On 20th September our 18th Case Study in the series was published – looking at two dispatch intervals on 25th March 2019 where Semi-Scheduled units collectively underperformed by more than +300MW (at 12:40 as high as +367MW). If we wind the clock forward 11 days now, to 5th April 2019, we have our 19th Case Study looking at a case of extreme* under-performance late afternoon 5th April 2019.

* in terms of ‘extreme events’, we’re specifically looking at Dispatch Intervals where there has been:

Scenario 1) more commonly ‘large’ collective under-performance across all Semi-Scheduled units (being measured as Aggregate Raw Off-Target > +300MW); or also

Scenario 2) much less frequently ‘large’ collective over-performance across all Semi-Scheduled units (being measured as Aggregate Raw Off-Target <-300MW).

(A) Background context

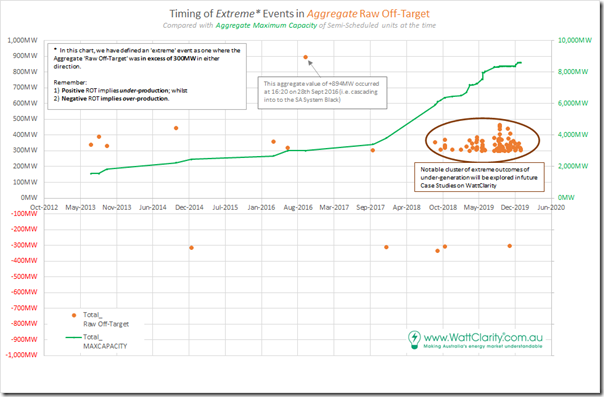

Remember that we identified a total of 98 discrete instances where aggregate Raw Off-Target across all Semi-Scheduled units was either:

(a) above +300MW (representing collective under-performance) or, much less commonly,

(b) under –300MW (representing collective over-performance relative to AEMO’s expectations, seen in the Dispatch Target).

There was a smattering of only 10 cases through 2013, 2014, 2015, 2016, 2017 and through until August 2018. However thereafter (to the end of 2019) there was a sharp escalation of extreme incidents – as seen in the following chart:

Note also that we have not yet looked into 2020 data, which will be the focus of the GSD2020 (so we can’t comment on whether the trend from 2019 has continued to grow).

We’re doing this given a push from the AER Issues Paper, but moreso inspired by the deliberations by the (now defunct) COAG Energy Council and (extended?) ESB relating to ‘NEM 2.0’ with submissions due on 19th October 2020. Note that these case studies deal with imbalance in the Dispatch Interval timeframe, but readers should understand that there are other challenges that ‘NEM 2.0’ also needs to resolve, including:

Other Challenge #1) Within the dispatch interval timeframe, energy-related services focused on frequency maintenance and response to contingencies;

Other Challenge #2) Relating to ‘firmness’ of supply in the broader forecast horizon; and

Other Challenge #3) Others that we bundled into a ‘keeping the lights on’ services in our discussions in the Generator Report Card 2018 (for instance, in relation to System Strength).

In preparing these focused Case Studies, we’re seeking to understand why and what the implications are of this escalation.

(B) Looking just at the 17:05 dispatch interval

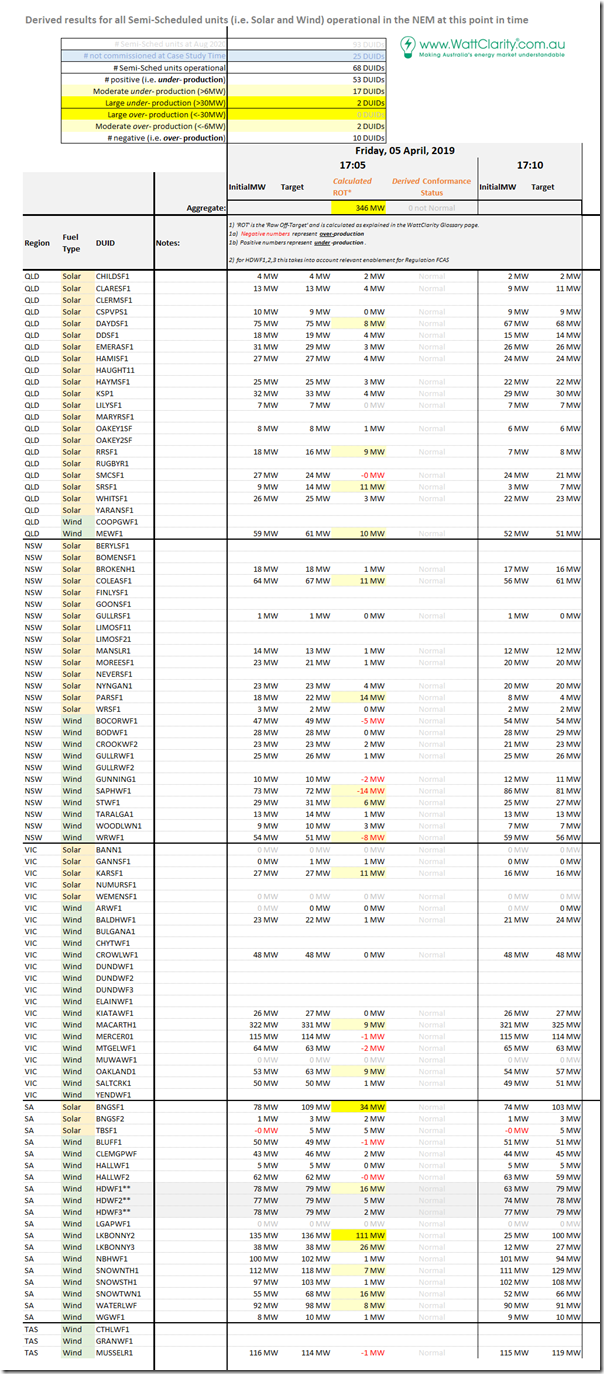

Here’s the same tabular framework of results for individual Raw Off-Target performance of all 68 x Semi-Scheduled units that were operational at the time:

In summary from this table, we can see the following:

1) Of the 68 DUIDs registered at the time, there are 530% the number under-performing (53 DUIDs) as there are over-performing (10 DUIDs).

2) Of the units highlighted as having Raw Off-Target greater than 6MW (a threshold that is one of the inputs in determining Conformance Status for a unit), we see the split is even more unbalanced:

(a) 17 DUIDs flagged as under-performing by at least 6MW (with 2 of these under-performing by more than 30MW); whilst

(b) Only 2 DUIDs flagged as over-performing by at least 6MW (with neither over-performing by more than 30MW).

… which, needless to say, is a very skewed ratio (and not the first time we have seen it, either).

One more reminder of how the commonly touted belief that I might paraphrase as ‘the unders and overs will average out’ just does not hold true, at least in many of these extreme events.

(B1) Units showing large Raw Off-Target Results

We’ll start with the three DUIDs that show Raw Off-Target of greater than 30MW, a quite significant deviation for an individual unit. Remember that the choice of what’s ‘large’ is a little subjective – however I have based it on two things:

Criteria #1) Practical considerations, like my time constraints in drilling into each instance – not to mention my sense of a reader’s patience in working through these articles;

Criteria #2) More holistically, though, I have also made the choice based on the fact that 30MW has been the historic threshold where a dispatchable asset must be registered with the AEMO and operate as a Scheduled Generator. Keep in mind that the registration threshold for a battery is 5MW (i.e. it was seen that 30MW was too large a tolerance for invisibility).

… so for now 30MW seems a good criteria for me to also use in looking at the growing number of invisible, and quite random ‘phantom generators’ we have entering the NEM which are operating as the ‘evil twin’ of a Semi-Scheduled generator which would be fully predictable in a dispatch time horizon through the AWEFS and ASEFS processes.

With this in mind, let’s have a look at the 2 DUIDs which had large ‘phantom generators’ coupled with what was expected in NEMDE to deliver large unpredictability. Both of these were in South Australia:

(B1a) Bungala 1 Solar Farm in South Australia (under-performance by 34MW)

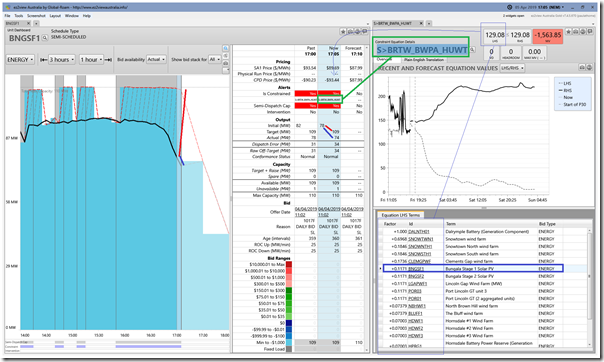

With the snapshot from ez2view below (combining the ‘Unit Dashboard’ widget and the ‘Constraint Equation Details’ widget) we see the following situation for BNGSF1:

With respect to BNGSF1 in this dispatch interval, we can see:

Observation #1) The constraint ‘S>BRTW_BWPA_HUWT’ is bound, and is having some (albeit small) impact on BNGSF1:

#1a) Constraint relates to ‘Out= Brinkworth- Templers West 275kV line, avoid O/L Hummocks-Waterloo 132kV line on trip of Blyth West-Munno Para 275kV line’

#1b) Because of the positive factor applied to BNGSF1, the constraint is trying to ‘constrain down’ the output of the Solar Farm

#1c) However the factor is only +0.1171 (compared to +1.0 for DALNTH01, for instance) so the impact of the constraint is less for BNGSF1, all else being equal.

#1d) This constraint delivers a CPD Price of –$93.44/MWh for BNGSF1, which is significantly under the Dispatch Price for SA.

#1e) However we see that BNGSF1 is bid down at –$1000/MWh, so well below the CPD Price.

Observation #2) As a result, we see that NEMDE is trying to increase the output of the plant from 78MW to 109MW.

#2a) However the unit ‘goes the wrong way’ to drop slightly to 74MW.

#2b) Hence a net imbalance (or Raw Off-Target) of 34MW.

Observation #3) Finally, we see that the unit has experienced a large Raw Off-Target over most of the dispatch intervals shown in the prior 3 hour periods:

#3a) This coincides with when this constraint has bound

#3b) When the constraint binds, ASEFS flips (for the dispatch interval) its mode of operation to establish the Available Generation by combining the number of panels in service and the solar irradiance. In this case, it thinks the capability of the plant is 109MW.

#3c) Evidently this logic has been overly optimistic over the past 3 hours when used.

(B1b) Lake Bonney 2 Wind Farm in South Australia (under-performance by 111MW)

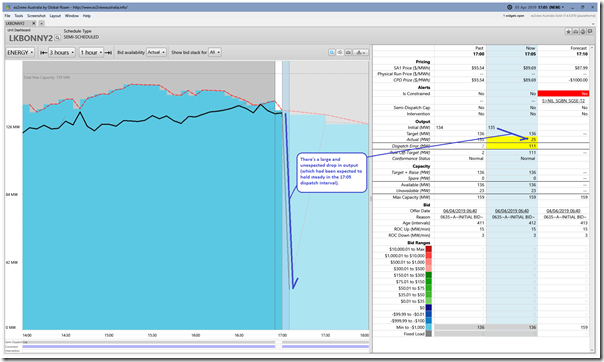

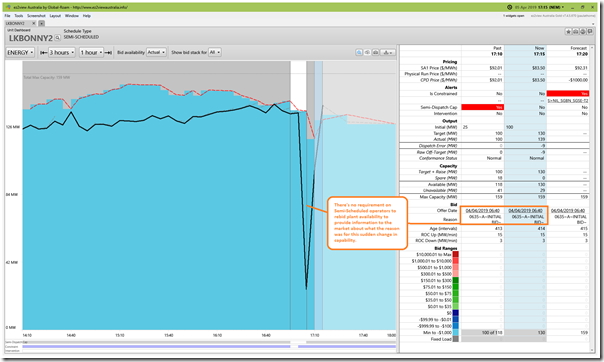

An even larger deviation is shown for LKBONNY2, also in South Australia:

Observation #4) There’s a large and clearly unexpected drop in output at the unit, which had been expected to hold steady around 136MW (which is around where it had been over the prior 3-hour period). Instead the unit drops to 25MW (not fully offline).

Observation #5) Except for the 17:00 and 17:05 dispatch intervals, we see that the constraint ‘S>NIL_SGBN_SGSE-T2’ had been bound, seeking to cap collective output of units it could control in the south-east of South Australia (Lake Bonney 2 and 3, along with Snuggery GT and the output from the Lake Bonney Battery – noting that Canunda and Lake Bonney 1 are Non-Scheduled).

#5a) It’s also noted that this constraint was then forecast to bind again at 17:10 in the P5 predispatch run, dropping the CPD Price down to –$1,000/MWh.

#5a) How this might have contributed to the steep drop in output (i.e. whether it could be involved at all) is not clear.

Observation #6) It’s also worth noting that negative prices (which are central to the concern raised in the AER Issues Paper) is clearly not a factor here.

Observation #7) Winding the clock forward two dispatch intervals on the display above (to 17:15 – noting different title bar colour in Time Travel to distinguish) we see that the plant output bounced straight back up:

Observation #8) As noted on this image, there was no rebid supplied for 17:10 or 17:15 that would help to inform the market of what the reason was of the sudden loss of output, and just as sudden recovery:

#8a) Note that the current market rules do not require there to be, because of special leeway provided for Semi-Scheduled units in terms of how they operate;

#8b) As explored in the Generator Report Card 2018, we do wonder about the scalability and sustainability of the Semi-Scheduled category as it currently operates:

(in Theme 13 within Part 2 of the 180-page analytical component in the GRC2018)

#8c) This is a question we are exploring further:

i. In this series of Case Studies; and

ii. If time permits before 19th October 2020 we would look to describe in a submission on ‘NEM 2.0’ in response to these ESB deliberations. Would be our 2nd only formal submission in 10 years or more…

iii. Certainly in the next update to our Generator Report Card, possibly for release in the first half of 2021.

(B2) Units showing smaller (but still significant) Raw Off-Target Results

That’s not the end of the story, however…

Observation #9) In between the 2 units above the aggregate under-performance was 145MW – which still leaves a significant remaining under-performance of 201MW spread across the remaining units. That’s a sizeable residual ‘phantom generator’.

Observation #10) This discrepancy was mostly contributed by the 15 other units which were Raw Off-Target greater than 6MW but lower than 30MW:

#10a) Remember that all 15 of these have discrepancy levels large enough to be equivalent to what the AEMO sees as one criteria for Conformance Status being away from ‘Normal’.

#10b) Hence none of the discrepancies are trivial – especially when DUIDs were overwhelmingly under-performing.

#10c) Of these remaining 15 DUIDs, one was greater than 20MW (LKBONNY3) and many were at least 10MW (see in the table above).

#10d) A key lesson, here, is that the smaller discrepancies add up to something big when there is such a skew in results and most units are under-performing at the same time.

One more reminder of how the commonly touted belief that I might paraphrase as ‘the unders and overs will average out’ just does not hold true, at least in many of these extreme events.

That’s all I have time for now…

It seems to me that if a generator is contracted through CfD, this effectively reverses the effect of spot prices on bidding behaviour.

The CfD rewards generators for low spot prices, which incentivises generators to bid low and keep spot prices down.

But that doesn’t necessarily translate into low electricity prices for customers, and certainly isn’t providing an investment signal (unless you can score a government offtake)…

The added benefit of being semi-scheduled means following a dispatch set point is almost always optional, which is certainly an advantage compared to scheduled generators who can’t sell their output when they’re dispatched down to make room.