There’s been a bit of yo-yo-ing with the forecast LOR3 condition in NSW for Tuesday afternoon-evening 26th November 2024:

1) With our latest (and perhaps last?) update of AEMO’s Market Notice updates noting ‘It’s back! Forecast LOR3 for NSW on Monday 26th November 2024’

2) Whilst ‘risk of load shedding’ may well be in the media headlines in the coming days, it’s important to remember that:

(a) these types of forecasts are designed to elicit a market response

… so, as noted in earlier articles, we’re hoping for that.

(b) The broader sense is that (whether LOR3 or LOR2 eventuates) it seems almost certain that it will be quite tight, and hence quite volatile

i. both on Monday 25th November 2024

ii. also on Tuesday 26th November 2024

If our team has time, we’ll endeavour to post some snippets here on WattClarity in terms of what unfolds … but, for those with their own licence to ez2view, here’s some things we suggest you keep an eye on….

(A) Watching constraints on Interconnectors!

Let’s start by remember that ‘An inter-regional interconnector refers to *the whole of* the transmission path between RRNs’ (not just the bit of kit that hangs over the region boundary).

A1) Watching the VIC1-NSW1 interconnector

In recent weeks we’ve already written about the number of times that VIC1-NSW1 interconnector is heavily constrained.

1) for instance the ‘N-MNYS_5_WG_CLOSE’ Constraint Set has been a particular culprit, because of the effect it has on some 330kV flow paths from southern NSW to Sydney

… including via the ‘N::N_CTMN_2’ constraint equation, which is one of many constraint equations in that set.

2) when that happens, NSW can’t be supported by surplus capacity in VIC, SA or TAS – so relying on supply capacity locally, and possibly* in QLD as well.

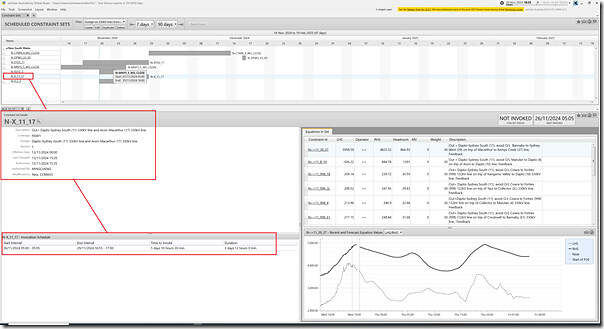

To take a look forward at what might be on the cards for Monday 25th and Tuesday 26th November, here’s a Gantt-chart style view of the scheduled invocation of a filtered list of Constraint Sets in the ‘Constraint Sets’ widget in ez2view:

Now in the filter applied here, we’re only looking at outage-related constraint sets that relate to network outages on the 330kV network between southern NSW and the Regional Reference Node.

… in Allan’s prior article ‘What’s happening around Wagga?’ he explains why these are important.

In the view above, we see three particular constraint sets that are worth highlighting as follows:

Constraint Set #1) The the ‘N-MNYS_5_WG_CLOSE’ Constraint Set

In the article ‘Reviewing the ‘N-MNYS_5_WG_CLOSE’ Constraint Set, as a major factor in recent northern volatility’ we took a focused look at this one. In the snapshot above we see that (currently) the expected end of the outage is Monday afternoon 25th November 2024 :

1) interestingly, that article showed an earlier snapshot showing the expected end of outage being Tuesday afternoon 26th November 2024

2) so, thankfully, that outage looks to be running ahead of initial schedule (perhaps with a ‘hurry up’ delivered via these forecast LOR3 warnings from the AEMO?)

Constraint Set #2) The the ‘N-DTSS_11’ Constraint Set

There’s a gantt chart entry for the ‘N-DTSS_11’ constraint set … which:

1) Has not (yet?) featured as heavily in articles here

2) But relates to an outage on the Dapto to Sydney south (11) 330kV line; and

3) Is currently scheduled to extend to Friday evening 29th November 2024.

Constraint Set #3) The the ‘N-X_11_17’ Constraint Set

More ominously (perhaps?), there’s also a Gantt chart entry for the ‘N-X_11_17’ constraint set … which:

1) Has not (yet?) featured as heavily in articles here

2) But relates to an outage on the Dapto-Sydney South (11) 330kV line and Avon-Macarthur (17) 330kV line; and

3) Is currently scheduled:

(a) to only commence on Tuesday morning 26th November 2024;

(b) and extend until Friday evening 29th November 2024.

… one wonders if this outage will find itself moved? Those with the ‘Notifications’ widget configured could even set an alert watching it become invoked (or even checking, say 24 hours out, that it’s forecast to be invoked).

A2) Watching the VIC1-NSW1 interconnector

Worth remembering that for periods in and around 8th May 2024, the QNI interconnector was also limited … so NSW was really ‘on its own’ there.

We’ve not, at this point, looked at potential limitations on QNI via constraint sets at all… but that would be worth keeping an eye on.

(B) Watching demand

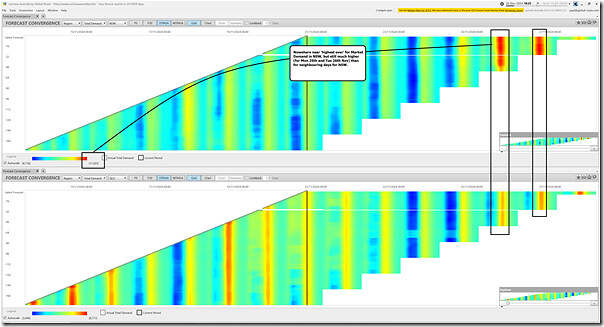

Moving right along, we’ll use a collage of two copies of the ‘Forecast Convergence’ widget in ez2view with NSW on top of QLD for a change*, looking successive forecasts for ‘Market Demand’ in both regions:

* well, NSW did win State of Origin in 2024.

As noted on the image, we see that NSW forecast ‘Market Demand’ (at just over 11,000MW) is much higher than any neighbouring days – whilst still being a long way below the all-time maximum.

(C) Watching available generation … for Scheduled units

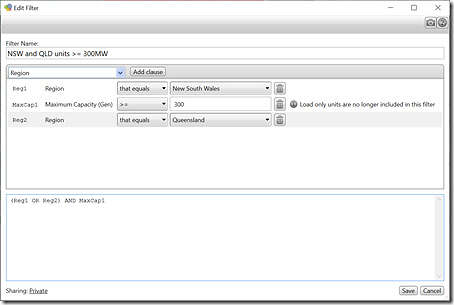

On the assumption that VIC1-NSW1 flows will be heavily constrained at periods of stress (e.g. because of outages on those 330kV backbone lines) we’ve filtered the ‘Generator Outages’ widget in ez2view here to look at any fully scheduled* units above 300MW in size, using this filter:

* noting the invisibility of Semi-Scheduled units in terms of MT PASA DUID Availability data)

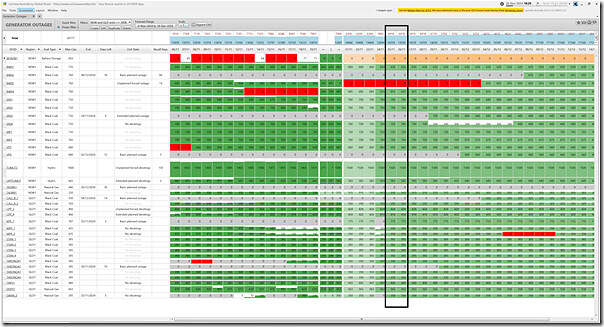

That reveals this list:

Now I’ve highlighted the two days in question and would encourage ez2view users:

1) to keep an eye on how the planned outages marked unfold

… does the AEMO step in to recall any?

2) … or any other unplanned outages (in addition to BW03) that emerge.

(D) Watching energy-constrained availability … for Semi-Scheduled units

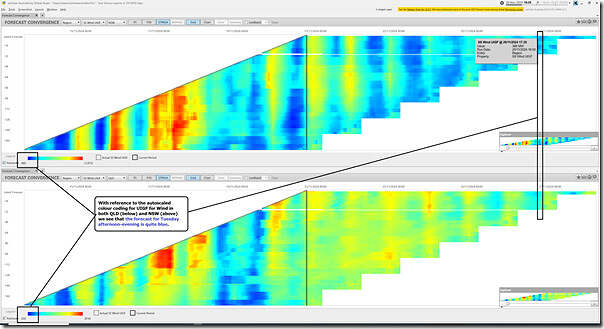

In another view of the ‘Forecast Convergence’ widget in ez2view we flip NSW and QLD to look at UIGF for Wind in each region.

As noted on the image, it’s looking like a decidedly modest contribution from wind farms across QLD and NSW during the critical period

… noting that network constraints might mean performance is lower still than capability.

I have not bothered to flip for Solar units, because we all know they won’t be producing after sunset … what would be interesting is to see how they perform in the couple hours leading into sunset (e.g. whether affected by rainfall similar to what we’ve seen the past couple of days?).

That’s where we will leave it for today …

Those network constraints also limit the contribution of some NSW generation as well – Uranquinty gas generation, wind in the south-west, Snowy scheme hydro can all be affected depending on how the constraints bind.

Yep, all trying to squeeze into a smaller sized pipe to Sydney. Hence the comment at the bottom of the article about potential further reductions on already reduced VRE

Yep and with more power trying to flow around the Bannaby – Mt Piper – Wollar – Bayswater 500kV route to get into Sydney from the north it’s possible the Bayswater-Liddell bottleneck could limit contributions from an even wider set of NSW generators. I don’t see how AEMO would let the Avon – Macarthur line 17 outage proceed if it was having any material effect on reliability.

Well, since that earlier comment the line 17 outage does appear to have been cancelled!