Today, on the 16th of March 2023, the AEMO published its 2023 Gas Statement of Opportunities (GSOO). The executive summary of the publication begins with the line “Despite increased production commitments from the gas industry since the 2022 GSOO, gas supply in southern Australia is declining faster than projected demand“.

The report highlights the ‘risk of peak day shortfalls’ in the southern states from winter 2023 which are being forecast when modeled under very high demand conditions. It goes on to state that annual physical gas supply is forecast to be adequate until 2027 but investment “is needed in the near term to ensure operational solutions from 2027, despite falling gas consumption”.

Almost one year ago, the AEMO’s 2022 GSOO flagged longer-term challenges with the country’s eastern and south-eastern gas market with the AEMO’s Merryn York then-stating that the market operator was uncertain about the future demand supply of natural gas as the market looks to decarbonise.

Early Media Coverage

I have noted the following stories in mainstream media that have covered the AEMO’s release of the GSOO:

- Australian Financial Review

- LNG exporters may need to divert supplies to avoid shortfall by Angela Macdonald-Smith

- Forrest’s Squadron recommits to NSW LNG imports by Angela Macdonald-Smith and Gus McCubbing

- Labor’s gas big stick delays new supply from the AFR View

- RenewEconomy

- The Australian

- Gas shortages every winter for the next three by Perry Williams

- Winter crunch looms as bills set to soar by Perry Williams

- ABC

- AEMO warns of gas shortfalls during extreme weather this winter and long-term supply gap from 2027 by Jake Evans

- The ABC’s Sabra Lane interviewed AEMO CEO Daniel Westerman

- The Guardian

- The Sydney Morning Herald

- Gas shortages loom as power bills to rise by up to 31 per cent by Nick Toscano and Mike Foley

- 9News

- Christina Hearn reported ‘Winter gas shortage warning’

- SBS

Early Social Media Coverage

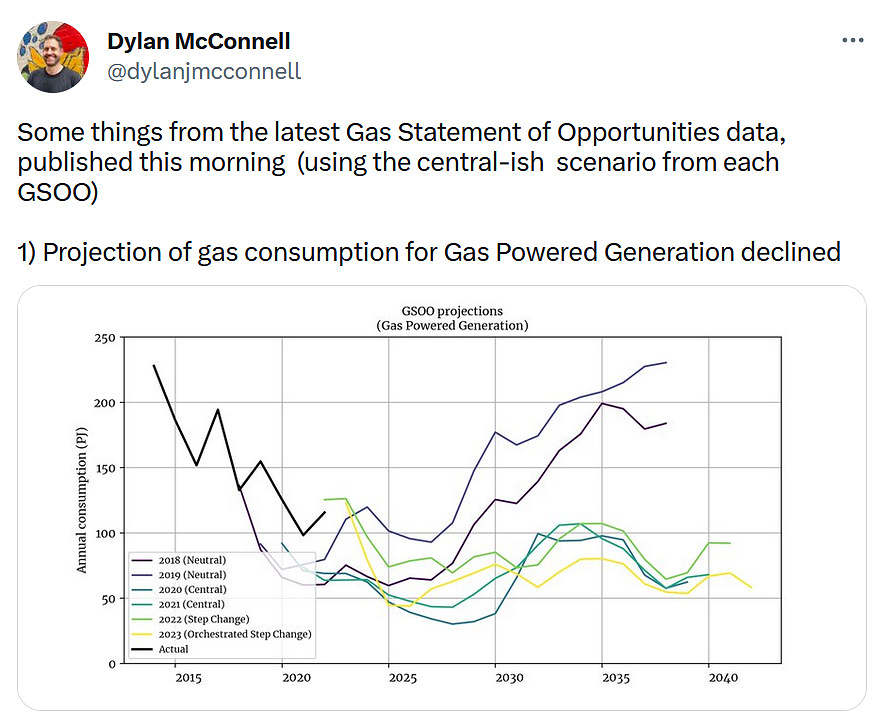

So far I have only come across the following Twitter thread from Dylan McConnell of UNSW, which covers his main findings from the GSOO data:

With about 35TWh/y of renewables committed including rooftop solar over the next 4 years 19 TWh/y of coal retiring and probably 2-3GW of storage in front of and behind the meter and storage/pumped hydro sucking up negative priced coal and solar power at midday and dumping into the $130/MWh evening market, what role is left for gas. If gas generation is half what it is now in 2026/27 it will be amazing.

In the meantime, heatpumps for hot water and space heating combined with gradually increasing energy efficiency will accelerate, so AEMO’s 2% per year decline in other gas demand will be looked on with wistful fondness by the gas companies in a few years’ time.