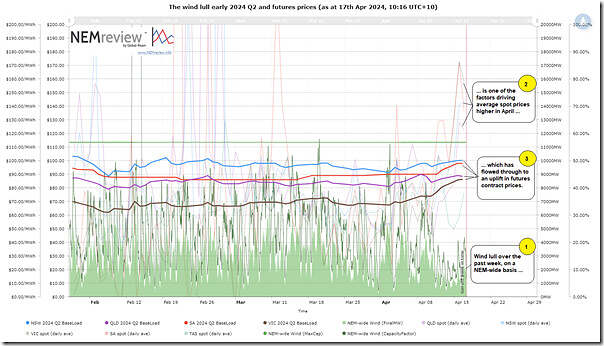

On Tuesday we noted that the ‘NEM-wide wind lull stretches extends to a full week (Tue 16th April 2024), and has another week to go!’, which followed from Monday’s article about ‘Low wind production on Monday morning 15th April 2024’.

… these articles have sparked some conversations in various forums (e.g. on social media, on group chats on phones, and directly back to me)

One comment someone’s made has been with respect to pricing outcomes flowing from this.

As a result, I’ve opened up NEMreview v7 and prepared this trend here illustrating the way in which the lull in wind (no doubt amongst other factors) flowing through to higher spot prices and then into ‘base load’ futures prices for 2024 Q2:

For those with a licence to the software, they can open their own copy of this query here.

Don’t have time for anything more, at this point.

Be the first to comment on "Has the wind lull of early 2024 Q2 spooked the futures market?"