On or around Thursday 12th June 2023*, there will be a change to the dispatch process that is specifically targeted at Semi-Scheduled units.

* Delays to the ‘go live’ date

1st Editor’s Note: In an update from the AEMO on Friday 2nd June 2023, they noted that:

‘due to iterations in User Acceptance Testing (UAT), the tentative Max Avail Production implementation date has been rescheduled to ~21-23 June 2023. AEMO will advise via email once the Production implementation date is confirmed.’

———————-

2nd Editor’s Note: In a further update from the AEMO on Mon 19th June 2023, they noted that:

‘AEMO wishes to advise that due to scheduling dependencies and risk management, the tentative Max Avail Production implementation date has been rescheduled to Wednesday 12 July 2023. AEMO will advise via email once the Production implementation date is confirmed.’

- We’ll all need to watch AEMO communications (and email from AEMO Operational Forecasting) as that date approaches to see a more definite ‘go live’ date.

- We’ve built a new version of our ez2view software to reflect this improvement in the bidding and dispatch process:

- You’ll need to be running version 9.7.1 or above to take advantage of this.

- Paul wrote briefly about this on Tuesday 23rd May 2023.

What is the imminent change?

The AEMO is re-enabling the ‘MaxAvail’ figure in the bids for Semi-Scheduled units. It will limit available capacity fed into the NEMDE dispatch process for the unit.

The specifics of the change are as follows:

| Before the change | The maximum availability (MaxAvail) value in a semi-scheduled unit’s bid does not impact dispatch outcomes and market systems.

Semi-Scheduled unit bids have always included a MaxAvail field, in MW. The structure is no different to Scheduled unit bids. Yet the field: · Has been ignored for semi-scheduled units, and · Is instead overwritten by the UIGF (the ‘Unconstrained Intermittent Generation Forecast’), o Which itself can come from several sources. |

| After the change | Bid MaxAvail will be applied as a limit on unit availability in the market systems.

After the change, a semi-scheduled unit’s availability will be the lower of the bid MaxAvail and the UIGF. |

Why the imminent change?

This change has been a relatively long time coming.

On 18th December 2020, in the article ‘Increasing the transparency and correctness of intermittent generation availability information to AEMO’ Marcelle discussed how use of the bid MaxAvail field would make it easier for participants to provide accurate availability information in challenging situations.

Marcelle noted:

‘There are several good reasons why this should be done, at least in dispatch (I’ll look later at other timescales):

-

- To provide an easy place for the participant to communicate a limit on plant availability to AEMO, particularly in unusual circumstances. [more detail in Marcelle’s article]

- A rebid of MAXAVAIL would require a rebid reason, which is good for commercial transparency. [more detail in Marcelle’s article]

- Finally, a timely benefit with the requirement for participants to communicate high-temperature effects to AEMO is that participants could enter in one bid submission an estimated maximum availability profile for several hours ahead.’ [more detail in Marcelle’s article]

… and that’s just some of the benefit.

In this LinkedIn update on Thursday 11th May 2023, Overwatch Energy wrote:

‘Currently (and arguably oddly) the only way a semi-scheduled wind or solar plant can bid out of the market within the 0-30 minute dispatch window is to place all its volume at the highest possible price ($15,500/MWh)

The trouble with that is that $15,500 is happening quite a lot these days, so even bidding at this price you might still get dispatched. If you need to get your asset ‘off’ in that window for a good technical reason then you could be a bit stuck.’

One recent example was highlighted in April 2023 by Paul when reviewing market impacts while ‘Beryl Solar Farm (BERYLSF1) shut down with grass fires’.

In this situation information on the availability reduction was only available to the dispatch engine in the dispatch timeframe (for the next dispatch interval). The upcoming change provides operators with a way to communicate maximum availability changes to the market and AEMO using their energy offers which can extend out to the end of the next trading day.

It will improve transparency and correctness of semi-scheduled unit availability for AEMO and the market.

It’s great to see this initiative being implemented!

Transparency boost, with more data published

The initiative to improve the transparency of intermittent generation unit availability includes the publication of additional information in the public market data tables (the MMS).

Supporting the use of bid MaxAvail:

- The unit solution tables for dispatch, P5min and P30-Predispatch time horizons will include the new field “UIGF” to register the UIGF value that was passed to the dispatch engine.

This accompanies the existing “AVAILABILITY” field that represents the availability used by the dispatch engine which, for semi-scheduled units, will represent the lower of the UIGF and the bid MaxAvail. - Region-aggregate tables for dispatch, P5min and P30-Predispatch will include new fields “SS_SOLAR_AVAILABILTY” and “SS_WIND_AVAILABILTY” to register the aggregate availability values for each region’s semi-scheduled wind and solar units. Note this this will compliment the present publication of aggregate wind and solar UIGFs which, after change, may no longer be the same as availability.

Supporting actual availability information:

- A new table, INTERMITTENT_GEN_SCADA, will provide the SCADA Availability for every intermittent generating unit, including Elements Available (wind turbines/solar inverters) and Local Limit. However, this is planned to be implemented in the latter half of 2023.

A quick initial ‘before the change’ review

When the change comes into effect the bid MaxAvail will act to limit availability:

- We recognised that there’s therefore a risk that, if bid MaxAvail is overlooked and set low (because currently it has no effect) the unit’s availability will be limited to that level, regardless of other information such as the UIGF.

- So our curiosity drove us to have a look at how Semi-Scheduled plant have currently been treating MaxAvail in the bid (i.e. are there current habits that will need to change when MaxAvail becomes enabled for these units?)

- We thought it might be of interest to share some of these insights with readers here.

Current bidding activity suggests most units are well prepared to be able to adjust the MaxAvail value in their bids as needed.

Reviewing data for early 2023 (from 1 January to 27 April), the following table summarises how MaxAvail changes presently in energy bids. We categorise bidding variability into three approaches. It is necessary to remember that, until the change occurs, there is no requirement for semi-scheduled MaxAvail to be at any particular value or reflect operational conditions.

Patterns in semi-scheduled unit bid MaxAvail

| Fuel Type | Region ID | Days | Units | Approach #1

Units offering Max Avail at Max Capacity in all bids |

Approach #2

Units offering Max Avail at |

Approach #3

Units offering Max Avail at varying levels

|

| Large Solar | NSW1 | 117 | 31 | 21 | 0 | 10 |

| Large Solar | QLD1 | 117 | 33 | 22 | 1 | 10 |

| Large Solar | SA1 | 117 | 15 | 8 | 0 | 7 |

| Large Solar | TAS | 117 | 0 | There are no large-scale Solar Farms in TAS, but the row added for completeness | ||

| Large Solar | VIC1 | 117 | 10 | 7 | 0 | 3 |

| Wind | NSW1 | 117 | 13 | 10 | 0 | 3 |

| Wind | QLD1 | 117 | 5 | 2 | 0 | 3 |

| Wind | SA1 | 117 | 24 | 11 | 0 | 13 |

| Wind | TAS1 | 117 | 3 | 2 | 0 | 1 |

| Wind | VIC1 | 117 | 23 | 10 | 0 | 13 |

Approach #1) Units offering Max Avail at Max Capacity in all bids.

We might call this the ‘set and forget’ mode.

In this category all bids over the period included the same MaxAvail for the unit, and it was the same as the unit’s maximum capacity. Acknowledging that it isn’t necessary to change MaxAvail in semi-scheduled bids it is nonetheless interesting to contrast the number of units in this category against Units offering Max Avail at varying levels. In some cases, it is a 50-50 split, but in other cases it is not. The obvious possible and practical reason that MaxAvail didn’t change in bids for these units is that the unit was fully operational for the four months we analysed.

Approach #2) Units offering Max Avail at Zero in all bids.

Only one unit had MaxAvail set to 0 for all bids.

Based on rebid explanations the unit was in the early stages of commissioning.

Approach #3) Units offering Max Avail at varying levels.

The patterns of changes to MaxAvail, of units in this category, also varied. We observed:

-

- Many units appear to be already actively adjusting MaxAvail in their bids and rebids on a daily and sub-daily basis.

- Occasions exist where units include MaxAvail at a lower but constant level for extended periods. This appears (from rebid explanations) to reflect commissioning regimes in many situations but also planned outages (which we can verify from the number of elements unavailable in the intermittent cluster availability outlooks).

Some specific examples at unit-level

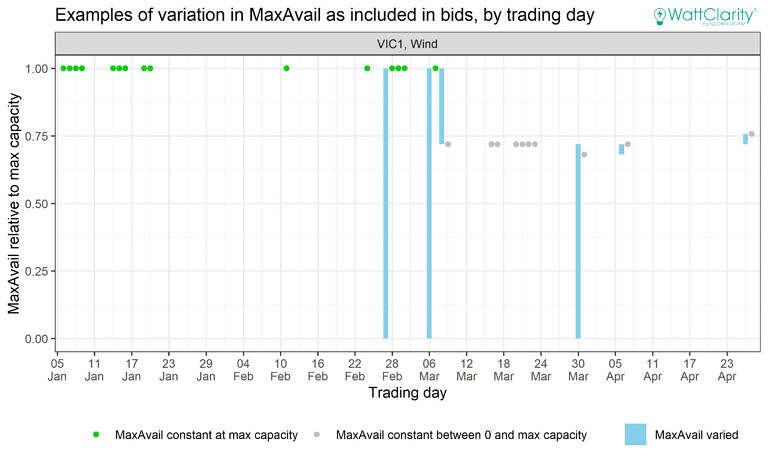

The following wind unit in VIC tended to make energy bids with MaxAvail set to max capacity in January but did not make a specific bid for each trading day (there are gaps).

MaxAvail varied on 27th February and ranged from maximum capacity to zero. Ten days later, bids for the 9th March set MaxAvail to a reduced level (near 75%) for the whole day.

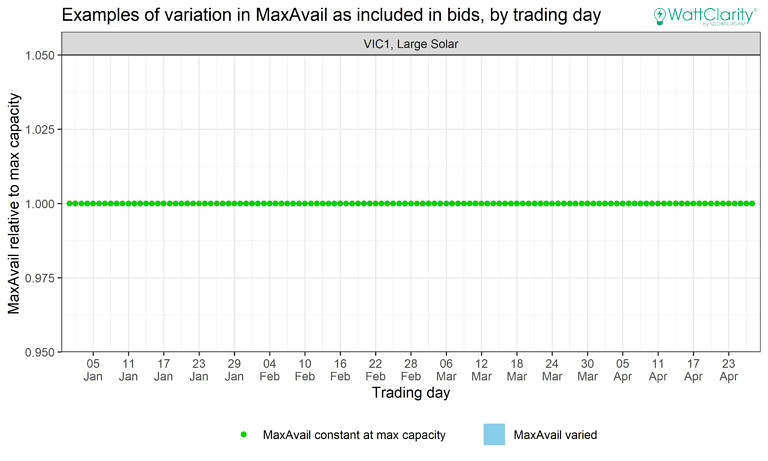

The following large solar example from VIC highlights a unit which has MaxAvail set at max capacity and never changed it in the period we analysed.

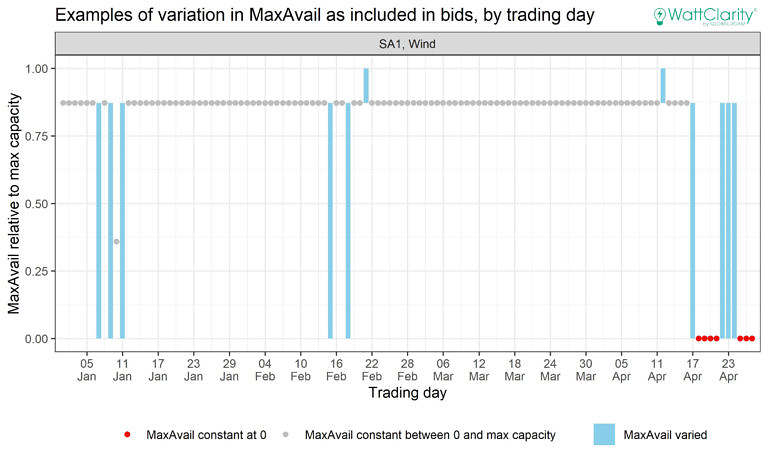

The following wind example from SA captures a unit that regularly made bids with MaxAvail at 87.5% of max capacity.

We see days where MaxAvail was set to zero, but not for the full day (MaxAvail varied). And towards the end of April, MaxAvail was set to zero for full days.

Collated Results for all units

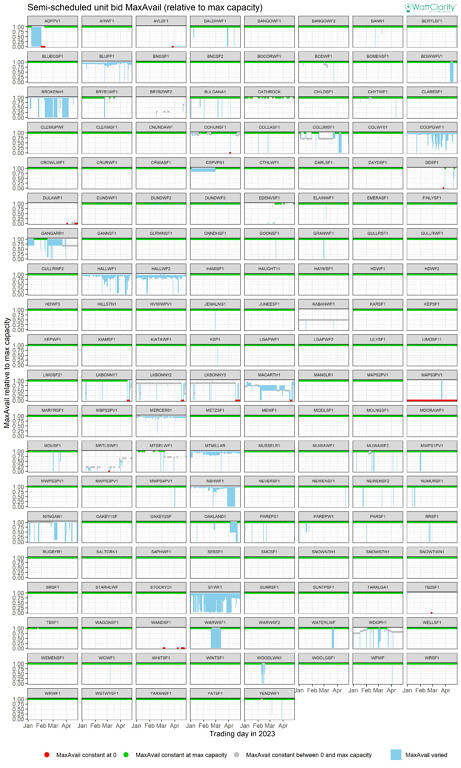

The following chart collates all semi-scheduled units (click on the chart to open a higher-resolution view into which you can zoom in to observe specific details).

As with the examples above, it presents the range of bid MaxAvail for each semi-scheduled unit. The data was drawn from relevant MMS database tables. Although we’ve made some effort to ensure the analysis is correct, the chart is published “as-is” for informational purposes only, and is not intended for trading purposes or financial, investment or other advice.

Upgrading ez2view to assist in visibility of this additional data

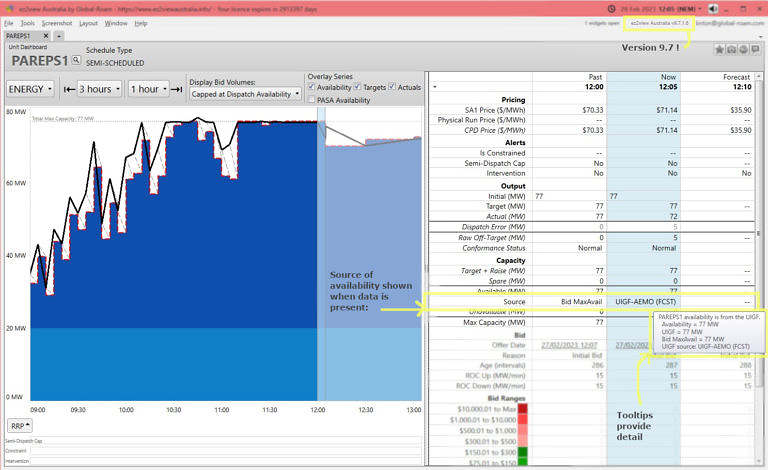

We’ll be communicating more directly with existing clients via a Release Note about the enhancements made to the software to provide visibility, and enhance understandability, of these new data permutations (amongst other enhancements) … though Paul did provide this initial update.

However, we thought it would be useful to include this initial snapshot of the ‘Unit Dashboard’ widget (based on mocked data) – one of the widgets enhanced as a result of this change:

In particular note that the source of the Availability figure feeding into NEMDE for Semi-Scheduled process might be any of three high level sources:

| Source | Description |

| UIGF-AEMO(AWEFS) | When the UIGF is from AEMO.

In this situation the source indicates: · The availability is set by the UIGF (Unconstrained Intermittent Generation Forecast), and · The forecast originated from AEMO, and · The forecast origin label was AWEFS (Australian Wind Energy Forecasting System). Different origin labels may be used including ‘ASEFS’ for solar units, and ‘FCST’ or ‘SCADA’ in other less common situations. |

| UIGF-Self(<origin label>) | When the source is a UIGF, and the UIGF is from a participant’s self-forecast system (not AEMO).

AEMO facilitates the option for participants to provide “Self Forecasts” for use in the dispatch timeframe only (the upcoming dispatch interval). It is possible to have several different self-forecasting systems running so the self-forecast’s origin label is useful to differentiate forecasts when more than one self-forecasting system might potentially be used. When the source changes from a UIGF-AEMO to a UIGF-Self it indicates a self-forecasting system issued a forecast and it was not suppressed (either by the participant or by AEMO, as discussed here). |

| Bid MaxAvail | When the bid’s MaxAvail value limits availability.

This may occur after the change that impacts semi-scheduled units, if the bid MaxAvail of a semi-scheduled unit is lower than its UIGF. It will also be relevant for scheduled units as availability is taken from the bid (subject to other plant limits or operating levels which are accounted-for in the dispatch engine). |

Users should also be aware that dashes (–) indicate that the change has not yet occurred, and/or that data (the UIGF value) is missing. As highlighted above, the UIGF value will be published when the change is implemented.

It’s a much simpler process for fully Scheduled units – much less likely to cause confusion to analysts sitting on the outside of the market looking in.

Leave a comment