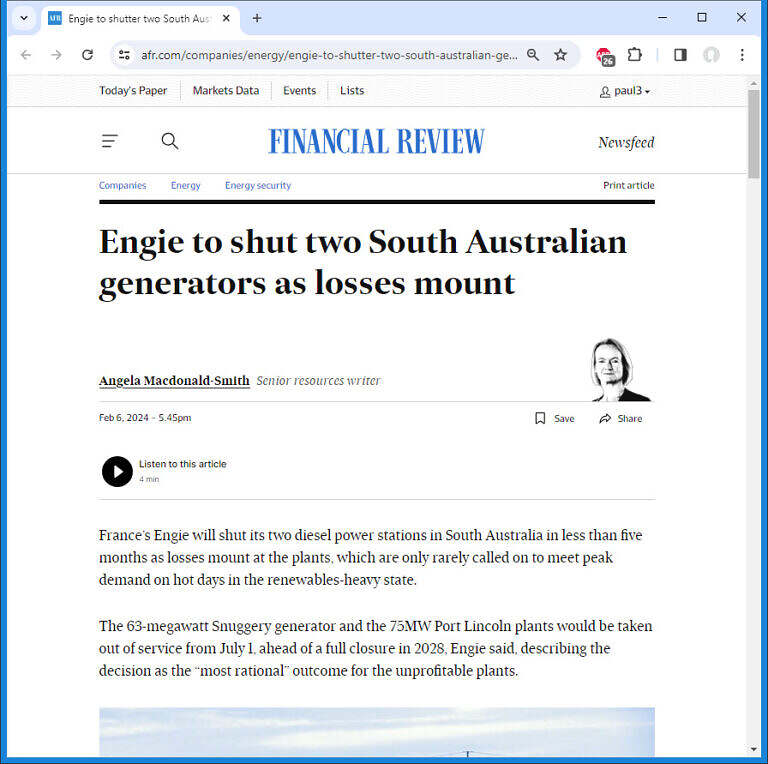

It was this article in the AFR, on the 6th, which drew our attention back to generator closures.

The AFR article helps us understand Engie’s reasoning for the closures. The plants, which are designed to run only on peak demand days, are unprofitable.

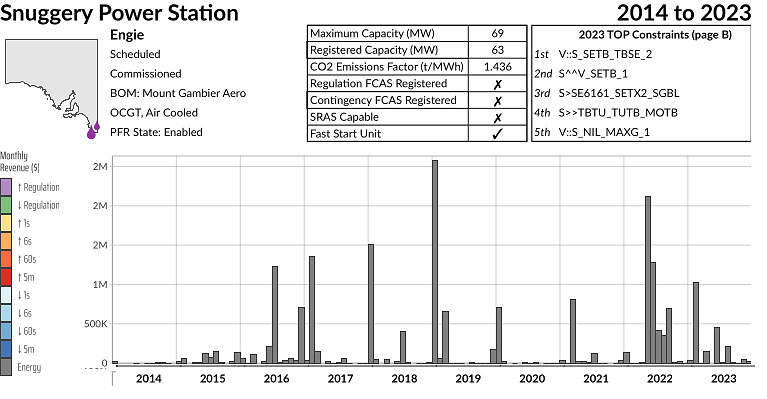

The imminent release of GSD 2023 captures revenues at Port Lincoln and Snuggery, and more…

In the third of three volumes in this year’s expanded edition, GSD 2023, we find Port Lincoln Power Station’s two generating units POR01 and POR03. The Snuggery Power Station is also within, registered with unit identifier SNUG1.

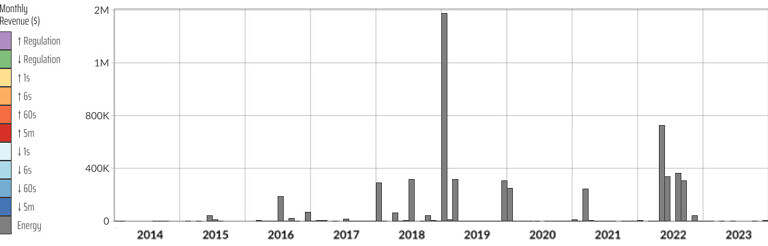

We can see, in the spot market revenue chart of GSD2023 for Snuggery:

- Revenue has always been from the energy market, it’s not registered in any FCAS markets.

- Monthly revenue is typically greatest in summer months (January and February). And low or near-zero in most other months. Winter 2016 and 2022 being the main exceptions.

- The greatest revenue month was January 2019 where revenue reached above $2M.

- The most consistent revenue year was 2022 (from May, the ‘energy crisis’) where May to September saw reasonable revenues, relative to prior years.

- There was some, shall we say, ‘out-of-season’ revenue in 2023 also.

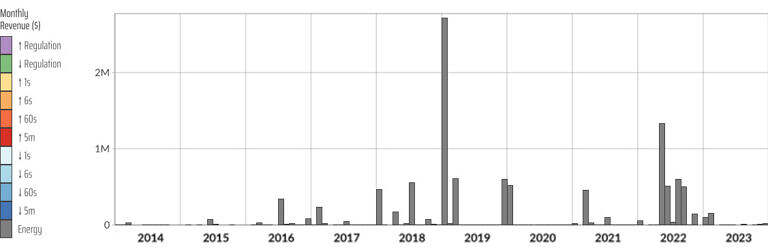

In the spot revenue chart of imminent GSD 2023 for Port Lincoln’s two units, we see a similar pattern to that of Snuggery:

- Higher revenue in summer months, with January 2019 being the stand-out.

- Generally consistent revenue over the energy crisis months in 2022.

- Not captured here, but the next chart on the GSD page shows bid volumes. Readers will be able to see how the unit has almost always been offered at the high end of the price range (> 10,000 $/MWh), though we can spot rare occasions where some volumes have been offered near the market price floor (-1000 $/MWh).

- Unit POR01’s revenue saw some gains in January and February in 2023. As such 2014 and 2015 appear to be years with slightly lower revenues than 2023 on the chart.

- Energy market spot revenue across 2023 for Unit POR03 was the lowest it has been since 2014.

Reductions in Scheduled Supply-Side Units

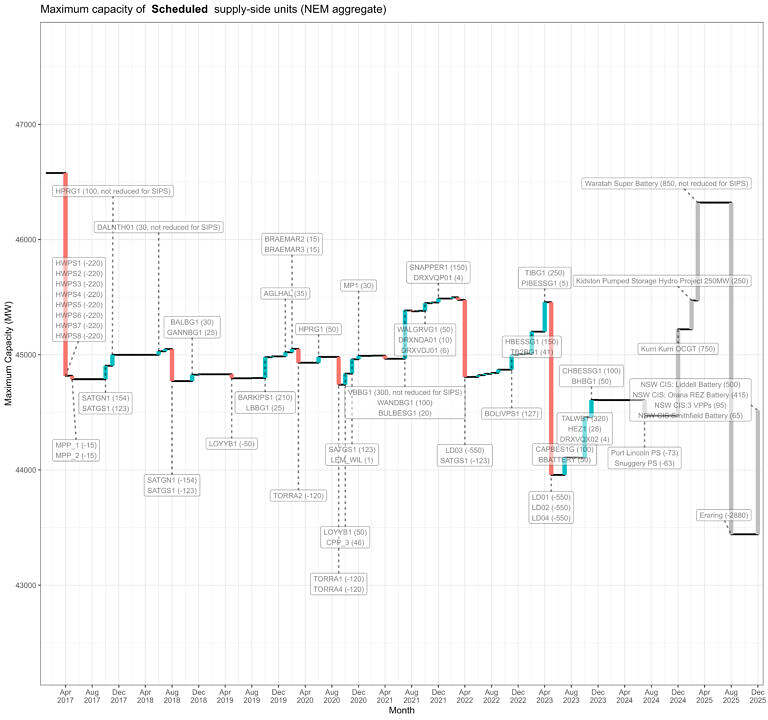

The closures bring forward a reduction in dispatchable generation capacity that is relevant for peak demand periods. In GenInsights we’ve been monitoring the changes in dispatchable generation capacity using market data and AEMO’s list of future closures on the Generation Information page. Back in May 2023 we posted this article about how we might not be keeping up with replacing dispatchable capacity, at the rate and magnitude of recent and upcoming closures.

The announcement for Snuggery and Port Lincoln missed the cutoff for AEMO’s January 2024 release of its Generation Information spreadsheet, which holds the old date as 31 Dec 2030. Yet we have been able to accommodate it in the next chart, a pre-release (draft) version for the upcoming GenInsights Quarterly Insights for Q4 2023.

Pre-release view of changes in scheduled supply-side capacity from GenInsights Quarterly Insights for Q4 2023

Looking past 2025

The next withdrawal of dispatchable generation appears to be AGL’s Torrens Island B. With 3/4 units totaling 600 MW (note that unit 1 was mothballed in 2022, but not appearing on the above chart as has not ‘technically’ closed) this will make a dent in total dispatchable capacity when it closes. The current closure date is 30 June 2026.

Increased interconnection in the form of Project Energy Connect

Supporting the flow of energy between states, Project Energy Connect is underway as a two-phased project.

This is the new electricity transmission project connecting the southwest of NSW to SA.

It will provide approximately 800 MW of transmission capacity between New South Wales and South Australia power networks*.

- Phase 1 will deliver 150 MW of bi-directional capacity, estimated to be operating from mid-2024 with transmission between Robertstown in SA and Buronga in NSW.

- Phase 2 will increase the transfer capacity from and to SA (which is measured in conjunction with the existing Heywood interconnector in the south-east of SA) once the transmission line works are complete (including extending from Buronga to Wagga Wagga)*.

*PS1

After Phase 2 of PEC is completed, the combined transfer limit across Heywood and PEC interconnectors is expected to be 1,300 MW import into South Australia and 1350 MW export. This represents the existing capacity of Heywood (650MW) operating in conjunction with the new 800 MW capacity of PEC.

The project energy connect RIT-T modelling got much of its market benefits through it causing early closure of SA peaking plant, which lowers total market OPEX. This outcome seems to be confirming that modelling and should be no surprise.

Sadly Project Energy Connect will do nothing for SA when the wind isn’t blowing strongly and the sun isn’t at its peak.

There is a reason industry has fled SA, unreliable and expensive energy driven by the closure of fossil fuel plants.