Paul recently highlighted the superceding of the original and somewhat infamous “X5 constraint” – formally known as N^^N_NIL_3 – which I’ve written about previously on WattClarity just before and just after it commenced operation back in late 2020. His piece noted that from mid-March AEMO has replaced that constraint with a pair of new constraints labelled N^^N_NIL_X5_BESH and N^^N_NIL_X5_BEKG, which don’t appear awfully different from their progenitor, and then promised readers that I’d be back to review some of the impacts that the original has had, and to explain any possible differences in its successors. So here I am.

Coincidentally, Peter Brook at the Australian Energy Council produced a very helpful overview and analysis of recent impacts, caused in part by the N^^N_NIL_3 constraint, on inter-regional power flows via the Victoria – New South Wales Interconnection (VNI).

Thanks to Peter’s work I won’t spend quite as much of this article as I might have on illustrating why the “X5 constraint” and others affecting VNI transfers have been of concern to NEM observers. However I will provide some additional background and analysis on this front, before summarising how the replacement constraints differ from their predecessor.

Issues in a nutshell

Emerging transmission limitations in the southern New South Wales region, exemplified by the X5 constraint – along with others – have had significant market impacts, particularly on daytime transfers of lower cost power from the southern NEM regions into New South Wales and Queensland. Peter Brook’s article neatly estimated the direct opportunity costs of these reduced transfers, but it’s arguable that there are substantially wider impacts. While certainly not the only driver of the “north-south price gap” that has emerged in the NEM, reduced VNI transfer capacity has contributed to higher northern NEM spot prices than would otherwise have been the case, and this has almost certainly fed into forward contract prices in those regions. These forward contract prices in turn feed into the retail energy prices paid by millions of consumers in New South Wales and Queenslamd.

Underlying these limitations and their effects are both physical and market structural factors: physically, when weak transmission links reach their secure flow limits, generation or load somewhere has to be constrained to ensure these limits aren’t exceeded. Features of the current market design – which I touched on at the end of my second article on the X5 constraint – can act to throw more of the constraint burden onto inter-regional flows, which means that generators and loads distant from the constraint location are the ones affected, often disproportionately.

On this view, tweaks to the X5 constraint and others like it may be helpful incremental improvements, but can’t address the underlying problems of either insufficient transmission investment, or market design and operation features which amplify transmission limitations.

Further discussion of both these areas opens up big policy questions which I won’t deal with here, but they’re worth keeping in mind as we wade through the following details. Let’s start with the underlying network issues behind the X5 constraint.

VNI’s not a thing

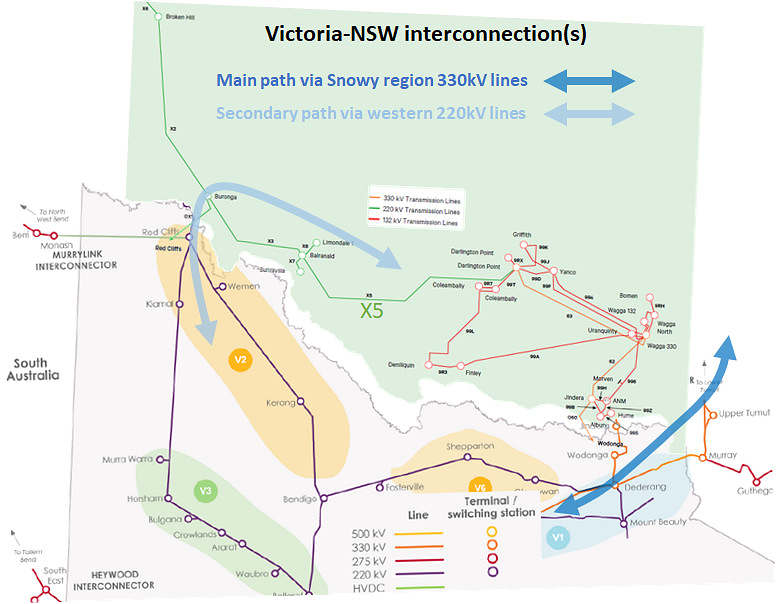

Fundamental to understanding the issues here is appreciating that there isn’t a discrete “Victoria-New South Wales Interconnector” at all, despite much discussion of it. The state power grids of New South Wales and Victoria became linked thanks to construction of the Snowy Scheme in the 50’s and 60’s. The 330 kilovolt (kV) transmission lines built to carry power from the Scheme into each state also enabled additional flows between the two states (capacity subject to the level of Snowy generation and other factors).

Probably around this time (although I haven’t checked), the long skinny grid extensions in the north-west of Victoria and south-west of New South Wales also became linked by a 220kV line between Red Cliffs (Vic) and Buronga (NSW). In fact this part of the New South Wales grid – including the X5 line itself – is all 220kV up to Darlington Point, and more like an extension of the Victorian 220kV grid into New South Wales, which was predominantly 330kV. (Like rail gauges, each state originally decided to go a different way in choice of main transmission voltage – the South Australians naturally chose 275kV.)

Here’s a rough map mashed together from a couple of Transgrid and AEMO diagrams that attempts to summarise the flow paths created by these interconnections.

The point here is that when we talk about “flows on VNI” or “VNI transfers”, that is simply shorthand for the net transfer of power between the Victorian and New South Wales NEM regions across all the possible flow paths, not the flow on some specific asset.

Another critical point is that the grid operator can’t directly control the proportions of this aggregate flow that make their way between regions via the different flow paths – these proportions follow the dictates of physics as expressed in Ohm’s and Kirchhoff’s Laws. But flows are influenced by things determined by the market clearing process, such as which generators and loads are dispatched. To modify flow levels on the weaker 220kV lines, the basic options are to change outputs of generators electrically close to those lines, or to make much bigger changes to the overall inter-regional transfer level, some of which flows “around the corner” on the 220kV network. Limitations in a weak part of the network can this way potentially exert “leverage” over flows on much higher capacity sections of the interconnection.

As newly built generation has connected in north-west Victoria and south-west New South Wales, this has increased loadings along the relatively weak 220kV flow path, meaning that lines and transformers operate closer to their secure limits more often, with greater potential for impacts on the overall level of inter-regional flows.

Market Impacts

My earlier articles go into lots of detail about how this can play out with respect to the original X5 constraint, while Peter Brook’s AEC article provides a good (and much shorter) summary. If generators near the weak line bid to maximise their output by offering at -$1,000/MWh, the market dispatch process can, instead of constraining those local generators, schedule significant changes to overall inter-regional flows even when there’s plenty of capacity on the main flow path. This change in scheduled inter-regional flow effectively amounts to constraining down southern generators remote from the physically constrained area and constraining up northern generators, both by much larger amounts than would be required at nearby generators (by a factor of ten in the case of N^^N_NIL_3).

It’s important to realise that this is only one of many constraints that can affect inter-regional transfers, and there are others with structures and potential impacts somewhat similar to those of N^^N_NIL_3, reflecting other limitations in different parts of the regional grids.

It’s equally important to realise that the market outcomes of these constraints, particularly on interconnector flows, reflect the combined impacts of:

-

- physics (network flows and stability),

- mathematics (representation of the physics in the dispatch optimisation process),

- economics (particularly the underlying market design with “zonal” rather than “local marginal” pricing and settlement), and

- behaviour (how participants potentially affected by constraints decide to bid in light of all the above factors).

I touched on all this at the conclusion of my second X5 article, which I’m sure every reader got to the end of, so I won’t discuss further here.

For now, let’s review how flows from Victoria to New South Wales have changed whenever they reach the binding northward limits determined in the market dispatch process. I’ll revert to the convenient shorthand of labelling these transfers “VNI flows”, but remember they are not flows on some specific piece of grid equipment.

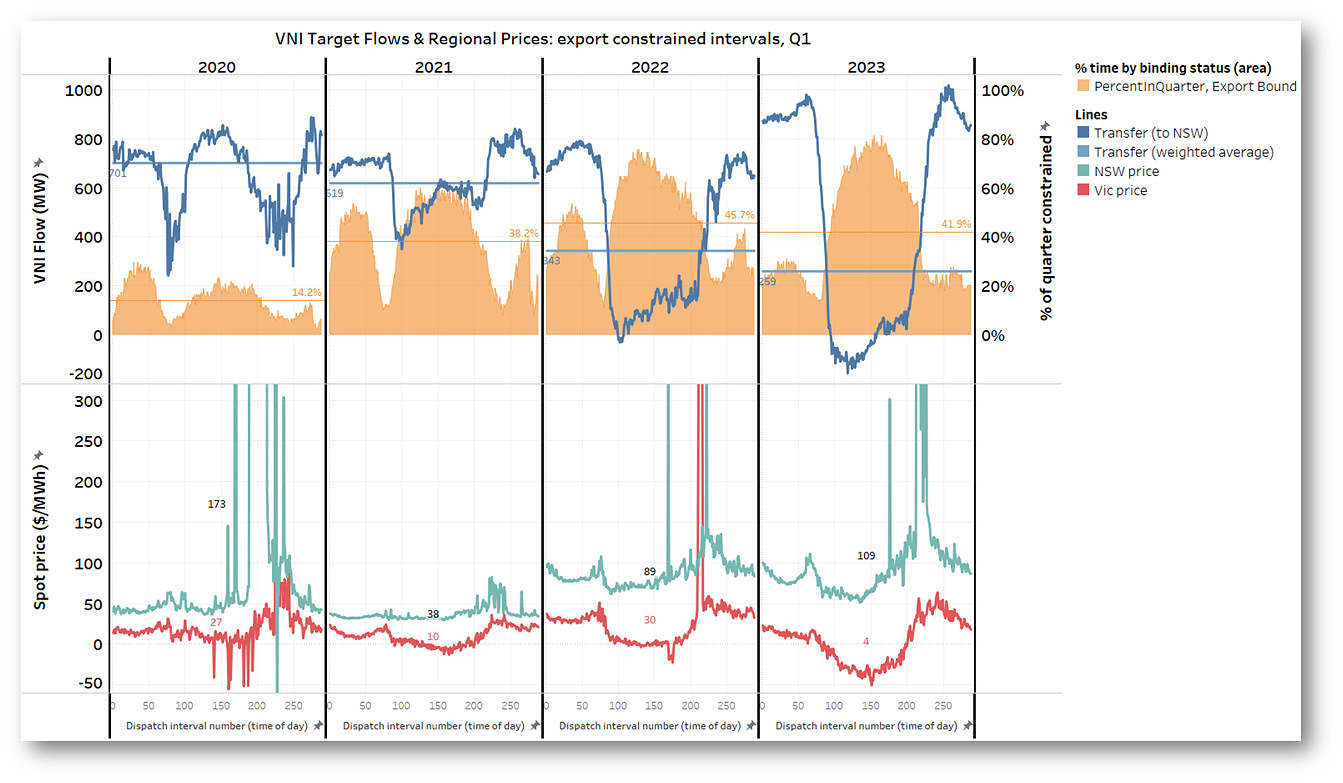

The following chart summarises the impact of northward (“export”) transfer limits on VNI flows in Q1 (Jan-Mar) across the last four years. For each year the chart shows both time of day average profiles and overall averages for:

- VNI transfers when constraint-limited northward,

- the percentage of time for which flows were constrained at these northward limits, and

- regional spot price profiles for New South Wales and Victoria at these times.

Tightening restrictions on VNI northward transfers in the daytime hours are very obvious over this period – during these hours the proportion of time that constraints have limited flows has increased substantially and the flow limits have reduced even more dramatically, to the point where they were negative (forced southward flow) for a substantial proportion of daytime hours in Q1 2023. But outside daytime hours, flow levels when constrained have not been materially affected and actually increased in Q1 2023.

The corresponding price profiles also show increasing price separation between Victoria and New South Wales at times when flows were at their northward limits over the 2021 – 2023 period. Note that price separation has increased overnight as well as during daytime hours, which implies that while the reduced daytime export limits on VNI have certainly contributed, they are not the only driver of increasing overall price separation. The large overall price separation in Q1 2020 reflects specific instances of extreme afternoon price volatility in New South Wales which drove up the overall average in that year.

Proximate Causes

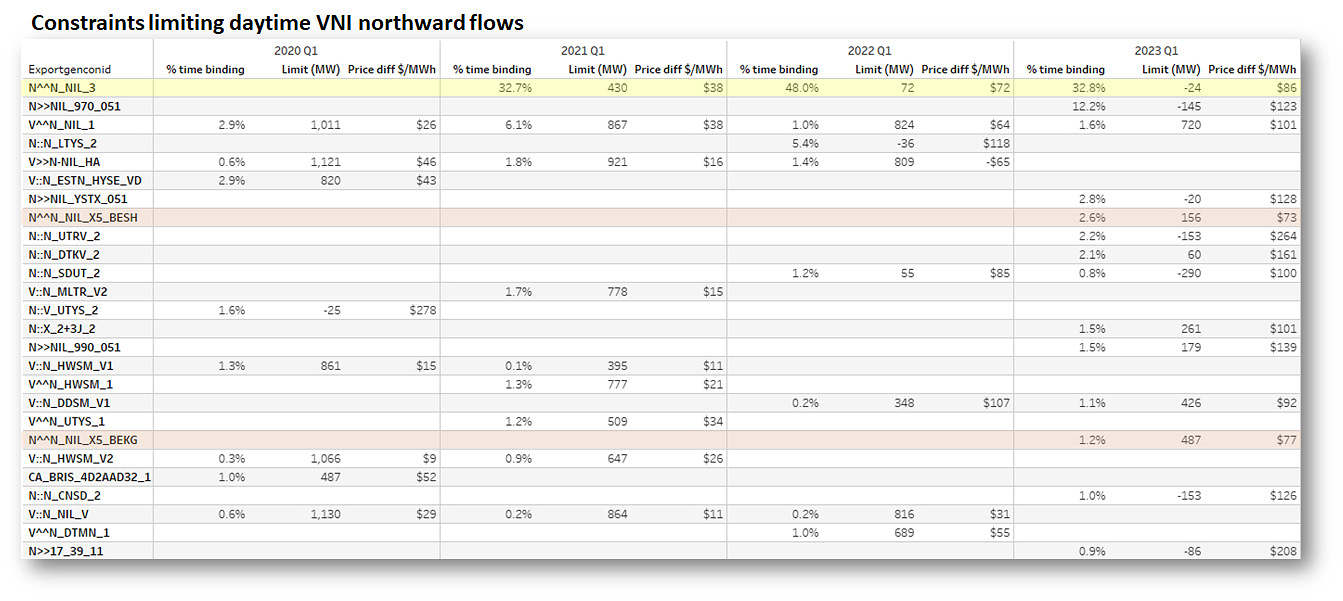

For more insight into whether this has all been the doing of the X5 constraint, or reflects the emergence of other constraints, I’ve tabulated the principal constraints limiting northward VNI flows across the four Q1s during “core daytime hours” (which I’ve defined as 7am – 6pm), summarising by constraint:

- the percentage of time across the quarter that the constraint limited northward daytime flows,

- the average flow limit when binding, and

- the average spot price difference (New South Wales less Victoria).

The constraints are ordered by overall time binding, highest first.

A technical note here – in any given dispatch interval, VNI flows may be impacted by more than one binding constraint (as explored by Marcelle in June 2022 with ‘Interconnector constraints and limits – an explainer, and a few traps’), in which case these constraints jointly limit flows. However the AEMO dataset from which I’ve compiled this table identifies only one constraint as setting the export limit. This means that the binding frequencies tabulated above may be materially understated for some constraints.

Clearly the old X5 constraint stands out as most frequently binding in the core daytime hours (remembering that it did not exist in Q1 2020), with its average binding flow limit also reducing across the three years, and average price difference increasing. However we can also see another significant constraint appearing in Q1 2023, N>>N_NIL_970_051, binding in 12% of core daytime hours at a lower transfer limit and larger price difference than for N^^N_NIL_3. Interestingly, this constraint is another case where protecting a lower capacity line in southern New South Wales can lead to limitations on overall VNI northward flows. A gaggle of other constraints also show up in Q1 2023 with much less frequent individual impacts but also imposing low transfer limits and substantial price differences, collectively amounting to additional significant impact on VNI northward transfers.

In addition to N^^N_NIL_3, I’ve highlighted its two successor constraints, N^^N_NIL_X5_BESH and N^^N_NIL_X5_BEKG. As these were only in operation from March 16th, or around one sixth of the quarter, we could in theory multiply their binding frequencies by six to get a rough sense of their impact relative to others. This would yield a combined ‘normalised’ frequency of around 25% for the two, somewhat less than for their predecessor. But this isn’t a strictly like-for-like exercise as the last half of March likely had different solar and wind conditions from the rest of Q1.

The Offspring

To finish, I’ll outline in detail how the new “BESH” and “BEKG” constraint variants differ from the original X5 constraint that they jointly replace. Readers who are tiring of all the detail can skip to the table at the end for a quick summary.

Paul pointed out that the new constraints appear very similar to N^^N_NIL_3 and in fact are identical in their Left Hand Side (LHS) terms and coefficients. That’s not entirely surprising as the LHS is essentially a proxy for the impacts of dispatch on X5 line flows.

What has changed, subtly, are some of the Right Hand Side (RHS) inputs that set the numerical limits that the LHS value is subject to. In particular the status of a network protection scheme related to the Murraylink DC interconnector is handled slightly differently in the new pair of constraints. The scheme is a “Very Fast Runback” (VFRB) mechanism, which would typically operate to rapidly reduce Murraylink flows to zero if triggered by certain network faults or “contingencies”.

This is important in the context of the X5 constraints, because Murraylink can act like a partial “pressure relief” valve when generation in NW Victoria / SW New South Wales is high, by carrying some flows out of the area into South Australia, rather than pushing into the X5 line (refer back to the network map above to see this). This is recognised in a negative coefficient for Murraylink on the constraint Left Hand Side, meaning that westward Murraylink flows reduce the LHS and tend to ease the constraints.

But if the risk of a network fault triggering operation of the VFRB scheme means that these flows might suddenly drop to zero at any time, forcing more flow onto the X5 line, this pressure relief valve has limited value. To reflect this, the N^^N_NIL_3 constraint had an adjustment built into its Right Hand Side that would largely cancel out Murraylink’s LHS impact whenever the VFRB scheme was enabled and flows were heading west.

The new X5 constraints separately recognise two distinct levels of status or control variables for the Murraylink VFRB scheme:

- “Master status” flags indicating that the scheme is enabled – meaning ready to operate. These flags feed into the “BESH” constraint’s RHS, and were handled similarly in the RHS of N^^N_NIL_3. However other differences on the BESH RHS mean that its value will be higher than the old N^^N_NIL_3 RHS, potentially providing more headroom before the constraint binds.

- “Trigger event” flags indicating whether the scheme is set to respond to, or ignore, particular network contingencies. These flags were not considered in N^^N_NIL_3 but now drive RHS evaluation for the “BEKG” constraint. The limited data I’ve reviewed shows these trigger flags as being disabled during daytime hours (6am to 6pm NEM time), meaning that the RHS does not get adjusted downwards when Murraylink flows west, again potentially providing more constraint headroom in these periods. Presumably these triggers being disabled means that the VFRB scheme is set in daytime hours to respond only to contingencies where runback of Murraylink would not be problematic for X5 line stability.

This finer discrimination amongst conditions driving operation of the Murraylink VFRB scheme means that in the right circumstances the new pair of constraints can provide more overall headroom during daylight hours than was available under N^^N_NIL_3 – summarised in the following table.

| Master Status flags | Trigger Event flags | Applicable constraint (lower RHS) | Net RHS change vs N^^N_NIL_3 | Comment |

| Enabled | Enabled (night) | BEKG | None | Constraint very unlikely to bind at night. |

| Enabled | Disabled (day) | Either, depending on level of Murraylink flow | Up to ~60 MW increase | Could allow up to ~600 MW additional VNI flow north (but other constraints very likely to limit the actual increase achieved). |

| Disabled | Enabled (night) | BESH | Up to ~60 MW decrease | Constraint very unlikely to bind at night, so probably not a material change. Unclear what this combination of disabled Master Status but enabled Trigger Event flags means. |

| Disabled | Disabled (day) | BEKG | None | Status quo when VFRB and triggers disabled. |

So in summary the new X5 constraints are likely to ease some of the limitations arising from their predecessor. How material this easing will be depends mostly on whether other constraints step in to more frequently limit VNI flows as the new X5 pair step back a little. But achieving major changes to the flow limitations that have emerged on VNI (and elsewhere in the NEM) would require wider actions across the industry than AEMO is able to achieve on its own by refining a few constraint formulations.

=================================================================================================

About our Guest Author

|

Allan O’Neil has worked in Australia’s wholesale energy markets since their creation in the mid-1990’s, in trading, risk management, forecasting and analytical roles with major NEM electricity and gas retail and generation companies.

He is now an independent energy markets consultant, working with clients on projects across a spectrum of wholesale, retail, electricity and gas issues. You can view Allan’s LinkedIn profile here. Allan will be occasionally reviewing market events here on WattClarity Allan has also begun providing an on-site educational service covering how spot prices are set in the NEM, and other important aspects of the physical electricity market – further details here. |

As a mere mechanical engineer, a lot of this is barely understood, but my simple question is. Why did we spend $42m upgrading VNI and in the last quarter Victoria exported 350GWh to NSW yet in Q1 2015 we were able to export 1,500 GWh. Back then the price differential was $7/MWh-this year $43/MWh.

This seems to need more than tweaking a couple of constraints in a constraint matrix. It would seem that either the money was spent in entirely the wrong place and Transgrid is being paid some $4m/y for adding costs to consumer bills or that the whole system model needs to be rebuilt

Peter – very reasonable question, no-one who looks at the current situation with VNI thinks it’s an acceptable outcome, but unfortunately it reflects the current market design and getting agreement to change things like transmission access and pricing has proven nearly intractable. If there was a “NEM benevolent dictator” this particular problem could probably be fixed tomorrow – but no-one is in charge of the NEM and the number of stakeholders with wildly different positions on things makes changing the status quo very very slow and painful. Allan.

So Project Energyconnect is adding 800MW of transmission capacity between Buronga and Darlington Point – presumably this will result in decomissioning this section of the X5 line and replacing the X5 constraints with new, looser ones?