The first (and currently only) significant price spike in the QLD region today was at the 14:30 dispatch interval, as noted in this article.

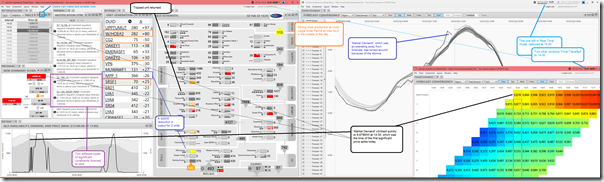

With the power of ‘Time Travel’ in ez2view, I thought I’d have a quick look at some of the factors – please click on the image below to open up the image in full screen(s) size … you might need to spread it across more than one screen to read all of the detail:

There’s a number of things going on here, so let’s start by explaining that there are 3 windows juxtaposed together:

1) Two windows are ‘Time-Travelled’ back to 14:30, when the QLD price spiked to $9,898.98/MWh; whilst

2) The third window (the ‘Chart’ view of ‘Forecast Convergence’ was left in Real Time, to allow me to keep an eye on more recent data for ‘Market Demand’ … and to share with you.

Hence let’s quickly walk through some of the annotations:

(A) Demand drop to 15:00

In the real-time window, we see that ‘Market Demand’ dropped noticeably from 14:30 to 15:00 … as a result of the storms noted in this earlier article.

(B) About the price spike at 14:30

Three factors influencing price:

(B1) Demand Side

In the ‘Grid’ view of ‘Forecast Convergence’, the auto-scaled colour coding used now (different than here) makes it easy to see that, to 14:30, demand was climbing rapidly … and that this was happening more rapidly than earlier forecasts. Furthermore:

1) from 14:25 to 14:30, the ‘Market Demand’ grew by 63MW in a 5 minute period (i.e. up the diagonal)

2) or, looking up the column, the demand was 154MW higher than AEMO was forecasting it would be in the P5 predispatch run 10 minutes beforehand).

3) not shown here (but visible to me if I flip to Price) this price spike was not forecast 5 minutes in advance.

So on the demand side, we understand one of the contributors to the price spike.

(B2) Supply Side

Obviously, supply in QLD (or from imports) would need to ramp up to deliver the additional demand requirement … but this requirement was further increased by the 42MW reduction in output* at the Millmerran units at the time.

* note that we don’t have visibility of the Dispatch Targets for any of the units in real time (that’s another ‘Next Day Public’ data set) … all we can see in the current day, but Time-Travelled in ez2view, is the FinalMW (i.e. metered output published by AEMO of what the unit was producing at the end of each Dispatch Interval).

1) In this we are assuming that Millmerran’s target’s reduced

2) If this was the case (an assumption!) then we presume that the targets were reduced as a result of the unit shifting its volume to higher price bid bands.

3) All of this is only hypothesis today – there may well be other explanations, and we’d need to wait for tomorrow to see if our guesses are correct!

On the supply side we’ve flagged a number of units (hydro, gas and solar) that increased their output coincident with the price spike … again presumably (for Scheduled plant, perhaps not so much for Semi-Scheduled) the units have increased their output in response to requests to increase in their Dispatch Target.

(B3) Imports or Exports

In the above quick summary, I have not looked at interconnection.

(C) Central-to-South constraint

Finally, worth also noting the forecast binding of a couple different types of ‘central to south’ constraints later in the afternoon. We wrote about the ‘Q^^NIL_CS’ constraint equation yesterday.

Be the first to comment on "A quick look at the 14:30 price spike today (Wed 2nd Feb 2022)"