I’ve been focused elsewhere in the NEM currently (such as on self-forecasting) but I did notice that CLP did announce its annual results recently … including a report on EnergyAustralia (which it owns):

I have not actually had time to flip through the results, yet, but did not that it generated some media coverage in the NEM with respect to EnergyAustralia, including:

1) In the AFR, Angela Macdonald-Smith wrote ‘EnergyAustralia to tackle Yallourn outages after big loss’;

2) In the Australian, Perry Williams wrote ‘EnergyAustralia sinks to $1bn loss amid power grid volatility’;

3) In RenewEconomy, Giles Parkinson wrote ‘EnergyAustralia turns to storage as unreliable coal sends it to billion-dollar loss’.

4) In The Guardian, Peter Hannam wrote ‘EnergyAustralia blames $1bn loss on ‘unprecedented conditions’ amid supply issues at coal plants’.

… as an aside, interesting the different choices for what to headline from the results!

—

So, taking a break over lunch I took a quick look at what’s visible in the market data.

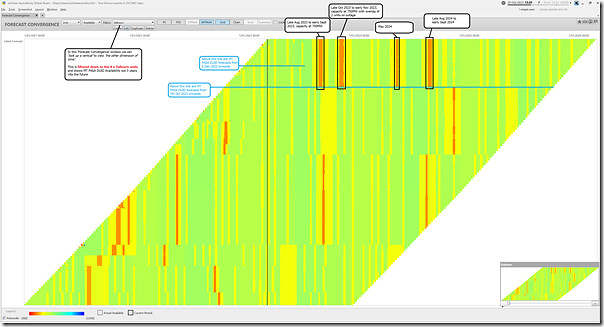

Using the newly enhanced ‘Forecast Convergence’ widget from ez2view v9.6.1.43 (release coming soon) we can ‘look up a vertical’ to review how EnergyAustralia’s outage plans for the Yallourn station have changed over the past couple of years, looking forwards up to 3 years into the future:

It’s colour-coded with lower numbers closer to red – which means periods where there are overlapping outages planned at two units (hence reducing available capacity to ~750MW) clearly shows up as orange.

I don’t have much time to expand on this today but the main observations at this point are:

1) Whilst the announcement to investors by CLP recently might have been news to some investors, the outage plans for four Yallourn units have not substantially changed since October 2022.

… what this will have meant is that these outage plans will already have been factored in the AEMO’s latest supply-demand modelling released with last week’s Update to the 2022 ESOO.

2) The way things are currently planned, there are 4 periods in 2023 and 2024 when there would be stints of a week or two where two units would be off simultaneously due to overlapping outages

(a) We can see some times in the past where this has happened (i.e. looking up the diagonal at ‘actuals’)

(b) But the width of the orange bands planned for 2023 and 2024 are notable, and we’ll endeavour to keep an eye on them.

(c) Of course we need to remember it’s only in conjunction with other outage plans (e.g. at Loy Yang A and Loy Yang B) that these really matter, from a supply-demand perspective (albeit that from a hedge cover perspective for EnergyAustralia it’s their own units that matter most!)

3) EnergyAustralia only seems to make significant change to outage plans for this unit a couple times each year.

… which seems like a logical approach, given the need to organise a significant number of things off the back of the outage schedule.

Nothing further, at this point.

Leave a comment