Yesterday evening (i.e. Tue 9th June), whilst in the process of finishing off this chronological ‘War Story’ record for a particular solar farm, my phone buzzed with a series of SMS alerts from NEMwatch and ez2view, noting that dispatch prices had spiked in all 4 of the mainland regions….

(A) A quick recap on Tuesday evening, 9th June 2020

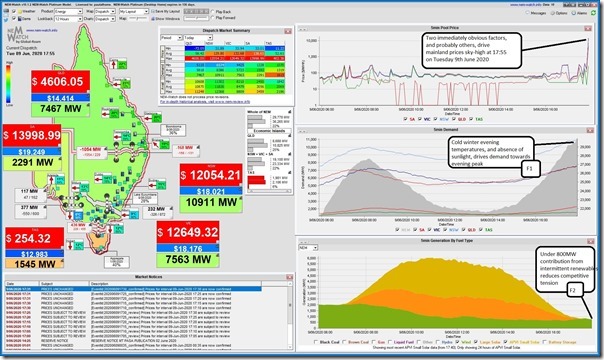

As a result of the TXT messages, I diverted my attention briefly to my own copy of our NEMwatch v10 entry level dashboard to the NEM in the 17:55 dispatch interval (NEM time) on Tuesday 9th June and quickly pinpointed two factors contributing to the elevated prices:

Contributing Factor #1 = the Scheduled Demand across the NEM was moderately high (up around 30,000MW), with added significance because of the rapid ramping increase in the demand shape (remembering that supply options all have different ramp rate constraints); and

Contributing Factor #2 = as seen here, aggregate output from all intermittent options (wind and solar, across the NEM) was quite low (under 800MW).

This was then Tweeted and LinkedIn-ed (whatever the verb is) to followers there. Amongst the responses I received were two I found particularly worth highlighting:

(A1) The opportunity for Demand Response

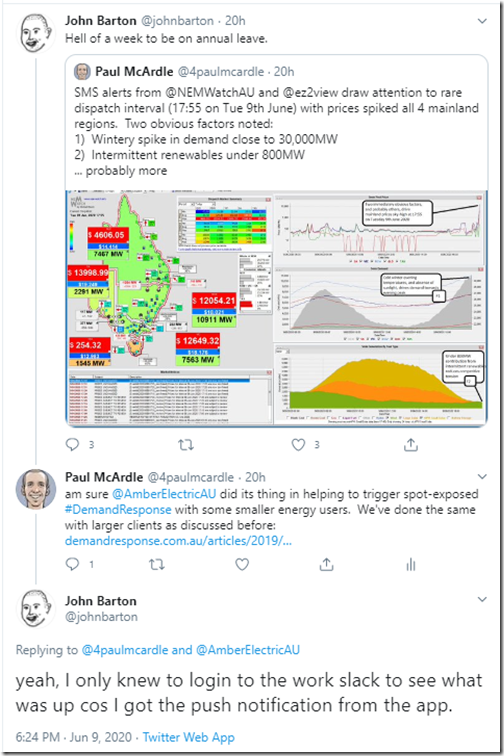

Firstly, there was this exchange on Twitter with John Barton:

What’s interesting here is that John’s the CTO at new energy startup Amber Electric, which focuses on extending the role of Demand Response down to residential energy users (some similarities to what we have been doing with major energy users at the other end of the scale for more than a decade). See Amber’s article here at the end of summer 2018-19.

Clearly a time of tight supply/demand balance is when you want Demand Response kicking in to take the pressure of the supply/demand balance.

MORE LINKS TO COME

(A2) ‘Dunkelflaute’

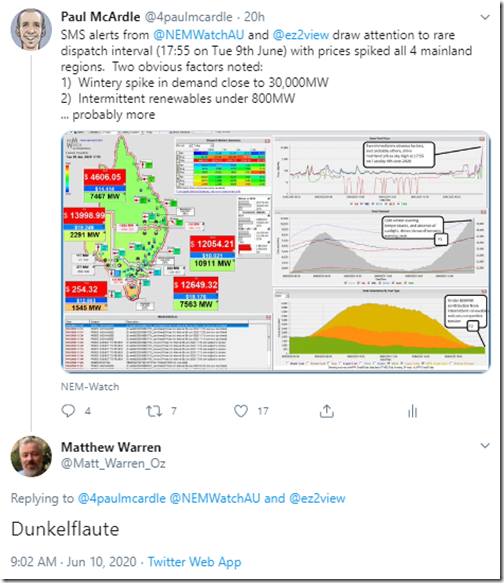

Then there was this (very brief) response from Matthew Warren this morning:

The exchange did not last long, but it did spur me to put this article together – as it solidifies the significant coincidence between:

1) what happened in the market yesterday evening; and

2) this exchange on LinkedIn between a number of stakeholders, spurred by some analysis Geoff Eldridge had published there speaking to the diversity (or more correctly the lack thereof) of wind output across different regions in the NEM.

————————–

The Germans have gifted us with many things in society – and, more specifically, with respect to this global energy transition.

1) Amongst other things, I understand that it was German early support for the PV industry that played a significant role in encouraging scale to enable the technology option to move down the cost curve. Something many residential consumers in Australia are benefiting from (including this grateful author).

2) Matthew reminded me that the Germans had also gifted us with the word ‘Dunkelflaute’ to sum up some of the challenges inherent in the form of energy transition that’s heavily reliant on use of intermittent renewables (notably wind and solar). For no other reason other than it was top search result in my browser today I link to this page titled ‘Afraid of the dark’, which helpfully includes this explanation as the top paragraph:

“In the German language, there is a word that refers to the fear of having inadequate sunshine or wind to maintain a viable supply of renewable energy: dunkelflaute. The dramatic connotation of the word may be lost a bit in translation, but essentially, dunkelflaute means “a dark lull”.”

That (i.e. ‘a dark lull’) is essentially what we experienced yesterday evening. Something we’ll need to become increasingly used to seeing (and having a more significant effect) in the years and decades ahead.

(B) Near-term forecasts

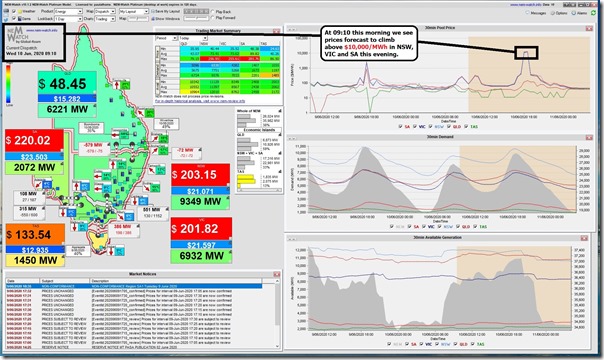

Powering up NEMwatch at 09:10 this morning, I saw a very similar situation forecast for the rest of the day. Here’s a snapshot highlighting the price spikes forecast for this evening in the southern regions (with QLD and TAS noticeably more subdued – at least in terms of the forecasts at the time):

So I’d intended to get a short article up today to continue the conversation…

(B1) Forecast for Wednesday 10th June 2020

… but other priorities have intervened.

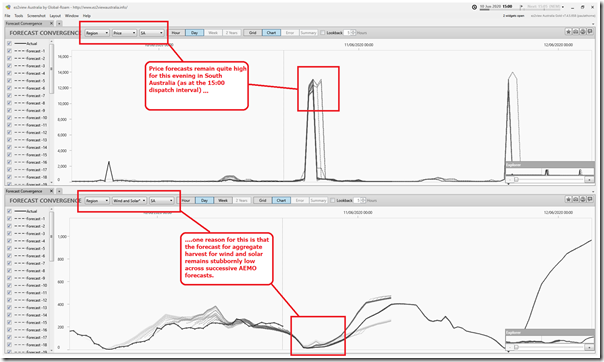

Thankfully, our higher-end ez2view makes it easy to keep tabs on how the AEMO’s successive forecasts are changing through the day – so here’s a quick view focused on the South Australian region of two particular forecast data sets in the ‘Forecast Convergence’ widget in the software:

That’s South Australia, but it’s also a similar picture in VIC and NSW. As at the 15:00 dispatch interval, the price spikes forecast were remaining in place – at least in part because aggregate contribution from wind and solar coincides ‘nicely’ with evening peak in demand in order to squeeze competitive supply options and drive prices higher.

(B2) Forecast for the rest of the week

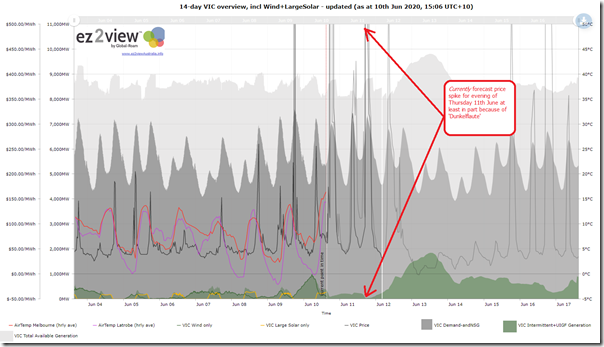

Looking further out into the future is also possible with ez2view, so for a change we use the online component (and in particular this live-updating trend query) to show that forecast contribution from Wind and Solar in the VIC region is also forecast to be low on Thursday evening (11th June) as well:

So we’re looking at an interesting couple days ahead…

(C) Broader context

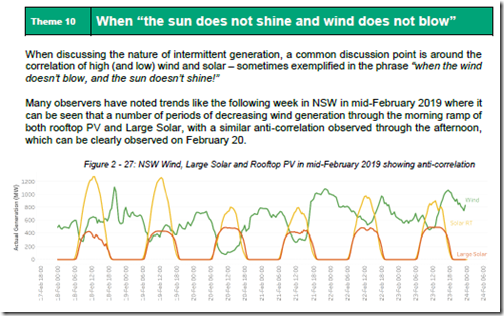

The word ‘dunkelflaute’ speaks to the broader questions about what will happen ‘when the sun does not shine and wind does not blow’.

This is a real challenge that needs to be addressed for the energy transition to work – not just in terms of ‘keeping the lights on’ but also in terms of doing so at a reasonable cost. That’s why we invested a considerable effort in exploring this via Theme 10 in Part 2 of the 180-page analytical component within the Generator Report Card 2018, which we released on 31st May 2019:

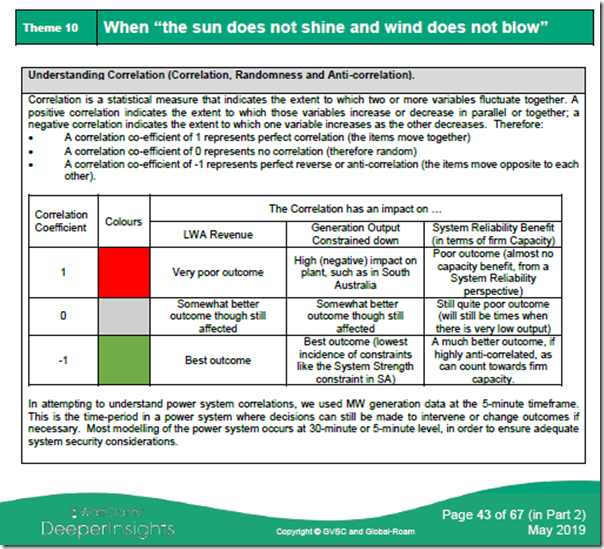

On 26th July 2019 I published the article “Assessing the diversity of intermittent (wind and solar output)… ” which I tagged into the discussion on LinkedIn yesterday. However it’s worth lifting out this particular table from that article to highlight how it’s anti-correlation and not randomness that we should be driving towards:

Short-cut to part of the answer noted in within the GRC2018, and that it that it’s highly likely even if you plastered all Renewable Energy Zones with wind farms, that there would be times when the aggregate night-time (and perhaps even cloudy daytime) periods when the aggregate output from wind and solar across the NEM was very low.

1) That’s what happens when the output is (at best) only random;

2) Which means that there is ‘still quite poor’ outcome from a System Reliability Benefit perspective. In layperson’s terms, it means having some form of other capacity in place to meet the lion’s share of demand across the NEM for occasions like these.

(a) What should this be?

(b) How should it be incentivised (understanding the higher risk it faces)?

(c) How would it be dispatched – especially if it’s all capacity with negligible instantaneous short run marginal cost?

etc…

In the 12 months since we published the GRC2018 I have (sadly) not seen the discussion progress much further from this point which frustrates me a little (perhaps you can tell?) because it’s only by realizing that diversity is not a ‘magic wand’ will we move on to designing ‘real world’ solutions for what is bound to happen ‘when the wind doesn’t blow and sun doesn’t shine’.

Unfortunately we seem to (collectively) not have realized that we ultimately get what we pay for, in terms of incentives. In Theme 12 within the same GRC2018, we also invested time to provide clear examples of how generators have (understandably, and quite rationally) responded to incentives* in place to modify their behaviour and improve their commercial outcomes:

* the incentives used in the example were the QLD 13% Gas Scheme, the MRET, and the ACT’s Renewable Energy Target. All understandable goals, but each of which produced outcomes that were perhaps not quite what the original policy makers had been envisaging in some ways.

Speaking of incentives, today’s an auspicious day with the rumoured release tomorrow of the final design of the ‘Negawatt Dispatch Mechanism’ at the AEMC which risks (as noted before) being another well-intentioned effort that produces obtuse outcomes not initially envisaged by the scheme designers… like ‘Negawatt Factors’ perhaps?

So let’s actually work out what we need to achieve, in managing ‘dunkelflaute’ and (avoiding rose-coloured views of what might be ‘magic wands’) carefully design NEM 2.0 such that it might actually deliver the capacity and the capability that we require – in the location it’s needed, and performing at the times it’s actually required.

Maybe “Dunkelflaute” will describe the new Zeitgeist. Some may see this with Schadenfreude.

touché, Reinhard.

… but then that’s not German … doh!

Seems to me the capabilities of coal, nuclear, gas and hydro perfectly meet the needs of a modern power system. While wind and solar do not.

If wind and solar were fully exposed to market conditions we wouldn’t need these conversations at all.