We’re counting the days down to the formal start of winter – but it sure seems like winter’s here already, judging by the run of evening volatility we’ve been seeing in QLD and NSW in the past couple of weeks:

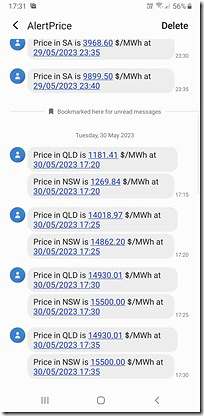

We’ve already noted that this was the case on Wed 17th May and Sat 20th May and Tue 23rd May and Wed 24th May and Thu 25th May and Fri 26th May. It’s been on again this evening, as seen in this initial burst of prices above $1,000/MWh (as far up as the Market Price Cap) from 17:20 this evening‘

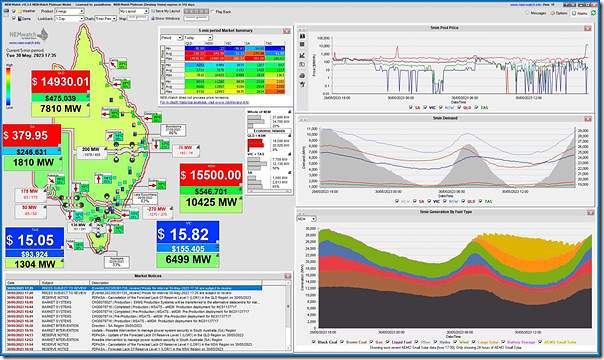

The spike at 17:35 was also captured in this snapshot from NEMwatch:

At some point we might be able to come back and review in more detail … but not today.

Leave a comment