I’m told that the AEMC will be issuing its final rule determination on the ‘Negawatt Dispatch Mechanism’ tomorrow (Thu 11th June) morning.

I wonder whether what’s contained inside will kick off the process to the creation of ‘Negawatt Factories’ – hence this short article this evening?

(A) Some background to this rule change process

Given our keen facilitation of a different type of Demand Response for longer than 15 years (despite the baloney parroted by other supposed supporters of DR that ‘it does not already exist’ in the NEM), readers will understand that we wait with keen interest to see what transpires on the ground with the final decision.

The gestation period for this particular rule change has been long and arduous – though frequent readers will understand that I wait with keen interest, and more than a little apprehension, to see what arrives in the birthing suite tomorrow. Will it be the golden child that some see as promised, or will it be more of a problem child?

Time will tell – and, whatever the outcome, we’ll be there to help our clients maximise the value they can obtain from the rules, the way they are drawn. I’d add a caveat on this, however, in that (as readers will have noted) we’re genuinely interested in making the energy transition work, so there are some approaches that could emerge that seem quite evident to us which:

1) Whilst delivering more value to our clients, and hence to us;

2) Really don’t seem to be in the long-term interests of the energy transition

… and hence we might need to make difficult choices in terms of whether to serve or not.

A1) Current iteration of push for a ‘Negawatt Dispatch Mechanism’

On 15th November 2018 the AEMC invited submissions on 3 different proposals for Negawatts to be included in the price setting process for Energy.

I initially expressed some concern on these proposals on 5th March 2019 with ‘Some thoughts about Demand Response, in parallel with AEMC deliberations’ – and then followed this up with some more specific feedback on the draft ruling published on 18th July 2019 in the article ‘All aboard the Negawatt Express… but where are we really headed’.

A2) Prior iterations of push for a ‘Negawatt Dispatch Mechanism’

To the AEMC’s credit, what was proposed in the draft rule on 18th July 2019 was a big improvement on what had been offered in some of the rule change proposals originally.

It’s also significantly better than what had happened the prior instance a Negawatt Dispatch Mechanism had been considered (beginning November 2015, with my early consideration here), and ultimately rejected.

(B) What could possibly (still) go wrong?

Earlier today I used this article to reflect on how we ultimately get what we pay for – or, more specifically, we ultimately end up with the behaviours we incentivise. History has proven this to be the case even if those behaviours were not initially envisaged by the people working through what’s turned out to be inadequately designed incentive structures.

With that in mind let’s use some simple cartoons to illustrate:

B1) State 1 = when prices are ‘low**’

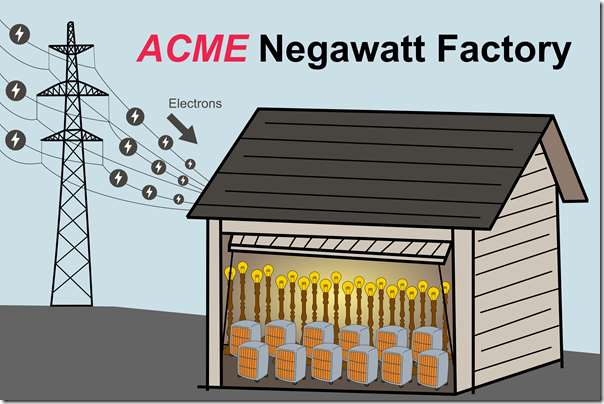

With apologies to Wile E Coyote and his outlandish plans to catch his bird, what was proposed in the draft rules seemed ripe for manipulation in the form of ACME*-styled designs for ‘Negawatt Factories’ which could be illustrated something like this:

* Any link between the (real) name AEMC and (fictitious) anagram ACME is unintentional and coincidental. Honest!

This state represents the ‘ordinary’ scenario – which it seems most people assume** will represent the vast majority of the Trading Periods over a certain period (year, say). During these time ranges, the general principle is that the market operates normally, with the electrons flowing as shown on the image:

|

What (and who) the Energy User pays |

What the Energy User is paid (by whom) |

|

This scenario is more of the traditional arrangement which, for the majority of energy users, will mean that they pay to their Retailer: MWh (of Real, Metered Electrons) x … and then the Retailer pays to the AEMO the following: Identical MWh (of Real, Metered Electrons) x Now keep in mind that the Retailer’s core business (as the intermediary or aggregator) is making money from the arbitrage between the Contracted Rate and the Spot Price (at least with Real Electrons at a Metered MWh). Some do quite well at that. |

If you believe the sales pitch by the advocates for this mechanism, the Energy User won’t be paid anything directly by anyone during this period. However I wonder … |

So far so good with the simpler State 1 … thought this still won’t be identical to the way things currently work in the absence of Negawatts as an institutionalised commodity.

B2) State 2 = when prices are ‘high**’

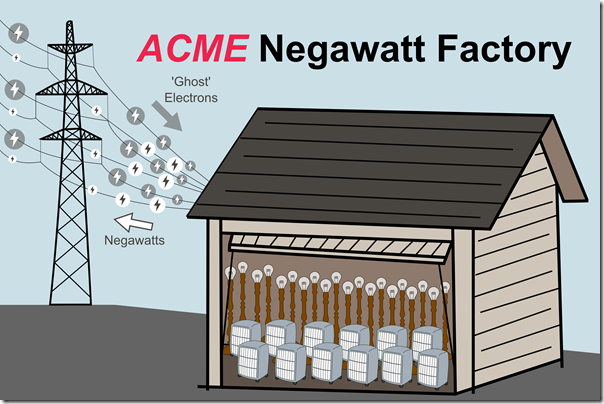

The real complexities comes when, via the probable rule change, we introduce an inextricably linked pair of intangible, imaginary, and unmeasurable commodities:

Imaginary commodity #1) On the one hand, with the load curtailed (via the centralised dispatch mechanism) we have a stream of ‘ghost electrons’ streaming through the transmission grid to serve the load that would ‘otherwise have been’ (notwithstanding the inherent difficulties in determining this); whilst

Imaginary commodity #2) On the other hand, we have a conveniently sized stream of ‘imaginary Negawatts’ passing back the other way (conveniently at a precisely identical rate – especially because of the fact that neither of them can actually be measured).

What could possibly go wrong here, I wonder? Under this arrangement in State 2:

|

What (and who) the Energy User pays |

What the Energy User is paid (by whom) |

|

The Energy User would (in most cases?) pay their Retailer according to the following formula: MWh (of Ghost Electrons) x … and then the Retailer turns around to pay the AEMO at: MWh (of Ghost Electrons) x |

In this case, the AEMO then pays the Energy User at the following rate: MWh (of imaginary Negawatts) x … noting that this might be possibly less a share of revenue to the Middle-Man (i.e. Demand Response Aggregator) if there proves to be a need for this organisation to exist. |

** Correction on the above

One of our knowledgeable readers has pointed out that I was incorrect in what I had written late on Wednesday evening.

INCORRECT: I had originally written that (for the ‘ghost electrons’) the Energy User would still pay the Retailer at their contracted rate.

CORRECT: However this reader reminded me that they instead pay the ‘Reimbursement Rate’, where the Reimbursement Rate, calculated quarterly, will be set at the peak period load weighted average spot market prices over the previous 12 months. This may or may not be equal to the contract rate.

Other comment by the reader:

The Ghost Electrons will be capped at the WDR dispatch target not the Ghost Electrons actually supplied.

So if the NEMDE issues a dispatch target for 2 MW of WDR and the load turned off is a 10 MW load, the DRSP will only be settled based on 2 MW at the spot price and the retailer will only receive reimbursement for 2 MW.

Similarly if the dispatch target if for 15 MW and only 10 MW is supplied, settlement s based on 10 MW.

There is no dispatch compliance penalty associated with the under supply of DR so to some effect it is semi-scheduled rather than scheduled.

Still not clear that there’s a significant potential mismatch? What was that I noted above about whole businesses, some quite large, being based on arbitrage?

(C) Some brief supplementary notes

I’ve previously written some lengthy criticisms of what I understand to be the mechanism that’s likely to be adopted (notably on 5th March 2019 and then on 21st October 2019). So I am not going to repeat all of my concerns here – what’s done is done, in terms of the decision the AEMC will make tomorrow.

However I would just leave you with three thoughts:

(C1) Remember – what others think are ‘high’ and ‘low’ may not be what you have in mind….

I’ve added ** asterisks in purple to draw attention to what seems to be an implicit (and even subconscious) assumption made by many in their consideration of that – and that is that an Energy User might want to curtail when the price was what we might normally think of as high. Think $1,000/MWh, or perhaps the cap trigger price of $300/MWh – though we have known of our clients who have triggered as low as $100/MWh depending on their own commercial criteria.

Under the greater degrees of freedom, then, that the likely Negawatt Dispatch Mechanism offers, is it not worth considering under what circumstances an Energy User might see their ‘High’ trigger price as something quite low – say $10/MWh, or even $1/MWh?

Something to think about…

(C2) Always back the horse named Self-Interest?

Who was it who said (or, probably more correctly, how many people before me have said) ‘in a horse race always back the one named Self-Interest’.

Whilst this has seemed to be the case amongst some of those whose business models are dependent on Negawatts ‘existing’ (even if in a virtual sense), in recent years I have become increasingly more concerned by some pretty self-evident ways (at least in my view) that the arrangements suggested above could likely* be manipulated for personal/organisation.

* remembering I don’t (this evening) know the specifics of what will actually be included in the Final Rule.

For instance, what if the developers and/or owners of the ‘Negawatt Factory’ above started thinking of the incandescent light-bulbs sketched above not as ‘bright ideas’ in the altruistic sense, but as ‘cheap and nasty’ means to generate more negawatts (oops, meant to say economically-beneficial consumption there. Honestly!). Seems likely to me that, in a market as volatile as the NEM and with volatility set to increase with the advent of Five Minute Settlement, the temptation to find creative ways to manipulate this new mechanism will continue to grow.

… or to put it another way, when the seemingly inevitable happens and the horse named ‘Self Interest’ is at the lead in the race, the Racing Stewards will always be at least a few paces behind. Welcome to the brand new world we’re on the verge of opening up, by virtue of imaginary, intangible and unmeasurable new commodities.

(C3) The least we can hope for…

Given that I’ve already noted (and the AEMC agrees!) that such a mechanism as we’re likely to end up with tomorrow is neither scalable nor sustainable (and I am resigned to the fact that the AEMC feels the need to do something, despite the fact that it’s heading in the wrong direction) the least I am hoping to see tomorrow are two things:

Minimum Viable #1 = we need to see a clear sunset on the use Negawatts in dispatch; whilst

Minimum Viable #2 = we need to see a clear transition path to a properly functioning Two-Sided Market as part of NEM 2.0. I’ll have more thoughts to share on this in the not-too-distant future.

—————-

We’ll see what the morning brings…

Leave a comment