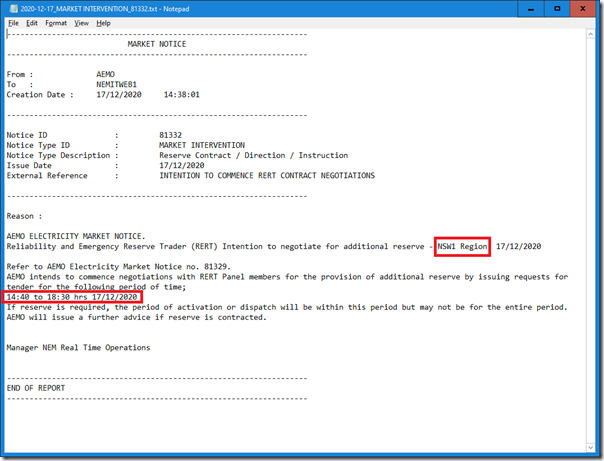

At 14:38 the AEMO published Market Notice 81322 noting that they had commenced negotiations with their RERT Panel Members for the provision of ‘Reserve Trader’ services for the period until 18:30 this evening:

This was in conjunction with an actual LOR1-level (i.e. the least severe) Low Reserve Condition warning (discussed in Market Notices 81331 and 81333) out until 20:00.

Currently there are 6 coal units offline in NSW2:

1) 5 units from AGL MacGen, and Mt Piper unit 1;

2) At last part of this will be because of catch-up maintenance (i.e. delayed due to COVID restrictions earlier in the year).

This is one reason that the supply/demand balance is tighter than it would normally be … especially with La Nina effects probably dampening demand expectations a little.

However as noted yesterday it is also a factor that aggregate output from Wind and Large Solar is considerably lower than what it was during daylight hours on Fri 11th, Sat 12th, Sun 13th and Mon 14th (~300MW higher today than yesterday, but still ~1000MW down in aggregate).

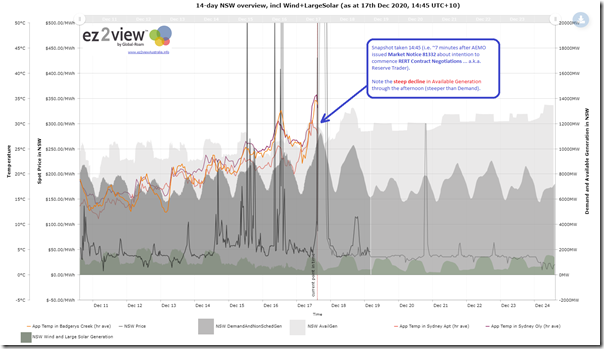

To illustrate what will be one of the reasons behind the call for Reserve Trader, the above trend (captured at 14:45 in the ‘Trends Engine’ component of ez2view) shows a 14-day view for NSW … 7 days backward and 7 days forward.

1) As noted in the image, pay particular attention to the steep decline in Available Generation capacity through this afternoon, which appears to be steeper than the decline in Demand. Part of the reason Available Generation drops in the afternoon is because of the waning impact of Large Solar generation, but there may be other reasons as well (we are unable to tell in real time, as that data is not public).

2) For ez2view licensed clients, you can access your copy of this trend here to track how this unfolds.

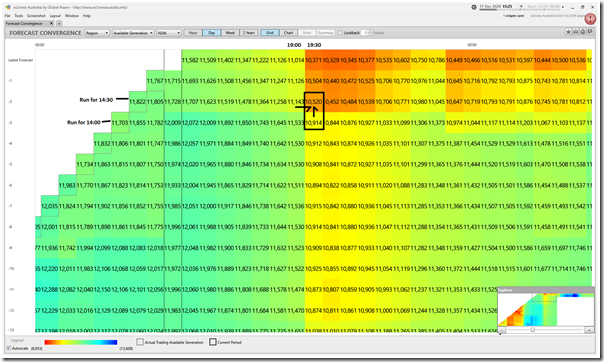

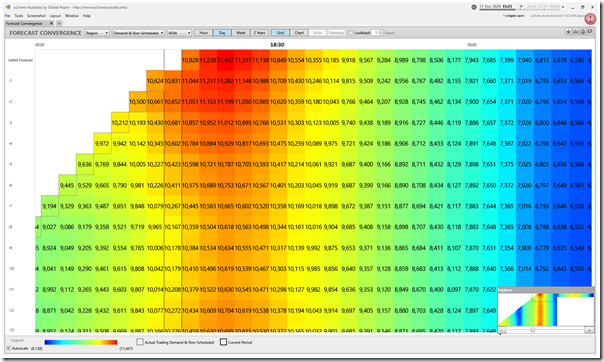

Here’s a snapshot from the ‘Forecast Convergence’ widget in ez2view that highlights a concerning drop in Available Generation from the 19:30 trading period this evening:

Flipping to look at ‘Demand and Non-Scheduled Generation’ (see here for the gory details of demand) we see the forecast in Demand is getting hotter in successive P30 forecast runs!

Oh, and as a final(?) note, in Market Notice 81339 (published 15:39) that Reserve Trader had been dispatched:

MARKET NOTICE 081339

________________________________________________________________________________________________

Notice ID 81339

Notice Type ID Reserve Contract / Direction / Instruction

Notice Type Description MARKET

Issue Date Thursday, 17 December 2020

External Reference RERT DISPATCHED

________________________________________________________________________________________________

AEMO ELECTRICITY MARKET NOTICE.

AEMO Intervention Event, Reliability and Emergency Reserve Trader (RERT) – NSW1 Region- 17/12/2020

Refer AEMO Electricity Market Notice no. 81332

AEMO has dispatched/activated reserve contract(s) to maintain the power system in a Reliable operating state.

The reserve contract(s) was dispatched/activated at 17:20 hrs 17/12/2020 and is forecast to apply until 18:30 hrs 17/12/2020

AEMO has implemented an AEMO intervention event for the duration the reserve contract(s) is dispatched/activated/

To facilitate the RERT process, constraints commencing with the following identifiers may be evident at various times in dispatch,

#RT_NSW1

Manager NEM Real Time Operations

… and here I was thinking this lead-into Christmas might not be so eventful…

————

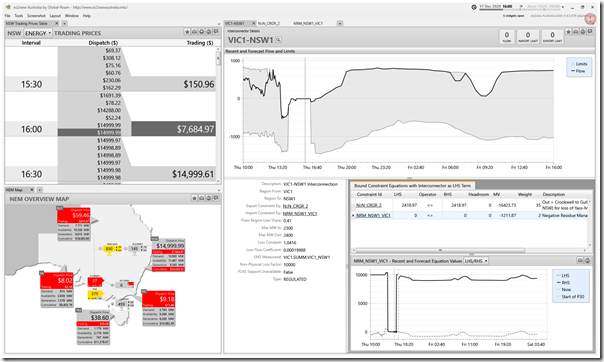

PS1 at 16:04 Flows clamped between VIC-NSW

Worth also noting that (from 14:40) the flows between VIC and NSW have been clamped at 0MW because of two separate transmission constraints:

‘N::N_CRGR_2’ had been bound from 13:35, and relates to an outage on Crookwell to Gullen Range(3H) transmission line.

‘NRM_NSW1_VIC1’ has been bound since 14:25, but restricts flow south.

Paul

It looks like common factors in all the NSW volatility this week are:

– significant numbers of coal-fired units on outages, I’m unsure to what extent these are planned maintenance vs breakdowns

– transmission constraints between southern NSW and the rest of the state, due to outages of some important 330kV lines – again I’m not sure if these are planned or forced outages.

While these price spikes were occurring, the transmission constraints were forcing flows OUT of southern NSW into Victoria, until “Negative Residue Management” constraints were invoked to wind down generation in the south of NSW and prevent further counterprice flows.

In essence, despite the reduced availability of coal, wind and solar generation mentioned in your posts, there was still sufficient available generation in NSW + imports from Qld to comfortably meet demand, but the transmission constraints from southern NSW meant that not all of this generation could be dispatched.