Frequent readers here will remember Wednesday 8th May 2024 as the day in which NSW commenced a week-long stint under Administered Pricing:

1) Triggered when three bouts of prolonged volatility (Tue 7th May evening, Wed 8th morning and Wed 8th May evening) tipped the Cumulative Price past the Cumulative Price Threshold;

2) and which only ended at 04:00 this morning, Wednesday 15th May 2024.

Today already:

1) one reader’s also pointed me at Bruce Mountain’s opinion piece; whilst

2) another reader’s prompted me to update this trend of percentage contribution of Eraring to NSW Underlying Demand.

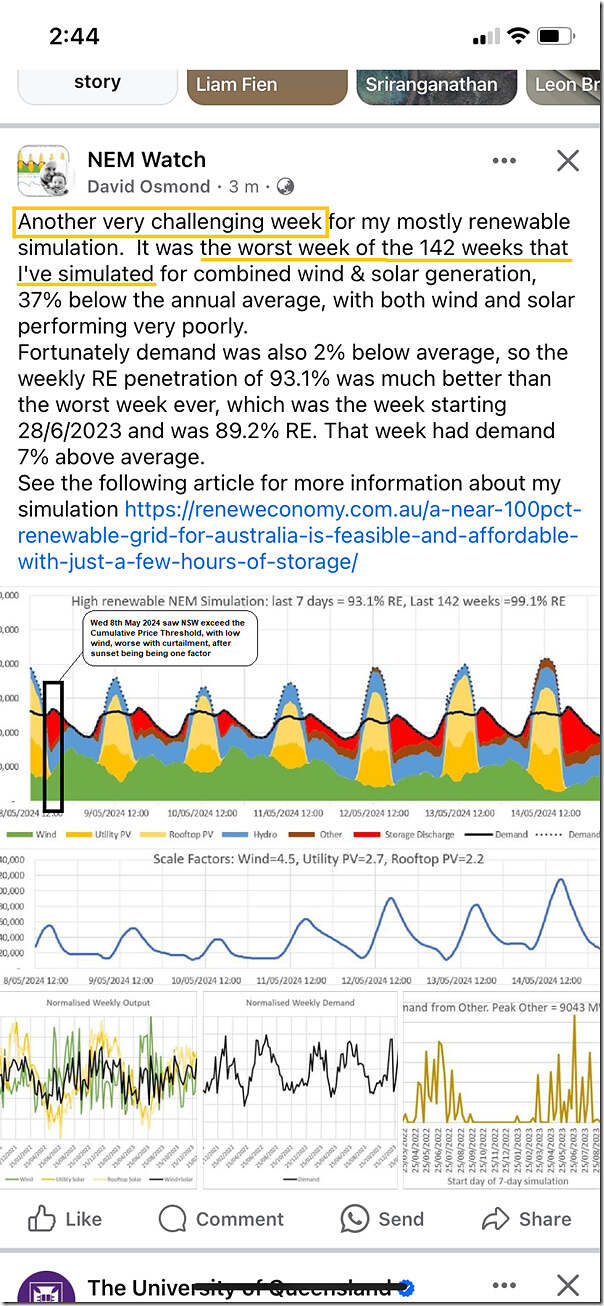

One of our internal team member also spotted an update on Facebook from David Osmond, who has been running an interesting weekly simulation of a hypothetical VRE + Firming Grid (albeit simplified) by scaling up actual production profiles for Wind and Solar and (albeit ignoring transmission issues and other ‘Keeping the lights on’ services) assessing what might be required for Firming of different types:

I can’t stomach creating a Facebook account myself, so I can’t help if you want to find where this update was today.

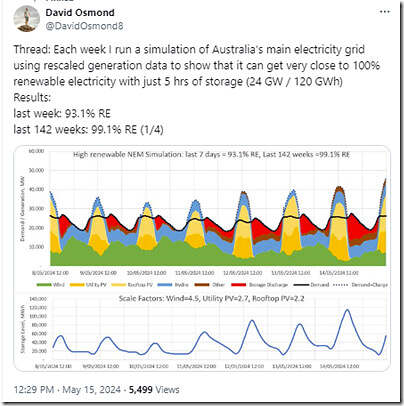

David’s equivalent note on Twitter is here:

A couple key points here:

1) Yesterday I had copied in Jess Hunt’s comments about Low Wind harvest in South Australia for a shorter period in the same week.

2) On 10th May I’d written about how wind farm performance in NSW on Tue 7th May and Wed 8th May:

(a) Had been disappointing, in terms of the underlying wind resource;

(b) and that this had been exacerbated by spillage of some of the limited resource available due to constraints.

(c) and hence how that had been one factor in the volatility.

I’ve highlighted on the snapshot from Facebook above the period of firming in David’s modelling for Wednesday evening 8th May that had contributed so much volatility and had triggered the Administered Pricing.

One other independent data point reminding us of challenges still to be resolved.

Leave a comment