This article follows from earlier snippets about the prognosis for NSW on Thursday 14th December 2023:

1) On Tuesday (12th Dec), we wrote about Market Notice regarding the AEMO requesting generator recall information in NSW and QLD.

2) Yesterday (13th Dec), we posted about LOR forecasts and a view of Generator Outages in the region.

3) Earlier today:

(a) We saw a moderating demand forecast. (though that has reversed a bit now, as you see below); and

(b) We looked at forecasts for wind capability in NSW and across the NEM

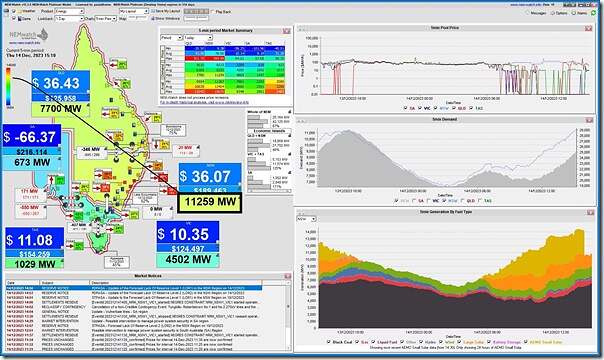

This article follows from those, and includes a snapshot from NEMwatch at the 15:10 dispatch interval (NEM time), showing both QLD and NSW ‘Market Demand’ up out of the ‘green zone’ (set based on historical min and max range):

At this point the NSW ‘Market Demand’ is 11,259MW – which is highest point thus far in the day, and steadily climbing. Apart from one price blip at 11:05 in NSW (to $299.99/MWh) and QLD (to $301.35/MWh) prices have been quite subdued … at least to this point.

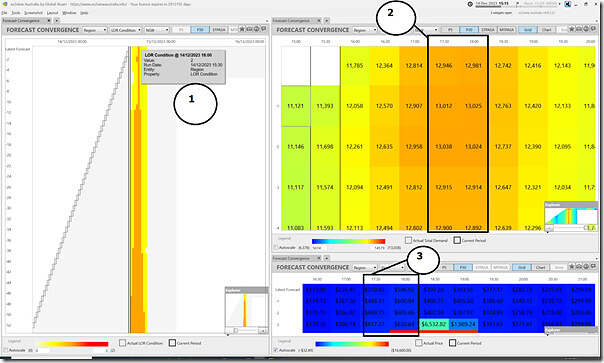

Updating the ez2view multi ‘Forecast Convergence’ widget snapshot we see several things:

We see:

1) A forecast LOR2 condition still persisting for the half hour ending 18:00 (NEM time);

2) The forecast for NSW ‘Market Demand’ warmed back to have forecast above 13,000MW for two x half-hour periods (17:30 and 18:00) … but has since dropped just below

3) Forecast price volatility has fallen away* over successive P30 predispatch forecasts:

* worth reminding readers that AEMO’s forecast process is designed to elicit a response. Specifically with respect to forecast (but not firm) prices

(a) Data junkies will understand that more often than not these successive forecasts revise prices down (in response to participants using that feedback signal to offer more capacity).

(b) Occasionally (e.g. when there’s some unexpected shock) prices might spike unexpectedly … but that’s the exception not the rule.

My guess is that most readers will probably have the view that successive price forecasts being revised down is a good thing, as a sign of market response.

Nothing else at this point.

Be the first to comment on "NSW ‘Market Demand’ over 11,000MW – and forecast evening demand warming back towards 13,000MW"