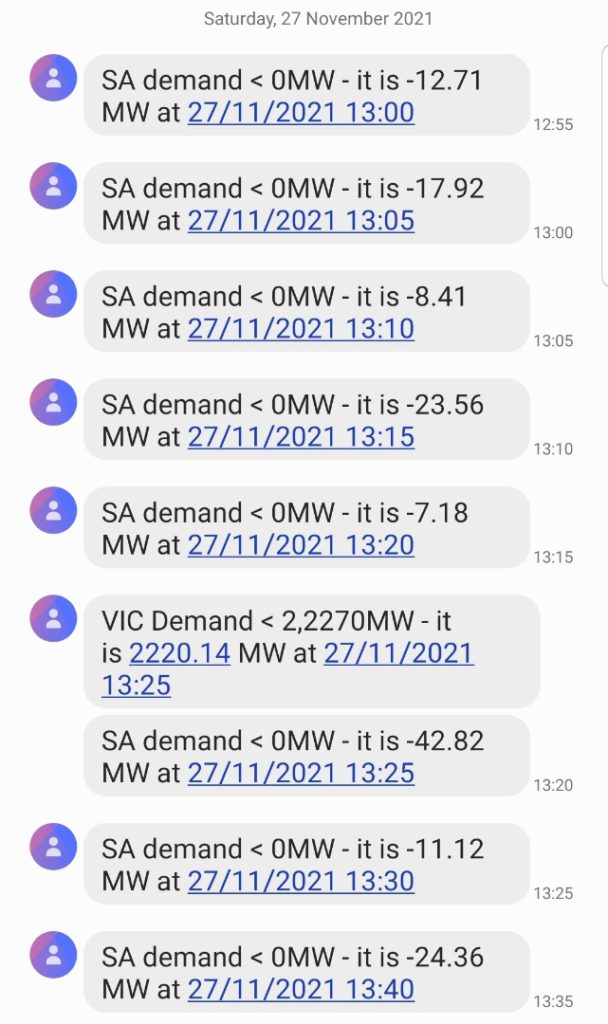

Earlier this afternoon we started to receive SMS alerts from ez2view notifying us that scheduled demand in SA had dropped below zero for the second time in less than a week.

Meanwhile, scheduled demand in VIC also hit a record low for the 13:25 dispatch interval this afternoon as well.

Declining minimum demand is a theme that we are exploring as part of our analysis within GenInsights21, to be released on the 6th of December. If time permits, we will try to post more on today’s developments in the coming days.

I note the AEMC are doing their best to deal with the big picture problem-

https://www.msn.com/en-au/money/news/kill-the-viability-big-batteries-to-lose-out-from-electricity-grid-rule-change/ar-AARgprt

Essentially with RE we should have started out with a level playing field for all tenderers of electrons to the communal grid. Namely reasonably guarantee them 24/7/365 along with FCAS (ie short of unforeseen mechanical breakdown) or you can keep them and use them yourself.

That only leaves the political bunfight over carbon taxing penalties for fossil fuels but now we have the worst of both worlds the AEMC has to grapple with. What’s more with the switch to EVs for transport we’re seeing scarce light-weight lithium battery resources being squandered on fixed batteries for temporary grid firming as that’s where the cream is. I wish the Regulators well with it all when we really need rational statesmanship.