Given the prognosis for strong wind production today* noted yesterday (here and here) I was not expecting to see much price volatility in the southern regions (especially in SA) – which is why this brief burst of volatility in South Australia

We see the price spiked to the $15,100/MWh current** Market Price Cap at 18:05 dispatch interval (NEM time), and then spiked a little lower for 18:10.

** the MPC is increasing to $15,500/MWh from 1st July 2022.

Let’s have a quick look this evening…

(A) Earlier in the day

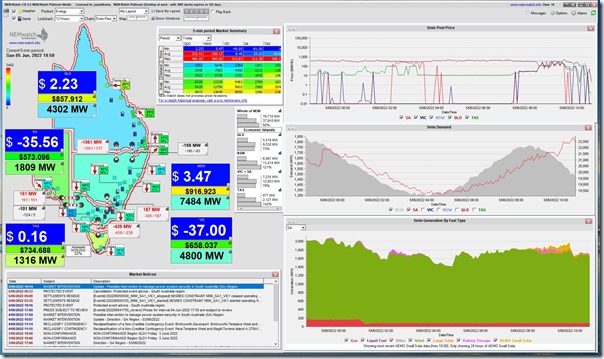

In the morning and early afternoon we’d seen prices low across all regions (and even below zero) – such as this snapshot from NEMwatch at 10:50:

The fuel mix trend here for South Australia shows a solid block of green for wind production, the minimum production from gas-fired generation, and also quite low production from solar (have not investigated why).

(B) * Today’s wind production

With reference to the recently set ‘all time record’ level, what happened today was that (on a NEM-wide basis) aggregate production did reach just above 6,500MW … but not as high as the recent record.

(C) Evening volatility in South Australia

We’ll quickly walk through what was happening at the time…

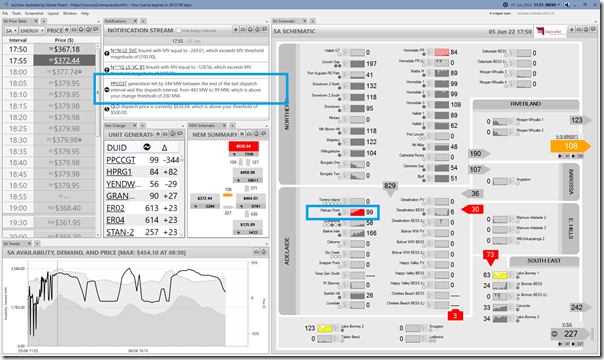

C1) At 17:55, before the spike

Let’s start with this snapshot from ez2view ‘Time Travelled’ back to 17:55 this evening (remembering that this switches the display of generation output to be end-of-interval values, to better match other values):

What jumps out (as highlighted) are these things:

1) We see Pelican Point rapidly ramped down (from 443MW to 96MW in this 5 minute period); and

2) There are no units on at Torrens Island, but other thermal units at Quarantine and Barkers Inlet.

3) We see Heywood flowing east (target flow -227MW) to supply the higher-priced VIC region.

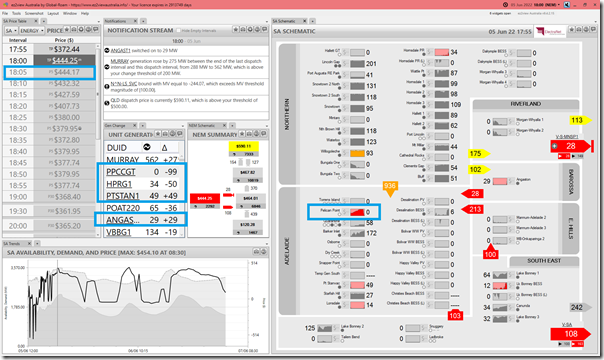

C2) At 18:00, immediately preceding the spike

Five minutes later, we see Pelican Point dropped another 99MW further to 0MW.

At this point we can’t be sure why the unit ramped down so quickly over two dispatch intervals at this point, but would seem to be some sort of technical problem.

In addition we see:

1) The P5 predispatch price forecast for 18:05 only at $444.17/MWh; and

2) We also see other plant changing output:

(a) HPRG1 has decreased by 50MW;

(b) PTSTAN1 and ANGAST1 have both increased (+78MW in total).

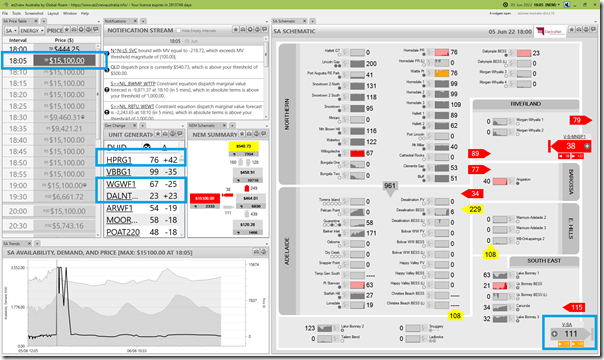

C3) At 18:05, the price spikes

Five minutes later, we see the price spike ‘out of the blue’:

Apart from the price spike we see a number of things:

1) We see aggregate Available Generation for the South Australian region drop, further reinforcing the sense that it was some technical issue at Pelican Point

2) HPRG1 ramps back up 42MW (almost as much as it decreased by in the prior DI);

3) Several other batteries ramp up (DALNTH01 and LBBG1)

4) Other peakers ramp up (PTSTAN1 and ANGAST1)

5) But in unfortunate timing, Willogoleche Wind Farm drops 25MW.

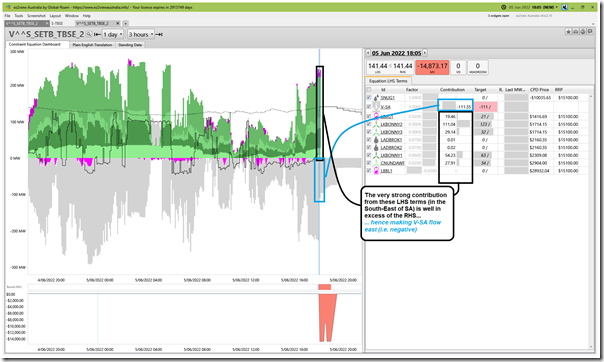

6) It’s also worth noting that Heywood is still dispatched to flow east at –111MW … which is because of the effect of the ‘V^^S_SETB_TBSE_2’ constraint equation

(a) which I wrote about before the weekend

(b) in the ‘S-TBSE’ constraint set (with the outage still planned to end on Tuesday evening).

(c) here it is illustrated in a slightly-more-advanced ‘Constraint Dashboard’ widget in ez2view v9.4.2.15 … making it clear that the strong wind in the south-east of South Australia is making the Interconnector flow east because of the limited capacity between the South-East of South Australia and the central part of South Australia:

… as a result of the outage of one South East –to- Tailem Bend 275kV line there is not enough transfer capacity in from Victoria to have any impact on the sudden price spike in South Australia.

(d) It’s also worth noting that the very low CPD Price for Snuggery suggests that the plant was prevented from running (assuming it wanted to) because of this constraint equation at this time.

C4) Actual LOR1 at 18:24

The AEMO market this by publishing Market Notice 96815 at 18:24 noting an actual LOR1-level Lack of Reserve condition occurring in South Australia:

——————————————————————-

MARKET NOTICE

——————————————————————-

From : AEMO

To : NEMITWEB1

Creation Date : 05/06/2022 18:24:59

——————————————————————-

Notice ID : 96815

Notice Type ID : RESERVE NOTICE

Notice Type Description : LRC/LOR1/LOR2/LOR3

Issue Date : 05/06/2022

External Reference : Actual Lack Of Reserve Level 1 (LOR1) in the SA region – 05/06/2022

——————————————————————-

Reason :

AEMO ELECTRICITY MARKET NOTICE

Actual Lack Of Reserve Level 1 (LOR1) in the SA region – 05/06/2022

An Actual LOR1 condition has been declared under clause 4.8.4(b) of the National Electricity Rules for the SA region from 1815 hrs.

The Actual LOR1 condition is forecast to exist until 1930 hrs.

The capacity reserve requirement is 352 MW

The minimum capacity reserve available is 275 MW

Manager NEM Real Time Operations

——————————————————————-

END OF REPORT

——————————————————————-

This condition was cancelled by AEMO in Market Notice 96821 at 19:18

Leave a comment