A quick post today following questions from some about the package of measures announced by the Queensland Government yesterday and over the weekend aimed at reducing electricity prices in the Queensland regions. These measures were described in this press release here (including some tweets over the weekend by the Minister for Social Media (oops Energy)), were covered in the AFR by Mark Ludlow and in the Australian by Sarah Elks.

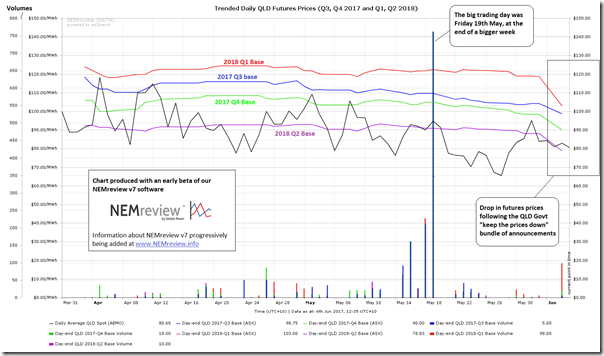

Accessing an early beta of our NEMreview v7 software (as noted here, all v6 clients already have access to this), I quickly through together the following trend of Base Load futures prices for the following four quarters.

A drop in prices can be seen for yesterday compared to prior weeks – for which the Government’s announced raft of changes will presumably have contributed.

Some starting questions…

Q1) What would have been?

Would the price have dropped in the absence of the Government’s announcements – and, if so, by how much? That’s a much harder (if not impossible) question to answer…

Q2) Directions to generators?

… and then there’s an imponderable question about what the following direction to Stanwell Corporation from the QLD Energy Minister actually means (quote in the article in the Australian, linked above):

“We are going to direct them to maximise output while … staying profitable …

Um, what does that actually mean … maximise volume BUT stay profitable?

Why was CS Energy also not (apparently?) given the same direction.

Q3) Prioritising electricity over gas?

Bringing Swanbank E back from mothballs will (presumably) help to reduce electricity spot prices when it runs – but also (just as presumably) will have the effect of further increasing spot gas prices in the STTM. Is it the intention of the policy to favour electricity over gas?

… more questions later…

There are a couple of models for competition in duopoly / oligopoly markets – two different versions include Bertrand comptetion – where you competing on price, not output, and another is Cournot competion, where you basically compete on quantity, rather than price.

Two very different modes of competition, and behaviours – but both theoretically profit maximising (though in different ways). Maybe it would be too wonking or obscure for the Energy Minister to say “We are going to direct them to behaviour in a manner consistent with Cournot competition”.

…and if they did that, change the mode of competition, CS energy would also be forced to respond (assuming they are also economically rational / act strategically, and try to maximize profit given different behaviour from Stanwell).

Complete speculation – and theoretical. But there is – at least arguably – some logic to it.