For a couple reasons (but mainly because we’ll link back to this later, both in future articles here on WattClarity and in direct communications with clients) I’m posting an article today about an outage that’s been, and is being, conducted in the NSW transmission network in southern NSW.

(A) The Outage held in May 2023

On 15th May 2023 an outage commenced on the Dapto –to– Kangaroo Valley transmission link (called ‘line 18’) and ran through until 3rd June 2023 in a few separate spurts. This outage coincided with, and contributed to, a rise in volatility seen in the QLD and NSW.

(A1) Volatility in QLD and NSW

We’ve already noted that there was spot price volatility in QLD and NSW in the latter half of May … such as on Wed 17th May and Sat 20th May and Tue 23rd May and Wed 24th May and Thu 25th May and Fri 26th May and Tue 30th May 2023.

In this quick article today, we’ll start to have a look at why.

… but remember that the NEM is a complex place and there will almost always be multiple factors involved:

1) Including some shown here;

2) But also others as well … such as

(a) the closure of Liddell in April; and

(b) the prolonged outages at Callide C3 and Callide C4; and

(c) no solar at this time of the winter evening; and

(d) occasions of low wind;

… and so on.

(A2) Constraint Sets invoked

Remember that Ryan Esplin illustrated ‘How dispatch works … it’s much more than just a bid stack’.

In order that the market can reflect the underlying realities of the physical system:

1) NEMDE (the NEM Dispatch* Engine) is configured to reflect the physics of the system:

* a hint to readers is that it’s called NEMDE and not NEMPE (or the ‘NEM Pricing Engine’) as the primary purpose of this algorithm is determining dispatch for the market – with prices just a by-product of this primary function, not the other way around

2) There are typically 600-1,000 individual ‘Constraint Equations’ invoked (the fancy term for ‘used’) in any given dispatch interval. During rare periods of no transmission outages it might be at the lower end of this range, but most of the time there are outages proceeding in certain parts of the network.

3) These constraint equations are invoked in ‘Constraint Sets’

… the ‘Constraint Set’ Details widget in ez2view provides a focused view of a specific ‘Constraint Set’

4) From a market point of view, if these ‘Constraint Sets’ are not invoked then NEMDE the market will not reflect any other limitations.

… so all market participants need to watch ‘Constraint Sets’ closely.

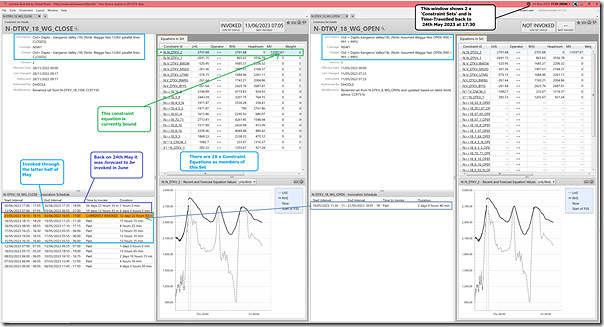

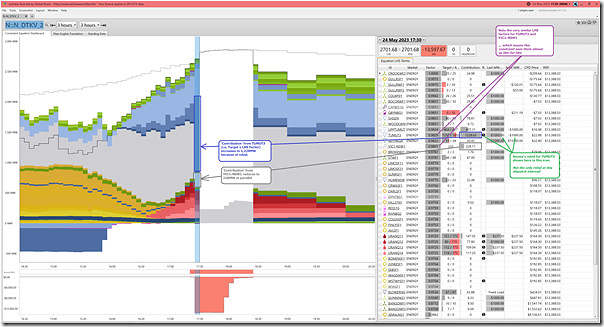

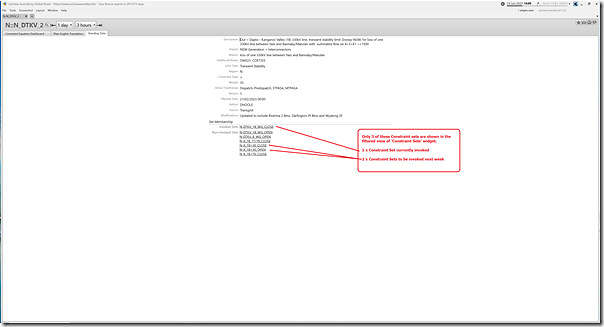

5) In our ez2view software, there are several widgets specifically focused on Constraint Sets, with the ‘Constraint Set Details’ widget highlighted in this snapshot below time-travelled back to 17:30 on 24th May 2023:

(a) There are two different Constraint Sets (a pair) shown:

i. ‘N-DTKV_18_WG_CLOSE’ constraint set … which has a description ‘Out= Dapto – Kangaroo Valley (18) [Note: Wagga-Yass 132kV parallel lines CLOSED]]’, and is currently invoked at the time snapshotted; and

ii. ‘N-DTKV_18_WG_OPEN’ constraint set … which has a description ‘Out = Dapto-Kangaroo Valley(18), [Note: Assumed Wagga-Yass OPEN (990 + 991 + 99P)]’, which was invoked between 19th and 21st May.

(b) I’ve added some annotations to help in the understandability.

(A3) A geographical view of the transmission outage

Back in May there were a number of different threads on social media related to ‘why are prices being volatile in QLD and NSW?’ … with one of them being from Charles Rendigs here on LinkedIn.

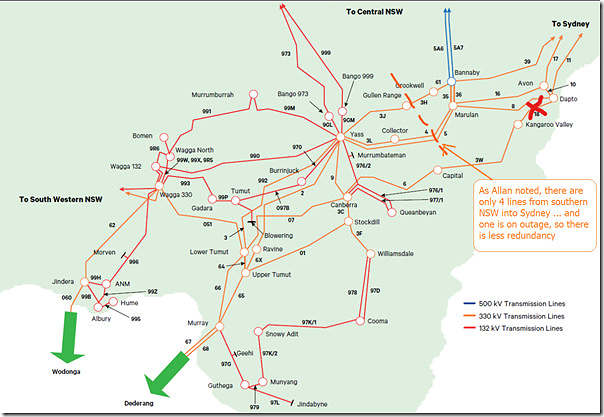

In providing some context to readers there, Allan O’Neil helpfully noted in this comment that:

‘There’s a longish outage (nearly 2 weeks!) of Line 18 (Dapto-Kangaroo Valley 330 kV) which is one of four 330kV lines between central and southern NSW. This limits secure northward flows (contingency being a trip on one of the remaining 3 lines – see the network diagram attached) so makes volatility more likely in peak demand periods when not all Snowy + other southern generation (let alone anything from Victoria) can get to the Sydney / Central area. Get prepared for more volatility I’d say.

Given the length of the outage perhaps it is something to do with upgrades for HumeLink?’

Here’s a larger view of the image Allan added to that comment:

(A4) Volatility

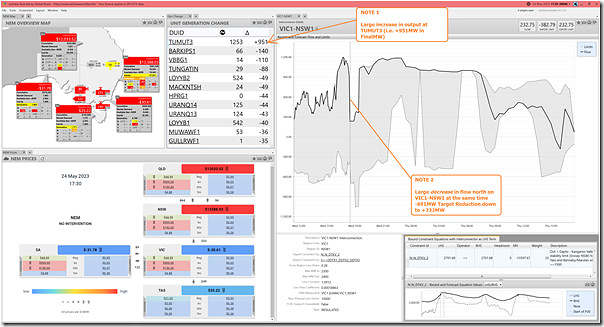

Here’s a snapshot from ez2view with some different widgets highlighting the volatility in the QLD and NSW regions for the 17:30 dispatch interval:

As noted on this image, we see at the same time:

1) A large increase in output at TUMUT3 (in the southern part of NSW);

2) Traded off against a large reduction in flow north on VIC1-NSW1.

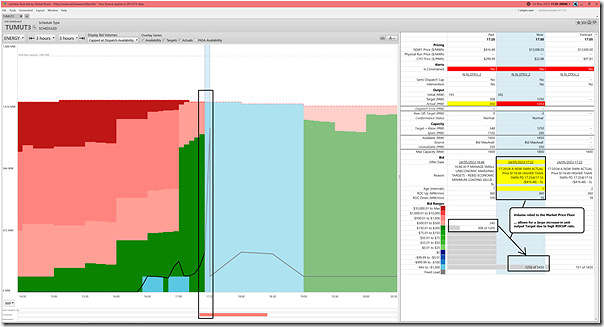

(A5) TUMUT3

Next, here’s the ‘Unit Dashboard’ widget in ez2view focused on Snowy’s TUMUT3 unit – which (for the 17:30 dispatch interval) rebid to put all its volume down at the –$1,000/MWh Market Price Floor:

Given the large ROCUP rate (360MW/min) it was able to gain a large increase in volume coincident with the price spiking, shown in the two images above.

To avoid any misunderstanding, the TUMUT3 unit benefited from, but did not necessarily cause, the price volatility this evening.

(A6) The ‘N::N_DTKV_2’ constraint

Finally, here’s the ‘Constraint Dashboard’ widget in ez2view focused on the ‘N::N_DTKV_2’ Constraint Equation (which has not yet been discussed in earlier articles, but is now tagged here):

We can see that both TUMUT3 and VIC1-NSW1 are on the LHS of this particular constraint and they have very similar factors … so this constraint is effectively just trading off imports from VIC against the increase in (now much cheaper*) generation at TUMUT3

* remembering that NEMDE sees the bid price offers as ‘input cost’ … even if each DUID in a region gets paid the RRP (and, before anyone comments, if the market was ‘pay as bid’ market, all participants would end up bidding much differently than now).

(B) Recent return of the Outage in June 2023

The ez2view window above shows that the expectation was (back on 24th May) that the same two Constraint sets would recommence on Tuesday 13th June 2023 at 07:05, and roll through until 19th June … before coming again briefly on 30th June 2023.

So let’s have a quick look …

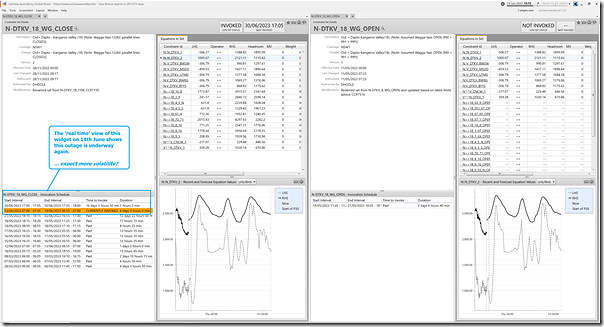

(B1) Looking currently at the Constraint Sets

Here’s the same window in ez2view flipped over to ‘real time’ mode and showing the same 2 x Constraint Sets at 13:15 on Wednesday 14th June 2023:

This window does show similar to what was expected on 24th May (i.e. with a gap where the offending Constraint Equation becomes uninvoked).

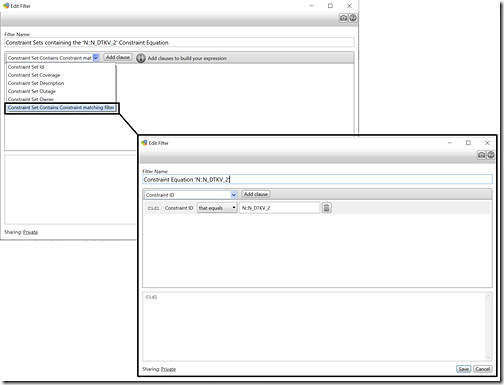

(B2) Filtering into the Constraint Sets

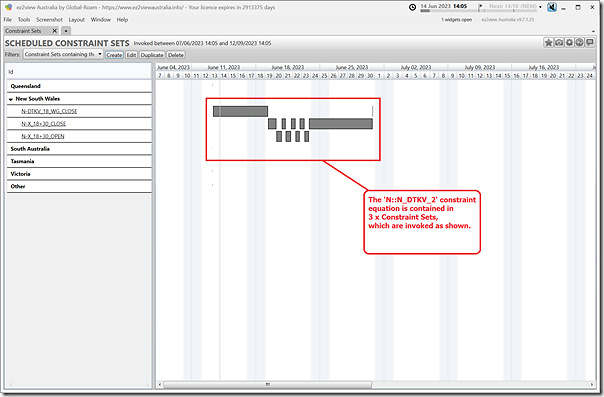

But it’s worth looking at the ‘Constraint Sets’ widget, that shows a Gantt-chart-style view of the scheduled invocation of Constraint Sets.

This view can be filtered, as I have done in this example here (i.e. looking in the Constraint Sets for particular Constraint Equations … in this case, the offending one):

Turns out there are three constraint sets that (joined up) show a continuous outage:

(B3) The ‘Constraint Dashboard’ widget

Indeed looking at the ‘Standing Data’ tab of the Constraint Dashboard widget shows that the ‘N::N_DTKV_2’ constraint equation is currently a member of 7 different constraint sets, only one of which is currently invoked:

So we see this outage is underway away, out until 30th June 2023 – so perhaps we can expect to see some volatility return? … though not a factor on Monday 12th June 2023.

Leave a comment