After taking a week away last week, I’ve skimmed the many pages of energy sector media reports and commentary to catch up. One particular snippet caught my eye, for a number of reasons – noting that another industrial energy user in South Australia has gone into Liquidation.

There are bound to be other reasons (not specific to the electricity sector) that contributed to the demise of this particular business. However I know for sure that electricity prices were one of the contributing factors – as explained below.

1) Serious pricing shocks

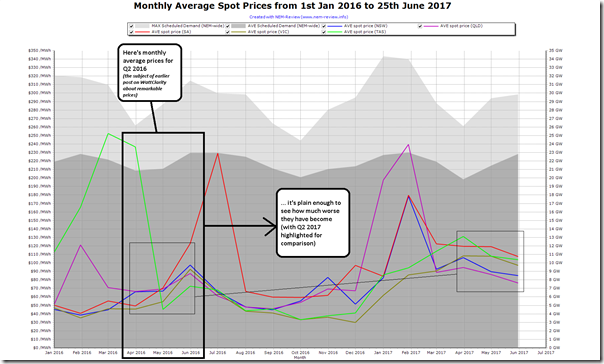

Back in July 2016, I posted this article about the remarkable pricing patterns seen in Q2 2016. To reduce the risk of readers jumping to the wrong conclusions here (at either end of of the Emotion-o-Meter) let me quickly note three things:

1a) These price shifts were seen across all regions;

1b) They occurred due to a multitude of factors; and

1c) Both the level of prices, and uncertainty surrounding them (even back in June 2016) were posing a significant risk to many commercial businesses for whom electricity consumption forms a non-trivial input cost.Since Q2 2016, however, the situation has only become worse. There was the sky-high volatility of July in SA followed on by security-of-supply shocks in South Australia and NSW, and huge volatility in QLD.

This can be seen in the following trend produced in NEM-Review v6:

Unfortunately, there does not seem to be a rational end in sight.

2) A growing disconnect between the supply side and the demand side

Reflecting on the volume of media attention focused on the energy-sector over the past week as I scanned through both hard copy and electronic records, I could not help but reflect on the very low percentage of the coverage that seemed to take into consideration the very valid concerns commercial and industrial energy users have about the abysmal way in which this energy transition is being managed.

Whilst there are many businesses facing existential questions about closing up shop (or moving offshore, if that is an option for them) the supply-side of the energy sector seems to be continuing a circular finger-pointing exercise about “who’s to blame” for the mess that we’re in. I’ve already noted about how our current crop of politicians (at state and federal level, across all political parties) are doing much the same – now with barely pause for breath after the release of the Finkel review.

Like a macabre game of “musical chairs”, I wonder how many energy users will be departing the scene as the fiddler plays and Rome burns …

2a) Spot exposure for Demand Response, as a last resort for the business in question

The particular energy user in question (who I cannot name) came to us at the end of 2016 with the only option left available to them being taking spot exposure, whilst hoping to physically hedge the risks inherent in this approach through the use of our software.

Approaches like these are not a surprise to us, given the price shocks above. There have been a significant number of calls we’ve received in the latter months of 2016 – a trend which has continued into 2017:

(i) We are probably (at least by some measures) the largest supporter of Demand Response in the NEM.

(ii) Our software has been used by a range of energy users, across all regions, to help them manage the physical risk associated with the “real time pricing” method of Demand Response.However, a rushed implementation of demand response is not in anyone’s best interests :

(i) At best it means that the benefits delivered are sub-optimal to the energy user, at worst they can be counter-productive if poorly implemented.

(ii) Which is why we will sometimes work one-on-one with energy users contemplating going to down this path to help them understand the nuances of this new approach (Step 1 = Educate) and then explore how it would work for them (Step 2 = Define the business case).

(iii) We’re also happy to work with a range of Retail Energy Brokers* to help them understand how this method of demand response is already working in the NEM.* In our experience, most Retail Energy Brokers don’t understand wholesale market dynamics all that well – and hence are blindsided to changes they see in retail contract price offers provided by retailers when they pursue their more “traditional” re-contracting processes. This, unfortunately, seems to be one factor leading to the sudden rush of energy users who’ve called us up as a last resort.

Unfortunately, it seems that what we could do to help this particular energy user was a case of “(too little?), too late” – as a result of which they have sadly closed their doors.

2b) Demand Destruction, more generally

On WattClarity we have been posting insights about declining demand in the NEM for almost 10 years now. Back in 2011, I posted this list of factors all contributing to the pattern of declining demand.

Unfortunately in some circles, the variety of factors have been forgotten and a simplified view has emerged (for some) that this has just been a substitution of wholesale generation for production behind the meter (primarily solar PV, but also a bit of cogen and other). Because of time constraints, and also the opacity of solar PV I have previously posted about, I am unable to contribute more analysis in this area today – but suffice to say that solar PV is only one of a number of factors.

Business closures like this reinforce this to me – however I wonder what percentage of those involved in the ongoing debate about the energy transition will be aware of notices like these (given the splintering of social media leading to some people only listening to others who reinforce their own existing belief systems)?

There seems to be a disconcerting number of people who would actually celebrate such demand destruction (facetiously it could be pointed out that such demand destruction would be the surest way for a particular location to achieve some form of “X% by 20YY” renewable energy target).

There are a number of examples I’ve seen that seem to corroborate this feeling, such as:

2a) Our guest author, Jim Snow noted a similar experience in his article back on 2nd June, paraphrasing the sense he’d gained from talking with a number of renewables proponents. Jim said:

“Price and even reliability are seen in the short terms as acceptable collateral damage to ensure the eradication of fossil fuels from the energy supply in this ideological battle.”

2b) Internationally, I have seen it noted a number of times by proponents of Energiewende in Germany, that the high prices paid for electricity are something that should be celebrated (i.e. as a lever to incentivise lower consumption, hence reduced emissions – because of demand elasticity). I’ve seen similar things noted about the NEM, as well.

Challenging times ahead, indeed….

Regarding point 2b, it may be more accurate to say “the high prices paid *by retail consumers* for electricity are something that should be celebrated”.

A large proportion of industrial consumers are still insulated from the extra costs associated with supporting the Energiewende, and, apparently, levied with the intent of dissuading electricity use.

Thanks for this article.

A friend has been helping a medium sized business plan for their energy needs. Despite the fact that they are in Outer Metro Adelaide it appears that their best option is to buy and operate number of diesel generators for n-1 redundancy and disconnect from the grid.