On Sunday I posted this 13th Case Study in a series looking at a single dispatch interval on 19th December 2018 (one of 3 days through 2018 that saw a single instance of large* collective under-performance).

* with ‘large’ collective under-performance being measured as Aggregate Raw Off-Target across all Semi-Scheduled units being above +300MW.

Today we’re publishing this 14th Case Study of the series – as there are 98 instances of extreme imbalance seen up until 31 December 2019, we still have a fair way to go.

(A) Background context

Remember that we identified a total of 98 discrete instances where aggregate Raw Off-Target across all Semi-Scheduled units was either:

(a) above +300MW (representing collective under-performance) or, much less commonly,

(b) under –300MW (representing collective over-performance relative to AEMO’s expectations, seen in the Dispatch Target).

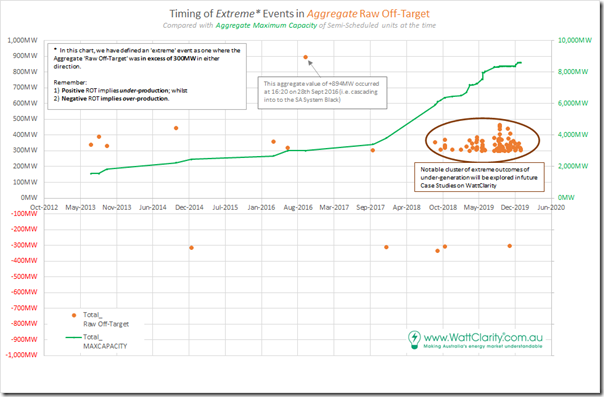

There was a smattering of only 10 cases through 2013, 2014, 2015, 2016, 2017 and through until August 2018. However thereafter (to the end of 2019) there was a sharp escalation of extreme incidents – as seen in the following chart:

Note also that we have not yet looked into 2020 data, which will be the focus of the GSD2020 (so we can’t comment on whether the trend from 2019 has continued to grow).

We’re doing this given a push from the AER Issues Paper, but moreso inspired by the deliberations by the (now defunct) COAG Energy Council and (under threat?) ESB relating to ‘NEM 2.0’. Note that these case studies deal with imbalance in the Dispatch Interval timeframe, but readers should understand that there are other challenges that ‘NEM 2.0’ also needs to resolve, including:

Other Challenge #1) Within the dispatch interval timeframe, energy-related services focused on frequency maintenance and response to contingencies;

Other Challenge #2) Relating to ‘firmness’ of supply in the broader forecast horizon; and

Other Challenge #3) Others that we bundled into a ‘keeping the lights on’ services in our discussions in the Generator Report Card 2018 (for instance, in relation to System Strength).

In preparing these focused Case Studies, we’re seeking to understand why and what the implications are of this escalation. … so let’s look at this particular event:

(B) Summary results for Monday 15th October 2018

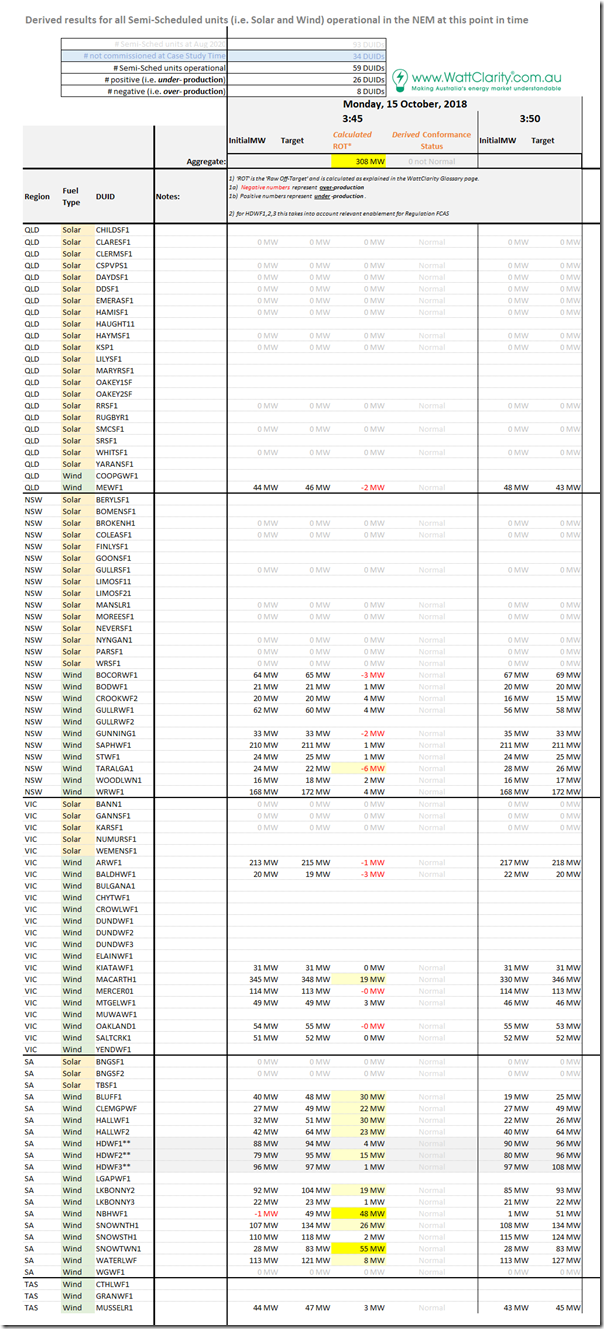

Here’s the same tabular framework of results for individual Raw Off-Target performance of all 59 x Semi-Scheduled units that were operational at the time (2 more than the 57 present on 28th September, 3 weeks beforehand).

In summary from this table, we can see the following:

1) Of the 59 DUIDs registered at the time:

(a) there are three times the number under-performing (26 DUIDs) as there are over-performing (8 DUIDs).

(b) It’s the middle of the night, so the solar farms don’t feature.

2) Of the units highlighted as having Raw Off-Target greater than 6MW (a threshold that is one of the inputs in determining Conformance Status for a unit), we see the split is even more unbalanced:

(a) 11 DUIDs flagged as under-performing by at least 6MW (with 2 of these under-performing by more than 30MW); whilst

(b) Only 1 DUID flagged as over-performing by at least 6MW.

3) Almost all of the wind farms in South Australia are significantly under-performing (two particularly so).

(C) Results for individual DUIDs

Once again we use the ‘Unit Dashboard’ widget in ez2view (and the ‘Time Travel’ powerful rewind functionality) to review what some of the core stats were for this point in time for each of the units flagged as having significant Raw Off-Target.

However, before we do, keep in mind that the AEMO had published two Market Notices which had spoken about ‘severe weather warning’ issued about 5 hours earlier. Here’s the first one (64891), published at 22:57 the day before:

________________________________________________________________________________________________

Notice ID 64891

Notice Type ID Reclassify contingency events

Notice Type Description MARKET

Issue Date Sunday, 14 October 2018

External Reference Reclassification of a Non-Credible Contingency Event: Brinkworth-Davenport, Brinkworth-Templers West and Para-Templers West 275kV lines in SA due to severe weather warning.

________________________________________________________________________________________________

AEMO ELECTRICITY MARKET NOTICE.

Reclassification of a non-credible contingency event as a credible contingency event due to severe weather warning.

AEMO considers the simultaneous trip of the following circuits to now be more likely and reasonably possible. Accordingly AEMO has reclassified it as a credible contingency event.

Region: SA

Lines: Brinkworth-Davenport, Brinkworth-Templers West and Para-Templers West 275kV lines

Duration: 14/10/2018 2300 hrs until further notice

Constraint set(s) invoked: Nil

Manager NEM Real Time Operations

Here’s the first one (64892), published at the same time (22:57) the day before:

________________________________________________________________________________________________

Notice ID 64892

Notice Type ID Reclassify contingency events

Notice Type Description MARKET

Issue Date Sunday, 14 October 2018

External Reference Reclassification of a Non-Credible Contingency Event: Para-Templers West and Magill-Torrens Island A 275kV lines in SA due to severe weather warning.

________________________________________________________________________________________________

AEMO ELECTRICITY MARKET NOTICE.

Reclassification of a non-credible contingency event as a credible contingency event due to severe weather warning.

AEMO considers the simultaneous trip of the following circuits to now be more likely and reasonably possible. Accordingly AEMO has reclassified it as a credible contingency event.

Region: SA

Lines: Para-Templers West and Magill-Torrens Island A 275kV lines

Duration: 14/10/2018 2300 hrs until further notice

Constraint set(s) invoked: Nil

Manager NEM Real Time Operations

There’s a fair chance that high wind speeds would be part of this ‘severe weather’ – hence reminding us to look for clues of high-wind cut-out at the wind farms in South Australia.

(C1) Two DUIDs showing major under-performance

We’ll take a more detailed look at the two DUIDs that show Raw Off-Target of greater than 30MW, a quite significant deviation for an individual unit.

(C1a) Snowtown 1 Wind Farm under-performing by 55MW

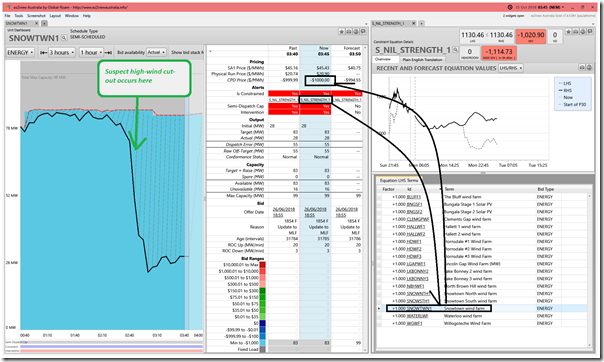

Here’s what the view for SNOWTWN1 looked like:

As noted on the image, one form of the System Strength constraint for South Australia (‘S_NIL_STRENGTH_1’) was bound – as it often is during high wind conditions – making the situation more complex.

Even though the plant is notionally being capped in output, in actual fact it can’t get anywhere near its Target, and has not been able to for a number of dispatch intervals. Was this the result of high wind speed?

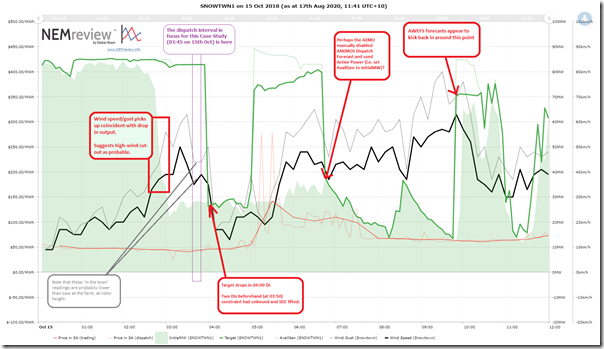

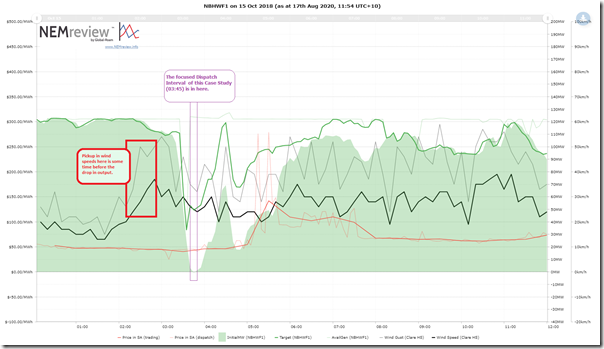

To see the trend of output in conjunction with the BOM readings for Wind Speed and Wind Gust at the nearest BOM measurement station (which we identified for all DUIDs for the GSD2019 and which, in this case, happens to be Snowtown Rayville Park) we use this trend view in NEMreview v7 to produce this view over the 12 hours in the morning:

With particular respect to the red notes noted on the chart:

Red Notes #1) We can see that the wind speed (measured in the town) does pick up, coincident with the drop in output about an hour before the focused time of this Case Study. Whilst this might not be seen as high enough to cause high-wind cut-out, we need to remember that this is a measurement taken by the BOM at their measurement point (Rayville Park) whereas the wind speeds seen by the turbines at hub heights would be different – presumably higher.

Red Notes #2) Shortly after 03:45 we can see that the Target does drop – the Target was 83MW for 03:55 and was 26MW for 04:00 (which was much closer to actual output). I’m still struggling up the learning curve about what exactly happened here, but would point out two separate events roughly coincided:

2a) At 03:50 the System Strength constraint unbound, and hence the Semi-Dispatch Cap (SDC) lifted on SNOWTWN1 (along with all the other DUIDs on the LHS) … but this is two dispatch intervals before the Target drops. My understanding of what NEMDE would have done in this case is as follows:

For 03:45 (and dispatch intervals beforehand) the SDC flag is set. When this happens, NEMDE reaches for the ASWEFS forecast for Availability which:

i. In this instance is a “wind based” forecast,

ii. because the presence of the SDC means that the alternate “output-based” forecast generally would not work (because the unit would typically be ‘constrained down’ below what the current wind conditions would allow).

For 03:50 the raising of the SDC is an outcome of the dispatch process. Therefore (as an input) the AvailGen figure is produced as for the dispatch interval beforehand – hence an understandable Raw Off-Target error.

For 03:55 the SDC flag is gone:

i. so I was expecting AvailGen to revert to one more based mostly on persistence – which would see the Target drop, and the Raw Off-Target error; however

ii. It’s been explained to me that there is an intentional lag in here (i.e. AWEFS looks at SDC flag from 2 x DIs ago) to allow time for the output to come back up, helping to avoid an oscillatory response.

iii. Hence the Raw Off-Target value remains >50MW

For 04:00 the SDC remains off, and in this case persistence does set the AvailGen and hence the Target is set at a much lower (and more credible) amount. Hence the Raw off-Target error reduces to negligible.

2b) Coincident with all of this we can also see, in the NEMreview chart above, that the wind speed and gust readings for Snowtown (Rayville Park) dropped:

i. Gust was 50km/h at 04:00 and 17km/h at 04:10 – the BOM providing samples 10 minutes apart

ii. Speed was 35km/h at 04:00 and 17km/h at 04:10.

… but I am not sure if this had any effect on the above.

Red Notes #3) There’s a spike in AvailGen and Target after an hours grace:

At 05:00 the SDC flag turns on again (due to System Strength) meaning that, reversing the above, the AvailGen reverts to overly optimistic values of 80MW.

At 05:05 this means we have Raw Off-Target values >50MW again.

… then there is a period that continues like this

At 06:45 this appears to be resolved by some manual steps taken by the AEMO, where (we surmise) they manually disabled the ANEMOS Dispatch forecast and used Active Power:

i. Note ANEMOS is the weather-based forecasting system used in AWEFS

ii. ‘used Active Power’ means setting AvailGen and hence Target at exactly the InitialMW despite the fact that the SDC persists afterwards (it’s been explained to me that this is somewhat different to what happens inside of AWEFS when it is using the “output-based” forecast, which includes persistence but also other factors).

Red Notes #4) The above seems to persist (i.e. with low Raw Off-Target error) until:

At 09:50 the AvailGen jumps to 70MW – Target follows it up (even though the SDC flag is on at the time):

Question 1) Is this when NEMDE reverts back to using ANEMOS?

Question 2) If this is the case I am unsure of why? If AEMO has reverted to using the AWEFS forecast, was this done because the wind speed dropped (noting Q3 below), or for some other reason?

At 09:55, looking at the upside, we see that the Actual Output does climb up to 65MW, reducing the Raw Off-Target value.

Question 3) The NEMreview v7 trend above shows that, coincident with this, measured (in town) wind speed and wind gust had climbed back up to levels above where they had been prior to the 03:45 focused time (where we speculate that high-wind cut-out was an issue). What does this mean about the validity of using these BOM readings to try to decipher what’s gone on?

———–

Note that more knowledgeable people than me have been trying to help me understand what might have been going on through this period, which has helped in my descriptions. However keep in mind that any errors here are purely mine (being slow on the uptake)!

(C1b) Hallett 4 ‘North Brown Hill’ Wind Farm under-performing by 48MW

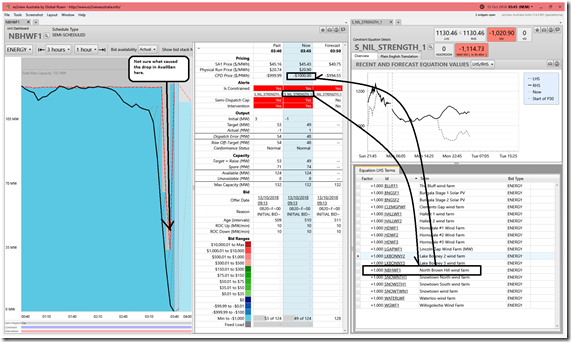

Here’s what the view for NBHWF1 looked like:

On this occasion we use the same approach to produce this trend query (using Clare High School weather station) in NEMreview v7 to produce this 12-hour view:

In this case the link between higher wind speed and the drop in output is not so clear.

(C2) Nine DUIDs showing smaller, but still significant under-performance (and one over-performance)

Working through the list from top to bottom, we see that some of the following had Raw Off-Target as high as 30MW – which reminds us that our criteria of ‘>30MW’ is a little arbitrary for denoting ‘major’ imbalance in performance, and was chosen somewhat because that’s the AEMO’s criteria for ‘must register’ for scheduled units.

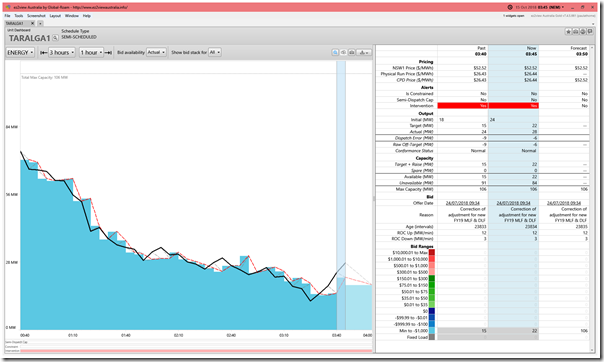

(C2a) Taralga Wind Farm in NSW over-performing by just over 6MW

Here’s what the view for TARALGA1 looked like:

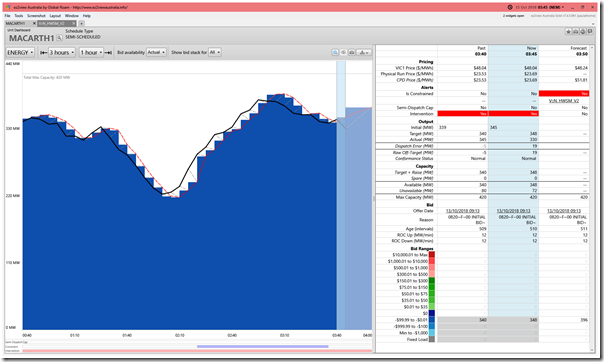

(C2b) Macarthur Wind Farm in VIC under-performing by 19MW

Here’s what the view for MACARTH1 looked like:

(C2c) Hallett 5 ‘the Bluff’ Wind Farm in SA under-performing by 30MW

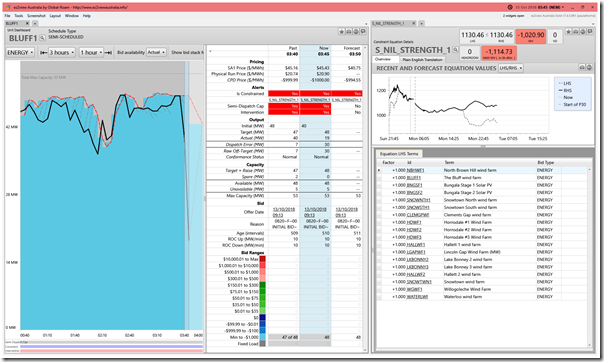

Here’s what the view for BLUFF1 looked like:

There’s a steep drop in output shown in that one!

(C2d) Clements Gap Wind Farm in SA under-performing by 22MW

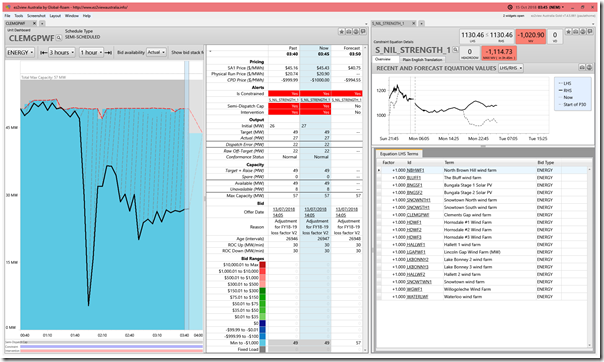

Here’s what the view for CLEMGPWF1 looked like:

This is a similar pattern to what we saw about for SNOWTWN1. Is this high-wind cut-out as well?

(C2e) Hallett 1 Wind Farm in SA under-performing by 30MW

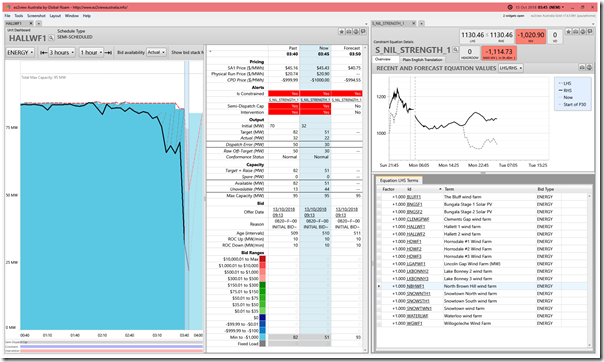

Here’s what the view for HALLWF1 looked like:

Located not too far away from NBHWF1, we see some similarities.

(C2f) Hallett 2 Wind Farm in SA under-performing by 23MW

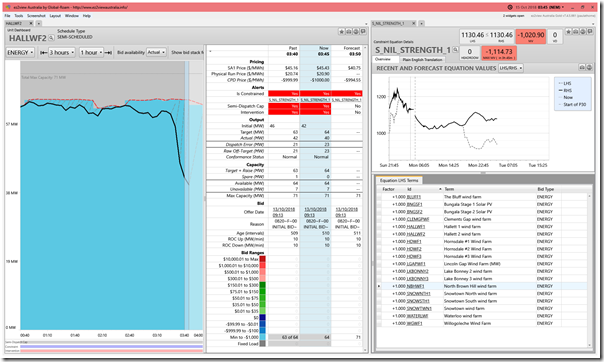

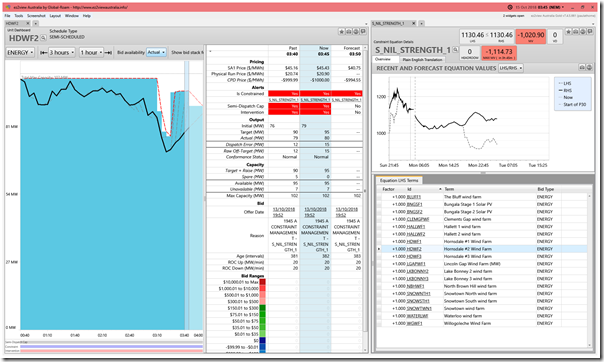

Here’s what the view for HALLWF2 looked like:

(C2g) Hornsdale 2 Wind Farm in SA under-performing by 15MW

Here’s what the view for HDWF2 looked like:

What’s interesting, for me, is that neighbouring HDWF1 (4MW) and HDWF3 (1MW) were two of the few wind farms in South Australia that performed ‘better’ and were not flagged. I don’t have time to explore why.

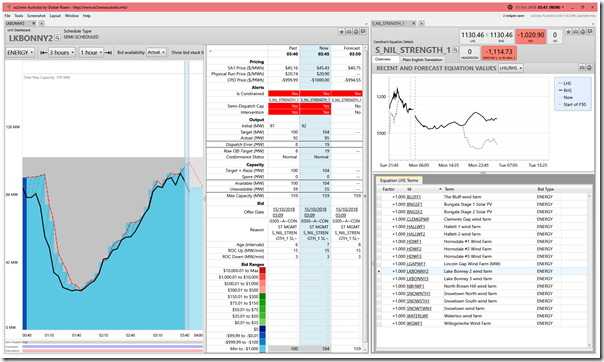

(C2h) Lake Bonney 2 Wind Farm in SA under-performing by 19MW

Here’s what the view for LKBONNY2 looked like:

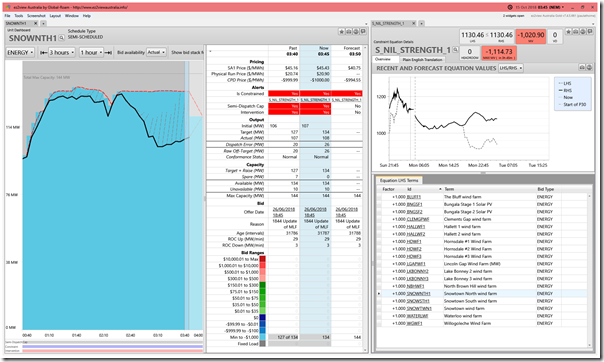

(C2i) Snowtown 2 North Wind Farm in SA under-performing by 26MW

Here’s what the view for SNOWNTH1 looked like:

This looks similar to SNOWTWN1. Is this high-wind cut-out?

However, I note that SNOWSTH1 was very well performed, only 2MW Raw Off-Target. Again, no time to explore why.

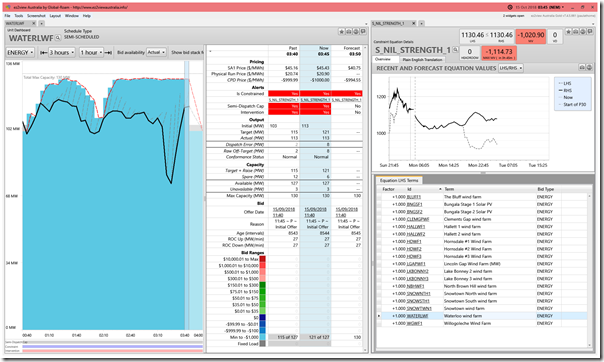

(C2j) Waterloo Wind Farm in SA under-performing by 8MW

Here’s what the view for WATERLWF looked like:

This shows 3 hours of under-performance, though not by a huge margin.

——-

That’s all we have time for today in this Case Study

Just remember when there are gaps in reliability with transitioning it’s the regulators wot fail to anticipate and provide insurance wot will get it in the neck-

https://dailycaller.com/2020/08/17/california-blackouts-renewable-energy-california-gavin-newsom/

That’s some raw on target for you and they couldn’t pay me enough to be a transitioning regulator.

Snowtown 1 Wind Farm and the Hallet Wind Farms are Suzlon S88’s, which are older technology turbines. It’s likely they are more sensitive regarding high wind cut out. This would explain the difference between Snowtown 1 and Snowtown North/South which are co-located, but different turbine technologies.

It’s important to note that the issue of High Wind Cut Out has been mitigated in AEMO’s 2016 ECM updates, which require generators to send (in real-time via SCADA) exactly how many turbines are out due to High Wind, and the forecast in AWEFS is updated accordingly. This has been retrospectively configured in some generators, but is mandatory for all new generators.

https://aemo.com.au/-/media/files/stakeholder_consultation/consultations/electricity_consultations/2016/energy-conversion-model-guidelines-consultation—2016-final-report-and-determination.pdf

I just checked my own assumptions, and looks like AEMO rolled back the “Mandatory” HWCO back to “Optional” in the Final Determination. A shame as it’s a simple signal to implement!

https://aemo.com.au/-/media/files/stakeholder_consultation/consultations/electricity_consultations/ecm/oct/energy-conversion-model-guidelines-consultation—2016-second-draft-report-and-determination.pdf