On 7th August 2023, following requests from a number of stakeholders (including Marcelle here) the AEMO implemented a small but significant change for Semi-Scheduled units, in enabling them to utilise the MaxAvail field in the standard bidding process to provide the market notice of physical limitations with respect to their Solar Farm or Wind Farm.

… there’s a growing series of articles about this change accumulating under this Category on WattClarity®.

It’s also worth reminding readers of Linton’s excellent explanation of the complexities behind ‘What inputs and processes determine a semi-scheduled unit’s availability’.

Adoption of this Market Change?

Nine days after that change, Linton published these ‘Initial Results’ in relation to the early adoption of this new capability. But since that time, I’ve been curious about what the ongoing take-up has been, with questions like:

Q1) What DUIDs (and participants) have adopted this new approach…

(a) and under what circumstances?

(b) for what periods of time (in aggregate)?

Q2) Are there any DUIDs (and participants) who have, conversely, not used this new option?

(a) if so, what are the reasons for this lack of adoption?

(b) are there cases where participants have not even been aware that this was a possibility?

Alas, no time since then to look, until now …

Using the GSD2023 Data extract

With the recent release of the GSD2023 on 15th Feb 2024 (just over 4 weeks ago), we’ve been presented with an easy way to take this next look at how much utilisation this new market change has been seeing from the range of Semi-Scheduled generators to whom it was directed.

1) New to this issue is a section in Volume 1 that’s focused specifically on semi-scheduled units;

2) This contains 4 discrete sections, looking at different aspects of Semi-Scheduled unit operation:

Table 1 takes a look at Availability, Production and Curtailment

Table 2 takes a look at the source of that Availability (including a row for use of MaxAvail in the bid)

Table 3 takes a look at the use of participant self-forecasts (or defaults back to ASEFS/AWEFS) during periods of Semi-Dispatch Cap; and

Table 4 looks at (for those units utilising self-forecasts) the extent to which they have been suppressed … either:

(a) Self-Suppressed (by the generator, the vendor, or their agents); or

(b) Suppressed by the AEMO as discussed by Linton on 14th April 2023.

3) Dan’s already published ‘Keeping up with the curtailment: 3.7TWh of semi-scheduled economic and network curtailment estimated in 2023‘ on 7th March, utilising Table 1 in this report.

So in this quick Sunday sideline, I’ve grabbed Table 2 from the Data Extract (which is an option for clients when they purchase the GSD2023) and focused in just on the ‘MaxAvail’ statistics across all Semi-Scheduled units for the months August to December 2023.

With reference to this data, here’s some top-down insights …

A 60% participation rate, over 5 months

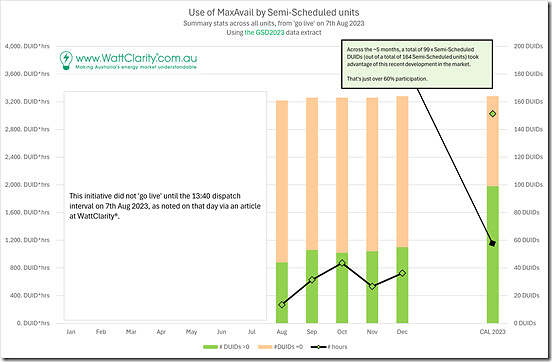

In this first chart we highlight (in green) the number of Semi-Scheduled DUIDs that utilised MaxAvail in the bid at least once in each month:

The bar on the right is the aggregate result for the ~5 months in 2023 over which this possibility was a option. This shows 99 DUIDs out of 164 in total utilised this capability at least once over this period … that’s a 60% participation rate, which is nice to see for a change that’s relatively new, and was also quite low-key.

A long tail of degree of utilisation

Now let’s state up-front that it’s envisaged that Semi-Scheduled units would only need to utilise this capability occasionally …

1) With the default option being their self-forecasts (if they have one), or AEMO’s ASEFS or AWEFS processes.

2) So it was not really too much of a surprise to see a relatively low number of aggregate ‘DUID * hours’ trended in the chart above.

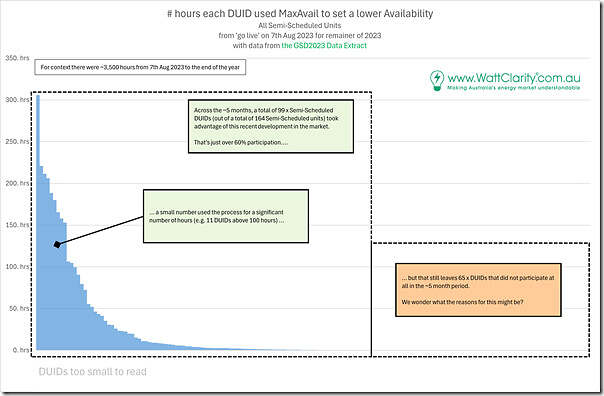

In the chart below we’ve looked at all 164 DUIDs and the aggregate number of hours for each DUID over the ~5 month period that they utilised MaxAvail to set their availability in the bid.

For comparison purposes, there were ~3,500 hours in total from the time the market change went live through until the end of the year:

1) So the DUIDs at the left end of the chart (especially the top one) were using MaxAvail almost 10% of the time … which does seem a surprise

2) And, for the curious people (like us) prompts follow-on questions about the specific circumstances of these units.

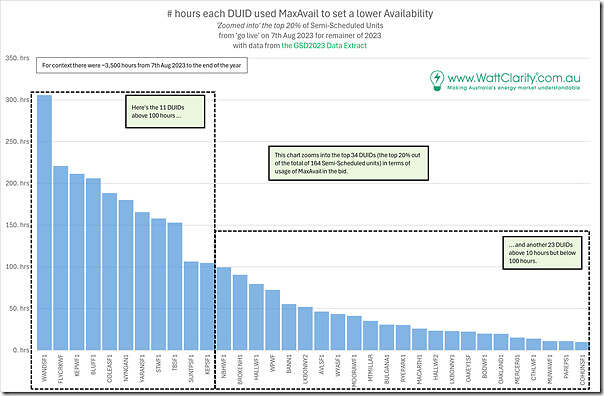

Zooming into the top end of the chart, we see the following:

There were 11 DUIDs above 100 hours, and another 23 DUIDs above 10 hours (but below 100). That leaves 130 DUIDs in a very long tail (i.e. below 10 hours, with 65 of these DUIDs at 0 hours over the ~5 months)!

A tabulated list

I don’t have time to delve further today (or in the coming days) but thought it would be useful to provide this tabular reference for all of the DUIDs sorted from top to bottom to make it easier to revisit later … or readers might like to do further analysis themselves…

| Cluster of Utilisation | Details, and List |

|---|---|

|

The 11 DUIDs with utilisation >100 hours |

These are listed in rank order below: WANDSF1 = 305.9 hrs |

|

The 23 DUIDs with utilisation >=10 hours (but below 100 hours) |

These are listed in rank order below: NBHWF1 = 99.7 hrs |

|

The 65 DUIDs with non-zero utilisation (but below 10 hours) |

These are listed in rank order here (but numbers are not provided, in order to condense the list): GULLRWF1, PAREPW1, LKBONNY3, HVWWPV1, MUSSELR1, BALDHWF1, GANGARR1, SMCSF1, KIAMSF1, WOODLWN1, BANGOWF2, MUWAWF2, DULAWF1, SNOWTWN1, WDGPH1, CNUNDAWF, RUGBYR1, MRTLSWF1, KIATAWF1, BOCORWF1, NUMURSF1, ADPPV1, BLUEGSF1, HDWF1, HDWF3, WEMENSF1, NEWENSF1, GULLRWF2, SRSF1, ARWF1, WGWF1, BOWWPV1, GRANWF1, LGAPWF1, GLENSF1, HDWF2, CRURWF1, MWPS2PV1, JUNEESF1, SEBSF1, COOPGWF1, COLUMSF1, GULLRSF1, YENDWF1, EMERASF1, CHILDSF1, MWPS3PV1, HAYMSF1, LGAPWF2, NEWENSF2, KARSF1, PARSF1, WATERLWF, BNGSF2, CHYTWF1, JEMALNG1, KABANWF1, NEVERSF1, BANGOWF1, CRWASF1, CSPVPS1, MTGELWF1, SNOWNTH1, WINTSF1, WRSF1, |

|

The 65 DUIDs with no utilisation at all |

These are listed in alphabetical order below (as they are all ranked the same, being 0 hours): BERYLSF1, BNGSF1, BOMENSF1, BRYB1WF1, BRYB2WF2, CATHROCK, CLARESF1, CLEMGPWF, CLERMSF1, COLWF01, CROOKWF2, CROWLWF1, DARLSF1, DAYDSF1, DDSF1, DUNDWF1, DUNDWF2, DUNDWF3, EDENVSF1, ELAINWF1, FINLYSF1, GANNSF1, GLRWNSF1, GNNDHSF1, GOONSF1, GUNNING1, HAMISF1, HAUGHT11, HILLSTN1, KSP1, LILYSF1, LIMOSF11, LIMOSF21, MANSLR1, MAPS2PV1, MAPS3PV1, MARYRSF1, MBPS2PV1, METZSF1, MEWF1, MIDDLSF1, MOLNGSF1, MOREESF1, MOUSF1, MWPS1PV1, MWPS4PV1, OAKEY2SF, RRSF1, SALTCRK1, SAPHWF1, SNOWSTH1, STARHLWF, STOCKYD1, SUNRSF1, TARALGA1, TB2SF1, WAGGNSF1, WARWSF1, WARWSF2, WELLSF1, WHITSF1, WOOLGSF1, WRWF1, WSTWYSF1, YATSF1, |

That’s all for now!

Leave a comment