It’s Wednesday evening 21st June 2023 and in the lead-up to State of Origin Game 2 the spot prices in QLD and NSW are battling it out to see which can spike the highest.

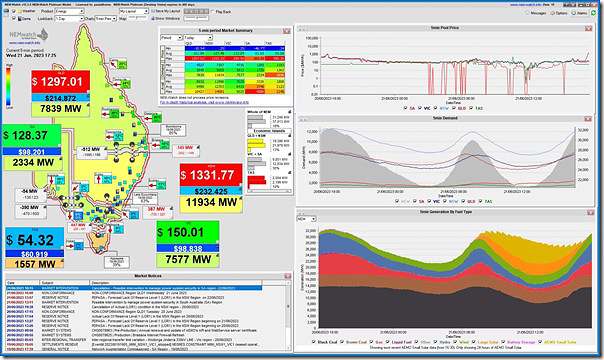

Here’s a snapshot from NEMwatch at the 17:25 dispatch interval with NSW slightly higher:

Is that a good thing or a bad thing – depends on one’s perspective, and position in the market?

Some similarities to yesterday (Tuesday 20th June) evening – but also some differences:

1) The cold winter weather has driven NEM-wide Market Demand well above the 30,000MW mark

… at this dispatch interval it’s 31,240MW and climbing.

2) Solar yield has gone to bed again, but this evening wind is producing a more reasonable amount (~3,000MW … so an instantaneous capacity factor of ~30% across an aggregate Maximum Capacity* of 10,426 MW)

* readers might remember:

(a) this earlier discussion about choosing the most appropriate measure of Installed Capacity … and

(b) that installed capacity for (a growing technology like) wind is likely to deliver a lower apparent Capacity Factor, because of the lag between MaxCap being updated in AEMO EMMS and the wind farm proceeding through commissioning to produce output.

3) The higher wind yield is one reason why the NEM-wide IRPM is higher than the low-points set yesterday evening

… there may well be other reasons as well, but I have not checked.

4) On a more localised basis:

(a) the ‘QLD+NSW Economic Island’ is seeing lower Instantaneous Reserve Plant Margin contributed to by constrained exports on the VIC1-NSW1 interconnector

i. which is again affected by the ‘N::N_DTKV_2’ constraint equation …

ii. … which is part of the ‘N-X_18+30_CLOSE’ constraint set …

iii. … which is invoked because of the network outage between Dapto –to- Kangaroo Valley (line 18) discussed earlier

(b) the ‘TAS Economic Island’ (formed by constrained export on Basslink) is also flagged with a ‘low IRPM’ alert.

5) Like seen yesterday, prices were elevated:

(a) With the constraints mentioned above meaning more pricing action in QLD and NSW than VIC and SA (but still somewhat elevated there).

(b) Not shown here, but Raise FCAS prices in the mainland are a little elevated (and Raise Reg in Tasmania).

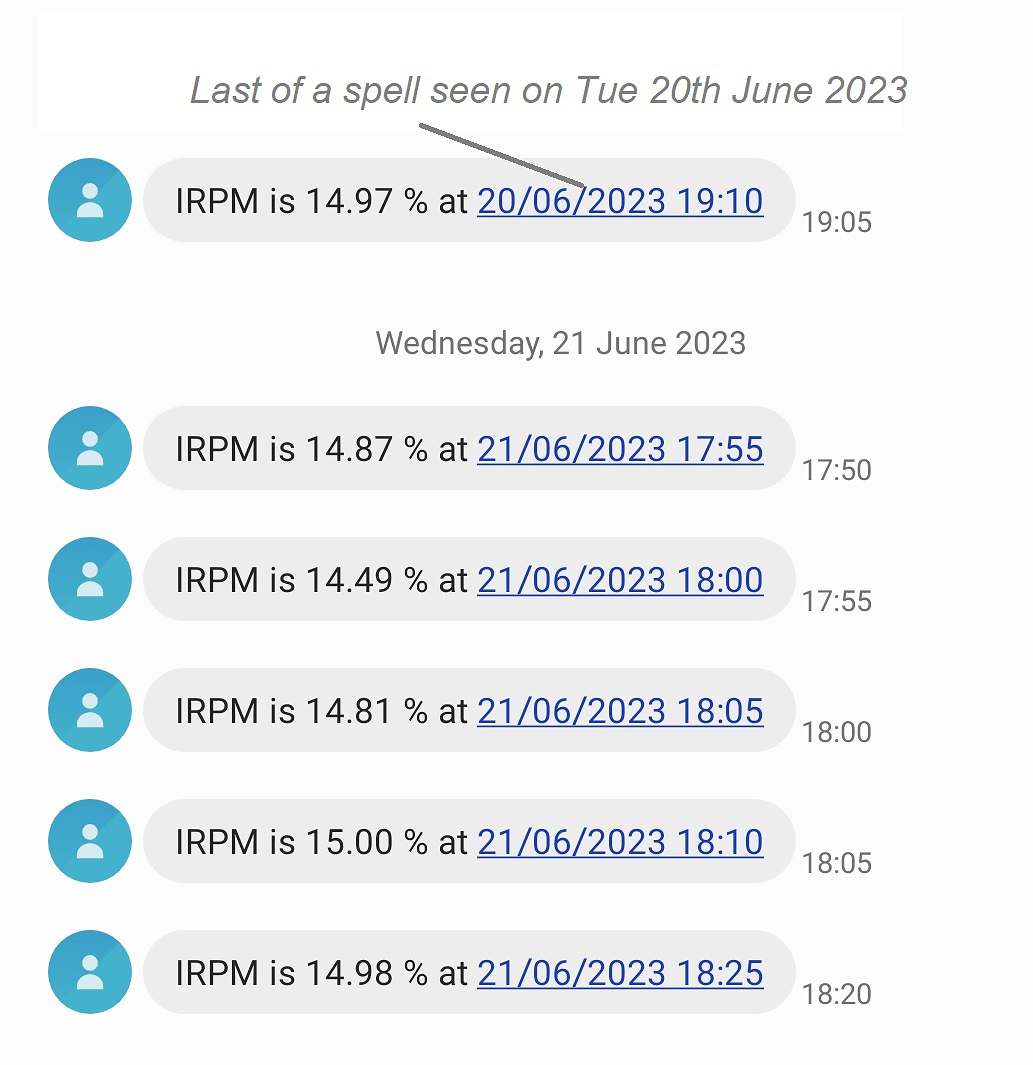

PS1 – a brief spell with IRPM <15%

The NEM-wide IRPM did drop below 15% as captured in these SMS alerts:

… though not as low, or as long, as seen yesterday.

Nothing more at this point…

Be the first to comment on "Evening volatility in QLD and NSW on Wed 21st June 2023"