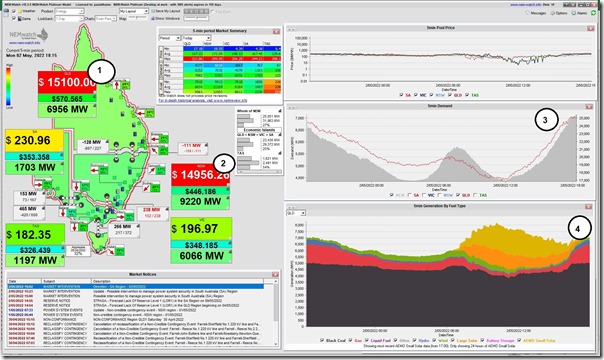

Let’s start this short article with this NEMwatch snapshot of the 18:20 dispatch interval this evening:

(A) Price volatility in QLD and NSW

With respect to the numbered notes on the image:

1) We see the QLD dispatch price at the Market Price Cap of $15,100/MWh

2) Whilst the NSW dispatch price only slightly below that (separated by just the dynamic inter-regional loss factor across QNI)

3) This at the time when the QLD Market Demand is a quite modest (i.e. ‘green zone’) level of 6,956MW … and indeed Market Demand across all regions in the ‘green zone’

4) With the trended fuel mix for QLD showing reversion to coal and gas (with a small portion each of wind and hydro) with the diurnal exit of solar at this time.

(a) Note that the export capability from VIC-to-NSW is limited significantly at this point by the ‘N::N_RVYS_2’ constraint equation:

i. on this occasion, its because of an outage this week (i.e. ‘N-RVYS_2’ constraint set) on the network between Ravine and Yass in the Snowy Mountains

ii. this was communicated in Market Notice 96004 at 18:45 which noted:

‘At 1808 hrs 02/05/2022 there was an unplanned outage of Ravine-Yass No. 2 330 kV Line.

The following constraint set invoked at 1815 hrs 02/05/2022

N-RVYS_2’

iii. More generally, the limited export capability from VIC to NSW through Q1 was noted in the AEMO’s QED for Q1 2022, but many commentators just skimmed (or even omitted entirely) any mention of this as a factor.

(b) Also readers might see the ~28 minute mark in our presentation to the Smart Energy Council audience with respect to our GenInsights21 report (specifically about the increasing ramp rate required for ‘Aggregate Scheduled Target’) as I suspect – without checking in this particular instance – that this is one of the principal factors involved.

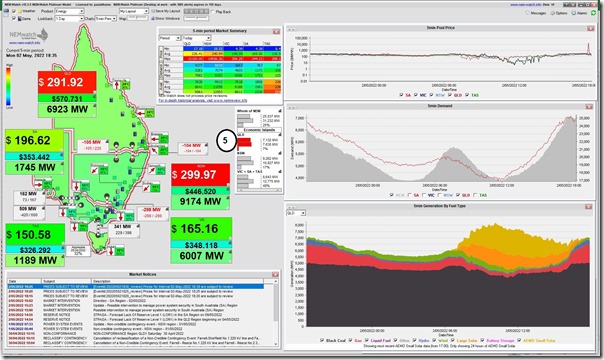

(B) Drop in Available Generation in QLD

What really jumped out at me was this snapshot from 18:35 – as you can see, the prices have subsided back below the $300/MWh cap trigger price…

5) However what’s particularly startling is that the Instantaneous Reserve Plant Margin (IRPM) for the QLD-only ‘Economic Island’ formed by constrained exports QLD-to-NSW on QNI is down at a low level of only 7% even with Market Demand being quite modest.

(a) Seen in this window, we see the following stats:

i. Available Generation of only 7,630MW /p>

ii. Supplying net Market Demand of 7,132MW (because of additional 209MW flow south into NSW)

iii. Meaning only 498MW surplus (i.e. Available Generation that’s unused) – or a 6.98% IRPM for the QLD only Economic Island.

(b) So I wonder why is available generation capacity so low?

(c) Turns out the AvailGen for QLD dropped from 8,373MW at 18:20 down to 7,630MW at 18:35 (i.e. a drop of 743MW over that 15-minute, 3 x Dispatch Interval, period)

… but none of my usual ‘unit trip’ alerts went off!

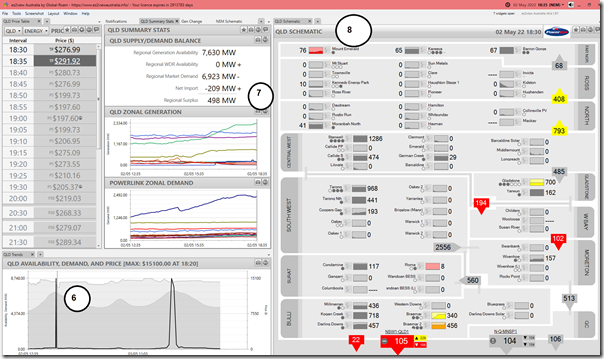

To understand more I wound ez2view back to the 18:35 dispatch interval using Time-Travel (which ensures it uses end-of-interval ‘Final MW’ figures for unit outputs) to see what could be seen:

With respect to the numbered annotations on this image:

6) We can see the effect of the drop in Available Generation in the QLD Trend widget

7) This delivers a ‘Regional Surplus’ of only 498MW (i.e. the drop in AvailGen of 743MW was a significant one!)

8) There are no significant drops in output shown for units operational at this time in the QLD region:

(a) which leads us to conclude that it was more than one unit that’s not running, but bid available, that removed themselves from the market for some reason

(b) noting Kogan Creek is the only one that big, and it’s running flat out, so can’t have been a factor here.

(c) There are a couple coal units not running, and it might be them … but it might also be something else (have not invested time to try to work it out, at this point).

9) Not shown here, as there is nothing to show, is no Low Reserve Condition market notice from AEMO as a result … at least to this point.

—

Nothing more to add, at this point.

—

PS1 … note that this drop was recovered in the 19:05 dispatch interval (it’s still unknown why it dropped in the first place)

Good spotting. Wonder what it was?

Just a tidbit in case it’s useful. Millmerran has a coal ash dam shutdown starting today (https://www.seek.com.au/job/56745397?type=standout#sol=8b6f7600ba668dcefd72cd3f1e97237f0a4c695f) and has been trucking (!) coal down from Callide for a couple of weeks (https://www.banana.qld.gov.au/news/article/375/increased-heavy-vehicle-traffic-in-the-area). Could be related to that generator.

Nice pick-up, in terms of Millmerran’s coal issues – which I have flagged here:

https://wattclarity.com.au/articles/2022/05/03may-trucking-coal-from-callide-to-millmerran-as-a-result-of-the-la-nina-rain-event/

Thanks for that!

Oh, also, a cryptic comment about one of the contributors here:

https://wattclarity.com.au/articles/2022/05/03may-price-volatility-in-qld-and-nsw/