This article has taken a few days to pull together, in between other priorities – taking a first look at the extended outage proceeding for Loy Yang A2 unit in Victoria in 2022 (as distinct from the one in 2019!). It’s one we might refer back to later.

—

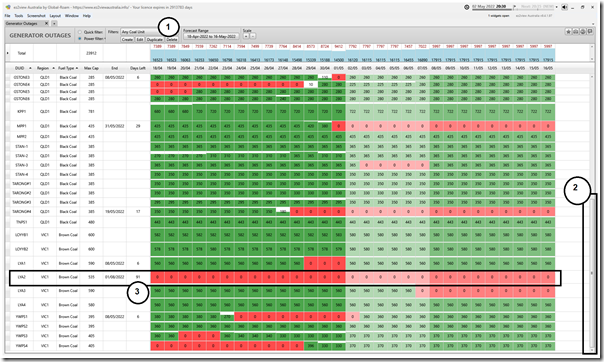

Let’s start with a snapshot from the ‘Generator Outages’ widget in ez2view – which was recently release with the v9.4 upgrade and has been well received by clients as a result, as at Monday evening 2nd May at 20:30:

With respect to the annotations on this widget:

1) You’ll see the widget has been filtered just to show the 47 coal units remaining in the NEM currently (which is one fewer than the 48 coal units analysed in some depth in GenInsights21 and the GRC2018 beforehand – i.e. minus the now closed Liddell unit 3);

2) And scrolled down to view the 10 x brown coal units in VIC

3) With the row for Loy Yang A2 unit highlighted, showing the currently expected return-to-service of Monday 1st August 2022 …

(a) This is as per the ‘MT PASA DUID Availability’ data now published by AEMO (thanks to the ERM Rule Change, and included in several widgets in ez2view)

(b) The most recent data at the time we snapshotted the image above was communicated by AEMO in the 18:00 MT PASA update this evening (Mon 2nd May 2022) – and has not changed (in terms of RTS for this unit, at least) at the time of publication on Wednesday afternoon 4th May 2022.

(A) Cause of the outage

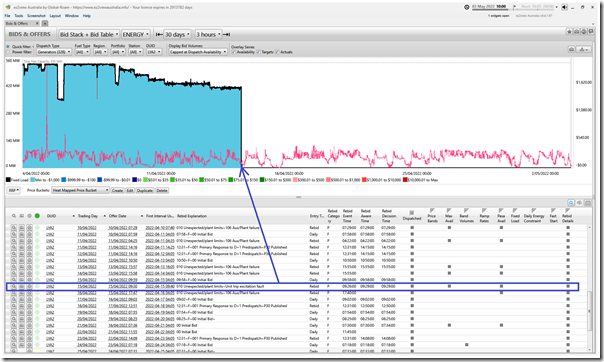

As noted in the snapshot of the ‘Bids & Offers’ widget this morning in ez2view, the unit tripped offline in the morning of Friday 15th April 2022 (Good Friday) with an ‘excitation fault’, and has been offline since that time.

The following week (Wednesday 20th April) AGL published this short briefing about ‘Loy Yang A Unit 2 Generator Fault’ which said:

‘On Friday 15 April 2022, Unit 2 at AGL’s Loy Yang A Power Station in Victoria was taken out of service due to an electrical fault with the generator. An investigation is under way into the cause of the electrical fault and AGL is engaging with the relevant authorities and technical experts.

AGL is currently assessing the length of any resulting outage that may occur at Loy Yang A Unit 2 as well as measures that may be taken to mitigate the impact of the outage. On a precautionary basis, AGL has informed the Australian Energy Market Operator that the length of this outage may be until 1 August 2022, subject to the completion of this assessment. AGL notes that this estimate is highly preliminary and subject to change.

AGL will inform the market of any financial impact of the technical fault and timing of the outage once these assessments have occurred. It is currently estimated that this information will be available by no later than the first week of May.

Authorised for release by AGL’s Market Disclosure Committee.’

(B) Memories of the long outage (also electrical fault) with LYA2 back in 2019

As noted elsewhere, this same unit experienced an outage lasting more than 7 months through 2019 … so beginning just under 3 years ago.

(B1) AGL Reporting on the outage of 2019

Back when that outage occurred, AGL had published a number of progressive updates, including the following:

1) On 8th June 2019, this ‘FY20 impact of extended unit outage at Loy Yang’. which stated:

‘AGL Energy Limited (“AGL”) has today completed an assessment of the extent and impact of an outage at Unit 2 at the Loy Yang A power station (“the Unit”) in the Latrobe Valley. AGL now believes this outage may extend seven months and, as a result, have a material impact on its financial results in FY20.

The Unit has been out of service since 18 May 2019 following an electrical short internal to the generator, which caused consequential damage to the stator and rotor components. AGL’s initial expectation was that it would take between two to four months to return the Unit to service pending results of internal generator inspections.

Following rotor removal and cleaning, further technical assessments revealed a more extensive level of damage than was previously assessed, the full impact of which has now been determined. AGL now expects it may take until December 2019 to return the Unit to service and ensure its ongoing reliability. This duration of repair reflects the unique original technical design specifications of the Unit and the extent of damage.

AGL does not expect any material impact on its results for FY19 from this outage. AGL continues to expect Underlying Profit after tax in FY19 towards the mid-point of its guidance range of $970 million to $1,070 million.

However, while AGL is seeking to mitigate impacts to portfolio availability and cost of the outage, AGL currently expects its extended nature to lead to a reduction in potential Underlying Profit after tax in FY20 of between $60 million and $100 million. Detailed assessment of the required repair process and likely financial impact is continuing.

Any material recoupment of these impacts via insurance claims is not likely to occur until FY21.’

2) On 11th July 2019, this ‘Repairs underway to bring Loy Yang Unit 2 back to service’:

‘AGL has today announced the appointment of GE Power Australia Pty Ltd (GE) to complete repairs on Unit 2 at our Loy Yang A Power Station.

Last month, AGL confirmed an extended outage at the unit following an electrical short internal to the generator.

GE has been selected to complete the repair works following an extensive procurement process, involving multiple vendors.

AGL Executive General Manager Group Operations, Doug Jackson said ensuring the unit’s future reliability was a critical factor in selecting a vendor.

“We understand the importance of Loy Yang to Victoria’s electricity supply, GE is the Original Equipment Manufacturer (OEM) and has the expertise and experience to complete this complex repair work,” Mr Jackson said.

“A detailed technical analysis on the generator has been completed and the repair will involve what’s known as a full rewind, which will see the replacement of the original coils and copper parts.

“This will deliver a proven design and engineered solution that meets AGL’s technical specification.

“The capital cost of the repair and upgrades at the station during the outage window will be $57 million. Most of the work will be done by local providers and is expected to create around 200 local jobs during the outage.

“The expected return to service date remains mid-December 2019 and we’re looking at other ways we may be able to increase generation from across our portfolio while these repairs take place,” Mr Jackson said.

“As the market operator, AEMO is responsible for managing system reliability and while there are no forecast shortfalls by this outage, we want to do everything we can to eliminate any impact of the outage on overall supply over this period.

“We have a range of options available due to AGL’s diverse and flexible portfolio that allows us to manage this outage well.

“We’re committed to delivering affordable and reliable power for our customers and we will continue to look at all potential options.

“I want to thank our hardworking teams at Loy Yang who are working to ensure we bring Unit 2 back to service as quickly and safely as possible.

“Since acquiring Loy Yang, AGL has invested $900 million in capital expenditure to ensure it remains reliable and keeps electricity affordable for our customers over the remaining years of its technical life.’

3) On 26th September 2019, updated with ‘Loy Yang A Unit 2 repairs well underway’:

‘AGL has confirmed repairs on Unit 2 at Loy Yang A Power Station are on track and progressing well, ahead of the summer months.

AGL General Manager Coal Operations, Steve Rieniets said he remains confident the works will be completed by mid-December 2019.

“We know how important it is to return this unit to service as soon as possible and I want to thank the hard-working teams who’ve done a great job,” Mr Rieniets said.

“Right now, we have more than 120 workers from Siemens, Lend Lease, and GE Power Australia working around the clock to complete the job and ensure the unit is reliable for summer.

“GE Power Australia has been conducting what’s known as a full rewind of Unit 2, which involves the installation of customised replacement pieces.

“To date the repairs are progressing well with the testing of the generator core successfully completed.

“This confirms that the stator core is in good condition and will now only require cleaning ahead of replacement parts being installed.

“Additionally, the internal pressure piping for the boiler will undergo a full inspection, as well as potential repairs. This work will include inspections of the internal burner, external ducting, precipitators and the boiler fans.

“AGL understands the concern this outage has caused many households and businesses, but we want to reassure the community that we are doing all we can to return the unit back to service as soon as possible.

“We are also working closely with the market operator, AEMO to facilitate a reconnection to the grid once the critical repairs are completed.”

Since acquiring Loy Yang in 2012 we have spent more than $900 million in capital expenditure to ensure the plant operates over the remaining years of its technical life.’

4) In the Annual Report 2020, the company noted (p6) that:

‘Underlying Profit after tax, which excludes these movements in fair value and Significant Items, was $816 million, down 22 percent, in line with the guidance range we provided in August 2019. The principal drivers of the decrease in profit were the unplanned outage at AGL Loy Yang in the first half, reduction in gas sales volumes, lower wholesale electricity and largescale generation certificate prices, and increased depreciation and amortisation expense’

(B2) Coverage of the 2019 outage on WattClarity®

The unit dripped offline on Saturday 18th May 2019, but it was not till 10th June that we wrote a first brief note about the outage.

In the lead-up to summer 2019-20 …

1) Guest author Allan O’Neil wrote ‘Extended outage of Loy Yang A2 –reliability and forward price impacts’ on 14th June 2019;

2) Allan also wrote about ‘Keeping the lights on this summer – possible impact of the Loy Yang A2 and Mortlake outages’ on 23rd July 2019

3) This article on 7th August 2019 also included some observations.

4) It all went down to the wire – as we wrote in ‘Sweating on the return of Loy Yang A2’ on 17th December 2019, the extremes forecast for summer 2019-20 caused some consternation about the return of the damaged unit

… and remember that this was without the added visibility of generator outage plans, which was mostly alleviated (except for Semi-Scheduled assets) with the ERM Rule Change.

The return to service was first attempted on Christmas Eve 2019 – but hit a snag (noted on 30th December 2019 again on 13th January 2020). It proved second time lucky on 20th January 2022.

(B3) Market view of the outage of 2019

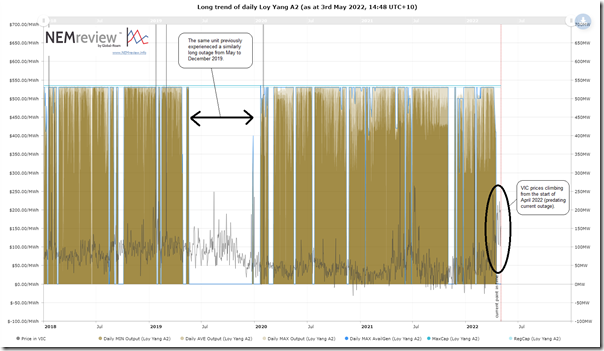

This outage we can clearly see in this trend from NEMreview v7 that looks back to the start of 2018:

(for those with a licence to the software, they can open their copy of this query here)

In the chart we can also see how operations at the unit have shifted towards more cycling, particularly from the end of 2021.

(C) Cost of the outage

A few brief notes, at this point – on the expectations that more will be updated in subsequent articles.

(C1) Expect changes in Return to Service?

Reviewing the history above, and noting that the return to service expectation is currently 1st August 2022, it’s worth noting that this date may well be pushed back significantly (as it was in 2019) – once a proper assessment of the failure (and any damage) is done, and repair works are contracted and scheduled.

(C2) Cost to AGL Energy

A couple days after the unit came offline (on Good Friday, 15th April) was these first few articles that I saw after Easter on Wednesday 20th April :

1) In AFR was ‘AGL suffers outage at Loy Yang as coal worries grow’ by Angela Macdonald-Smith – which quoted a note by Rob Koh at Morgan Stanley to its clients:

‘Morgan Stanley analyst Rob Koh reminded clients that the generator was rebuilt in 2019 over seven months, costing $100 million in earnings when Victoria’s pool price for electricity averaged about $90 a megawatt-hour.

“AGL recovered those losses from business interruption insurance, however AGL is now self-insured,” Mr Koh said in a flash note to clients.

“We view a repeat of this scenario as a worst case.”’

2) In the Australian Perry Williams wrote ‘Victoria faces winter power curb as AGL Energy’s coal unit knocked out’. Perry also quoted Rob Koh from Morgan Stanley, and then quoted Morgans analyst Max Vickerson:

‘ ”My impression is that the impact is likely to be a missed opportunity rather than a large drop in earnings. The other units at the plant are running close to 100 per cent capacity whereas typically the output of this unit would be more like 70-80 per cent,” Morgans analyst Max Vickerson told The Australian.

“My base case assumption is that AGL‘s short position is probably limited but we won’t know for sure until the company provides more information. The flip side is also that AGL can’t participate in the very high wholesale prices that otherwise might have boosted the second half of 2022 earnings.” ’

3) Jackson Graham wrote in the Age about ‘Two of Victoria’s biggest coal-fired power stations hit with faults’, also referencing two units being out at Yallourn Power Station (though both units 3 and 4 at Yallourn have since returned to service and were not of the same significance).

4) For RenewEconomy, Michael Mazengarb wrote ‘Loy Yang A coal generator unit offline for second time in three years’.

—

Perry Williams then followed with:

1) On Thursday 21st April, the article ‘Loy Yang coal power station failure sparks demerger doubts for AGL Energy’, with the note:

‘It (i.e. AGL) expects an earnings hit of $70m or $20m-$30m per month, hitting the final two months of the financial year and the start of the 2023 earnings period.’

2) Then on 26th April, with ‘AGL Energy faces $90M hit from Loy Yang A coal breakdown’, quoting research by RBC analyst, Gordon Ramsay.

—

This week on Monday 2nd May, AGL Energy issued this ‘Updated FY22 Guidance’, which noted:

‘AGL Energy Limited (AGL) has today updated its earnings guidance for the financial year ending 30 June 2022 (FY22) as follows:

-

-

- Underlying EBITDA for FY22 to be between $1,230 and $1,300 million, down from the previous guidance range of between $1,275 and $1,400 million

- Underlying Profit after tax for FY22 to be between $220 and $270 million, down from the previous guidance range of between $260 million to $340 million.

-

This update follows a review of the anticipated financial impact of the generator fault at Unit 2 of the Loy Yang A Power Station in Victoria, announced on Wednesday, 20 April 2022. AGL currently expects that the unit will return to service by 1 August 2022, however, engineering assessments are continuing and AGL will inform the market of any material changes to this timeframe.

The estimated total financial impact of this outage is approximately $73 million pre-tax ($50 million after tax) based on an expected return to service by 1 August 2022. This includes the direct trading impacts to date and the estimated portfolio trading impacts through to 1 August 2022.

The financial impact split between FY22 and FY23 is expected to be approximately $60 million pre-tax ($41 million after tax) and approximately $13 million pre-tax ($9 million after tax) respectively. The financial impact of the Loy Yang A Unit 2 outage is not recoverable via insurance.

The update to AGL’s FY22 guidance reflects the financial impact noted above.

Detail of Loy Yang A Generator Fault

On Friday 15 April 2022, Unit 2 at AGL’s Loy Yang A Power Station in Victoria was taken out of service due to an electrical fault with the generator. Subsequent testing determined that the generator rotor insulation had failed with options to repair the rotor for an expected return to service by 1 August 2022. AGL is focused on affordability and reliability for its customers and is reviewing whether any upcoming planned outages in the rest of the generation portfolio can be shifted to help mitigate AGL’s shorter energy position in the market.

Authorised for release by AGL’s Board of Directors.’

Following that market update, there was a subsequent series of articles about the costs:

1) ‘AGL cuts earnings guidance on Loy Yang outage’ by Angela Macdonald-Smith in the AFR

2) ‘AGL Energy cuts profit guidance after coal breakdown’ by Perry Williams in the Australian

3) ‘AGL energy reveals eye-watering cost of Loy Yang coal power plant outage’ by Alex Druce at News.com.au

4) ‘Loy Yang A coal plant outage expected to cost AGL at least $73 million’ by Michael Mazengarb in RenewEconomy.

(C3) Cost, and Risk, to the Market

It’s a different (though related) story about what the potential impacts of the outage are for the market more broadly:

1) In terms of prices; and

2) In terms of security of supply.

… but they are subjects for a later article or two (see the summary of 2019 above for an illustration).

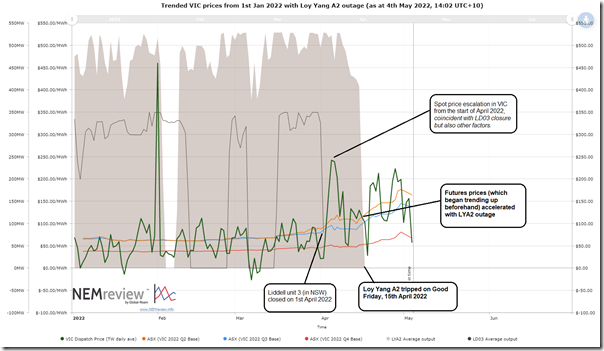

For now I’ll just leave readers with this trend in spot and futures prices for the VIC region since 1st January 2022, with an acceleration in futures prices for Q2 and Q3 (not so much Q4) coincident with the tripping of Loy Yang A2:

Coincidentally, also today guest author, Carl Daley, has re-posted his review of the ‘April market prices surge’ on WattClarity here.

Leave a comment