Back on Friday 21st December 2018, submissions closed for consideration in parallel with AEMC’s deliberations about these three Rule Change proposals relating to one method of Demand Response in the NEM. In 19 years of operations we’ve only made 1 or 2 formal submissions, so it should be no surprise that we did not make one in this case, either.

We do, however, try to make it along to public forums where rule changes we’re particularly interested in are discussed – which is why I am disappointed I can’t be at the AEMC’s Public Workshop on the demand response work program in Melbourne today (Tuesday 5th March). Unfortunately, the demands of completing the Generator Report Card are meaning other things are not making the list, or being deferred.

Our absence should not be taken for lack of interest. Indeed, following from questions from several parties who we know will be in attendance, I’ve invested some time to pen some thoughts here in the hope that they might be of use in the deliberations.

I’d just caution that I’ve not had enough focused time to think these thoughts through as far as I would like, so they are a bit “rough and ready” and may well have warts. Happy if readers want to point out glitches they see – but note I won’t be surprised if you do.

If you would like to speak with us about these thoughts (or about how we can assist you with Demand Response) please either:

1) give us a call on +61 7 3368 4064; or

2) if (like us this quarter) you’re working all sorts of odd hours and unable to call during the day, feel free to use this feedback form to provide us more details (and remember to include your phone number).

(A) A Quick Summary of my current thinking

For those not aware of how we’ve been facilitating DR for more than a decade, I previously provided this summary of our journey in service to Energy Users in relation to Demand Response thus far. We’ve been doing this for more than a decade – beginning way back nearly at the start of the NEM (back when most energy users, and their representatives, were pretty hostile to the idea of Demand Response!)

Thankfully we’ve come a long way since that time to where discussions about Demand Response are now fairly commonplace … however, it wonder whether a number of these discussions (perhaps the discussions at the AEMC today?) are stuck in yesterday’s battles, when the market has moved on and the challenges we face in the years ahead look quite different. Unfortunately, from what I have read of all of the three rule change proposals, my concern is that none of them will really deliver the demand response we will need to see in the NEM in the years (and decades) ahead.

In short:

1) Demand Response, as a percentage of our business, has grown over the years, and is a sizeable chunk;

2) This business will continue to grow, even if the rule changes proposed are not accepted.

3) If a formal mechanism for NegaWatts to be treated as a supply-side option in the dispatch algorithm is enacted, our business will receive another additional boost. We will help energy users make the most of that opportunity (thanks for that, in advance!) It will also help others whose business models are predicated on a need for NegaWatts.

4) However, I have serious reservations about whether that will actually advance us to where we need to be.

5) I’ve been wondering whether, that there could be a better way forward, that will build a more sustainable platform to last the market another 20 years into the future. This is outlined below (though have not had time to fully think this through – so it may well have holes).

6) I suspect there might be a number of different stakeholders who won’t like it, though – including:

(a) Existing retailers (small and large); and

(b) Those who have become emotionally wedded (including in their business models) to the idea that NegaWatts are a discrete and tangible thing, and that wholesale somehow is not linked to retail.

7) I understand the temptation will be to take the easier road for the implementation of a shallower NegaWatt mechanism – and if we (collectively) choose to go that way, we’ll benefit (as a company), as will our energy user clients.

8) However, we have this opportunity to think more broadly about this energy transition – and I, for one, would be interested in exploring that possible alternative route.

For those who have time to continue, here’s some further discussion…

(B) Some longer thoughts … though still a work in progress

As a software business we frequently hear stories of products that don’t quite hit the mark, primarily because they fail in addressing real problems that need to be solved. In our past we’ve had our own share of failures in that respect – where the product seemed like a good idea at the time.

In this energy transition there’s seems a risk that we (collectively) engage in the same sort of behaviours – building something that don’t solve real underlying problems. This challenge is particularly important with respect to institutionalized rule changes, given the costs involved in the change and the difficulty (impossibility?) in unwinding if it does not work.

So let’s start by outlining what we see as the underlying problem that needs to be solved.

(B1) A growing need for flexibility on the demand side

It’s clear to us that there is an increasing need for increased flexibility on the demand side of the electricity sector.

The AEMC Consultation Paper provides a reasonable explanation of what the underlying challenge is, and why the NEM needs a much more price-responsive demand side of the supply/demand equation in future. Coincidentally, also in December we noted this presentation by Brattle Group about the types of changes they see (and particularly the rise of intermittent renewables) warranting an evolution to what they call “Demand Response 2.0”.

(B1a) Increased variability a feature of “NEM 2.0”

The key point for me is that the need for responsiveness and flexibility on the demand side is about way more than those few days each year of peak demand. It’s commonly noted that the increased penetration of supplies from intermittent wind and solar PV generation technologies is meaning a different requirement for the remaining generation plant left to match the shortfall between supply and demand.

In the future) Back in October 2015, I posted this article examining how the ramp rate requirement would become significantly greater than had been the case historically.

Already the case now) We’re part-way through that journey to the “10x world” modelled in that analysis – and our Generator Report Card 2018 will provide some assessment of how far we have already progressed in that transition.

Of course, it’s not only increased range and control of ramp rate on the supply-side that will become increasingly important. Maintaining the balance between supply and demand could also be facilitated (if triggered well) by rapid changes consumption profiles from one interval to the next. This is, of course, the domain of “Demand Response”.

(B1b) What is “Demand Response”

“Demand Response” is a term given to a range of activities undertaken by electricity users, or people acting on their behalf, to temporarily curtail consumption from the grid in response to some form of commercial incentive. This might be done by a combination of:

(a) Reducing the total consumption at that point in time; and

(b) Reducing the draw on the grid by some form of onsite generation substitution. It might be possible to generate more than consumed, and so export to the grid at that point.

As such, there are a broad suite of potential approaches to eliciting a change in consumption profile. Identifying and exploring a range of these approaches is one of the reasons why we prepared this explanatory information at www.DemandResponse.com.au some time ago.

(B1c) Scale of the requirement

Starting from the top, it’s important we understand that the desired outcome is both of the following:

Outcome #1) We require additional demand response that can deliver total MW response well into the 100MWs per region (and possibly 1,000MWs in QLD, NSW and VIC)

Outcome #2) Because of the stochastic nature of the growing numbers of overlapping but independent variables (e.g. variability in consumption patterns, wind harvest patterns, solar harvest patterns, network capability patterns, etc…) it seems certain that demand response will be required to operate more frequently in future than has been the case in the past – and a times that won’t fit into a simplistic definition of “peak”.

Pricing patterns have changed in the NEM, and are set to change further. This analysis in 2017 and in 2016 talks about some of the changes – and here I spoke about possible implications for demand response.

It’s important to understand that the behaviour we wish to incentivize is not just to curtail at times of (still relatively rare) very high prices, which is the way it’s worked in the past for our clients and others. It also includes:

(a) consuming more when prices would otherwise be negative and renewable production otherwise curtailed; and

(b) it means moderating consumption much more frequently when prices are driven into the $100s due to low wind and solar harvest patterns.

To do this requires engaging a much broader set of energy users than has been the case in the past. But it also means correctly defining the problem as above (and my concern is that a focus singularly on NegaWatts could be an example of Villain no 5 in not focusing properly on the real problem/opportunity).

Instead, shouldn’t our objective be focused on removing real barriers to the ongoing growth of flexibility on the consumption side of the supply/demand balance?

(B1d) Real barriers we have experienced, to Demand Response

In parallel with the AEMC’s review of several rule change requests, and because of the underlying need to stimulate a more active demand side to keep supply/demand in balance given the increased challenges in the environment we’re driving into, I thought it would be useful to outline these real barriers to Demand Response in the NEM.

(a) In our journey, we have had some success in addressing these barriers, however there is still a long way to go.

(b) Below we make some suggestions as to approaches that might be (at least) considered as having the potential to deliver the increased flexibility that we’re all going to need.

(B1e) Demand Response is not, however, a “magic wand”

However, it is important to recognize that there seems to be a tendency of some to reach for their preferred “magic wand” to wave away the tricky challenges that are inherent this fast-moving, and even further reaching, energy transition.

Even though, or perhaps especially because, we are a keen facilitator of Demand Response in the NEM, and look forward to continuing to grow that side of our business into the future (whatever the outcome of this latest round of AEMC deliberation) we are keen to note that Demand Response is also not a Magic Wand , and shouldn’t be viewed as a “get out of jail” card.

We all need to understand that the prime reason any energy user connects to the grid is not to keep the lights on – but rather to use the energy embedded in the electricity supply to produce something useful to them. I have seen some positive heroic assumptions (akin to waving the magic wand) made about how demand response might fill some gap in the supply/demand balance in some modelling (one example of G-I-G-O).

These sorts of naive assumptions do nothing to help the energy transition succeed, and only embolden the critics who are amongst those advocating a U-turn on our energy transition.

(B2) Four broad routes we could choose?

The way I see things, we are approaching a crossroads in this energy transition – at which the choices we make (including with respect to this deliberation, but well beyond this one) will have far-reaching implications for the electricity sector – and the broader economy and environment.

Given that we are assisting a diverse range of clients manage the challenges (both threats and opportunities) inherent in this transition, I’ve been giving some thought to the implications of each of these choices.

Possible Route 1) U-turn not possible?

Firstly, let’s start with the choice that some would seem to be seeking to make – to turn this energy transition around, and make our way back to some “glory days” of the past where (as their recollections would have it) the energy sector was much more to their liking. Amongst these are two types:

Type 1 of U-Tuners) There are those Villain no3 who might be saying things like: “The sky will fall in!” if we continue with the energy transition. Some would like to wind the transition back only a few years, back to a point where the incremental unit cost* of wind and solar were such that it was not a rational choice, in the absence of external subsidy:

* As an aside, frequent readers might remember my recent request that we all start thinking/talking more about VALUE, rather than COST, following this shift.

Type 2 of U-Turners) Others would like to wind the clock back more than 20+ years, before the start of the market – though I have previously noted how those claims are based on some pretty strange recollections, at least in terms of the wholesale market.

It seems clear to me that, for a combination of reasons, we can’t go back to the past. U-turn not permitted.

Possible Route 2) Hazards straight ahead?

There are a sizeable number (it seems) who appear blissfully unaware, and contented to continue to plough on forward down the path we have been proceeding. Amongst these are those Villain no3 who might be saying things like: “The problems are already solved – see such-and-such report proved it could all be done.”

However, we have hit some potholes in this journey already, and the signs appear that there’s some significant hazards lying straight ahead in our energy transition, and we are a high risk of derailing, unless we take some precautionary action. I noted this back in July 2017, and would reiterate the warning here of “Hazards Ahead”!

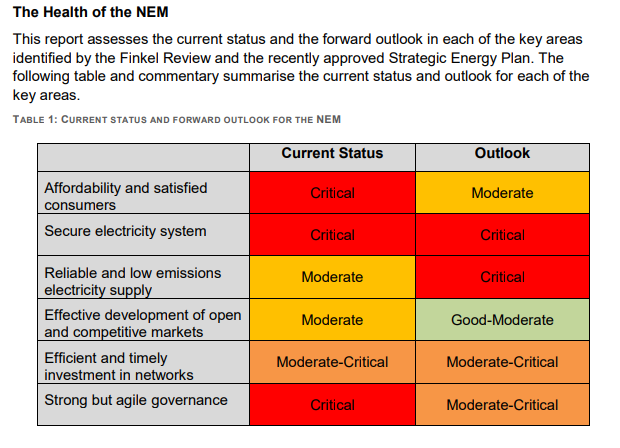

The ESB, in their 2018 Health of the NEM report, said pretty much the same thing – with the distinct red/orange shade of their report ringing alarm bells:

… so we can’t keep doing what we’ve been doing to date and need to change course, and many realize this….

Possible Route 3) Turn right into “NegaWatt Land”

Each of these rule changes that are under consideration at the AEMC essentially encompass a change in course that would incorporate two linked developments:

(a) The institutionalization, via the rules, of a NegaWatt as an intangible supply-side response; coupled with

(b) An increase in opacity of the demand side – through the institutionalization, via the rules, of an unmeasurable “what would otherwise have been” demand shape.

These two changes might be worth the costs and risks that would be incurred through, and introduced by, the change. It’s the AEMC’s job to assess the cost/benefit trade-off. If such a method is implemented, our revenues will increase – and we’ll help a number of energy users make money via the method (so happy days for us – though not without reservations…).

#3a) Start with the end in mind…

As noted above, the real problem is how to assist the market in delivering additional 1,000MWs of consumption (NEM-wide) that triggers more frequently than has been the case in the past. Coupled with the fact that we want to extend this flexibility down to loads smaller than 1MW in size means that we’re talking about engaging with a large number of sites (potentially 10,000s).

Any rule change (or other) method we produce through this AEMC process should start with this objective clearly in mind as the end goal.

The AEMC documentation also talks about the desire to have greater transparency about the process – but (in my view) this is a secondary requirement to the overall delivery of responsive consumption.

#3b) The proposals revolve around a “Negawatt” commodity

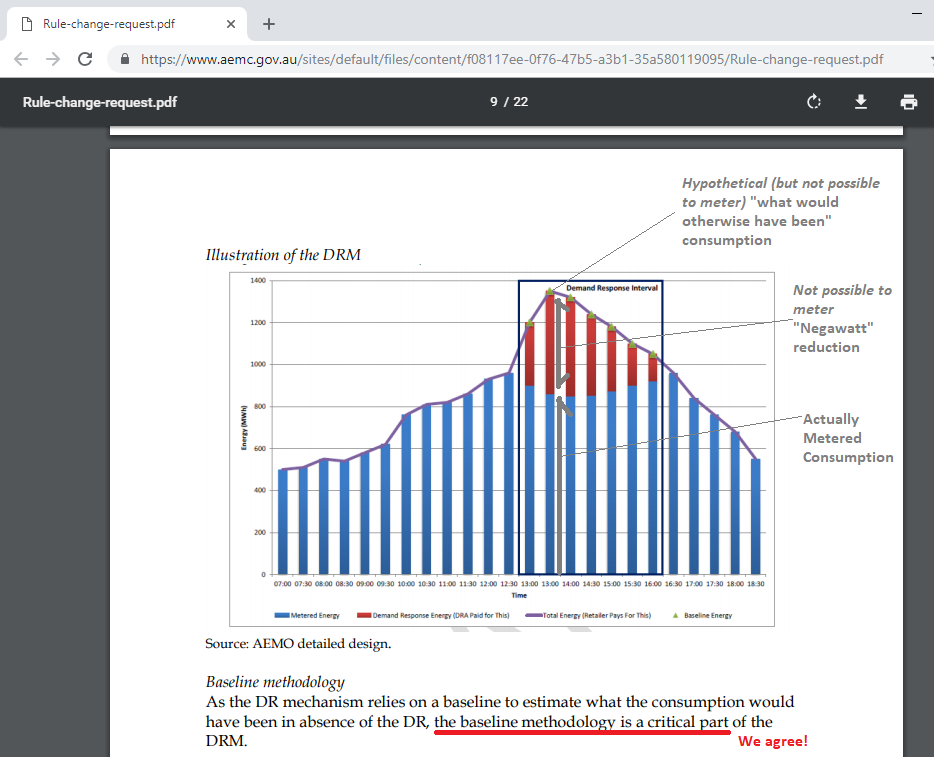

These proposals are based on some form of methodology for the creation of a (hypothetical) “what would have otherwise been” consumption level. This is generally called a Baseline – as noted here in the snapshot from the Rule Change proposal assessed in the 2015 round of deliberations:

I note that the rule change proposals submitted in 2018 were quite scant on details for how the specific methodology by which these baselines would be developed (e.g how, by whom, when, etc) – but it is important to keep in mind that whatever method would need to be workable for 1,000s or 10,000s of sites, perhaps many below 1MW individually.

For a Baseline method to work, we effectively need to think of three different trended variables/commodities:

Variable #1 = the intangible (unmeasurable) “what might have otherwise been” Baseline, which represents the Demand Side of the supply/demand balance in dispatch.

Variable #2 = the intangible (unmeasurable) “what they said they curtailed” Negawatt reduction, which acts as an effective supply-side contribution in the supply/demand balance.

Variable #3 = the measurable “what actually happened” consumption level, which would play a much lesser role in the dispatch process and is effectively relegated to the difference between Variable 1 and Variable 2, both of which can’t be measured.

Acknowledging the inherent impossibility of knowing “what would have otherwise been” (though it is a common analytical challenge) let’s move beyond the basics to understand how the widespread adoption of baselines could open up cans of worms in a number of ways.

#3c) Baselines, and cans of worms

I noted above that it’s my view that transparency should be a consideration secondary to securing the responsiveness of the electricity consumption – however let’s start by acknowledging that the introduction of two artificial (and unmeasurable) commodities for 1,000s (or perhaps 10,000s )of sites would hardly seem to be moving the NEM in the direction towards greater transparency.

Concern #1) Introduction of baselines will lead to “gaming the baseline” behaviour

In our own demand response journey, we have had energy users tell us directly that they have used our own software to “game the baseline” methodology established for them by their retailers. Understandably, they did not use those exact words:

(a) Whilst this has put us in a somewhat uncomfortable position (i.e. knowing that a particularly designed scheme is having an effect inverse to its intent), we also appreciate that it is a commercially rational outcome, given the incentives that are in place.

(b) At least in the current case, retailers can respond relatively rapidly (if they perceive that there are groups of energy users engaging in such behaviour) to amend the programs they have in place, or limit their scope. I would not be surprised if this is one of the reasons for the anecdotal evidence reported elsewhere that “my retailer does not call on my Demand Response much anymore” (i.e. this method here).

We’ve long known of the “spark spread” being the arbitrage across the gas-to-power bridge, and more recently have been thinking more of the “time spread” inherent in any value proposition for storage. The introduction of any mechanism that creates a NegaWatt commodity as a defacto supply-side offer will inevitably give rise to a “NegaWatt spread”, being the difference between:

- a fixed retail price for “What would have otherwise been” Consumption; and

- a dynamic, and at times much higher, wholesale price for NegaWatt curtailment as a Supply-Side option.

As we have been told already that energy users already use our software, on occasions, to optimize this, it seems blindingly obvious that we’re going to have more clients doing the same thing when the process is institutionalized in a rule change.

Now I’m sure that rules could be written to reduce the incentive for the energy user to game the baseline, essentially by increasing the increased cost of inflating it on the retail market (e.g. baseline shall be average of last 20 days of consumption, etc…), I wonder whether tying the energy user in a straight-jacket in this way is counter to the stated objective of incentivising them to be more responsive?

That’s one of the reasons we have serious reservations:

(a) On the upside, there is the possibility that formalization will bring with it a much more robust policing and enforcement capability; however

(b) History tells us that our business will grow further, with more sites using our software to do the same thing in this case (or at least to attempt to do so) – even though it will feel like a pyrrhic success for us.

Concern #2) Additional management costs will be significant

Remember that the reason for such a rule change deliberation is because we need to engender 1,000s or 10,000s of additional sites to provide responsiveness of demand, triggered by spot prices. The way it seems to me, this will lead to an escalation of costs across the industry – with a few areas highlighted.

2a) Costs at the AEMO

Naturally, the parties with vested interest in the NegaWatt, and hence the baseline, (i.e. energy user and aggregator) should not be the ones who ultimately define the baseline – that would just be inviting trouble. We presume it would be the AEMO who would be tasked (or at least heavily involved) with calculating the baselines in some form.

This won’t be a trivial amount of work, and would seem to require a new team of people and real-time information systems accessing site meter data for energy users, and possibly other data sets as well.

2b) Costs at the AER

Given the near certainty that some will try to game the baseline, and the inherent complexities in accounting for two commodities which can’t actually be measured (one on each side of the supply/demand mix), I presume that the AER would need to further beef up its monitoring and enforcement capabilities (people and tools, including more people to visit energy user sites and familiar with process operations for a range of energy users) to review the operations of all of these sites.

Apart from the costs involved in the AER, it also seems certain that the lawyers involved in NEM rules and regulations will see an uptick in their business as a result.

2c) Costs at the MDAs

Through the creation process, the Meter Data Agent will effectively need to create a time-series record of Variable #1 and Variable #2.

Given that the objective is to elicit demand response across many sites, and that there will be a need for a number of parties to access the “what would otherwise have been” demand trace for various reasons, it would seem to me that the presumption must be that the mechanism is put in place for Variable #1 and Variable #2 traces be created for all energy users (or at least all above a certain size, if there is some threshold set for the minimum size NegaWatt response).

If this was to be the case, then reason would dictate the change be made at the same time as 5-minute settlement is implemented (given the sunk costs already committed to the change in metering data at that time) – however we need to be aware that we’d be talking 3 x the data volume, which won’t be a trivial cost.

2c) More general data handling costs, and confusions

In our own experience, we have seen the NEM become an increasingly complex place – moving from a position where (historically) Scheduled Demand was the only real measure of consumption in the NEM. Now we have Operational Demand, Native Demand and Native Consumption on top of that historical basis – which does make one more prone to error in understanding and decision making. So much so, we put this long explanatory article together to help our readers.

Adding in a “what might have otherwise been” demand trace for a large number of sites seems a recipe for additional confusion.

These increased costs of data handling would presumably make their way through to energy users in their final bills.

Concern #3) Risk of higher retail prices

The underlying argument I have heard numerous times over the years is that the energy users is paid some share of the amount the Demand Response Aggregator is paid for dispatching the NegaWatts as a supply-side option in the price setting process. Hence, the argument goes:

(a) That particular energy user gets paid a revenue stream (as a defacto peaking generator on the supply-side); whilst

(b) All energy users benefit as a result of these other supply-side options keeping the lid on wholesale pricing.

Hence, so the argument goes, it’s win-win for all energy users – with the losers being those big bad generators who have been ripping us off in any case. Unfortunately, implicit in this storyboard seems to be an assumption that the cost of retail contracts won’t shift as a result.

Of course, it would be nice to think of these retailers as the big bad ones we all like to wave our big sticks at – however the reality is that the costs will be shared across all retailers, including the smaller ones (down to new entrants who are receiving more favourable media coverage and wear the black tee shirts, and might even be the ones we like to like)

In this earlier article on WattClarity from 8th October 2018, Mike Williams explains that the “Plain Vanilla” retail contract incorporates a general structure as follows:

Retail energy price = Wholesale energy price + Administration costs + Risk premium (volume, load profile and credit risks) + Retailer margin

The general structure of retail pricing is not a secret – I can remember it being discussed and presented on by a range of retailers and retail brokers for as far back as 10-15 years ago. It was back in October 2009 when I posted this article, for instance.

However, despite it being fairly widely understood that retailers add a risk premium onto their wholesale hedging cost to determine the retail contract prices they offer, proposals for the introduction of market-wide NegaWatt buyback mechanisms seem to always assume that the retail price the retailer offers to the energy user won’t change.

Personally, I can’t see why this would be the case – or why, at least, the retailer would not seek to charge a higher risk premium, and a higher administration costs, if competitive pressures allow. Remember that retailers are the ones who have had experience with their own NegaWatt programs in the past, including the observations that:

(a) the commercial structures incentivize some energy users to try to increase their consumption at times when they think the price might be high and their NegaWatts dispatched (which will mean that at least for some retailers they will be more “short” their own generation capacity when the price is high – after all, they can’t all be “long” at the same time); and

(b) oftentimes, price spikes forecast in predispatch will evaporate by the time they reach reality.

Hence it is possible that retailers might conclude that the “what would have otherwise been” energy consumption that they will be purchasing from AEMO on the wholesale market will, on average, increase in cost. This would be a cost that they would try to recover through the retail prices they offer.

The complication with an AEMO-administered market-wide program is that the retailer might not be able to know which energy user is supplying NegaWatts at any given point in time (e.g. if their identity is cloaked through some form of Demand Response Aggregator). Hence the risk is there that the retailer might conclude that they have to assume that all their customers are possibly participating.

Now it might be the case that competitive pressures mean that retailers are unable to hike their risk premium, in which case they will have to absorb the cost that this increased risk amounts to. However, that seems a big assumption to make – given the potential impacts might flow through to all retail rates.

Now it might be that this increase in cost paid for all MWh consumed is outweighed by the revenue earned by dispatch of some NegaWatts at different points in time.

| Let me reiterate that we’re ready to serve, should such a change be implemented. We have already identified several ways that our business will gain another step-change of growth if it happens. Our plans were refined back in 2015-16, when AEMC last looked at the introduction of a Negawatt buy-back mechanism.

For energy users who want to know more, they can call us on (07) 3368 4064 – if (or when) the rule change is passed. |

Before we get to that, however, the commencement of deliberation on the rule change is the point at which we can (and should) consider what the real objective is, and whether the path this would set us towards would assist us down the path of getting us to our intended (indeed, required) end destination.

Perhaps inadvertently, Craig Memery highlighted what jumped out at me as a key point in the following tweet during some dialogue a few weeks ago now:

Let’s leave aside the capacity payment line (not sure I would have said that we need one, as I have certainly noted before that they are fraught with their own problems). I’m also not sure that it’s the main barrier to DR (as I had noted these two greater barriers, based on our own experience), however it is a shortcoming in the NEM that there is (mostly) generation-only dispatch currently.

However, let’s be clear – the introduction of a NegaWatt commodity as a supply-side option in the dispatch process will (in my view) actually make that problem worse, not better.

| That’s because the AEMO will treat the NegaWatt as a defacto supply-side offer, and still be relied upon to assume the underlying demand shape for each region as an input into the NEMDE process.

(I assume) it will still be the AEMO who estimates the Scheduled Demand for just as many sites that needs to be met by dispatchable supply, which so sets the price. What will change is that the AEMO will (in this new world) need to also make assumptions for that “what would otherwise be” future demand shape at numerous sites across the NEM offering (i.e. not yet dispatched in the NEMDE run) NegaWatt supply. This assumed demand would thereafter never be able to be reconciled with any metered quantity (except in the case where you also add in an assumed, but unmeasurable, NegaWatt response), which does not seem a great way for progressively improving the refinement of demand forecasts over time. I don’t understand how such an approach adds to market transparency – especially when it needs to be scaled up to thousands of smaller sites to meet our Demand Response needs in the years and decades ahead? |

It seems to me that, at the very least, there are significant hazards ahead if turning right into NegaWatt Land.

Possible Route 4) Turn left towards a genuine 2-sided market

There does seem to be an alternative, however – though let me be clear that this is also not a panacea (not a magic wand).

There is already a category of participation that is currently within the rules (no changes required there) and which has begun to see what will become a rapid growth in involvement in recent times. That is, of course, the category of Scheduled Loads.

It used to be the case that it was a valid argument that it was too complicated for most energy users to be Scheduled Loads in the NEM.

Route 4a – Scheduled Loads as the final destination

However, a range of more recent technology enhancements (including the rapid drop in cost of battery storage, and the rise of automated and semi-automated bidding systems) suggests to me that the time is ripe to think strategically about how we might help to use this inflection point to significantly grow the volume of MW operating as Scheduled Load in the NEM.

I will expect that some of those who are particularly stuck on the introduction of NegaWatts into the NEM will plead about the Scheduled Load category being somehow more complicated than how a NegaWatt Supplier category would operate. However, I would suggest we clearly and dispassionately think this through, as I wonder whether this would just be another case of “socializing costs whilst privatizing benefits” for some of the organisations in that boat?

If a portion of an energy user’s load could operate successfully as a supplier of NegaWatts bid continuously into the market and dispatched as required, why could it not just as successfully be a Scheduled Load (and without also bringing along all of the deficiencies that NegaWatts would bring)?

Route 4b – Spot pass-through as an interim point on the journey

A stepping stone in this journey, would be to help energy users understand the nexus between the (very dynamic) wholesale price that’s accessible to them and the (quite static, for the most part) retail price they have used to be obsessing about. I see that some interim period of spot exposure for real consumption (in some form), would be one way of bridging that gap.

We have, as noted before, been working with energy users who operate in this manner for a number of years. As time has progressed, we’ve seen these energy users become quite sophisticated in their operations. It might be that the next step, for them, could be to become a Scheduled Load.

For other energy users further down the learning curve, here are a few suggestions that we’d like to have had more time to think through:

Possible Improvement #1) Benchmark cost in retail bills

Much has been written elsewhere of the current Federal Government’s initiative of implementing a Benchmark Retail Price. Implementation of something like that was a recommendation in the ACCC’s 2018 review of the electricity sector (as was also, we note, the implementation of some methods to facilitate more demand response in the NEM).

From the thinking I’ve managed to do thus far, I see that there’s an overlap between the two – in that it might be possible to implement a change that might be able to go some way of achieving both.

What I have been thinking through is the possible merits of a mandatory requirement for all retailers to include on all retail electricity bills a simple numerical comparison for that particular customer that noted what their energy component of their bill would have been for that particular period had they purchased their electricity at spot prices.

Delivering this would help to achieve a number of things:

1) Firstly, it would provide the start of a real, objective means for comparing their current offer, without requiring the AER (or anyone else) to manufacture some form of Default Retail Offer (with all the challenges that entails).

(a) Spot Prices are what they are – openly published, objective and well scrutinized after 20 years – surely we could (and should) use them as the benchmark?

(b) Such an approach would take explicit acknowledgement that a cost of supplying each energy user is unique, with a large share of the cost linked to their actual profile of energy use.

2) An additional benefit of this approach is that it would help to make energy users aware that there is a wholesale spot market, and that:

(a) There is an option available for them to purchase on the spot is an option for them through various means; and

(b) Even if they did not choose that option, it would help them understand that their time-based profile of consumption is a big determinant of the cost they pay in the retail market.

3) By comparison, the energy user will then also be made aware of the real services that the retailer provides them (e.g. insurance/hedging, and cash flow management) and the cost they are paying for these services.

(a) This will lead to a real benefit in helping the energy user decide if they value these retail services.

(b) In many cases I would expect that the energy user will decide that they value the retailer’s services and hence remain on their current arrangements. However, I would expect, over time, a growing number of energy users to more actively explore purchase at wholesale rates.

Furthermore, it’s possible (though this would need to be checked) that this might be lined up with the transition to 5-minute settlement starting 1st July 2021 to reduce the implementation costs and risks in the transition. This might help to defray some of the cost (and the risk) of another change to retailer billing systems.

Possible Improvement #2) Enhance Energy-Made-Easy

The second step in the process would be the enhancement of the Government-operated (via the AER) Energy Made Easy electricity offer comparison service. This could be done through three separate, but related enhancements:

Improvement #2a) Benchmarking

With the benefit of the clear separation of the “Energy” component of the retail electricity bill into its two separate components, it would make it much easier for the Energy Made Easy site to provide real benchmarking of costs on a more comparable basis:

Component #1 = Wholesale Spot Cost, which would be (obviously) very dependent on the timing of consumption data, but which would be much more easily comparable with it being separately itemized.

Component #2 = Retailers Service and Margin, which would be less dependent (though not wholly independent) on the particular load shape of the client, and hence much more comparable.

As such, enabling the user to enter their data for a real historical bill on Energy Made Easy to receive real feedback on comparable costs for each component

Note – if it was not possible, or desired, for Energy Made Easy to be evolved to provide this service, it seems likely that a third-party service provider might develop a service to provide this (it might be something we would consider, for instance).

Improvement #2b) Calculation service for “my spot cost”

In parallel with the above, it would be possible to create an online service for energy users to (through submission of several data points to authenticate their rights to the account – such as Address and NMI) access a calculation of what the wholesale cost would have been over some historical time range.

We have sometimes done this on a bespoke basis for energy user who have asked us, and I imagine there are other service providers (like Retail Brokers) who have provided a similar service. When done manually it is a time-consuming, and hence relatively expensive exercise – however it would be possible to automate and deliver a much more cost-effective (and timely) service to energy users.

Options for where this service might live include Energy Made Easy, on the particular MDA site, or on some third party site (again, it might be an option we could provide – as would a number of others).

Improvement #2c) Comparison of “Spot Management” as an option

As a separate enhancement to Energy Made Easy, it should be enhanced to provide explicit comparison of offers made by retailers to energy users for management and administration of spot price pass-through arrangements.

It doesn’t seem right that it should be mandatory for energy retailers to provide offers for that particular way to serve -however it does seem useful to mandate that energy retailers indicate their willingness (or otherwise) to serve in that way, and what their form of charge would be.

Other Possible Improvements …

Note that there had been other ideas rattling around in my head as possibilities. However these escape me this morning, unfortunately…. (if they come back to me at some point, and we’ve delivered the Generator Report Card to our clients, I will add them into a future post).

(C) Wrapping up

The NEM is going to need a load more Demand Response in future given the significantly different supply mix we will be working with, and the changes to the natural environment as the climate continues changing. We’ve been a keen supporter of Demand Response over more than 10 years and look forward to this continuing.

If the AEMC makes a rule change that creates a NegaWatt as a discrete, but intangible, supply-side addition to the supply/demand mix, we will be doing what we can to help our energy user clients make the most of these opportunities. Our prior experiences in working with energy users (including with the retailer’s own NegaWatt programs) has helped us identify opportunities there.

However we have significant reservations about the warts that such a change would make – and wonder if there are not better approaches that would help to deliver a two-sided market with more (not less) transparency? If the AEMC wanted to explore this alternative route, we would be happy to be involved (albeit being severely time constrained at present).

Finally, let me apologize for this being quite long and rambling. To paraphrase what Mark Twain is sometimes quoted as saying “if I had more time, this article would be much shorter”.

I enjoyed that write up, good job thinking outside the box. It is correct to point out that recent planning reports have escalated their tone and language around reliability.

So, a separate market for demand response sounds ok to me. What about a separate market for semi-scheduled generators?

Hi Ben, would you be able to help me understand what you mean by “separate market” please?

There is only one dispatch process that runs every 5 minutes.

Hi Paul, we already understand the AEMO bid stack where the power supply tenders are accumulated using the lowest price first, then the next lowest option until supply meets demand.

I was visualising two bid stacks, one each for dispatchable sources and another for non-dispatchable sources. The dispatchable demand would be total demand minus the non-dispatchable supply.

I believe this would calibrate each market correctly based on their true value. It would also remove what I believe is the masking effect of the RET on dispatchable investment signals.

I haven’t bottomed this idea out in my thinking yet, so I thought I would drop it here where somebody might give me some deeper insights.

Thanks for reaching out.

Interesting discussion Paul. For my part the way i conceptualise a 2-way market is for demand side (retailers, large users) to bid in their demand in tranches of decreasing prices (an old-style downward sloping supply curve) with non-curtailable load bidding in at the MPC. Retailers’ bid stack would reflect the sum of their agreements with customers. One further advantage is that there is less onus on AEMO to forecast demand accurately, that responsibility is devolved to market customers. This sort of approach would require a lot of retailers, of course, but at least initially, if they wanted to be pure price takers they could.

I’m not sure your idea of mandatory bill info would in itself do much to jumpstart greater customer interest in DSP. I think the ACCC-led process for 3rd party data access is more likely to help – with customers’ permission other parties can take their consumption data and use whatever analytical/presentational tools they like to present the DSP opportunity to that customer.