The market volatility on Wednesday 10th August 2022 turned out to be illusive.

We review unit output by fuel type to study how different generator groups responded on the day (in aggregate) finding increases, decreases and patterns in between. With the diversity of responses in mind, we hypothetically consider what the revised prices could mean for market revenue.

Readers seeking a detailed review of generator behaviour on the day may also be interested in this case study of wind farms on the day.

To recap

The event included Frequency and Ancillary Service (FCAS) service prices at the market price cap (MPC) for 13 dispatch intervals (65 minutes).

From 11:35 a sudden increase in the right-hand side values (the requirement to be met) of constraints for 6 and 60 second contingency Raise and Lower FCAS occurred.

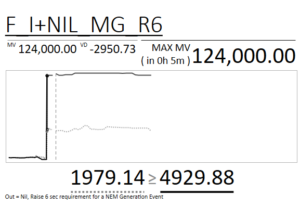

For example, the constraint setting the raise 6 second requirement for a NEM generation event is pictured showing the left-hand and right hand side values of the constraint.

The dotted line representing the enablement to be dispatched should be greater-than or equal-to the black line representing the requirement. At the point when the black line jumped up, the dotted enablement line fell well short.

The prices for Raise 6 and 60 second services and Lower 6 and 60 second services coincided with enablement levels at maximum availability.

The sky-high constraint requirements could not be met by available offers.

Over-constrained dispatch was flagged. Some constraints were violated (discussed further in the case study of wind farms on the day).

This is highlighted in the violation degree (VD) value of -2950.73 in the above example.

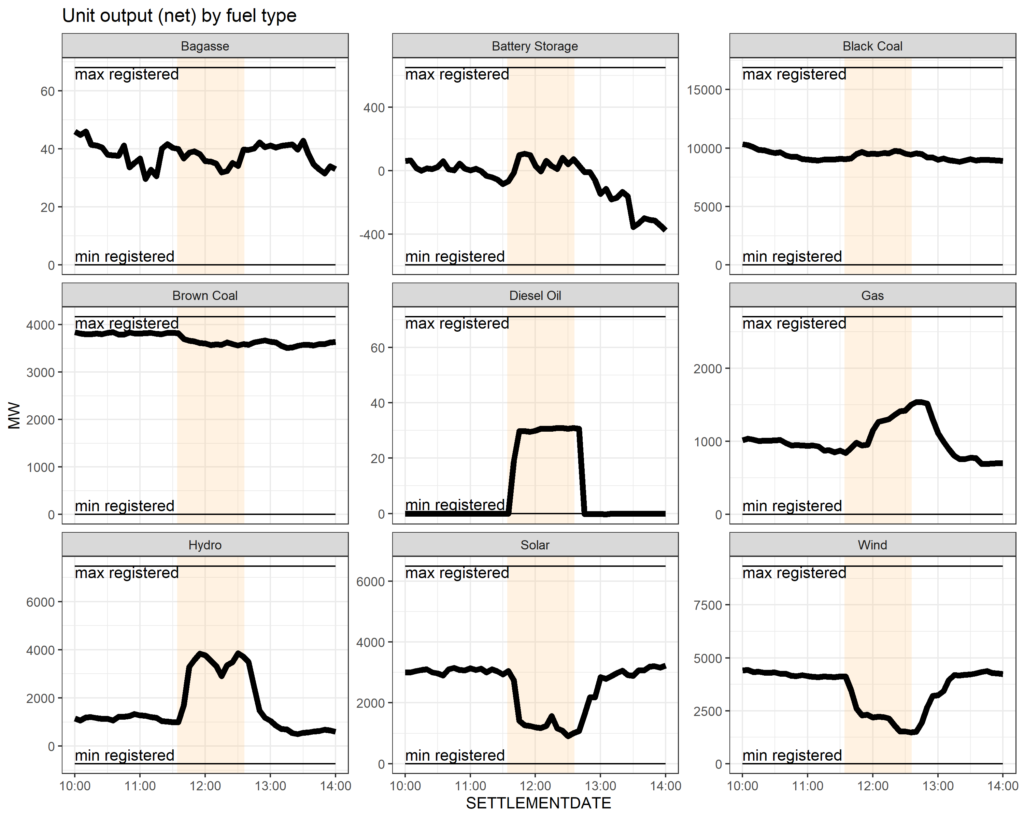

Changes in output, aggregated by fuel type, were diverse.

Some online estimates of the contingency FCAS value that would need to be recovered from some participants and paid to other participants – the FCAS price applied to what was enabled at the time – were upwards of $150 million. Understandably this would have driven some rebidding.

Changes in output are reviewed in the next section.

The event ceased by 12:40, following the roll-back of an IT change by AEMO.

The event lasted for 65 minutes.

Later that evening and into the following day market notices reported that the offending intervals from 11:35 to 12:35 had been revised.

The result returned prices back to normal levels, settling the FCAS costs for the 4 commodities of relevance to typical levels.

Changes in output, aggregated by fuel type, were diverse

The energy output by fuel type, aggregated at NEM-level, gives us a high-level understanding of how generators responded. We can see:

- Solar and wind output generally decreased during the event. Most units in these categories generally aren’t set up for FCAS provision and many may have aimed to avoid anticipated Raise FCAS entablement costs (calculated in proportion to output). Other possibilities also exist and are discussed in this this case study of wind farms on the day.

- Dispatchable sources with fast response times and ability to provide FCAS (Gas, Hydro and Diesel) generally increased output.

- Battery storage increased from what appears to be a slight tendency for charging at the start of the event to a slight net export of power. FCAS enablement may have been prioritised over energy revenues.

- Coal output decreased slightly in the brown coal segment and increased slightly in the black coal segment. Again, FCAS enablement may have trumped relatively minor moves in energy output at the time.

Note that the min and max registered capacities represent only the units that ran during the timeframe investigated. Other units that did not start or were off are not included. The capacities provide an aggregate view of the registered limits of the units that ran.

The prices were revised

The original settlement prices that the market faced might have filled some with glee due to potential enablement revenues and some with dread in anticipation of the FCAS cost recovery.

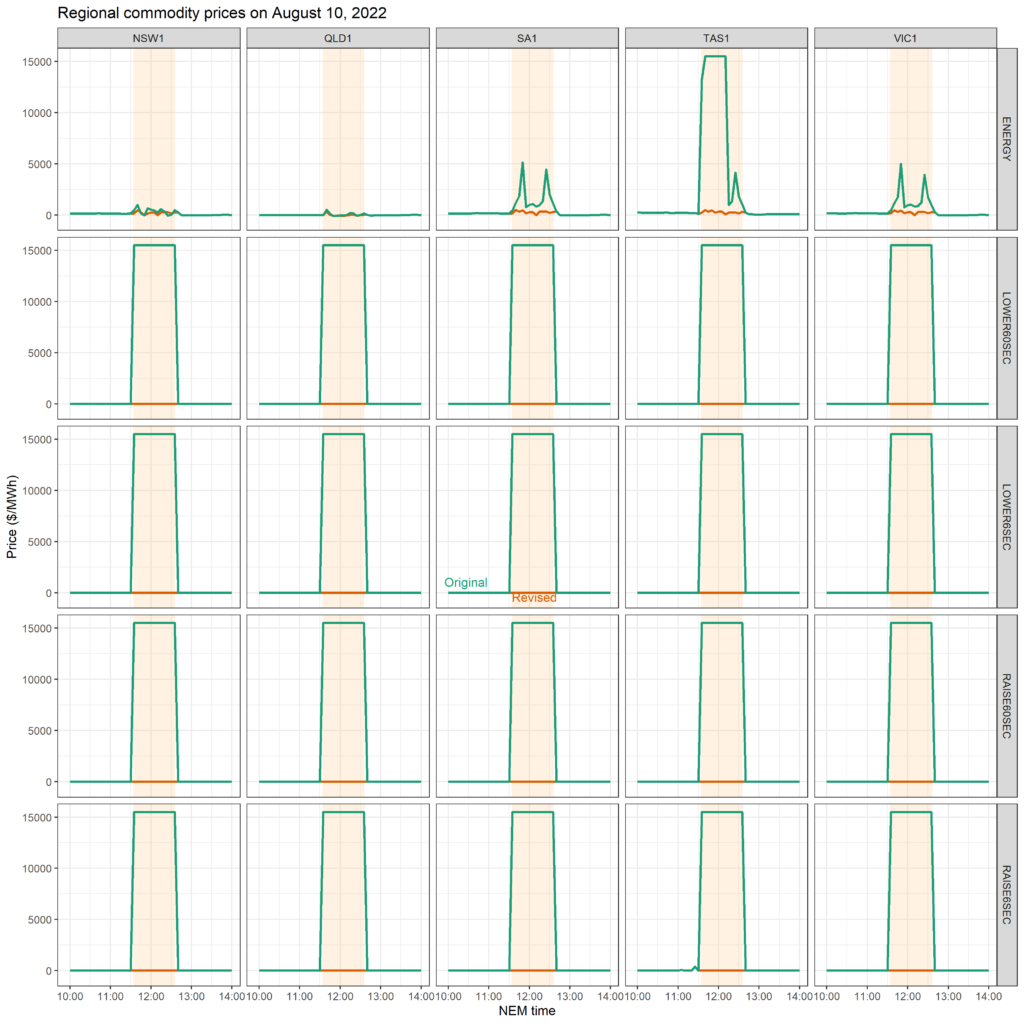

In the figure below we chart the original prices (green) and the revised (orange) values. Note that, in the figure, for clarity we’ve excluded the regulation Raise and Lower and 5-minute Contingency Raise and Lower prices as these were only marginally impacted and revised. And for context the revised prices are included in red.

Three observations stand out:

- Energy prices were most disturbed in SA, TAS and VIC but only TAS saw prices reach the MPC.

- The Raise and Lower 6 second and 60 second FCAS prices slammed into the MPC of $15,500 and stayed there for the duration of the event.

- The revision returned price levels to normal levels (at least, relative to these magnitudes).

The revisions came through later that evening

On the day: Market notices were issued alerting that prices were subject to review and being treated in accordance with the Over-Constrained Dispatch process

Later that evening: Price revisions began propagating into MMS database tables. As early as 18:56 on the 10th the first of 13 market notices was issued. It alerted users that prices had been confirmed at new, changed, values. The remaining notices were issued on the 11th.

Hypothetical outcomes suggest there were winners and losers

Based on the aggregate output by fuel type, and taking the price revisions into account:

- Units exposed to large FCAS costs which didn’t reduce energy output may be happy to see the revised FCAS prices back at comfortable levels.

- Units exposed to large FCAS costs which did reduce energy output (to minimise FCAS costs) may have lost revenue in the energy spot market, relative to their generation potential.

- Units which ramped up energy output in response to volatile energy prices and/or be positioned for Contingency Raise and Lower enablement may have seen anticipated spot market revenues adjust significantly.

Where to from here?

Price revisions don’t appear to be associated with compensation claims. Entitlements to compensation in the rules appear to be absent for these situations [alert! not legal advice]. In other words, it wasn’t an AEMO intervention event nor was it an administered pricing event or a suspended market event.

If a school kid was looking at the graphs, thy would say diesel is the go!!!!!.

I really did not think it was still in the system, but it is, and its in SA I am thinking.

Hi John, your thinking is right. There were two diesel generators that contributed to that group, both in SA.

It’d be interesting to estimate the additional CO2 emitted due to that NEMDE software error!