About an hour after I’d posted the article ‘… but ER02 return to service hit a snag (Thu 16th May 2024) – now possibly out until Tue 21st May 2024’, the AEMO publishes Market Notice 116641 alerting the market of a forecast LOR2 condition for Monday morning 20th May 2024:

‘——————————————————————-

MARKET NOTICE

——————————————————————-

From : AEMO

To : NEMITWEB1

Creation Date : 17/05/2024 08:56:09

——————————————————————-

Notice ID : 116641

Notice Type ID : RESERVE NOTICE

Notice Type Description : LRC/LOR1/LOR2/LOR3

Issue Date : 17/05/2024

External Reference : STPASA – Forecast Lack Of Reserve Level 2 (LOR2) in the NSW Region on 20/05/2024

——————————————————————-

Reason :

AEMO ELECTRICITY MARKET NOTICE

AEMO declares a Forecast LOR2 condition under clause 4.8.4(b) of the National Electricity Rules for the NSW region for the following period:

From 0600 hrs to 0730 hrs 20/05/2024.

The forecast capacity reserve requirement is 1126 MW.

The minimum capacity reserve available is 1121 MW.

AEMO is seeking a market response.

AEMO has not yet estimated the latest time it would need to intervene through an AEMO intervention event.

AEMO Operations

——————————————————————-

END OF REPORT

——————————————————————-’

Note that it’s only just in ‘forecast LOR2’ territory (i.e. by 5MW).

Several contributing factors

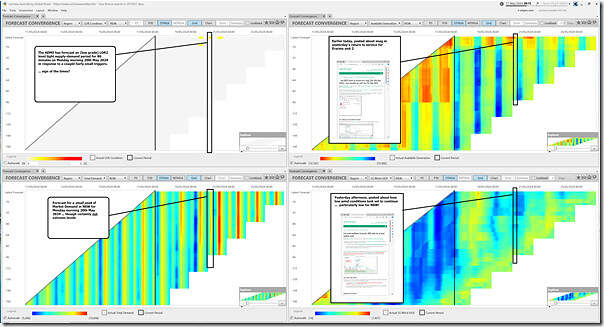

Using ez2view and a mash-up for 4 different ‘Forecast Convergence’ windows, we see a few other factors:

Remember that this widget allows one to ‘look up a vertical’ to see ‘that other dimension of time’.

Here’s a couple factors:

1) Note the timing of the forecast LOR2 (i.e. 06:00 to 07:30) in relation to sunrise at around ~06:44 for Monday 20th May 2024. So clearly a time of negligible solar production.

2) Yesterday afternoon we’d posted how ‘Low wind conditions to persist, NEM-wide, for at least another week’ … and we see in the ‘Forecast Convergence’ window above that it’s forecast to be particularly low in NSW on Monday morning 20th May 2024.

3) Now we also have the added factor of Eraring Unit 2 possibly being out until Tuesday morning 21st May 2024.

4) And it’s quite likely that there will be network limitations as well.

‘The Level of Risk in the NEM is escalating’

Way back in 2017-18, when we were compiling what became the GRC2018, we wrote (as Theme 2) that ‘the level of risk in the NEM is escalating’.

1) In the 6 years since that time, I’ve not really seen much to suggest that the level of risk in the NEM has been declining … and today’s ‘forecast LOR2’ notice is just the latest in an ongoing series.

2) Now readers should remember that the purpose of these forecasts from the AEMO is to elicit a market response, so by the time we get to Monday morning I hope it’s all abated.

3) But …

(a) the transition to a riskier environment is what we’ve been conscious of when posting this ‘Updated trend of ‘ENERGY’ bids in red, green and blue’ , where:

i. the changing patterns of bids feeds into the more volatile pricing patterns and hence increased financial risk, in the first instance

ii. though they might feed into supply-demand risk over the longer-term (e.g. by making it increasingly difficult to approve and fund replacement firming capacity).

(b) and it seemed to be one of the two main points that Bruce Mountain was making earlier this week (with the other being that energy transition forecasts are increasingly not matching reality).

Leave a comment