I’ve been without power and otherwise distracted as a result of the Brisbane floods this past week, like many others (and our office remains without power … not that Linton could clearly see any difference in demand levels in his analysis last Friday) and am just catching up on the goings-on in the National Electricity Market this weekend.

One thing that caught my attention was a series of on-again-off-again Market Notices by AEMO about the possibility of LOR2 Low Reserve Condition for the QLD region region this coming Tuesday 8th March 2022.

At 14:47 today, Market Notice 95092 was issued, warning of the tightest period being between 18:00 (i.e. half hour ending 18:30) to 19:00 NEM time on Tuesday:

——————————————————————-

MARKET NOTICE

——————————————————————-

From : AEMO

To : NEMITWEB1

Creation Date : 06/03/2022 14:47:23

——————————————————————-

Notice ID : 95092

Notice Type ID : RESERVE NOTICE

Notice Type Description : LRC/LOR1/LOR2/LOR3

Issue Date : 06/03/2022

External Reference : STPASA – Forecast Lack Of Reserve Level 2 (LOR2) in the QLD Region on 08/03/2022

——————————————————————-

Reason :

AEMO ELECTRICITY MARKET NOTICE

AEMO declares a Forecast LOR2 condition under clause 4.8.4(b) of the National Electricity Rules for the QLD region for the following period:

[1.] From 1830 hrs 08/03/2022 to 1900 hrs 08/03/2022.

The forecast capacity reserve requirement is 668 MW.

The minimum capacity reserve available is 655 MW.

AEMO is seeking a market response.

AEMO has not yet estimated the latest time it would need to intervene through an AEMO intervention event.

Manager NEM Real Time Operations

——————————————————————-

END OF REPORT

——————————————————————-

Note that this particular warning was cancelled at 15:18 with Market Notice 95094.

(A) High-level look ahead

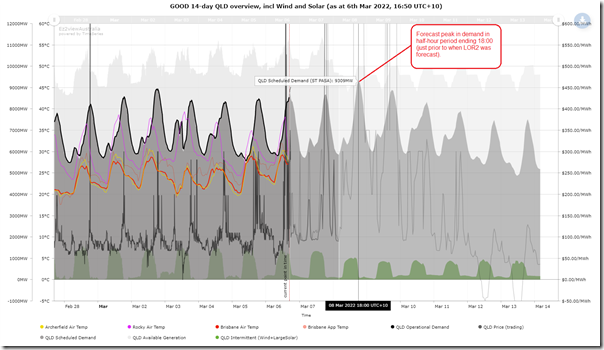

Opening up this pre-configured trend (which clients with licensed access to ez2view online will also be able to open) I see this is the state of the market at 16:50 today:

There have been a few 5-minute periods this afternoon with the price spiking in QLD in parallel with cloud cover cutting solar PV output (and perhaps other factors … have not checked).

Looking ahead to Tuesday (annotated on the chart) we see:

1) the peak Market Demand is forecast to be 9,309MW … still a bit more than 700MW below the all-time record (which was nearly eclipsed at the start of February), but noteworthy as we’ve technically passed from summer into autumn.

2) In terms of available generation:

(a) Following the vertical line at 18:00 downwards, we see the AEMO forecast for solar production during the day to have faded away to not much at that time (rooftop PV will also have gone to bed, removing any suppressing effect on Market Demand it might have had).

(b) We also see that the aggregate ‘Available Generation’ (light grey) shape is shown as considerably lower on Tuesday than on Monday … but readers are cautioned that this is, at least in part, because of the different method used by AEMO in adding up numbers in ST PASA compared with P30 predispatch.

(B) Looking more deeply

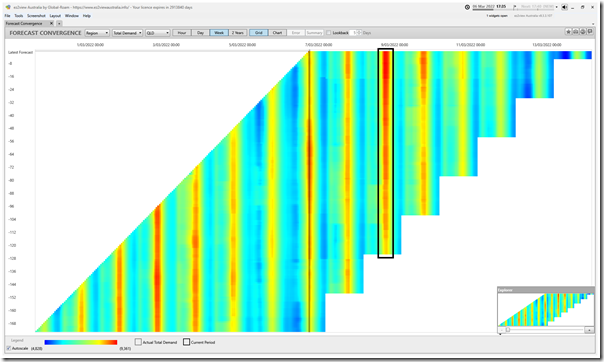

Using the ‘Forecast Convergence’ widget in the installed ez2view application at 17:35, we can see that the successive forecasts for Market Demand for peak demand time on Tuesday evening have been typically ‘getting hotter’:

Looking up the vertical, we see the red band get deeper (i.e. higher demand) and wider (i.e. more hours in the red range).

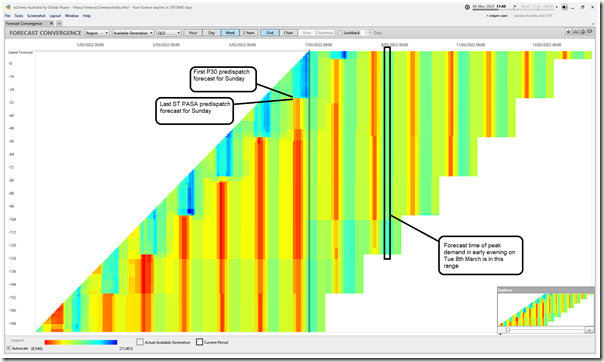

Flipping to look at Available Generation at 17:40, we need to keep in mind that the colour coding flips to be:

1) Red = LOW (generally bad, depending on the perspective of the user); and

2) Blue = HIGH (generally good, assuming the same user).

We an see that (in broad terms) the level of Available Generation forecast for these peak demand times on Tuesday evening has not been changing:

We can also clearly see the effect of shifting from the ST PASA (redder = lower) to the P30 predispatch (bluer = higher) forecasts runs over prior days.

(C) Something to remember!

It’s worth noting that the primary purpose of the AEMO forecast processes is to encourage a market response – and that this almost always occurs (only on very rare occasions does the AEMO feel the need to go ‘outside the market’ to activate other mechanisms … like how it triggered Reserve Trader on Tuesday 1st February 2022).

… and now, as I hit publish, I notice that the LOR2 forecast is back (in Market Notice 95098 at 17:24).

Leave a comment