A very volatile couple of days in Queensland on Wednesday and Thursday this week, with respectively 12 and 20 dispatch interval (5 minute) prices exceeding $1,000/MWh, and average daily prices of $406/MWh and $781/MWh.

It’s not our intention in these occasional reviews to cover every high price event, nor drill as deeply into their detail as in a couple of earlier posts, and in general we saw continuation of the underlying themes of strong, weather driven demand and a thin bidstack (little generator volume offered in the broad price range $300 – $10,000+ per megawatt-hour). So here I’ll just focus on one overall observation about Queensland that’s been evident from the last couple of days.

The demand side vs the supply side

There were pretty clear signs on both days of demand response triggered by either actual or threatened dispatch price spikes, battling with supply side pressures for volatility.

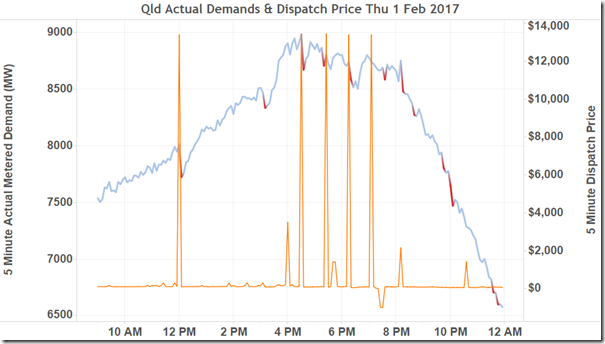

On this chart for Wednesday, I’ve plotted actual metered demands versus dispatch price, and highlighted in red downward demand movements in excess of 100 MW in 5 minutes:

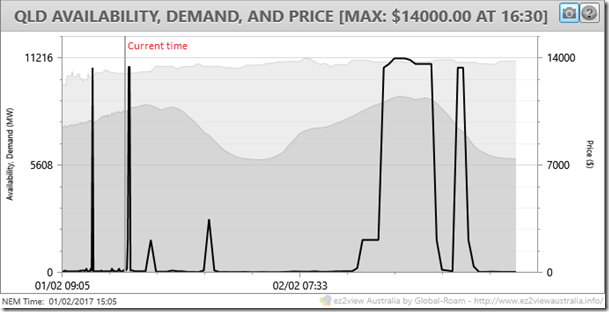

Other than later in the evening when demand naturally falls away rapidly, it’s clear that nearly all these demand falls happen immediately after or just before a price spike. Even that second fall (at 3:10pm) that doesn’t appear to be associated with a spike, actually is. Using ez2view’s Time Travel function to capture the market “pre-dispatch” outlook at 3:05pm:

– we can see that there was in fact a spike forecast at nearly $13,500/MWh within the current half hour trading interval. Almost certainly this outook led to price responsive load taking preemptive action by reducing demand as seen on the initial chart (such preemptive action makes sense because of the 5/30 issue discussed in an earlier post, as well as previously on WattClarity). This in turn was enough to prevent the spike actually occurring.

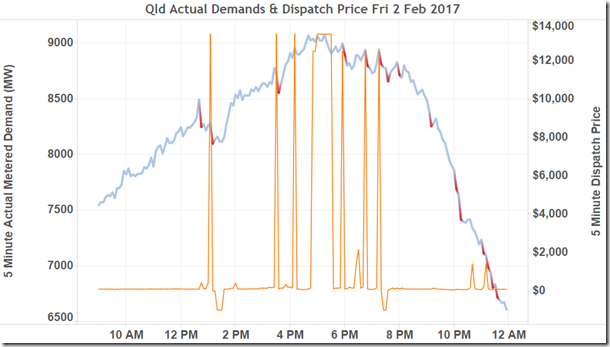

That same predispatch forecast also shows the potential for very high prices on the following day, and this is what we got:

The main differences here are what looks like a larger amount of demand response early in the day, and then its apparent absence during the main part of the afternoon peak in demand between 4pm and 6pm, including nine consecutive dispatch periods from 4:50pm where prices were at $12,499-$13,400/MWh.

The reasons for this aren’t clear, and as voluntary demand-side response is not scheduled by nor visible to AEMO in the same way as supply side offers and dispatch are, and therefore no detailed data becomes public during or after the event, we can’t do more than speculate. It’s possible that there actually was some load withdrawn right through this period. If so, this would have kept demand lower than it otherwise would have been, but clearly not by enough to stop prices breaking through to 5 digit levels once demands were solidly above the 9,000 MW level..

|

Allan O’Neil has worked in Australia’s wholesale energy markets since their creation in the mid-1990’s, in trading, risk management, forecasting and analytical roles with major NEM electricity and gas retail and generation companies.

He is now an independent energy markets consultant, working with clients on projects across a spectrum of wholesale, retail, electricity and gas issues. You can view Allan’s LinkedIn profile here. Allan will be regularly reviewing market events here on WattClarity. Allan has also begun providing an on-site educational service covering how spot prices are set in the NEM, and other important aspects of the physical electricity market – further details here. |

Allan

These analyses are really appreciated

They provide a clear and concise explanation of what has occurred.

What is missing (and this is not your fault) is why the generators are playing games and spike the prices to MPC and not offer prices more in keeping with their costs. There have been a number of attempts to prevent the generators using their market power (MEU – economic withholding, AER – ramp rates, SA gov’t – bidding in good faith) but they still do it. I am aware that generators will seek to maximize their profits by whatever means are available, but if there were increased competition then we would see the market more reflective of marginal cost bidding rather than gaming the rules

David

Thanks for your comment, I appreciate the feedback.

You’re correct that deriving explanations for the underlying bid structures / strategies of generators are outside the scope of these quick event reviews. But obviously they are important and of great interest.

As any number of commentators have observed, the NEM market design effectively requires the possibility of occasional “contingent market power” where generators are able to have offers priced very significantly above short run marginal costs dispatched. But the issue is how frequent these possibilities ought to be in a well-functioning market? Impacting on this will be basic supply-demand balance, industry structure, and the extent of financial hedging (both explicit via contracts and implicit via vertical integration). I think a general difficulty with rules seeking to govern bidding behaviour may be that the real issue is not behavioural but structural – eg supply side concentration.

It’s probably also the case that as we have seen increased vertical integration, the interests of retailers and generators in the prevailing level of and volatility in spot prices have converged.

All that said, an overarching control is meant to be that as the level of spot & contract prices reaches or exceeds long run marginal costs of supply (LRMC), the real or implied threat of new entry increases. For a long time in the NEM we became used to seeing prices arguably well below LRMC – entirely appropriate for an oversupplied market – so with generation retirements and increasing fuel costs, as well as strong load growth in Queensland, the recent increases in price level and volatility are not unexpected directionally – I’m not going to offer a judgement here on their level. But if they prove to be sustained, I’d expect to see even more discussion about new entry – both large and small scale.

Allan

Very interesting, Paul.

Thanks for pulling together these examples.