Over 2,000 MW – or around 55% – of South Australia’s firm supply capacity was unavailable last Friday evening (March 12, 2021), along with virtually all of its large-scale renewable supply (a further 1,800 MW or so) but the lights stayed on – just.

The Quick Summary

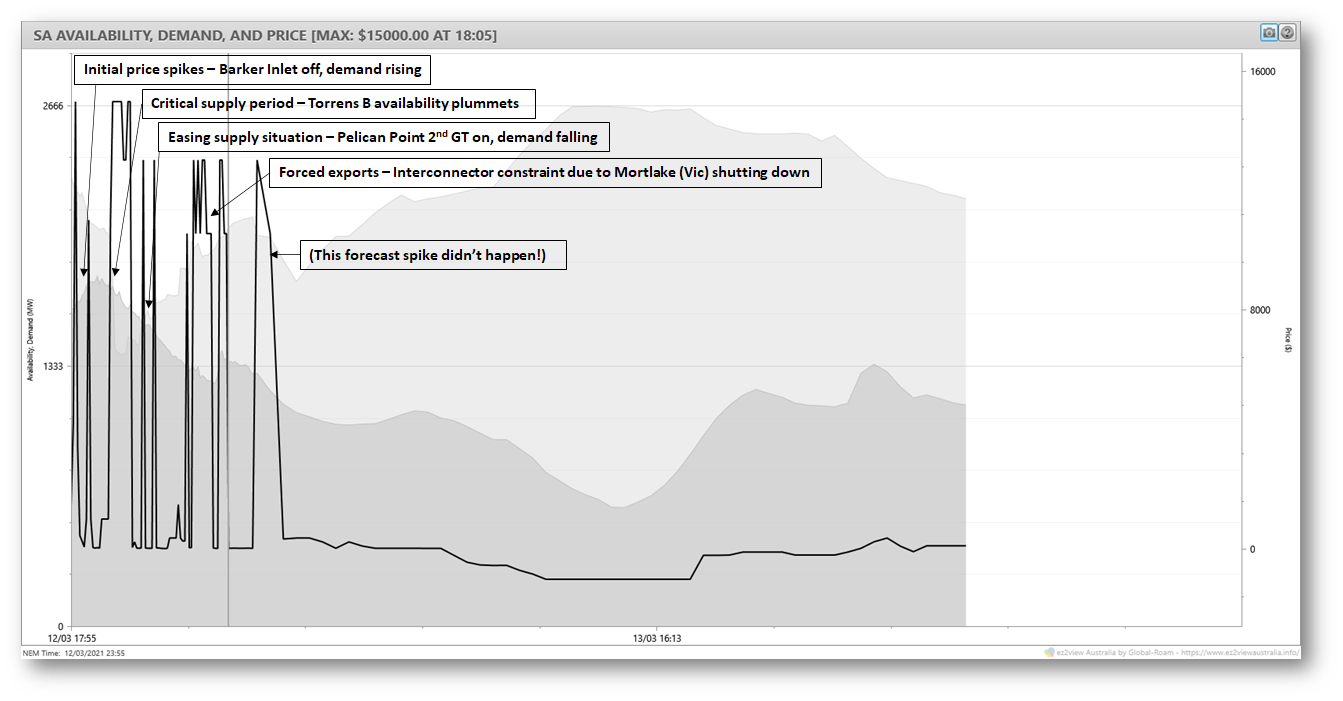

- An equipment failure in the Torrens Island high voltage switchyard just after 5:30 PM local time (17:00 NEM time) – described in some reports as a “fire” – forced off about 670 MW of generation capacity at AGL’s Barker Inlet and Torrens Island B stations.

- About 870 MW of slow-start gas-fired generation capacity was not running and unavailable to replace this lost supply capacity – except for Pelican Point’s second gas turbine which came on some hours after the initial incident.

- Another 330 MW of capacity at fast-start gas and diesel-fuelled plants was unavailable for various reasons.

- Supply from Victoria was down by at least 150-200 MW because of transmission works on the Heywood interconnection, ironically the final stages of reinstating the permanent lines in Victoria knocked down by a severe storm in January 2020.

- Calm weather and the setting sun reduced output from renewables to virtually zero.

- All of the above left the region with a perilously thin margin of supply relative to demand, which peaked at about 1,800 MW.

- Not surprisingly, spot prices rocketed in the face of these very tight supply margins, reaching 5-digit values for various intervals between 18:00 and midnight (NEM time).

It would be easy to start apportioning “blame” for this near-miss event to a whole raft of factors – the shouting match over the recent unmitigated disaster in Texas provides a sorry template for that – but I think it’s more useful to start by looking at themes that might emerge from events like this one.

I’ll then examine a few micro-details of what must have been a white-knuckle ride for AEMO, AGL, and South Australian transmission operator ElectraNet, evident in the detailed market data.

The Bigger Picture

While there’s a lot of understandable interest in the granular detail of Friday evening’s events, too much focus on that risks missing some larger themes brought home by this and other notable events that have affected the NEM (mostly South Australia) in the last five years:

- September 2016 Black System

- February 2017 load shedding

- March 2017 (very) near miss

- January 2020 Snowy region bushfires

- January-February 2020 extended SA islanding

And that’s not an exhaustive list.

I’ve picked out three themes for discussion here.

Theme 1 – Expect the Unexpected (Reliability isn’t Resilience)

Power system reliability draws a lot of focus, hundreds of pages of dense reports, and terabytes of modelling data, but is fundamentally a pretty narrowly defined statistical process for quantifying the chances of having enough supply to continuously meet demand, and the extent of any deficits. It’s all based on modelling of “mathematically expected” probabilities of failure etc.

Power system resilience is a much more loosely framed topic dealing with the ability of a system to manage through unexpected disruptions and shocks. So far it hasn’t garnered nearly as many pages or terabytes, but I suspect it’s more likely to keep system operators awake at night.

A feature of all but one of the events listed above is that parts of the power system were hit by multiple contingencies that took out significantly more supply capability in one hit than registers in any traditional reliability (or system security) analysis – or if it does register, only at such low probability levels that it’s essentially ignored in the formal reliability metrics like “expected unserved energy” or “loss of load probability”.

Another feature of some events was the extended nature of the triggering contingency and ensuing disruptions.

Texas provides an even starker illustration of the difference between reliability and resilience, if one was needed.

The kinds of event relevant to a resilience analysis are – almost by definition – those that fall beyond the statistical reach of reliability modelling, but as these real world examples show they seem to happen often enough. It’s just that we don’t yet seem to have good ways of characterizing and planning for them, in a generalized sense.

It’s more than high time we developed some! Paul has made a similar specific suggestion in regard to AEMO’s next ESOO.

Theme 2 – Energy is not Capacity (megawatts ain’t megawatts)

This one is more specific, but has become a personal bugbear of mine.

Low output from renewables in South Australia last Friday evening was not a direct cause of the supply “crisis”. We should henceforth cancel any discussion and comparison of the capability or “performance” of fundamentally different supply sources that simply uses megawatts as a measuring stick.

OK that’s a bit extreme, but frankly, talking about “poor performance” or “unreliability” of variable renewable energy (VRE) sources like solar and wind generation in some system event, using short term megawatt output relative to nominal megawatt capacity (aka short term capacity factor), almost completely misses the point.

Equally missing the point is to discuss “replacement” of the retiring 1,400 MW Yallourn Power Station in Victoria with X thousand megawatts of VRE generation, whatever the value of X.

The point is that VRE generation is variable and we’ve known that forever. So we shouldn’t pretend for an instant that it’s surprising or unacceptable that VRE produces very little output when the sun isn’t shining and the wind isn’t blowing. Nor should we pretend that any number of VRE megawatts is somehow a like for like substitute for dispatchable capacity.

Regarding VRE “performance”, pointing the finger at South Australia’s renewables for producing at only (say) 2% of nominal capacity late on a calm evening makes about as much sense as castigating householders for all turning on their air conditioners when the temperature reaches 40 degrees. It’s an entirely expected outcome in both cases; of course balancing supply and demand would be easier if things were different, but atmospheric physics and human behaviour being what they are, these are just phenomena that need to be planned for and accommodated.

More than a few commentators, on discovering that VRE generation is – shock, horror – variable, next leap to a conclusion that it must be completely useless. These commentators evidently don’t get the distinction between capacity (megawatts) and energy (megawatt hours), nor do they understand generation economics.

Traditional dispatchable generation sources deliver both capacity and energy, at a cost, with a relatively predictable (“firm”) profile; VRE sources essentially deliver energy, at an increasingly lower cost, but with a stochastic capacity profile that has to be “managed around” – just like variable demand with all those annoying consumers turning on air conditioners also has to be “managed around”. Providing dispatchable capacity to complement the stochastic profiles of VRE and demand is one of the costs of this “managing around”. So are any measures increasingly required to deal with potentially excessive VRE output and low demand.

If the cost of VRE is low enough that after adding these “managing around” costs it’s still the cheapest source of system energy, then build more of it (when needed).

If the total of the VRE energy costs and the “managing around” costs becomes excessive, that’s the time to think about changing strategy.

Most of the time, the popular discussion of all this never gets to the economics – despite, for example, the earnest efforts of AEMO in its ISP – and instead gets hung up on arguments that “my megawatts are better / greener / cleaner / firmer than yours”.

We could even extend this discussion to comparisons between “dispatchable” megawatts at offline slow-start plant – clearly not of any use in a sudden supply shortfall like last Friday – versus dispatchable megawatts at batteries – good in short bursts – versus dispatchable megawatts at fast-start hydro or thermal plant. They’re all different, depending on circumstances.

{/rant}

Theme 3 – Transmission has its Limits

Another characteristic shared by most of the events I listed earlier is that transmission limitations and / or exposure of the transmission system to environmental risks played a very significant role.

This is really one specific domain of the wider reliability vs resilience space, but it’s very important in the NEM because relative to the electrical size of the system, it’s a very long and stringy transmission grid with relatively low redundancy compared to the more typical strongly meshed grids in densely populated regions of the world.

And although transmission equipment is inherently pretty reliable, it’s unavoidably exposed to the elements, and also requires regular maintenance that can further reduce redundancy and cause significant, albeit temporary, capacity reductions. Just like we saw last Friday.

Building more of it to more tightly integrate the NEM should on the face of things improve reliability and resilience, but careful attention will need to be given to avoiding unintended consequences – a region which becomes more reliant on energy flows across lengthy interconnections which remain exposed to multiple failure modes and risk factors may not end up with much higher resilience.

I haven’t seen firm evidence one way or the other (and any assessment would need a hypothetical counterfactual), but I do wonder how much resilience – as opposed to lower average energy costs – South Australia has gained with the significant upgrade in capacity on the interconnection via Heywood in recent years. The flip side of this increased capacity may have been larger disruptions in that capacity when failures or maintenance occur (perhaps in conjunction with other events, such as last Friday’s), with at least the possibility of poorer overall resilience outcomes.

Three micro-details

As Paul has already produced a very detailed timeline of events, and I’m time-limited for this analysis, I’ll just pick out three details relying on some further market data mostly not available at the time of his write-up.

Microdetail 1 – TIPS B Rebidding

Without going into the schematics of the Torrens Island switchyard, my understanding is that the failure that forced off AGL’s Barker Inlet plant took out one of the two high voltage buses that also connect Torrens Island B, leaving its three units online at the time (B2, B3 and B4) more exposed to a consequential risk of tripping. Also in the aftermath of the incident, it was apparently unclear that these units would be able to remain online while damage to the switchyard was being assessed.

This led to a constraint on TIPS B that initially limited output to 270 MW (out of 800 MW registered capacity), and then from DI 19:20 (two hours after the initial incident) additional constraints and rebids that should prima facie have taken TIPS B3 and B4 offline, leaving just 60 MW running at TIPS B2. However for reasons that are not clear, TIPS B3 and B4 remained online each at a minimum load of 40 MW for a period of over an hour despite market dispatch targets to go offline. This is all summarized in the chart below:

A possible reason for TIPS B3 and B4 not following dispatch targets, and their owner’s own declared zero availability, from around DI 19:30 is that at this point there was virtually no spare dispatchable capacity remaining in South Australia, interconnector flows were at limit (reduced by the transmission work in Victoria), and removing another 80 MW of supply might have been the “straw that broke the camel’s back” and led to forced load shedding. This is speculation, but I have no doubt there were intense discussions at this time between AEMO, ElectraNet and AGL, and it’s just possible that AGL was asked to hold off tripping its two B units while the situation was assessed, and while a second gas turbine at Engie’s Pelican Point power station was in the process of starting up.

Microdetail 2 – Pelican Point Direction

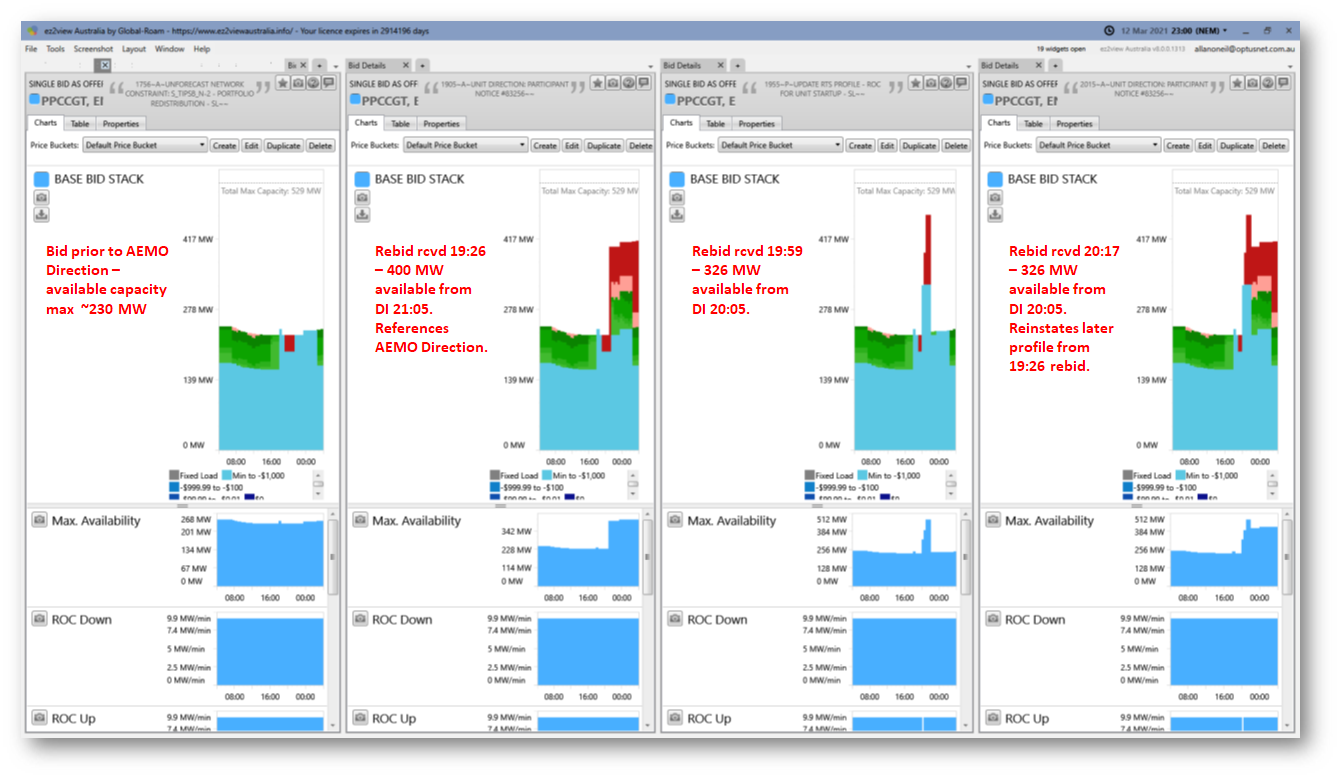

Whilst the above situation was evolving at Torrens Island B, the overall supply position began easing from DI 20:05 when Pelican Point synchronised its second gas turbine – whose capacity had been bid unavailable for some days prior to the event.

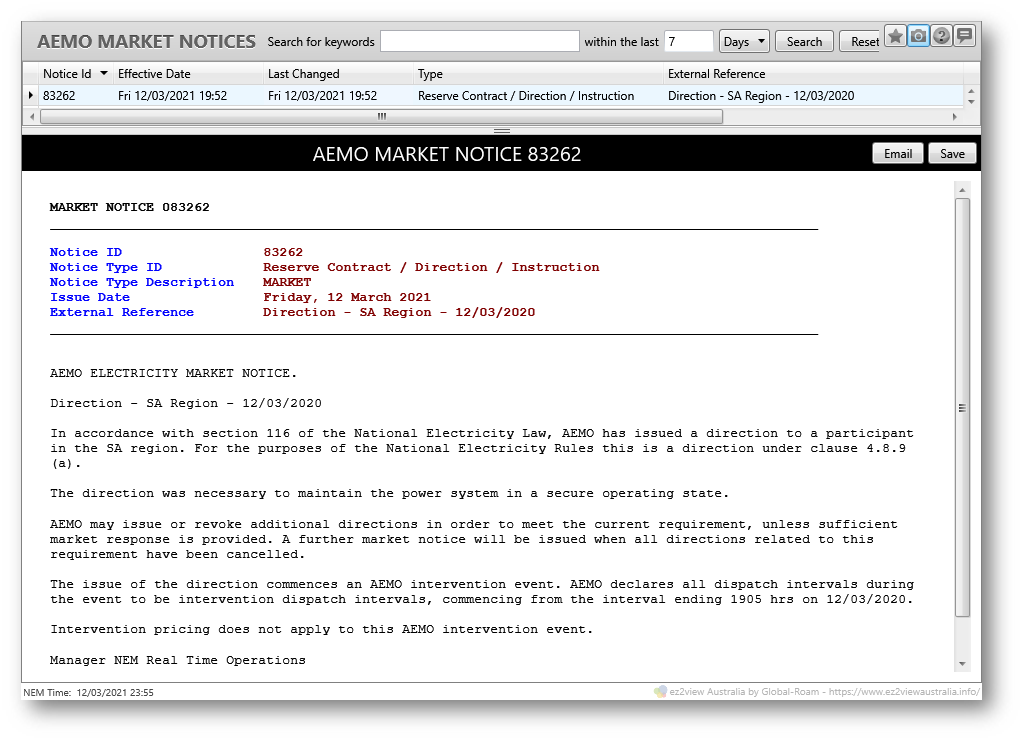

Rebid volumes and reasons for Pelican Point appear to indicate that this second unit was only started in response to a direction from AEMO, issued some time before 19:05 NEM time (actual time of issue is not visible in public market data, we just have to infer from things like rebid reasons and times). Presumably this is the direction referred to in a slightly later public market notice from AEMO:

The impact of the direction on Pelican Point’s offered capacity is summarized in the following panel of four rebids received by AEMO between 18:46 and 20:17 NEM time:

The additional 100 – 170 MW of capacity made available from DI 20:05 by this direction, together with TIPS B3 and B4 staying online, were clearly vitally important factors in maintaining uninterrupted supply over the critical period between DI 19:25 and DI 20:10, during which the spot price sat continuously between $11,000/MWh and $15,000/MWh.

Microdetail 3 – Interconnector Limits

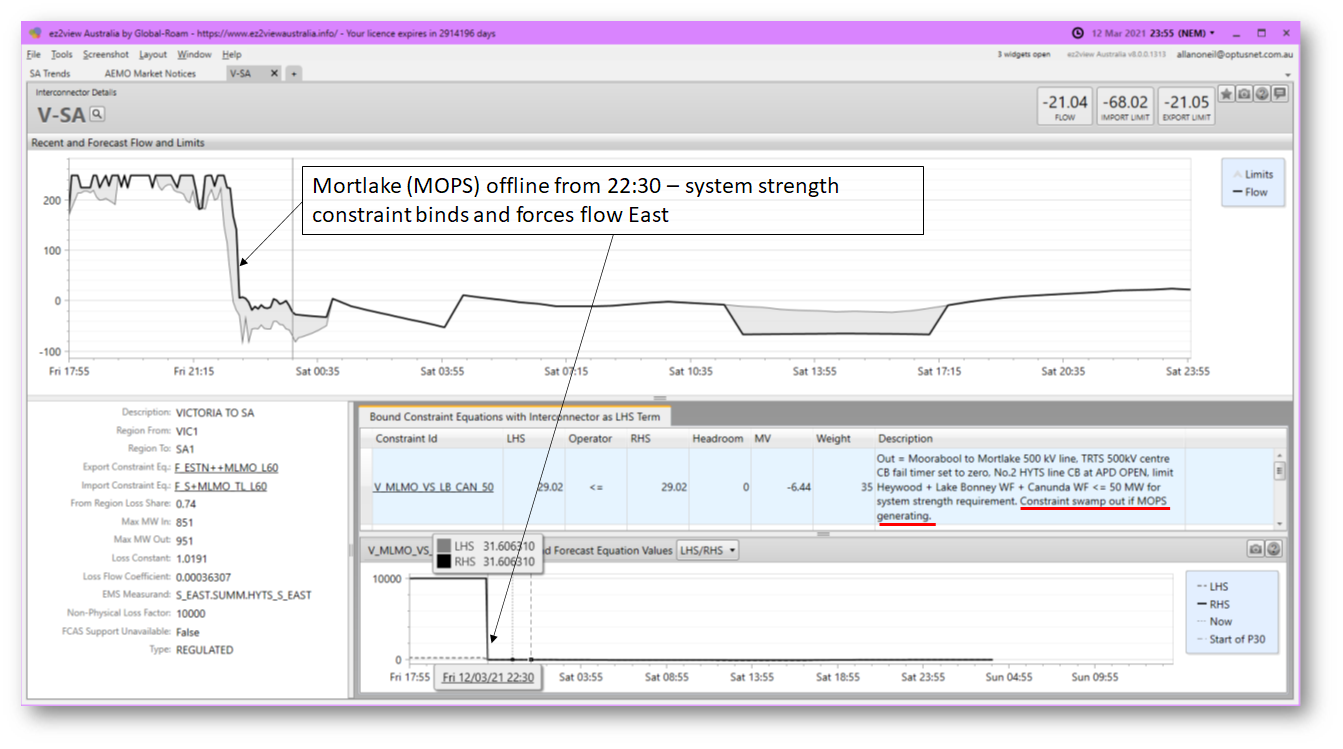

Once Pelican Point’s second GT had started and the question of keeping Torrens Island online was resolved, it might have seemed that the worst of the supply crisis was over by around 21:00 NEM time. But then another extended period of price volatility emerged between DIs 22:35 and 23:35.

It seems that the driver for this was probably an outage-related system strength constraint centered on generation in the south-east of South Australia and south-west Victoria that effectively forced flows out of South Australia once Mortlake Power Station went offline at 22:30. Mortlake is the predominant source of system strength in this region, and when offline (and when there is a single-contingency risk of the region becoming isolated from the rest of Victoria, as there was due to the transmission line work in progress), the constraint “V_MLMO_VS_LB_CAN_50” – what’s in a name eh? – became binding and limited total westward flows from this region into the rest of South Australia to 50 MW (see the constraint description below).

With local generation (predominantly at Ladbroke Grove) higher than this 50 MW figure, the only way for the excess to flow was out of South Australia, shown on the following chart.

This effectively reduced available supply into South Australia by over 200 MW, and likely accounted for the final period of volatility on a night that had already proved quite difficult enough.

About our Guest Author

|

Allan O’Neil has worked in Australia’s wholesale energy markets since their creation in the mid-1990’s, in trading, risk management, forecasting and analytical roles with major NEM electricity and gas retail and generation companies.

He is now an independent energy markets consultant, working with clients on projects across a spectrum of wholesale, retail, electricity and gas issues. You can view Allan’s LinkedIn profile here. Allan will be sporadically reviewing market events here on WattClarity Allan has also begun providing an on-site educational service covering how spot prices are set in the NEM, and other important aspects of the physical electricity market – further details here. |

Funny how all these issues keep happening in states where they are closing coal plants at record pace and replacing them with renewables which unbeknown to many people, don’t actually produce reliable supply of energy.

The answer from those in the know is to just install more renewables because they seem to be unaware that installed capacity does not equal energy output.

So we then move on to interconnectors at the cost of the end user which are more likely to fail due to the highly variable nature of a more renewable/less coal grid.

All this because the government supports renewables and penalises coal plants so no one builds firm capacity generation any more.

It’s only going to get worse as more coal plants close.

You have to then ask, what if it happened in Victoria? If a busbar trip put Loy Yang 500KV out of action, and perhaps basslink with it?

A 2013 transmission line fault in Victoria, triggered a sequence of events not dissimilar to the SA system black, as transient voltage disturbance led to generation tripping, including the AVR on a brown coal unit. Fortunately, only some under voltage load shedding resulted.

https://www.aemo.com.au/-/media/files/electricity/nem/market_notices_and_events/power_system_incident_reports/2013/psior_trip_of_ringwood_rowville_220_kv_transmission_line_multiple_generators_on_29_sept_2013.pdf

Hazelwood was still operating back then. Would be interesting to see how the situation would go in the current VIC market.

I imagine it would be much worse due to the expansion of renewables and closure of coal plants.

Did you even read the fucking article?

In case reading comprehension isn’t your strong point one of the key contributing factors was a significant shortage of DISPATCHABLE THERMAL GENERATION. But no, you’re right, some more coal plants will solve complex system resilience right away. Just build them and watch all the historical problems of the NEM design (and the state electricity commissions that preceded it) melt away.

Hell maybe we can export your simple and genius strategy to other grids around the world (hi Texas, you need more gas), along with lots of beautiful black Hunter coal.

How come we never had these problems before the expansion of renewables? The cause of the problem is the expansion of renewables which then means no one invests in reliable fossil fuel plant.

The “historical problems” of the NEM design are only problems if you decide to wholesale change the entire generation mix and rely on large scale transmission from unreliable sources.

I don’t think its so much VRE.

Isn’t it more “semi-scheduled generation” VS scheduled generation ?

Semi-scheduled generation is the low-cost energy,

yet the system needs scheduled generation. It’s the system energy.

(Especially when they get paid the same price)

Isn’t it time we put the onus on the operator to provide the system with system energy.

Shouldn’t the strategy be all DUIDs register capacity as scheduled.

The operators should take cares of the “managing around” bits. If they choose VRE,

then they need to provide the “managing around” bits thru hybrid generation or partnerships with

other providers.

100MW of Generation should be 100MW of generation. Not something less.

That would be completely the wrong approach, if we want to balance supply and demand at least cost (including environmental cost)!

100 per cent of demand is non-scheduled but system operators have found ways to manage its uncertainty and variability for at least as long as we’ve had large scale grids. Non-scheduled or semi-scheduled variable generation does not create a new kind of problem as far as capacity adequacy goes.

Of course any system will always need a large volume of fully dispatchable capacity, but it certainly doesn’t need that type of capacity exclusively, nor must any fixed or minimum proportion of energy over time come from that source. And you’re further incorrect to state that all forms of generation are paid the same price, in the NEM at least – there are dozens of analyses around, some of them on this site, demonstrating that the average spot price earned by different forms of NEM generation over almost any given time period is very different for fully dispatchable vs VRE plant, with “peaking” plant earning the highest averages and VRE typically the lowest.

I’d suggest you read the Grattan Institute report released this week (https://grattan.edu.au/report/go-for-net-zero/) for a balanced discussion and analysis of how the “managing around” task might work in a high VRE system.