After an extended drought in renewable energy investment under former Prime Minister Tony Abbott, once he was deposed Australia experienced an investment megacycle or boom. That boom has continued up until 2022 and is leading to a rapid transformation of Australia’s electricity mix and reductions in carbon emissions. But as projects associated with this boom have come online they have revealed an array of problems in our ability to effectively harness wind and solar technology.

These problems, and in some cases the solutions, are revealed within a wealth of data on power projects’ operation provided within the Generator Statistical Digest 2022. In our work analysing the renewable energy sector, Green Energy Markets has been confronted by the serious challenges and constraints projects have encountered as they have unfolded. In this paper we use the data within the Generator Statistical Digest to look back on the challenges that have flowed from the boom. We’ve done this through a series of case studies illustrating the good, the bad and the downright ugly of Australia’s electricity market transition to renewable energy.

We hope this drives better informed investment but also policy decisions.

An investment boom turns into a hangover

Every month, as part of preparing our forecasts of the market for Renewable Energy Certificates known as LGCs, Green Energy Markets reviews the monthly generating performance of every wind and solar farm in the country. We also review whether any new projects have secured long term power offtake agreements or been committed to construction, and how those under construction might be progressing through the construction process.

We do this in order to assess whether or not we need to adjust our estimates of the future supply of LGCs, which are essentially a forecast of how much electricity Australia will generate from renewable energy several years into the future.

Over the years of 2017 to 2019 these monthly reviews usually involved good news, as we steadily added new projects to our list of those under construction or contracted.

However, over 2020 it became increasingly evident that actual electricity generation was falling short of our forecasts. This shortfall grew worse and worse as each month passed. To be honest, these monthly reviews became like watching a slowly unfolding train wreck in the renewable energy sector.

To be clear this is not a trainwreck for electricity customers, nor the reliability of the grid. Rather it has been a horrible hangover for the commercial interests of those that have financed these renewable energy projects. Although thankfully it doesn’t seem to have harmed investors’ appetite to continue to finance what remains a rapid transformation of our electricity system. By 2025 it is likely Australia’s National Electricity Market will obtain a majority of its power from renewable energy.

At each month’s review we would scratch our heads at Green Energy Markets trying to understand why projects that we understood to be fully complete or almost fully complete would either be generating no electricity at all or a fraction of what they should be capable of generating (by benchmarking them against other projects within the state or ideally within a similar geographic region). I would ask my staff – ‘hasn’t this project had all its turbines erected?’. Or I’d ask, ‘what remains to be completed for this solar farm?’. We’d pore over the community construction update newsletters which would only reinforce our confusion. This horribly drawn-out grid connection commissioning process was our main head scratching problem, but other puzzling issues also popped up. Some projects would seem to get through commissioning and reach a reasonable steady state, but then after a few months of operation their output would then be dragged down to levels which were a fraction of what they should be capable of generating. Some even switched off completely. Some other projects which had performed well for years, saw their output suddenly fall.

Admittedly a range of experienced project developers and other electricity industry experts (such as the Generator Statistical Digest authors – Global Roam’s Paul McArdle and Greenview Strategic’s Jonathon Dyson) had warned us that many of these projects were being proposed for weak and constrained parts of the grid. Yet in spite of what were often adamant claims from experienced players that certain parts of the grid were a no-go zone and projects in these areas would “go nowhere”, we saw project after project shrug off these doubters to reach financial close. At the time we thought perhaps these developers knew something the doubters didn’t, because surely they wouldn’t commit financial suicide. Nonetheless we hedged our bets in many cases by assuming these projects would generate less power after accounting for transmission losses than the proponents claimed.

Ultimately once the transmission loss factors were declared, we hadn’t been conservative enough. To be fair to some of the developers, those that got in early had expected that once they proceeded with their project, others proposing to connect to the same part of the network would pull back knowing this would result in punishing loss factors for all. But it didn’t unfold that way.

However even projects that were connected to what we understood to be strong parts of the grid have encountered serious difficulties and delays getting through the grid connection commissioning process.

Another element taking its toll which we expected, but not to the degree that has ultimately transpired, has been output curtailment to dodge negative wholesale market spot prices. Given Green Energy Markets produces forecasts of rooftop solar installs for both the Clean Energy Regulator and AEMO, we knew that this sector would cannibalise and severely undermine the returns available to utility-scale solar farms. Yet the level of rooftop solar installs has been greater than we had expected and wholesale electricity market prices have reached incredible and sustained lows during sunny periods across South Australia, Queensland and now Victoria. While NSW has so far been resistant to this phenomenon, it is just a matter of when, not if, solar farms in this region suffer the same fate.

To a significant degree our monthly reviews became a bit like a game of whack a mole where the moles came so think and fast they became a bit of a blur. Our only consolation has been that we suspect everyone else in the electricity industry has also found this be a blurring game of catch-up. This includes the project owners, the equipment vendors and construction companies, the grid operators, the purchasers of the power and government agencies.

In trying to pull together a picture of the overall forest as well as the trees I’ve found the Generator Statistical Digest or GSD2022 incredibly useful. Hiding within what might on initial glimpse appear to be an indecipherable mass of charts and statistics, is a story of mistakes and challenges as Australia has grappled with the need to transform its electricity system from the most carbon polluting in the developed world to hopefully one of the cleanest by 2030.

What defines good and bad outcomes in renewable energy

In trying to evaluate what went wrong, you first of all need to appreciate what things should look like when they go right – a benchmark of what can be reasonably expected from solar and wind technology.

While Australia’s east coast electricity market has encountered significant challenges in integrating renewable energy projects, it hasn’t been a problem so much with the generating technology itself, but rather our ability to harness this technology.

Wind farm benchmarks

For wind farms Waubra is a useful benchmark for evaluating whether a wind farm is performing well. It is a useful benchmark because it has been operating for over a decade and so we have a good sample set of generating years to assess its long-run average performance that means we can see through year-to-year variation. At the same time Waubra isn’t so old that its technology could be considered hopelessly out of date, and it also shouldn’t be badly hindered by component aging and reliability problems. Finally, the wind farm, at 192MW, is of a significant scale that is reasonably in line with what developers are targeting at present. As the Generator Statistical Digest illustrates, the project achieves an average capacity factor of around 37.5%, with its low point being 35% in 2022 and its high point being 40% in 2020. There are wind farms in Western Australia that perform better than this, but they also have access to a grade of wind resource that is rare in mainland eastern Australia.

As a benchmark to indicate poor wind farm performance I’ve tended to use the Lake Bonney complex as my reference point. Again, this set of wind farms are old enough to give me a good sample set of annual performance, but not too old that they would be suffering significant mechanical problems. In addition, they were of a meaningful commercial scale once all three stages were completed at 278.5MW. Over 2012 to 2022 the average capacity factor aggregated across the three stages was 26.8% with a high of 30.5% in 2013 and a low of 23% in 2021. Although it’s possible to argue that the last three years have been affected by curtailment due to market and system management factors which are not inherent aspects of this individual wind farm. If we exclude 2020 to 2022 then the capacity factor rises to 28%. Most wind farms in Australia installed prior to the investment boom that commenced in late 2016 tend to achieve capacity factors better than 28% but it’s rare for them to do better than Waubra’s.

Now layered on top of these two benchmarks we need to also consider that wind turbine technology has improved considerably since these two wind farms were completed. In particular the turbine blades have got longer and hub-heights have increased. The increased rotor size and hub heights mean newer wind turbines should be able to produce more power for a given wind speed at ground level. Lake Bonney 1 has a turbine blade rotor diameter of 66 metres, while stages 2 and 3 have 90 metre diameter and Waubra’s is 77 metres. Hub height of Lake Bonney’s turbines is between 60 to 80 metres and Waubra’s is 80 metres high. By comparison Macarthur Wind Farm, which was completed in 2012, has a rotor diameter of 112 metres and a slightly higher hub height of 85 metres. If we then advance to a few years later to Kiata, which was completed in late 2017 the rotor diameter was 126 metres and hub height was 117 metres. Then if we look at what is being installed right now with Kaban the rotor diameter is 162 metres and hub height is 149 metres. All other things being equal this should mean capacity factors should be improving over time. Although in reality there has been a general move towards sites with lower wind speeds. Nonetheless the feedback that we’d received from both developers and turbine suppliers since 2015, as well as statements about expected generation from projects, indicated that capacity factors of projects would be close to or exceed that of Waubra.

Solar Farm Benchmarks

While Australia has a long history of deploying solar on rooftops at world leading levels, we were quite late to the party in terms of utility scale solar farms. The ACT and Western Australia kicked things off with some modest sized, fixed plate projects of around 10MW in scale. But things only really got serious when AGL rolled out the 53MW (in alternating current or inverter capacity) Broken Hill and 102 MW (AC) Nyngan projects. Both were located in places targeting inland, high solar radiation locations. These also sought to optimise their grid connection through oversizing panel capacity relative to inverters. This delivered AC-rated capacity factors far exceeding what we’d typically assumed for rooftop installations, with Nyngan achieving between 25% to 28% capacity factors over its first few years at full operation and Broken Hill managed 26% to 28%.

These two projects had fixed frames, but not long after we saw projects increasingly adopt single-axis, moving frames that would rotate panel direction in line with the sun. This new advance was first rolled out with Moree and then Barcaldine. This saw capacity factors increase, with Moree achieving between 30% and 32% in its first three years of full operation to 2019. Barcaldine came on around a year later and managed similar capacity factors in 2018 and 2019. The other important characteristic of these initial solar farms was that commissioning was quite straightforward, with a ramp up from initial energisation to the grid to achieving full output within around 3 months.

The solar farms committed after this initial set of pioneers also promised roughly similar capacity factors (although a bit lower in Victoria), and also reasonably quick construction timeframes of 12 months. This is consequently what we assumed for our generation forecasts (with some downward adjustment to account for weak transmission). It is interesting to think back to 2017 and consider that there was a general belief that solar farms were a low-risk proposition with minimal chance of mucking things up, whereas it was very evident that performance could in many cases fall well short of expectations if you got wind turbine siting wrong. But in the end, we subsequently learnt that there were plenty of ways to make mistakes with solar farms too.

The Good

First off, it’s worth noting that things have certainly not been all bad. Both wind and solar technology are capable of great things when rolled out well and unimpeded by transmission or system management constraints or poor market prices. Also, while a lot of projects have performed below expectations, they are producing very large quantities of electricity overall, and rapidly growing renewables overall share of the electricity market far faster than even an enthusiast like me would have dreamed of back in 2016.

Wind farms – Kiata and Diapur

The stars that show what modern wind turbines are capable of producing would have to be Kiata and Diapur. While these projects are very small at 31MW and 8MW respectively, it is clear why their owners thought they were worth persisting with in spite of the lack of economies of scale.

The GSD shows that Kiata has recorded annual capacity factors since becoming fully operational ranging between 44% to 48% with an average of almost 46%. What’s really impressive is that in 2020 and 2021 it is evident that the wind farm suffered significant curtailment judging by the fact availability in several months is noticeably higher than output, yet the project still managed 45% and 44% capacity factors in each of those years.

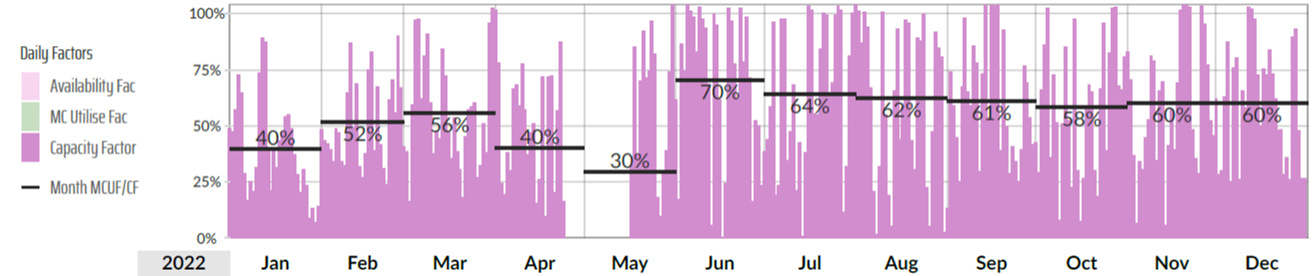

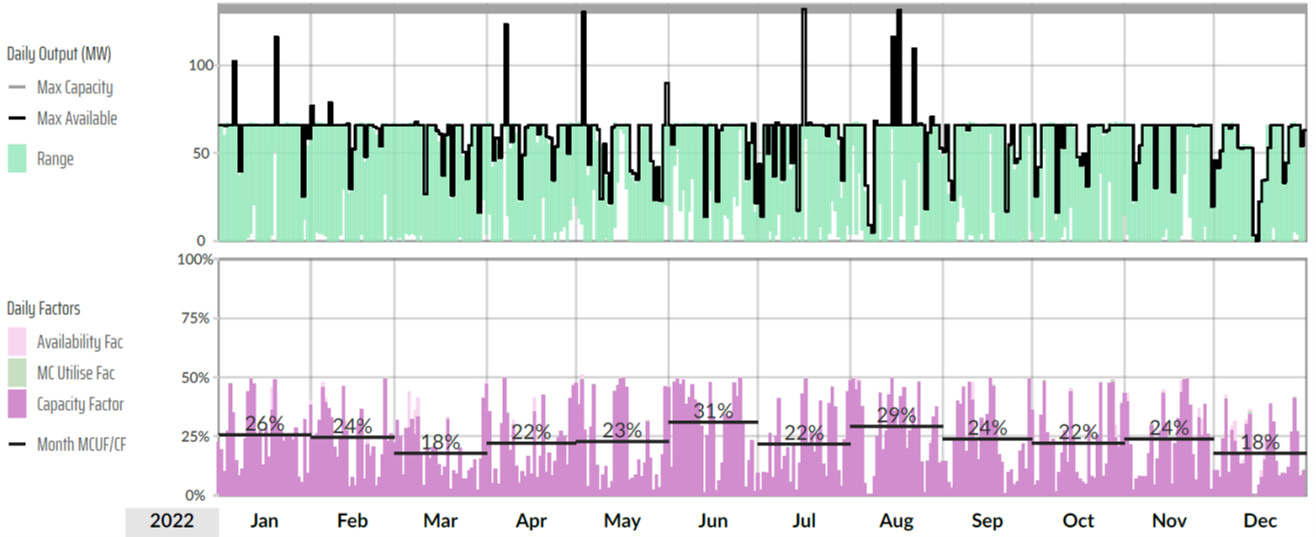

Diapur Wind Farm has only had one year of full operation, but its performance is so staggeringly good that it is hard to believe it won’t manage high capacity factors in subsequent years. Over 2022 it recorded an annual average capacity factor of 48% as measured by its rated capacity of 8MW, or 54% based on its maximum grid export capacity of 7MW. That is the best recorded in the country, even exceeding the performance of the WA wind farms. In fact, it’s probably up there as one of the best in the world. But what’s really amazing is revealed in the chart below drawn from the GSD. Each thin purple bar represents the capacity factor of Diapur for a day (based on its maximum grid export capacity of 7MW), while the black horizontal line shows the capacity factor across the month. Now look at late April and much of May – the wind farm was completely out of service for several weeks.

Daipur Daily Capacity and Availability Factor for 2022

Note: black line indicates average capacity factor for each month in 2022.

Source: Generator Statistical Digest 2022

Yet in spite of that outage, the project still managed Australia’s best overall annual capacity factor for a wind farm over 2022. If we look over the remainder of the year post the outage we can see why, with monthly capacity factors that many black coal generators would be happy to achieve.

Although while these two wind farms demonstrate how well modern wind turbines perform, they too haven’t been immune to the limitations of the grid. When Kiata first joined the grid, the combined transmission and distribution loss factor for its section of the grid was 0.961, which meant that it was assessed as losing 3.9% (100% minus 96.1%) of its generation in transportation to customer loads. That is a reasonably modest loss factor, in line with what we tend to see for many coal generators which are serviced by excellent high voltage backbone transmission lines. However, this loss factor reflected the history of that part of the grid before the wind farm was in place. By the subsequent financial year after the wind farm was connected, the loss factor was revised to 0.91 (9% of generation lost), which is less than ideal but tolerable. However, further generators were subsequently connected in western Victoria which then drove up line losses even further, such that in the next financial year Kiata was assessed as losing 16.8% of its generation in line losses. As of July 2022 this had crept up further to 18.1% in generation lost to line losses. That drags Kiata’s capacity factor after accounting for line losses down to 38% – still a very good result. In terms of Diapur its line loss factor began at 0.9 and has since been revised down to 0.879 in July 2022. After deducting this level of line losses Diapur would have managed a capacity factor of 43% (against its rated 8MW of turbine capacity) which would still put it as the best performing wind farm in the country.

Admittedly these projects’ small size reflects an attempt to cherry pick an exceptional wind resource. But there are a range of larger wind farms that have come online over the boom such as the Hornsdale complex, Crookwell 2 and Dundonnell which are achieving quality capacity factors between 36% and 40%.

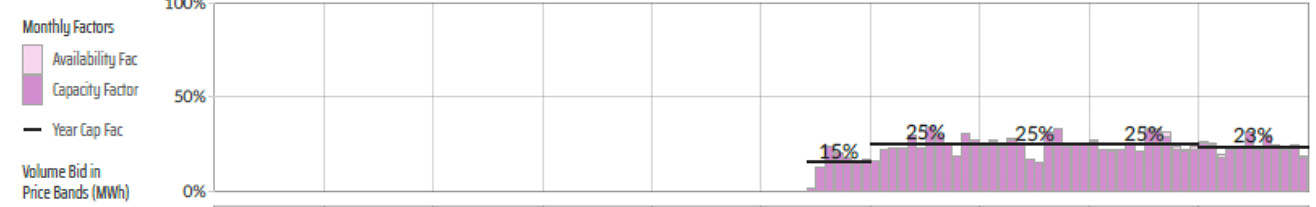

Solar Farms – Kidston and Haughton

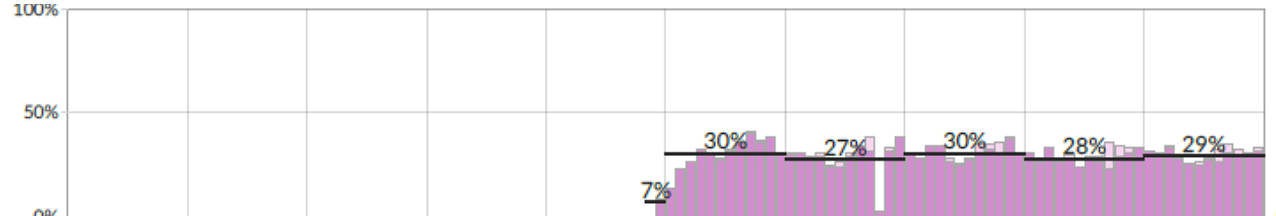

After the initial batch of pioneering solar farms that included Barcaldine and Moree, the next round were typically supported through funding under the Australian Renewable Energy Agency’s large scale solar program. One of the first projects to be completed from that program was the Kidston Solar Farm. Unlike many other solar farms that have come online since that time, it has managed to largely dodge the curtailment of output that has afflicted many other solar farms due to negative wholesale prices and transmission and system strength constraints. As the capacity and availability factor chart from the GSD illustrates below, since Kidston reached full output in 2018, it has achieved capacity factors ranging from 27% to 30% on a maximum grid export capacity basis (26% to 29% on an inverter capacity basis), which are close to our solar benchmarks represented by the early years of Moree and Barcaldine.

Kidston Monthly Capacity and Availability Factor

Note: black line indicates average capacity factor across the calendar year.

Source: Generator Statistical Digest 2022

It must be acknowledged that part of the reason behind these high capacity factors is that Kidston is located in an area with one of the best solar resources in the NEM. But if you look closely at the chart you can see in some months’ bars there is a light pink section at the top sitting above the darker purple section. This pink section of the bar charts shows periods where output was curtailed below available capacity. Kidston has not been immune to curtailment but part of the reason for Kidston’s better capacity factor performance has been that it has somehow managed to avoid the kind of nasty levels of curtailment that I’ll show you has afflicted other solar farms I’ve categorised under the bad and the ugly. The GSD shows that Rugby Run is another Queensland solar farm that has done well in that respect, with its capacity factors ranging from 28% to 29% since becoming fully operational.

Yet similar to the high-performing wind farms, while Kidston has gained from a fabulous solar resource, it has lost an awful lot from transmission and distribution losses. The GSD details that when Kidston first connected to the grid the loss factor was 0.91. But less than a year into operation this loss factor was revised to a horrible 0.793 in 2018/19 and hasn’t really improved since then. That means a staggering 20% of its output roughly goes out the window as heat in powerlines rather than electricity to customers. Adjusting for this, the post loss capacity factor is far less impressive, sitting at around 20% to 23%. It will be interesting to see if these loss factors materially improve as part of the transmission line upgrade that will be constructed in conjunction with the pumped hydro facility being added to Kidston.

Another solar farm worthy of highlighting in talking about the good is Haughton Solar Farm. This isn’t so much for the fact it is achieving outstanding output, but rather that it paints a pathway of how solar farms can potentially recover from horrific circumstances. Again, this is revealed through the capacity and availability factor chart within the GSD. During its commissioning year, there was little sign of the trouble that was ahead. It displayed a ramp up to full output within a few months of energisation to the grid, not all that different to what was experienced by the pioneering group of solar farms. But in the subsequent year things dramatically unravelled. Its annual capacity factor for 2020 was 19%, far below what we’d seen for Moree and Barcaldine – which also benefit from single axis tracking. It was even well below Broken Hill and Nyngan that lacked tracking frames. What helps reveal that this poor performance was a product mainly of system and economic curtailment, rather than any issue with the solar resource or a mechanical fault is the large chunks of pink in each month’s bar over several months of 2020.

Haughton Solar Farm Monthly Capacity and Availability Factor

Note: black line indicates average capacity factor across the calendar year.

Source: Generator Statistical Digest 2022

The GSD provides a degree of further insight in tables which break down the hours that Haughton was subject to system constraints relative to its overall operating hours. In 2020 the project was subject to some kind of binding constraint for almost half of the hours it was operating. Part of the reason that Haughton was subject to such regular curtailment is likely to be that AEMO adjusted its assessment of system strength levels in the Northern Queensland area in which Haughton was connected leading to a declaration of a system strength shortfall. AEMO’s annual NEM constraint report for 2020 estimated that this constraint resulted in a loss of output from Haughton that led to an increase in market pricing equal to $10.4m in spot market value – ranking it as the 3rd most costly constraint in the NEM. Haughton was also subject to another major constraint (with a constraint equation name of Q_HAUGHTSF1_ZERO) in 2020 that led to $1.4m in increased spot market value which ranked as the 17th most costly constraint.

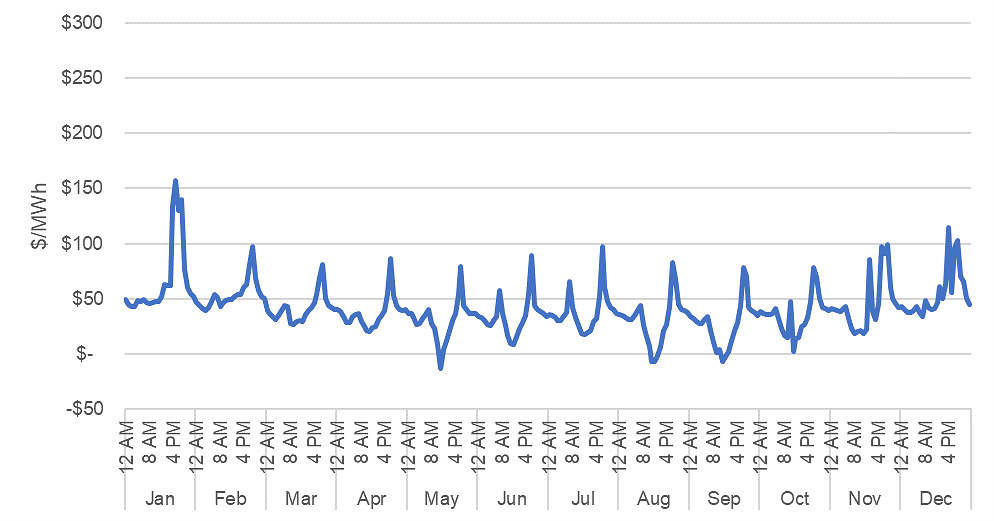

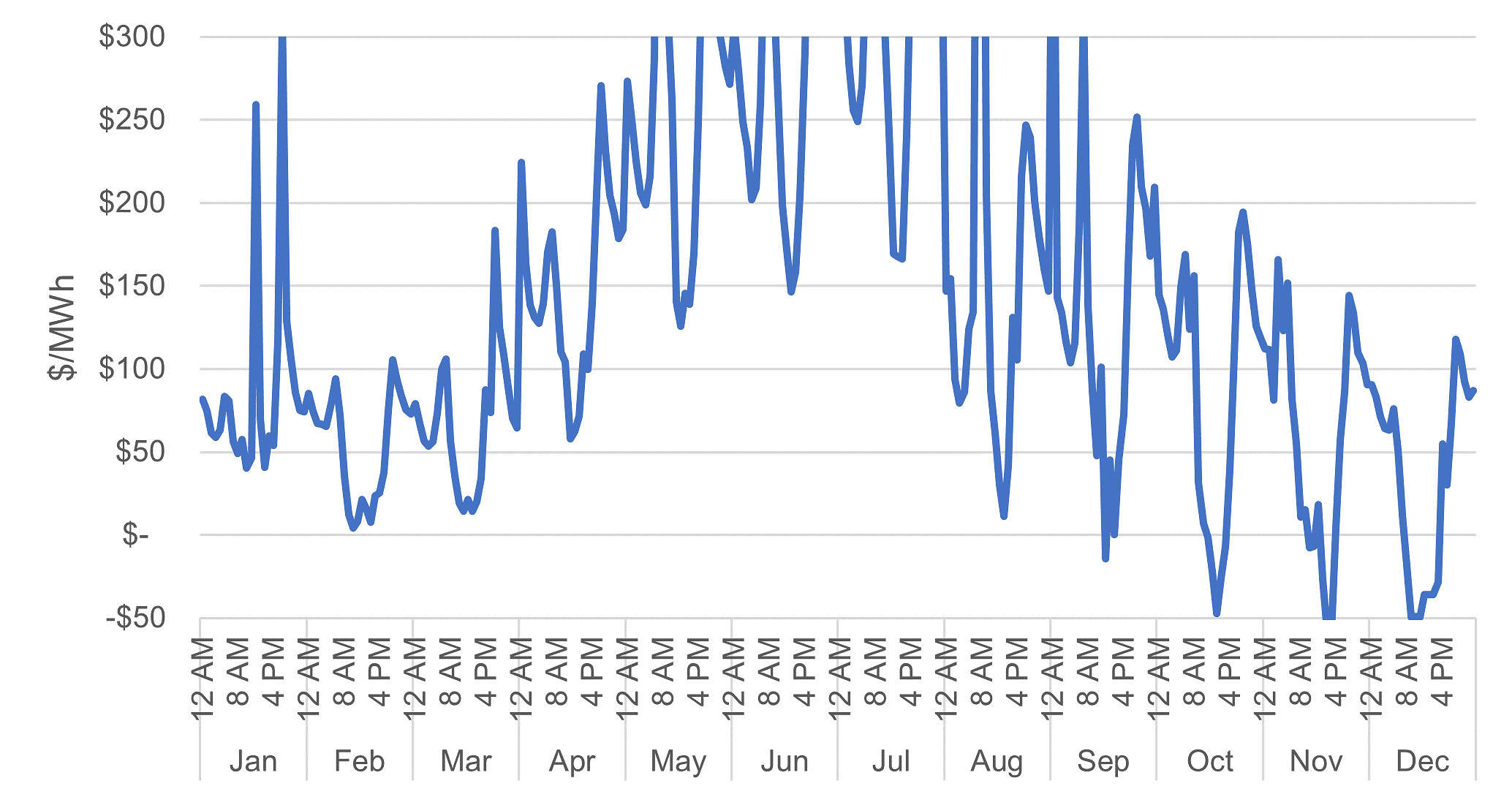

The other factor behind Haughton’s poor 2020 was likely to be economic curtailment. The year 2020 was subject to very low wholesale spot market power prices, some of the lowest on record since the NEM began. Unfortunately, while this year’s edition of the GSD provides some fantastic data on generators’ wholesale pricing exposure in 2022, it doesn’t provide historical information. However, by using Global Roam’s NEMreview software I’ve compiled data on Queensland average spot market prices by hour for each month over 2020 which is illustrated in the chart below.

Queensland Wholesale Spot Market Prices by Hour and Month over 2020

Source: Green Energy Markets analysis using NEMreview

The chart illustrates how for much of 2020, as the hour approaches midday, prices plummet to create not so much a valley, as a canyon. Over the entire month of May, prices averaged out at negative thirteen dollars over the hour surrounding 11am, and for 12 noon the average was just $4. In August prices averaged at a negative value over a 3-hour period from 11am until 2pm and in September they were negative from 11am until 1pm. While prices averaged out at slightly positive values in other months across the hours in the middle of the day, hidden within those averages was plenty of 30 minute intervals when prices went negative.

Pacific Hydro has stated that the Haughton Project has a power purchase agreement in place with a significant corporation (whose identity has not been disclosed as far as we are aware), but we suspect that this agreement still leaves Pacific Hydro exposed to negative spot market outcomes from Haughton’s output. Consequently, Haughton was repeatedly curtailed in order to dodge regular negative price events over 2020. For many other solar farms in Queensland we don’t tend to see the same extent of curtailment that afflicted Haughton. This is probably because these other projects have power purchase agreements in place which provide them with a fixed price per megawatt-hour generated, irrespective of spot market developments.

However, if we turn our gaze to 2022, spot market prices look rather different as shown in the chart below (using the same scale as the earlier price chart). While we continue to see canyoning in prices over midday, they don’t go into negative territory. This is likely to be one of the key reasons for the dramatic improvement in Haughton’s capacity factor over 2022 compared to 2020.

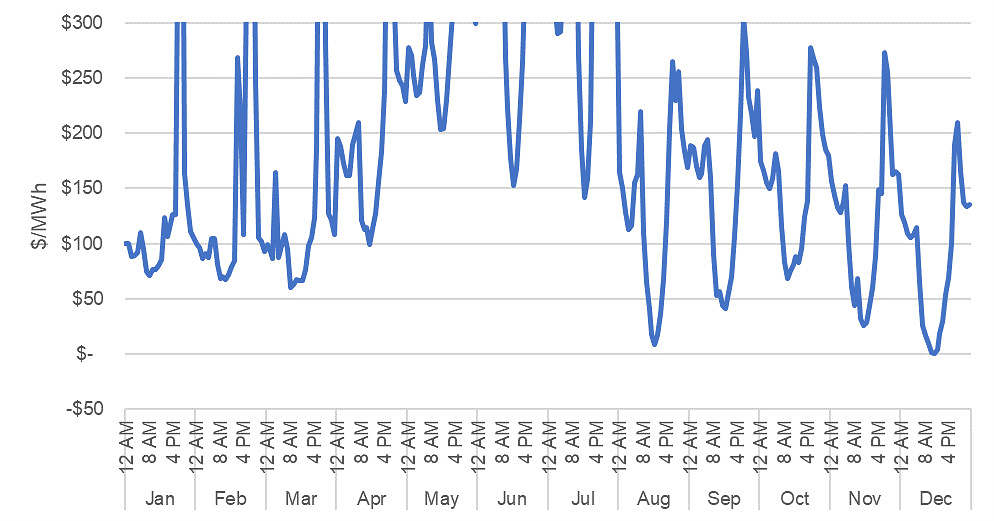

Queensland Wholesale Spot Market Prices by Hour and Month over 2022

Source: Green Energy Markets analysis using NEMreview

In terms of curtailment due to power system constraints, the GSD indicates that Haughton continued to be subject to constraints for slightly more than half its operating hours in 2022. However, the actual impact on Haughton’s output and financial costs has been far less than what occurred in 2020. Since the system strength inadequacy around northern Queensland was identified, a range of interventions have taken place to try to ameliorate the issues. In particular Haughton Solar Farm installed its own synchronous condenser in 2021. So while there were a large number of hours when Haughton was subject to system constraints in 2022, the operation of its synchronous condenser allowed it bypass these constraints.

The last aspect of the Haughton good news story, is that it’s powerline loss factor has improved noticeably from 0.862 when it first joined the grid, to 0.93 in the 2022-23 financial year.

So, while I’ll soon show that things can and have gone very badly wrong for a range of renewable energy projects over the last few years, they aren’t necessarily permanent. A range of interventions that are possible over the next few years such as transmission upgrades, adjustments to inverters, the roll-out of energy storage technologies, installation of synchronous condensers, electrification of heating and transport applications, and the exit of coal fired generators will help to alleviate some of the problems we see afflicting many renewable energy projects at present.

The Bad

Enough of the good, now it’s time to face up to what has been going wrong (although our prior discussion on Haughton gives you a good hint).

Ararat Wind Farm

Ararat Wind Farm was the project that broke the Tony Abbott renewable energy investment drought. It was committed to construction just days after the Labor Party and the Abbott Coalition Federal Government passed revised legislation through parliament that managed to bring to an end several years of uncertainty and doubt about the future of the Renewable Energy Target. It involved noticeable step up in turbine technology from our good reference project of Waubra with a turbine rotor diameter of 103 metres (our reference project of Waubra is 77 metres) and a hub height of 85 metres (Waubra is 80 metres). Also published wind resource assessments indicated that the area the project was located – close to Ararat –possesses a reasonably good wind resource.

Yet the capacity factor of the project has been close to that of Lake Bonney, which is my reference point for what would be considered poor wind farm performance. The GSD shows that in the project’s first year of being fully operational in 2017 it achieved an average capacity factor of 28% and this has been followed by years achieving similar levels of 27%, 28% and then 26% in 2021. This was well below the kind of performance that turbine suppliers and developers had been saying could be expected with the kind of turbines that were adopted for Ararat. Yet interestingly, unlike many other sub-par projects built over the post 2016 investment boom, it was very close to what the proponents had forecast the project would achieve. Documents released by the proponent when the project commenced construction stated it would produce power equal to the consumption of 120,000 homes, with the small print explaining each home would consume 4.9MWh per annum. So total generation of 588,000MWh per annum. That equates to a capacity factor of 27.8%, so almost smack bang on what has actually occurred.

But what tips this project into my list of the bad is what happened to the capacity factor of the project last year – it dived to an appalling 21%. In addition, the loss factor of the project has deteriorated horribly, moving from 1.03 in 2016-17 to 0.889 for 2022-23.

So what’s going wrong here? What the GSD shows when we zoom into Ararat’s daily output bar chart is the dreaded pink sitting atop the darker purple lines, indicating generation had to be curtailed below what the wind resource could provide.

Ararat Wind Farm daily generation and availability bar chart

Source: Generator Statistical Digest 2022

Unlike Haughton Solar Farm, negative wholesale power prices are unlikely to have had a significant role in the large level of curtailment the project experienced. Generation aggregated across all wind farms, unlike solar, tends to be more evenly spaced out over time. So while wind generation does tend to experience a discount in spot market prices relative to the output or time-weighted market average, it isn’t of the same extreme scale as we see with solar farms. The GSD shows the average market price in Victoria was $134/MWh and Ararat’s generation would have captured $106/MWh.

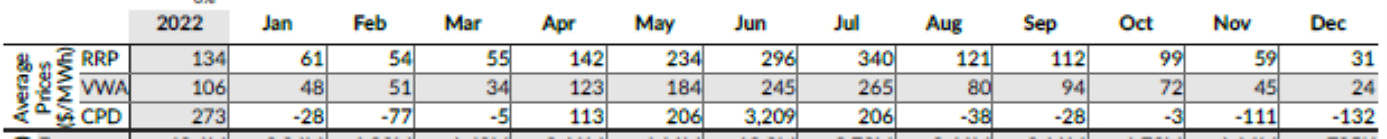

But there’s another piece of price information within the GSD that provides a clue to why Ararat suffered significant curtailment, which is the Connection Point Dispatch Price or CPD. In the table below, extracted from the GSD, you can see that the volume weighted average (VWA) price that Ararat received from the spot market in each month was not too far off the Regional Reference Price average which represents the price received for all generation in Victoria across the month. But to get that regional reference price AEMO needs to be able to transport your electricity to a customer load and the biggest load is Melbourne. In cases where generation being offered by generators on a particular power line exceeds the capacity of the power line, then a micro-market bidding war takes place between these generators which is separate to the state-wide market which sets the Regional Reference Price. In this micro-market generators find themselves competing for limited transmission line capacity where AEMO will prioritise generators access to the transmission capacity based on lowest bid price. The fact that the CPD price regularly averages across a month at negative levels suggests that the power line infrastructure Ararat relies upon is regularly unable to take all the generation which connected power plants can provide, resulting in curtailment.

Monthly average price received for Ararat’s output (VWA) compared to regional reference and connection point prices

Source: Generator Statistical Digest 2022

The other item of information that helps explain Ararat’s heavy curtailment is that it was subject to dispatch constraints for 3,462 hours out of the 7,517 hours it was operational in 2022.

The problem facing Ararat Wind Farm is that while it might have been the first to break the Tony Abbott investment drought, plenty more projects followed it. Critically, several of them located in the north-west of Victoria. The transmission backbone servicing this area (which feeds from Ballarat through Ararat and Horsham up to Mildura and then back down through Bendigo to Ballarat) has become known as the Diamond of Death or alternatively the Rhombus of Regret, or Polygon of Pain, for very good reason. Constraints associated with this rhombus/diamond shaped transmission have led to substantial curtailment across a range of projects. AEMO proposal to upgrade transmission in this area can’t come soon enough for these projects. Yet unfortunately for them, while AEMO highlighted the need and value of this upgrade back in April 2017, it isn’t expected to be completed until 2025.

Hughenden Solar Farm

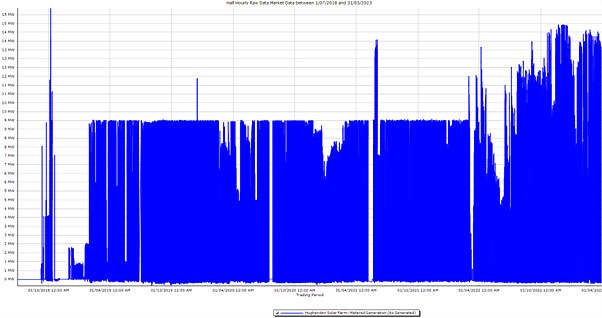

Hughenden is a small solar farm of 18MW registered capacity but one which caused me a lot of head scratching. Over 2019 and 2020 we saw a lot of projects that seemed to be struck in grid connection commissioning for many, many months with generation apparently stuck at hold point tests that they couldn’t manage to pass (the grid operator imposes several hold points on generators to gradually ramp up their output while it tests whether their electrical performance and impact is in line with grid requirements). But Hughenden was on another level of weird. As explained earlier, the first major solar farm projects of Moree, Barcaldine and Broken Hill had led us to believe that once projects in high solar resource areas, like Hughenden, were fully complete they would achieve an annual average capacity factor somewhere between 25% to 30%. But Hughenden achieved around half that in its first full year of operation in 2019 at 16%. Given it was a small project we didn’t look too deeply into it and just assumed it was suffering from the same commissioning testing problems that many other projects were going through. But in 2020 it again recorded a very poor 16% capacity factor, and then barely improved in 2021 to 17%. Because it is not a scheduled generator, we don’t have availability data to help inform us what might be going on.

To understand its poor performance you have to look beyond monthly and annual capacity factor averages and dive into the 30 minute interval data. The GSD doesn’t give this level of data, but it does something close by showing the full range of a project’s output for each day. In this chart you can see something quite curious for the days over the first two months of 2022 – its output almost without fail hits 9.5MW but never manages to get much past this level even though its registered capacity is 18MW. This is for months in summer when other solar farms will regularly manage to reach their full AC inverter rated capacity. In March it has an outage but seems to break out of this 9.5MW limit but then output falls away in the winter months before it manages to repeatedly break through 9.5MW and approaches almost 15MW.

Hughenden Daily Output Range over 2022

Source: Generator Statistical Digest 2022

Given this is a project that was first energised to the grid back in 2018, this is very intriguing. Using NEM Review I can delve back in time to look at its 30 minute output history since it first came online. What this reveals is a project that appears to have been held back at primary school after repeatedly failing to pass commissioning tests that would have allowed it to graduate into high school and ultimately reach its full 18MW of registered capacity. The positive here though is that over 2022 it seems to have finally passed the test to allow it to progress beyond 9.5MW and into high school, but is still being held back to 15MW.

Hughenden 30-minute interval generation output since 2018

Source: NEMreview

Tailem Bend Solar Farm

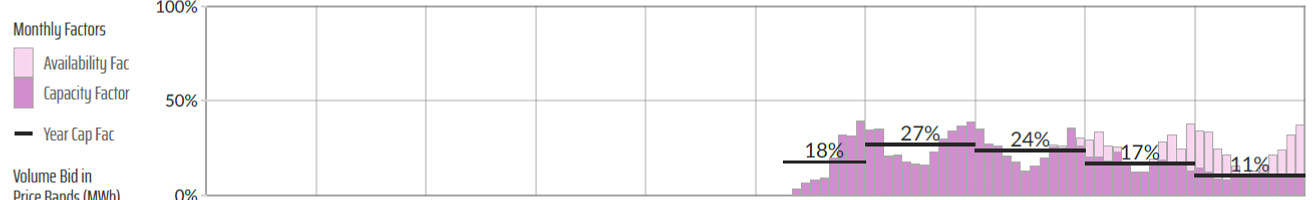

Tailem Bend Solar Farm came online in South Australia in 2019 with its first year of full output in 2020. Since then it has never managed to get anywhere close to the capacity factors of our reference solar projects like Moree, recording 19% in 2020, 17% in 2021 and then 19% in 2022.

Again this poor capacity factor is revealed not as a problem with the underlying solar resource but rather curtailment, with the monthly capacity factor and availability chart for Tailem Bend showing lots of pink.

Tailem Bend Monthly Capacity and Availability Factor

Note: black line indicates average capacity factor across the calendar year.

Source: Generator Statistical Digest 2022

This isn’t well explained by transmission constraints, with Tailem Bend only affected by such constraints over 2022 for 11% of its operating hours according to the GSD (the project incidentally also has an excellent transmission loss factor of 1.003 – which means rather than being penalised by having generation deducted for losses, it is rewarded for avoiding transmission losses in the system by having its output inflated by 0.3%).

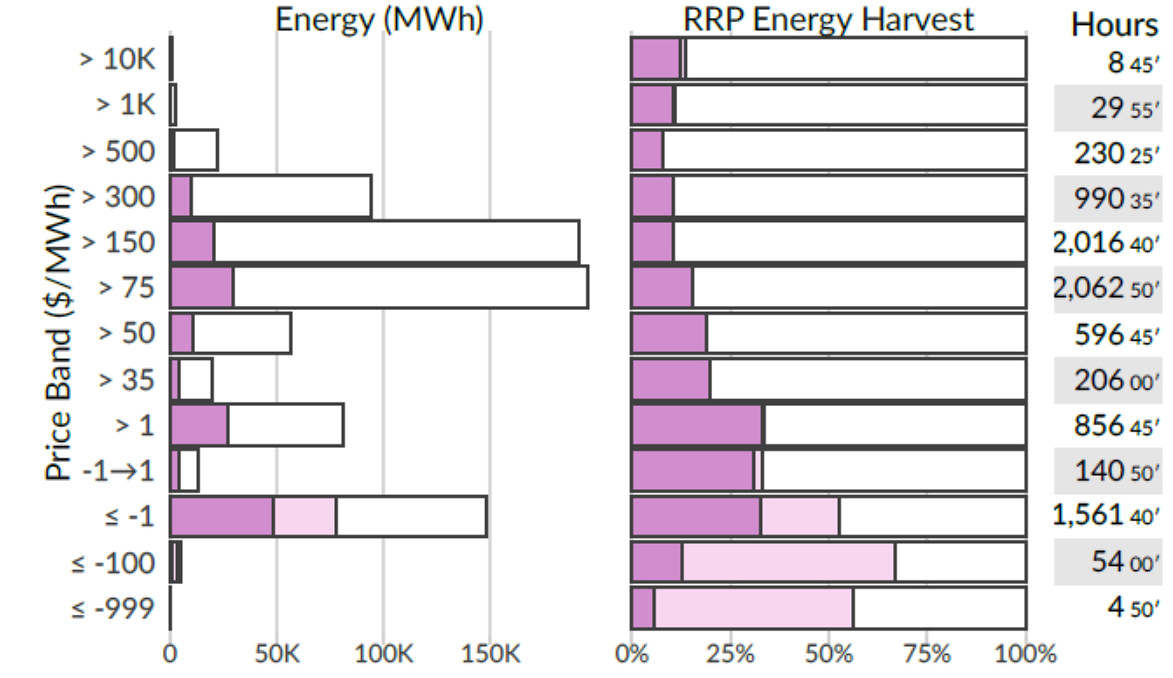

Instead, this is likely to be a product of economic curtailment, as Tailem Bend sought to dodge wholesale spot market prices that regularly dip into negative territory in South Australia over the middle of the day. Like Queensland, a substantial proportion of South Australian households have a solar system. According to the latest figures over 43% of detached and semi-detached dwellings have a solar system in South Australia. But further increasing the likelihood of negative price events is that South Australia gets a large proportion of its power supply from wind farms. Over 2022 wind produced almost half of the electricity generated in South Australia, almost all of which was bid in at negative prices, as revealed in the GSD.

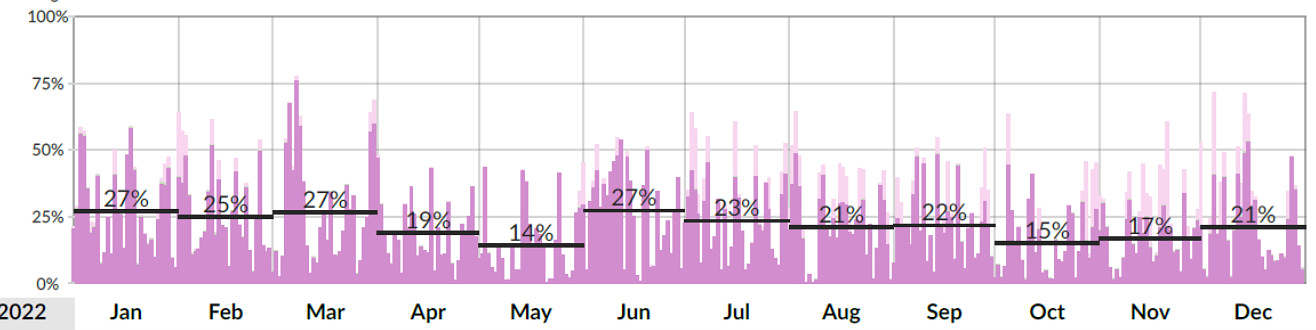

The chart below illustrates South Australian average hourly electricity spot market prices by month for the year 2022. The overall pattern of prices looks similar to that of Queensland in 2022 except prices plumbed to lower depths and regularly into negative territory, reflecting South Australia’s lesser reliance on black coal (international prices for black coal got incredibly expensive in 2022 and pushed up electricity prices in NSW and through them into Queensland).

South Australian Wholesale Spot Market Prices by Hour and Month over 2022

Source: Green Energy Markets analysis using NEMreview

What helps to confirm the high level of curtailment due to negative prices is the two charts below taken from the GSD. On the left-hand side is a scale of spot market prices within bands ranging from prices above $10,000 per MWh down to negative $999 per MWh. The problem for Tailem Bend is that the price band where it was capable of generating the most energy – around 70,000MWh (as shown in the left-hand section of the chart) was in the price band of negative $1 to negative $99 per MWh. The pink part of that horizontal bar shows that it curtailed around 20,000MWh, as it tried to avoid incurring negative price outcomes. The right-hand part of the chart shows the average capacity and availability factor for Tailem Bend under different market pricing periods (and the hours at which prices were at those levels). The pink sections of the bars show it had availability above 50% when market prices fell into the negative bands, but the purple section of the bars shows it curtailed much of this potential generation.

Tailem Bend’s availability and actual generation by spot market price band

Source: Generator Statistical Digest 2022

Note: Nick Bartels has written an explainer and analysis piece which explores the Price/MWh Havest metric in the GSD.

The Horribly Ugly

While the examples I’ve given of bad outcomes have likely been quite painful for the owners of these projects, there are occasional circumstances where things can get very dire and are almost certainly far beyond the worst-case scenario financiers planned for. The examples below aren’t just bad, they are horribly ugly – with generation likely to be far, far below what was planned for.

Wind Power – Mt Gellibrand

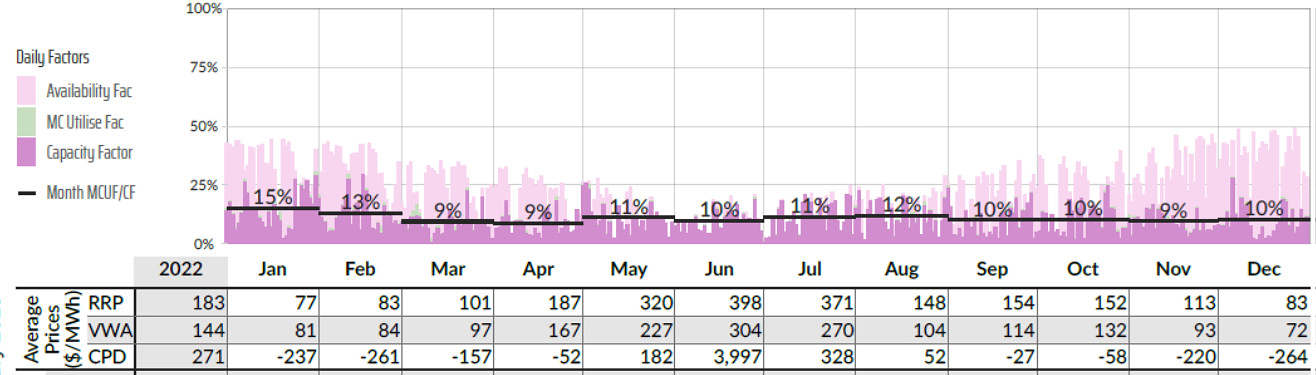

Mt Gellibrand is located in Victoria’s main wind farm belt stretching from west of Geelong to Portland and has a registered capacity of 132MW. In its first full calendar year of operation after energisation – 2019 – it recorded a capacity factor of 25%. At the time we were concerned but thought it would eventually get through its commissioning challenges and ultimately achieve capacity factors in line with average or good performing wind farms. But as the availability and capacity factor chart below illustrates it hasn’t managed to improve from the poor capacity factor recorded in 2019. What’s interesting from this chart is you can see almost no pink here, so the poor output isn’t a product of pulling back the wind farm’s output below what it could physically export to the grid.

Mt Gellibrand Wind Farm Monthly Capacity and Availability Factor

Note: black line indicates average capacity factor across the calendar year.

Source: Generator Statistical Digest 2022

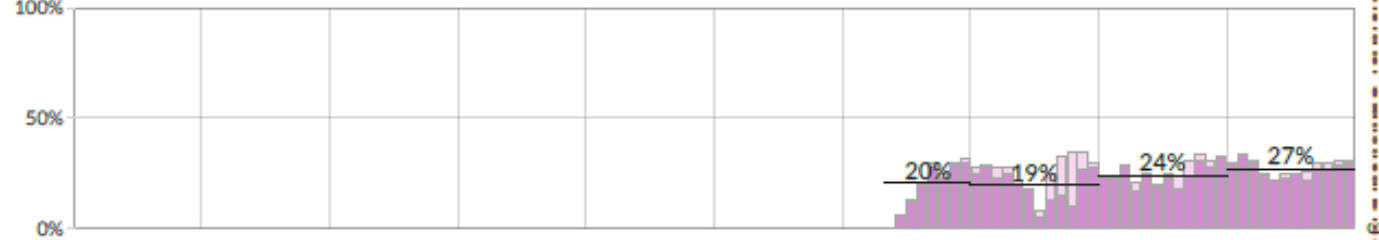

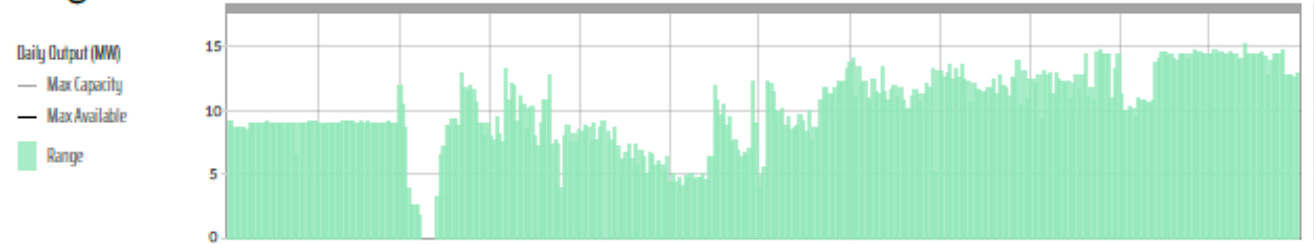

When we dive down deeper to understand what’s going wrong in the daily output range chart and daily capacity and availability factor chart we see the same characteristic pattern as Hughenden Solar Farm. The green output range chart shows that almost without fail the wind farm’s output hits half of its registered capacity, but rarely rises further showing a series of flat mountain mesas. These are occasionally interrupted by brief spikes above 66MW that peak out at the wind farm’s maximum capacity of 132MW. This means the project’s daily capacity factor (shown in the purple lower section) can never manage to get higher than 50%.

Mt Gellibrand Daily Output Range and Capacity and Availability Factor over 2022

Note: black horizonal line and percentage label indicates average capacity factor across the month.

Source: Generator Statistical Digest 2022

My interpretation from this data is that, like Hughenden, Mt Gellibrand is being held back in school by AEMO, repeatedly failing to pass commissioning testing that would allow it to graduate to its full capacity of 132MW. If this was its first year of operation then it wouldn’t be so bad, but what qualifies the project as horribly ugly is that it has been stuck here for four full years after its initial energisation to the grid. What makes this such a pity is that its output profile suggests this could be an incredibly good wind farm if it can get free of its hold point chains.

Solar Power – Manildra

Manildra Solar Farm has managed to make the horribly ugly list because it provides a picture of just how incredibly bad things can get if you find yourself in a choke point in the grid. Again, the pink section of the bars in the monthly capacity and availability factor chart illustrate something is going wrong in 2021 and this gets even worse by 2022. If we look back to the 2019 section of this chart we can see that this solar farm is actually capable of a 27% capacity factor – not too far off our reference point of Moree. But in 2022 curtailment brought this down to 11% – most rooftop solar systems with sub-optimal orientation and minimal oversizing of panel capacity would do better than this.

Manildra Monthly Capacity and Availability Factor

Note: black line indicates average capacity factor across the calendar year.

Source: Generator Statistical Digest 2022

The GSD reveals that this deterioration is a function of transmission constraints by detailing that while in 2019 it was subject to constraints for just 0.2% of its operating hours, by 2022 it was subject to constraints for 73% of its operating hours. Further clues to Manildra’s transmission constraints are shown in the connection point dispatch (CPD) price (discussed earlier in relation to Ararat Wind Farm) for each month over 2022 when mapped against their daily availability and capacity factor chart. You can see that the pink curtailment is highest over the months of January to April when the CPD price is negative, the pink curtailment section then subsides over May to August when the CPD price is positive and then ramps up again for the remainder of the year as the CPD price goes more and more negative.

Manildra Daily Availability and Capacity Factor mapped relative to market and connection point prices

Note: black horizonal line and percentage label indicates average capacity factor across the month.

Source: Generator Statistical Digest 2022

Solar Power – Kiamal

Kiamal solar farm is located smack bang in the middle of Victoria’s Diamond of Death, an area subject to weak system strength and inadequate transmission capacity. By the time Kiamal was committed to construction back in October 2018, this constrained transmission area had already clearly established its deadly reputation. So in a first for the renewable energy sector, the project was committed to construction with a synchronous condenser to help mitigate the area’s system strength inadequacies.

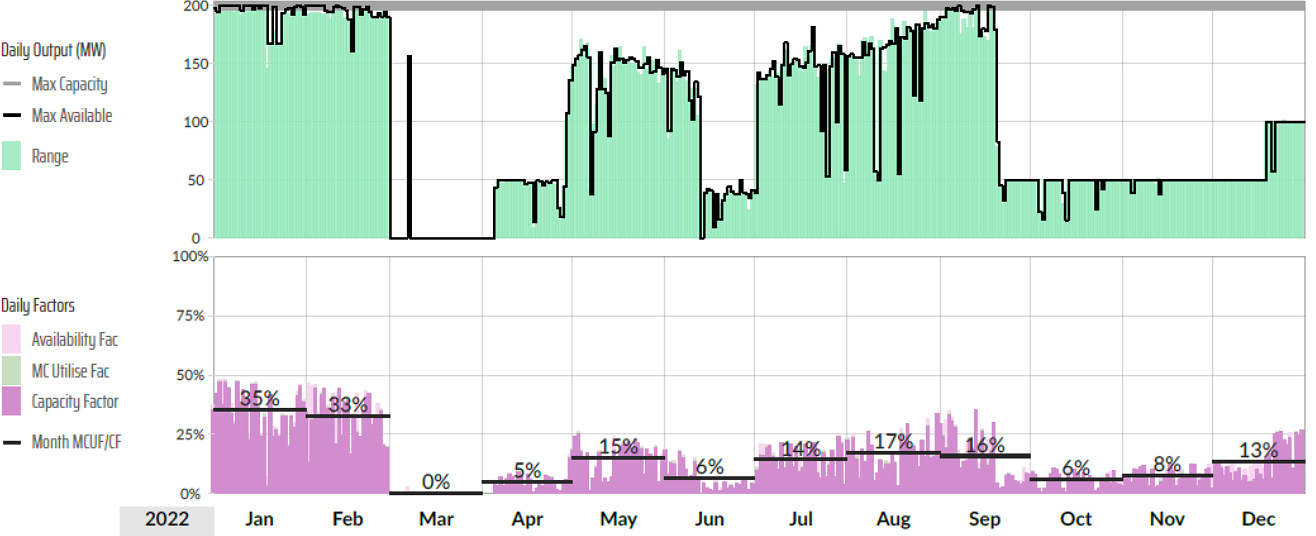

Unfortunately, this doesn’t appear to have allowed Kiamal to escape the Diamond of Death. After taking twice as long as initially expected to reach energisation, the project managed a capacity factor of 18% in the 2021 calendar year. This is bad, but not quite horribly ugly. However, in 2022 the capacity factor fell to 14% – no better than a typical Victorian rooftop solar system. Over 2022 Kiamal was subject to some kind of transmission constraint for 100% of its operating hours. But the puzzling thing is that when you look at the capacity and availability charts you can’t see all that much pink showing a gap between what the plant had available to dispatch to the market versus what was actually dispatched. What really reveals how things went wrong in 2022 is the daily output range chart shown below in conjunction with the availability and capacity factor chart.

Kiamal Daily Output Range and Capacity and Availability Factor over 2022

Note: black horizonal line and percentage label indicates average capacity factor across the month.

Source: Generator Statistical Digest 2022

Kiamal’s registered capacity is 200MW and for much of January and February 2022 it regularly managed to reach its maximum capacity resulting in very good capacity factors over those months of 35% and 33% respectively. But in March it was almost completely offline. In April it came back online but its output is clearly capped at 50MW. It then seems to manage to break free of that limit over May before being clamped back down to 50MW part way through June. It again escapes this hold point over July until mid September before the 50MW clamp is applied until mid December, after which it is then capped at 100MW.

I haven’t got to the bottom of exactly what is unfolding here, but it shows some characteristics potentially symptomatic of reliability challenges with the synchronous condenser. My guess is that when the synchronous condenser is fully operational Kiamal is allowed to generate without constraint, but when the synchronous condenser is down, then Kiamal’s output is constrained. Synchronous condensers, unlike solar photovoltaics, involve big moving parts, a bit like a thermal power station, which can lead to significant reliability headaches in their initial phase of operation as bugs are ironed out. This is often referred to as the reliability bathtub phenomenon. Outages are initially high, but these then drop away as the operator identifies and remedies faults and learns how to make the plant operate smoothly and without constraint for many years until it becomes old and worn out. Hopefully this is the case for Kiamal. But if my theory is correct, it shows that synchronous condensers, besides adding cost and potentially delay to project construction, also create an additional reliability fault point for projects.

Concluding thoughts

There can be little doubt that Australia’s renewable energy sector has become subject to the same kind of issues we often see in other capital-intensive industries with low marginal operating costs when faced by boom conditions, like mining or commercial property. Windows of opportunity to grab a foothold in capital intensive markets can sometimes only last so long, and if one is too cautious and waits too long they can find the window has closed as others have filled the market demand. Complicating matters is that often the suitable sites for renewable energy projects in many areas of the country greatly exceeds the available transmission capacity, plus planning approvals are often time-limited.

These characteristics can induce a type of musical chairs mentality as developers race to commit projects for fear of being the last person standing and left without chair. However, this race to commit can sometimes mean several project proponents are forced to share a chair with someone else.

Yet the bigger picture element to keep in mind is the fact that Australia still has a long way to go in meeting its climate change commitments. If governments were genuinely following through on their commitments and planning ahead then there should be plenty of chairs available for renewable energy investors.

Unfortunately, politicians over several decades have often paid lip service to their climate change commitments. The lack of clear policy direction has left government officials in charge of our electricity system and those that own fossil fuel generators with vague and unclear direction as to what they should be planning for. Should they take politicians talk seriously, or instead wait until the politicians back up that talk with policy money?

The end result is that we are to a large degree applying changes and improvements to our systems and infrastructure not so much just in time, but often well after the time they were needed. Some people might like to believe that if renewable energy investors were a bit less in a rush, things would have been far better. But my strong suspicion is that we had to have the capacity committed in order to force change from the other parts of the system. That’s been unfortunate for a number of renewable energy investors. Power generation in Australia is not some cosy regulated, rate of return business like it is in many other parts of the world. Instead it is subject to considerable risk, some which is entirely sensible and appropriate and should not be borne by consumers or taxpayers. Investors need to recognise this and undertake thorough due diligence. But politicians need to also recognise that sometimes it is more risky than it needs to be because they often fail to back up their climate change commitments with clear, long term and credible policy mechanisms.

About our Guest Author

|

Tristan Edis is Director of Analysis and Advisory at Green Energy Markets. Green Energy Markets provides analysis and advice to assist clients make better informed investment, trading and policy decisions in energy and carbon abatement markets.

You can find Tristan on LinkedIn here. |

A well designed and operated electricity generation and distribution system will supply customers with a cheap, reliable, and sturdy supply 24/7 365 days a year.

We’ve already had such systems in Australia – large, long life, affordable, coal fuelled base load generators, backed up by quick start, hydro and gas fired generators – more than capable of taking us through the typical peaks of the 24 hour cycle.

Incredibly, we are seeing these “dirty, old, clunkers” being demolished well before life expiry, in favour of thousands of individual small scale “renewable” entities, requiring billions of dollars of taxpayer subsidies, and as the above extensive analysis shows, not quite being up to the vital role they are supposed to fulfil.

It’s worse than that, because the much shorter life of these multitudes of minuscule power generators come with repeated and grossly expensive replacement and no doubt more and more taxpayer subsidies.

When will the blinding reality, that large scale nuclear reactors with long lifetimes – dropped in at locations close to the heavy capacity transmission lines already in existence – are far and away the only plausible way to power our nation into the future.

Smaller SMR units can readily be dropped in at other easy connection points i.e. close to heavy industry, and with existing hydro and gas units used to back-up the system up at times of peak demand.

This article treats our nation’s vital electricity supply system as some sort of grand experiment – let’s keep toying about with renewables, irrespective of the cost – and keep on avoiding the reality that there really is a better way to meet this need.

In addition to the multiple failures of the push to abandon reliable (fossil fuel) generation you pointed out, the pundits claimed renewables would be cheaper. However that claim only existed because the first batch of renewables did not need additional transmission infrastructure.

…or expensive storage initially-

https://www.msn.com/en-au/news/other/you-can-t-close-eraring-former-snowy-hydro-ceo/ar-AA1aFGFm

The fallacy of composition is Econ101. Trying to disprove a fundamental axiom of engineering that you can’t build reliable systems from unreliable componentry would rate alongside that.

What a fantastic summary! Thankyou Tristan!

Issues re Kiamal are dealt with in the following AEMO Power System Operating Incident Report:

06/09/2022

Trip of Red Cliffs Kiamal 220 kV line, Kiamal synchronous condenser, Buronga No. 2 and No. 3 synchronous condensers

Date of incident: 1 March 2022

580.72 KB

ditching the boat before reaching the shore.

My experience in Government and the Industry, across a range of infrastructure sectors, has been (and continues it seems) that politician-pushed programs (rather than technically/economically/soundly-managed programs) so often disappoint.