As expected earlier this evening, the NSW region has commenced Administered Pricing for ENERGY and all 10 x FCAS commodities this evening.

The AEMO notified the market of this at 19:45:15 via Market Notice 116550 as follows:

‘——————————————————————-

MARKET NOTICE

——————————————————————-

From : AEMO

To : NEMITWEB1

Creation Date : 08/05/2024 19:45:15

——————————————————————-

Notice ID : 116550

Notice Type ID : ADMINISTERED PRICE CAP

Notice Type Description : Administered price periods declared.

Issue Date : 08/05/2024

External Reference : [EventId:197] AP STARTED for ENERGY in NSW1 at 08 May 2024 19:45

——————————————————————-

Reason :

AEMO ELECTRICITY MARKET NOTICE

Issued by Australian Energy Market Operator Ltd at 1945 hrs on 08 May 2024

ADMINISTERED PRICE PERIOD DECLARED in NSW1 region.

AEMO has determined that the rolling sum of the uncapped spot prices for the NSW1 region over the previous 2016 trading intervals has exceeded the cumulative price threshold (CPT) of $1,490,200.00.

In accordance with Clause 3.14.2(b) of the National Electricity Rules, AEMO has determined that an administered price period will commence at the trading interval starting 1955 hrs on 08 May 2024 and will continue through to the end of that trading day*.

An administered price cap (APC) of 600 $/MWh will apply to all trading intervals during this administered price period. This APC will apply to spot prices and to all market ancillary service prices in the NSW1 region.

An administered floor price (AFP) of -600 $/MWh will apply to spot prices.

AEMO will continue to monitor the rolling sum of the uncapped spot prices and issue further Market Notices as required.

This is an AEMO autogenerated Market Notice.

——————————————————————-

END OF REPORT

——————————————————————-’

The AEMO note talks about ‘through to the end of the trading day’, which is the way the AEMO’s processes work … however the way the Cumulative Price is calculated, it’s highly unlikely to roll off until sometime during next Tuesday 14th May 2024 (at least!).

So expect a series of Market Notices at 04:05 each day for the next 5+ days, extending Administered Pricing (AP) for another day.

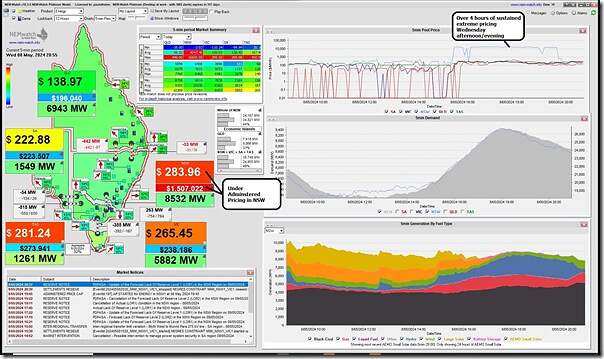

Here’s a snapshot of NEMwatch at 20:55 this evening:

A long run of volatility

This followed a period this evening of almost uninterrupted spot price volatility in excess of $1,000/MWh (indeed, mostly above $10,000/MWh) commencing 15:40 this afternoon (NEM Time) and running through until 19:50 (i.e. the dispatch interval after which AP commenced).

That’s more than 4 hours of sustained volatility!

Second time ever, in NSW?

I don’t have time to check comprehensively, but I believe that this is only the second time (in 25 years!) that Administered Pricing for ENERGY has been used in NSW … with the only other time commencing on 13th June 2022 as part of the Energy Crisis.

The list of questions begins

Much and all as this is an interesting turn of events, (fortunately or unfortunately) we have other things we need to be focusing on, so the (growing) list of questions about what’s happened and why has already started to mount up … including the following:

Q1) What role did electricity demand play?

In the NEMwatch snapshots the last few days, the level of ‘Market Demand’ in NSW has barely registered above the green zone … i.e. has been pretty modest.

Is there more to it than that?

Q2) What’s going on with the networks?

Ability to import from QLD (to the north) and VIC (to the south) has both been severely limited – with network outages playing some role (and negative residue management in the mix in some directions). We’ll look to focus in more detail

Q3) Technical limitations on supply-side assets?

We’ve noted before that there’s been limitations on a range of supply-side assets in NSW, but a bit of time (and ‘next day public’ data) will give us the ability to delve further … but please don’t read this as a promise we’ll do this tomorrow!

Amongst the questions:

Q3a) What about VRE?

We noted in several articles that VRE harvest was low through the past couple days – low solar (due to season, and also due to weather), and also low wind. But more detail needs to be added to understand just how poor.

Q3b) Coal units offline

We noted this morning that Vales Point 5 had come offline this morning in an outage not planned in advance, and also that there were two Eraring units off on unplanned outages. Those 5 units being off clearly did not help.

Q3c) Other firming capacity

What happened with the other NSW-located firming capacity … the gas, the hydro and the batteries?

Did the batteries run dry, and were there water concerns at the hydro?

Q3d) Negawatts?

Given our historical role in facilitating a different form of demand response (i.e. not via the WDRM), and that we’ve written before that that whole rule change process was a disappointment, I’m curious to see the level of participation in the (very small volume of) WDRM registered in NSW.

Q4) Commercial limitations on supply-side assets?

Again, we look forward to walking through each type of asset in turn … for instance, of the coal units available, some did not seem to be running flat out (despite, or perhaps because of, the high prices).

Q5) is there a mismatch between the LOR criteria and the Market Price outcomes?

Through yesterday evening and again this evening the NSW ‘only’ reached ‘Actual LOR1’ levels … and yet high prices were sustained for a long period of time. Is there anything more to think through in that apparent mismatch?

Might take us some days to get back to, and/or through, this list. In the meantime, please feel free to throw others into the ring, via comments below (or directly via email). Preferably don’t call, as we need to turn our focus elsewhere for a while…

Leave a comment