I was offered the opportunity for an early review of the GenInsights21 publication, by Global-Roam Pty Ltd and Greenview Strategic Consulting (GR and GVSC), and jumped at that chance. In this article I share some of the things that jumped out at me…

—

The second paragraphs of GenInsights21 starts with the following statement:

“The primary purpose of an electricity market is to provide for efficient dispatch of electricity to meet the long-term needs of energy users and does this by providing a clear price signal for the locational wholesale supply of electricity”

… and proceeds to present some deep analysis of the NEM based not just on the views of GR and GVSC, but equally on the extensive and rich data set that Global-Roam provides to market participants.

That data, including a history of bid bands, FCAS bids, generator outages (forced and unforced), patterns of demand and supply from the start of the NEM to today is likely better than any NEM data bank outside of AEMO.

Data of course serves to provide information, and information requires analysis of the data. Again Global Roam provides the tools that will enable a skilled analyst to get the data to talk.

Through GenInsights21, GR and GVSC, identify two key challenges – namely:

1) that variability and uncertainty are increasing, and

2) complexity is increasing.

3) These lead to a conclusion, put as a challenge, that risks are increasing.

Like any good analyst, GR and GVSC conclude that these risks require more information and more analysis. And I agree. Specifically GenInsights21 draws a conclusion that “the market” has become more reliant on forecasting. For many of us, the thought that keeping the lights on depends on forecasting is indeed a concern.

However even though some risks are no doubt increasing, one might also argue that other risks are reducing. New technology, new ways of doing things, bring benefits as well as problems. At least in this author’s opinion. For instance even though behind the meter solar is weather dependent, it is not dependent on any one supplier.

GenInsights21 concludes, correctly in my view, that price signals traditionally provide by the energy only NEM have become distorted. Still this is hardly a new conclusion – State Government policy, the lack of a carbon objective in the National Electricity Objective, and renewable energy policies all bias the “energy only” spot market and the associated futures markets.

The price signals that are available, that is spot prices and various futures prices (baseload and caps), arguably might reassure system designers. If market participants forecast significant high price volatility likely the price of the thinly traded $300 cap would increase. One aim of markets related analysis, at least in the view of this analyst, is to get “ahead” of the market. Theory suggests that for fair markets, ones with liquidity where trades are only made on the basis of public information, it is difficult if not impossible to consistently get ahead. And yet there is a reward for analysis, because it reduces uncertainty. And so it may be with the risks identified in Gensight21. GR and GVSC may just be ahead of the game.

Equally though one can perhaps take some comfort from the draft version of the 2022 ISP. That models an accelerated closure of coal plant, allocates in heaps of new renewable energy, transmission and storage, runs a large number of half hourly simulations, although maybe not enough for everyone and concludes that the reliability standard can be met without impacting consumer prices too much.

Yes as observed in GenInsights21, there will be lots of spilled energy, and unresolved issues of who pays for it, and no doubt other problems as well, but the overall message is reassuring. And that will comfort many, because at the end of 2021 it’s the path that the majority of informed observers believe we are most likely on. Humans being humans they may of course have a different view next year.

Structure of GenInsights21

GenInsights 21 is divided in three sections (already discussed here).

Section 1 is a summary of sorts.

Section 2, which I personally found of particular interest was a high level analysis of and over view of aggregations of data. This is where GR & GVSC’s strengths are most evident.

Section 3 is a series of 28 seemingly unrelated articles presented as appendices dealing with various issues including, for instance a reflection on what a 100% renewable NEM might mean, or a study of wind correlations. Users are invited to think about each issue as the need arises. One problem with this as a document, is a lack of connection and flow between the appendices

GenInsights21 also includes an extensive glossary (in Section 2), of significant value in itself.

ITK Perspective

Here at ITK Services, we take a “think global act local” approach to thinking about the NEM.

We start from a world view that about US$3 trillion per year of production coal, gas and oil around the world is going to be replaced over a 20-30 year time frame. Although this initially sounds impossible is it any different to the way cars replaced horses? As ever in change of this scope different analysts will have different perspectives. Some will focus on the problems and some on the opportunities. What is for sure is that the problems have to be well understood and analysed so that robust solutions are adopted.

Here at ITK we used to focus on the problems, but as time passes the “opportunity” pie grows and the “problem pot” declines as the problems are solved. Each step on the path bringing different issues. Whether its lithium for batteries, or software to control millions of devices, or building green retailers as big as the big three gentailers today or grid modelling software the future presents opportunities.

In 2021 an obvious example is “system services”. ITK adopts this as a catch all for not just the current FCAS market but also the emerging and, in our view, likely to be dominant, synthetic or virtual inertia market. As GenInsights21 makes clear the industry is yet, on average, to accept that virtual inertia is a technically appropriate general solution.

And yet progress towards that general acceptance has been dramatic in 2021. And should VSM devices turn out to be as effective as theory and practice, in the off grid segment to date suggests, they open up new ways of doing things, and perhaps a more reliable grid. If a house can run during a blackout using a battery, why can’t a street or a suburb? Why can’t a suburb with surplus energy supply to one short? Would this be a better or worse way of doing things? Top down centralized control with coordinated dispatch and a complex linear program that co-optimises supply demand and control is a wonderful thing, but it may not be the only way.

Three examples from GenInsights21

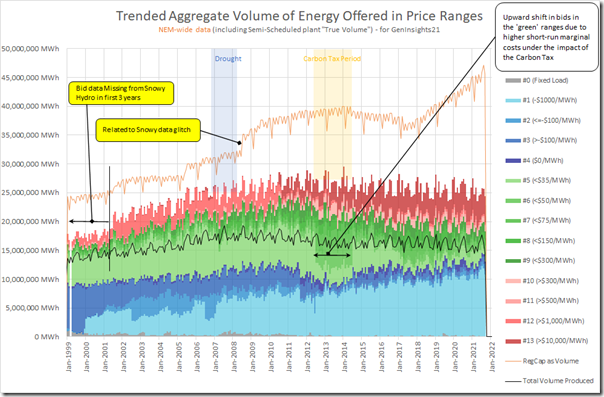

A great example in Section 2 that demonstrates the strengths which GR and GVSC bring to GenInsights21 is the analysis of bid bands over the history of the NEM. This is a wonderful chart that few other organisations have the capacity to produce.

Figure 1 Source: GenInsights21

At a glance one can see the total history of the NEM, the increasing proportion of very low bids and the increasing proportion of very high bids and the falling proportion of bids in the middle. At the same time there is the total volume produced, by the “Operational sector” almost unchanged in a decade. It is up to each reader to use that “information” to tell the story as they see it – but there the story is, laid out in technicolour for all to see.

Perhaps one might be interested in the price you need to bid in order to be dispatched, or the discount that you need to offer, to get dispatched relative the regional node price. That too is available and termed the “Connection Point Dispatch Price (CPD Price)”. Well worth a look.

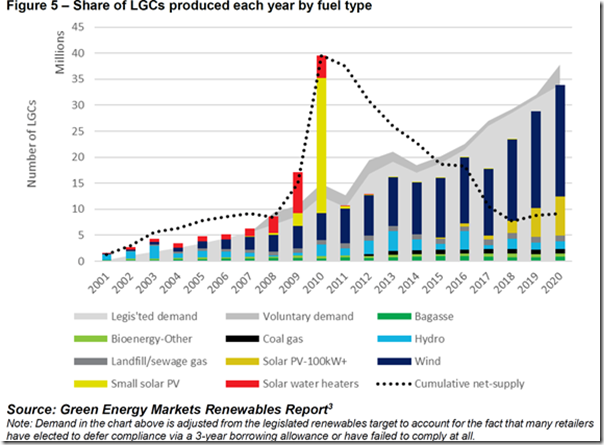

Turning to the appendices, there is a great reminder of the significance, to this day of the LGC scheme and its contribution to the returns of renewable energy generation.

The following figure (from Appendix 1) shows the history of LGC production by fuel and year. The conclusion I draw is that the LGC scheme has primarily benefitted the wind industry, and in my opinion, like feed in tariffs for rooftop solar is a policy instrument that has succeeded.

Figure 2 Source: GenInsights21

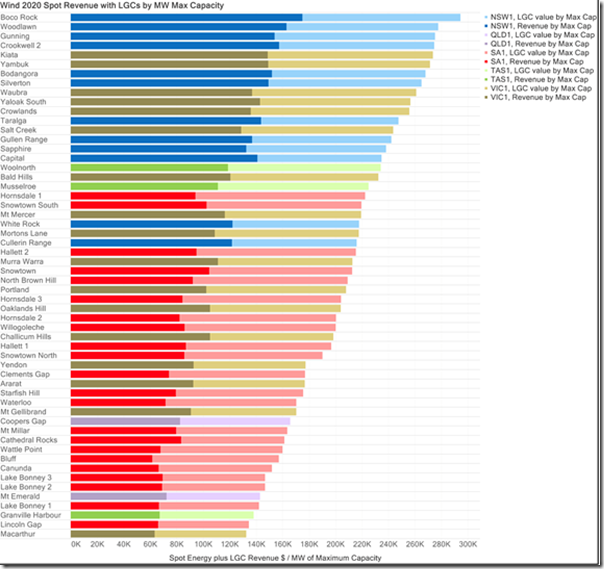

Although not directly connected, a later appendix (Appendix 7) shows for each solar and wind farm, revenue per KW with and without LGC value added and separately FCAS cost.

Still the reader would still be required to do more work to eliminate the costs (FCAS and other operating costs) to get back to what the actual underlying, pro forma return on capital is.

Figure 3 Source: GenInsights21

One of the great benefits, to the renewable supplier, of the LGC is that the price doesn’t vary with time of day but only reflects total supply and demand adjusted for voluntary surrender and banking. In short it’s a fixed annual stream of revenue. In 2020, not necessarily a guide to the future, it was providing 50% of the total “spot” revenue for an average wind farm.

There is lots more where this came from.

In short one doesn’t have to identify precisely the same issues or the weight attached to them by GR and GVSC to appreciate the value that they have delivered in GenInsights21.

————————————–

About our Guest Author

|

David Leitch is Principal at ITK Services.

David has been a client of ours (and a fan of NEMreview) since 2007. David has been a long-time contributor of analysis over on RenewEconomy, very occasionally contributes to WattClarity! David also provided valued contribution towards our GRC2018 (which came before this GenInsights21). David has 33 years experience in investment banking research at major investment banks in Australia. He was consistently rated in top 3 for utility analysis 2006-2016. You can find David on LinkedIn here. |

Leave a comment