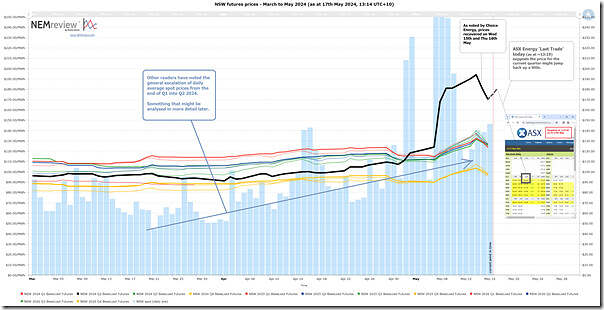

Three days ago (on 14th May 2024) we’d posted ‘Spot price volatility in May 2024 in NSW flows through to ‘baseload’ futures prices’.

I’d not been watching, but this update today on LinkedIn by retail broker Choice Energy highlighted that (with respect to the futures market) …

‘…Following the price period and the previously stated issues being mostly resolved, the market has recovered.

With a 5% drop Wednesday and further drops yesterday…’

So I re-opened the previously prepared NEMreview v7 query to fill in the most recent couple of days as follows:

Those with their own licence to the software can open their own copy of this query here.

This clearly shows the drop in traded price for 2024 Q2 baseload contracts in NSW (and also the future quarters … traders trading on sentiment, as noted before) on Wednesday 15th and Thursday 16th May 2024.

But I wondered what might be happening today in the live market, given that:

1) Eraring unit 2 has hit a snag and is out for a number more days; and

2) Forecast wind harvest in NSW is quite poor for Monday 20th May and so (for these and other reasons) the AEMO is forecasting LOR2 for Monday morning 20th May 2024

… incidentally, forecasts which are becoming tighter currently.

So I opened up the ASX Energy live window (snapshot shown above taken at ~13:19 NEM time) and see the ‘Last Trade’ for NSW baseload 2024 Q2 today at $180/MWh:

1) so up from the $170/MWh ‘end of day’ price for Thursday 16th May

2) as sketched above

Interesting times!

Be the first to comment on "Some yo-yo action in NSW baseload electricity futures"