I’ve noted recently in other articles that it used to be the case that LOR3 Market Notices were as ‘rare as hen’s teeth’ (even ‘just’ about forecast load shedding conditions) … but I’m probably not alone in thinking that the incidence of these scares has been increasing in recent times.

Prior to today’s SMS alerts about pricing excursions, there were two sequential alerts about market notices

Let’s take a quick look at these…

(A) MN100822 flags forecast LOR3 on Monday 15th August 2022

As shown above, at 07:33 the AEMO published Market Notice 100822 as follows:

——————————————————————-

MARKET NOTICE

——————————————————————-

From : AEMO

To : NEMITWEB1

Creation Date : 10/08/2022 07:33:27

——————————————————————-

Notice ID : 100822

Notice Type ID : RESERVE NOTICE

Notice Type Description : LRC/LOR1/LOR2/LOR3

Issue Date : 10/08/2022

External Reference : STPASA – Forecast Lack Of Reserve Level 3 (LOR3) in the SA Region on 15/08/2022

——————————————————————-

Reason :

AEMO ELECTRICITY MARKET NOTICE

AEMO declares a Forecast LOR3 condition under clause 4.8.4(b) of the National Electricity Rules for the SA region for the following period:

From 1800 hrs 15/08/2022 to 1830 hrs 15/08/2022.

The maximum load (other than interruptible loads) forecast to be interrupted is 5 MW at 1800 hrs.

AEMO is seeking a market response.

AEMO has not yet estimated the latest time it would need to intervene through an AEMO intervention event.

AEMO Operations

——————————————————————-

END OF REPORT

——————————————————————-

I saw this, and wondered what was up?!

(B) MN100824 flags forecast LOR3 on Monday 15th August 2022

At 10:46, Market Notice 100824 issued a cancellation to that forecast, effective from 10:00.

(C) A view in Forecast Convergence

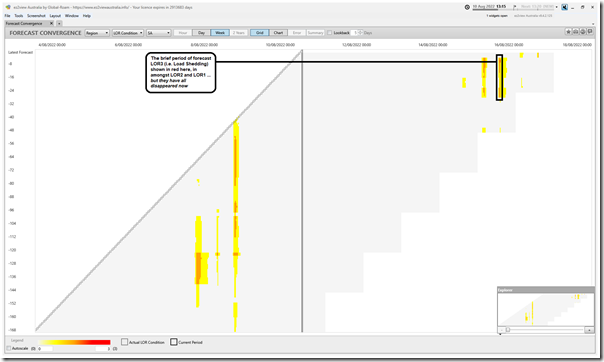

Using the Forecast Convergence widget in ez2view, here’s a quick look at forecast LOR conditions for the South Australian region:

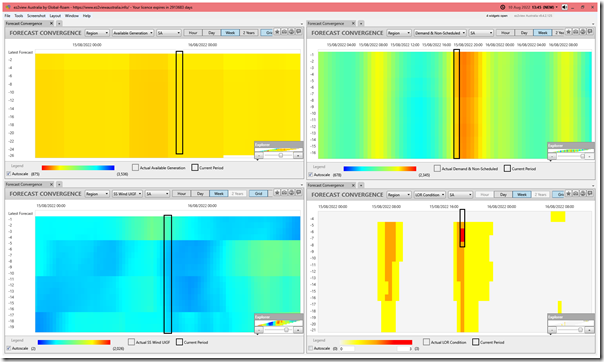

Adding in three other dimensions to the data on 3 different widgets and zooming into that half-hour ending 18:30 on Monday 15th August 2022 we see the following:

Looking up the relevant verticals (and keeping in mind I did not look at other dimensions, such as interconnector transfers) we see:

1) In the Bottom-Right widget, the forecast LOR3 condition last existed in the ‘Run Date’ being 08:00 this morning, stepped down to LOR2 for ‘Run Date (RD)’ being 09:00 and disappeared completely for ‘Run Date’ being 10:00.

2) In the Top-Right widget, there’s negligible change in forecast for ‘Demand and Non-Scheduled Generation’ (which is similar to, but not the same as, ‘Operational Demand’ which AEMO does not provide forecasts for)

3) In the Top-Left widget, there’s a very slight increase forecast for Available Generation in the SA region over that period … from 1,465MW at RD 09:00 to 1,489MW at RD 10:00.

4) In the Bottom-Left widget, there’s a bigger increase in forecast wind harvest (i.e. UIGF) … from 393MW at RD 09:00 to 775MW at RD 10:00.

In the GRC2018 we noted ‘The NEM is becoming increasingly dependent on the weather’ … and in GenInsights21 expanded on this in a number of ways.

What we saw with the forecast (briefly) load shedding for SA on Monday evening disappearing because (it appears) AEMO has revised upwards its forecast wind harvest for Monday evening is just one illustration of this.

Is another major wind drought forecast?

There was an epic wind drought in several states over the weekend, running into Monday and lifting on Tuesday, hard on the heels of record high winds.

That’s intermittent energy!

https://spectator.com.au/2022/07/energy-policy-where-parallel-universes-are-set-to-collide/