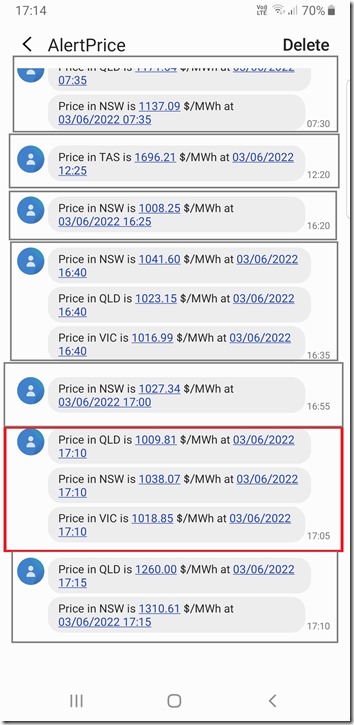

A short (initial?) article this evening to coincide with the start of this evening’s pricing volatility. Let’s start with this run of SMS alerts for dispatch intervals with ENERGY prices above $1,000/MWh:

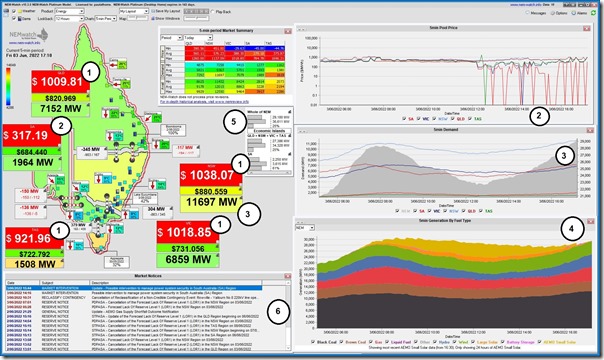

I’ve highlighted the 17:10 dispatch interval and chosen to focus on this dispatch interval in this snapshot from NEMwatch below:

With respect to the numbered annotations:

1) Prices are above $1,000/MWh in three regions (QLD, NSW and VIC), and not far off in TAS

2) The price in South Australia is noticeably lower – and indeed has been negative at times through the day:

(a) As noted on the image, SA is exporting to VIC at this time … but it’s exports are constrained below the thermal capability of the line.

(b) Not shown here, but in ez2view we can see that:

i. this is due to the ‘S::V_TBSE_TBSE’ constraint equation, which relates to an outage of one Tailem Bend to South-East 275kV line

ii. reflected in NEMDE via the ‘S-TBSE’ constraint set … which is currently scheduled to be invoked out till 17:30 on Tuesday evening 7th June 2022

iii. So expect lower prices to persist in South Australia until that time when the wind is blowing strongly.

3) Demand is ramping up into the evening in all regions – but NSW is particularly worth noting, with ‘Market Demand’ at 11,697MW and out of the ‘green zone’ of the historical range compared to the 14,649MW all-time maximum at that measure.

4) The fuel mix is similar to what’s been shown on other recent evenings, with the most noticeable change being the return of wind production across the NEM (which is the primary reason why prices are lower in SA than elsewhere).

5) On a supply-demand balance basis across the NEM, the IRPM is a healthy 25%

6) In the Market Notice window, a bewildering array of ‘on-again then off-again’ LOR1 notices from AEMO (including for QLD and NSW with respect to today).

Nothing further to note, at this point…

Leave a comment