Last Saturday (4th February 2024) I was able to belatedly make a start on some analysis for the GenInsights Quarterly Update for 2023 Q4 release.

There are several analysts across both organisations* who are involved with different aspects of the compilation of each Quarterly Update …

… remember (*) that these ‘WattClarity Deeper Insights’ publications (including GenInsights Quarterly Updates, but also the soon-to-be-released GSD2023) are compiled by a combined team across two organisations:

(a) There’s a team of us here at Global-Roam Pty Ltd,

(b) But there’s also the team of people at Greenview Strategic Consulting (led by Jonathon Dyson).

For me personally, I have a list of different pieces of analysis that I complete each quarter – and we’re actively seeking to expand the our analysis each quarter. Two focal points for me have been as follows:

1) I’ve already posted two snippets about IRPM results through 2023 Q4:

(a) There was ‘Sky-high IRPM in the middle of the day, Sunday 1st October 2023’ and

(b) There was also ‘Brief details of IRPM through the day on Monday 20th November 2023’;

… both of which we might delve into later in subsequent Case Studies…

2) In this article I’m posting about one snippet about % VRE.

… might have time to talk about other focal points later.

(A) Background to % VRE

The specific focus on percentage VRE was added into the Quarterly Updates series with the release for 2023 Q3 (i.e. the one just before that).

From that release I’d previously published ‘Case Study (part 1) of low % VRE NEM-wide on 3rd and 4th July 2023’. That prior article is useful to highlight here, because it explains:

1) Why we believe it’s more important for us to focus on ‘percentage VRE’ and not ‘percentage Renewables’; and

2) Why we believe it’s more important for us to understand the low points, rather than (for us to join many others to) celebrate the high points.

(B) The week 15th Oct 2023 to Sat 21st Oct 2023

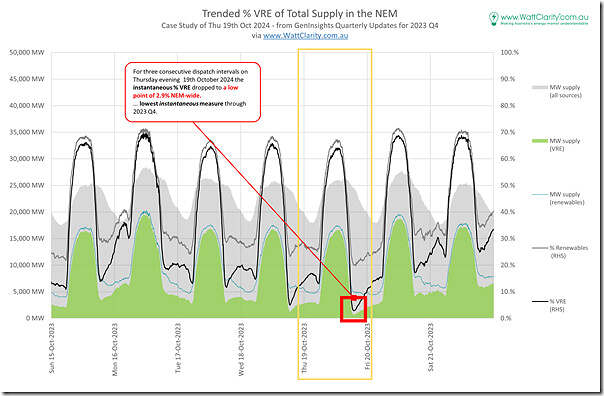

In the following chart we’ve extracted a subset of the data compiled for the GenInsights Quarterly Update for 2023 Q4 report:

In this article I particularly wanted to flag the low point (at 2.9% percent VRE) seen for three consecutive dispatch intervals on Thursday evening 19th October 2023.

1) But I thought it would be useful to show the whole week for context

2) There’s a very noticeable spike in VRE through daylight hours:

(a) supercharged by the ‘gangbusters rooftop PV’ that we’ve talked about recently;

(b) but also supported by production from Large Solar

i. to the extent that

> it’s not commercially curtailed due to negative prices; or

> it’s not technically curtailed due to network limitations

ii. a useful time to highlight that clients will be able to quickly ascertain both (and understand the difference), for individual solar farm DUIDs, through the new add-in focused on Semi-Scheduled units to the GSD2023.

4) But in particular through this period the total VRE production drops to only ~700MW for a period around 19:00 in the evening of Thursday 19th October 2023. At this time total supply was ~24,500MW:

(a) so ~23,800MW required to come from various forms of firming supply.

(b) which harks back to concerns raised before that ‘We’re not building enough replacement firming capacity’.

I’m not going to explore the events of Thursday 19th October 2023 in more detail at this point – but more posting this here today in order that one of us might follow on later (if time permits) to explore in more detail.

These short minimum don’t worry me as much as the many consecutive days of very low VRE output in Victoria and SA that occurs at least once per “winter” period per year. These events are often also followed or preceded by periods of poor VRE output. These periods are also during the time of year when demand is very high. They are also long enough that most BEVs will have been depleted even when used purely for road use as distinct from V2G.

If V2G becomes a large supply option, then combined with other storage such as residential and utility scale BESS, short periods of VRE won’t be a problem. The technology and economics are generally improving to assist in solving these short term VRE dips.