Last article today, I hope, on a day (Tuesday 1st February 2022) that must have meant the peak number of articles on WattClarity in a single 24 hour period!

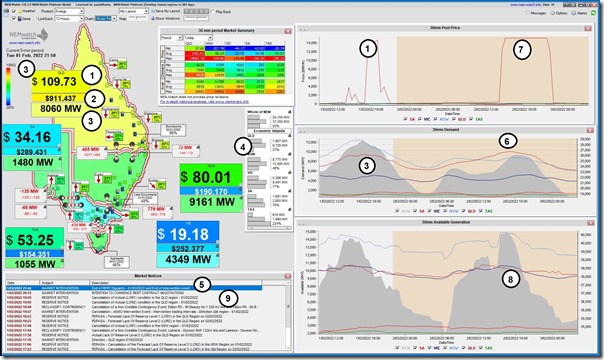

I’ll start with this snapshot from NEMwatch in the 21:50 dispatch interval and discuss a few things…

With respect to the numbered annotations, we’ll address each in turn below:

(A) A brief recap on Tuesday 1st February 2022

Some much more detailed recaps will follow in the coming days/weeks (as time permits), but for now let’s sum up:

1) Price outcomes

The price has subsided to $109.73/MWh for the 21:50 dispatch interval – but this is after a sustained period of market volatility that had driven the time-weighted average price for the day up above $1,700/MWh.

2) Cumulative Price

As a result of the sustained price action, the Cumulative Price for the QLD region is now up at $911,437 …. which is not quite as high as I noted it could be in this article (comments which Mark Ludlow references in the AFR here), but was about double where it was this morning.

3) Demand outcomes

On a 5-minute basis, and looking at ‘Market Demand’ we see the QLD region peaked at 9,470MW in the 16:40 dispatch interval – but this evening (with temperature and humidity remaining uncomfortably high) it’s only dropped back to 8,060MW at this late point in time.

4) Reserve Margin

The Instantaneous Reserve Plant Margin (IRPM) has risen again to a much more comfortable level (which explains in a large part why the price has subsided).

5) End of AEMO interventions

As noted in Market Notice 94413 published at 21:44:33 the AEMO has ended dispatch of the Reserve Trader, and there is no more Market Intervention. The key wording was as follows:

Refer AEMO Electricity Market Notices 94372

Activation of reserve contract(s) has ended.

The reserve contract(s) were activated from 17:00 hrs 01/02/2022 to 21:30 hrs 01/02/2022

The AEMO Intervention Event ended from 21:30 hrs 01/02/2022

The AEMO also summed up the results for the day in this tweet at 20:18:

(B) Looking ahead to Wednesday 2nd February 2022

With the charts set to 30-minute periods, they shift to incorporate the AEMO’s P30 forecasts … notwithstanding that there’s a bit of uncertainty now about what P30 predispatch actually refers to (see Tripwire #1 and Tripwire #2) under the 5MS arrangements. With the advantage of these charts, we have noted the following:

6) Demand forecast

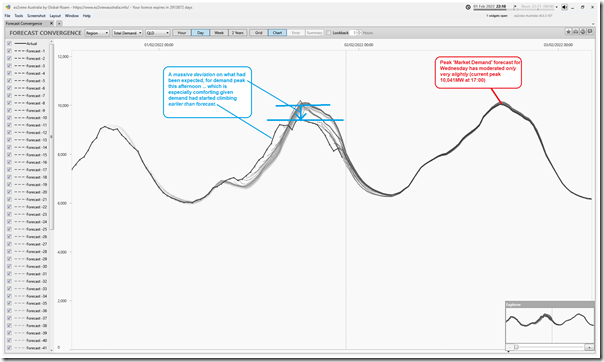

We missed the prize of ‘record demand in QLD’, but the current forecast has QLD nudging 10,000MW tomorrow evening. The ‘Forecast Convergence’ widget in ez2view shows here both:

(a) Clearly how much the ‘Market Demand’ in QLD was lower than previous forecasts … due to a number of factors we’ll discuss later in another article; but also

(b) How the current demand forecast for tomorrow is holding fairly steady … with the peak expected to be 10,041MW in the five minute period ending 17:00 (NEM time)

7) Price forecast

As was the case earlier, looking ahead into this afternoon, the forecast is for many hours at the $15,100/MWh Market Price Cap (MPC).

We did not hit the Cumulative Price Threshold today … but there’s every chance we might do so tomorrow.

8) Available Generation forecast

As was the case today, the AEMO forecast shows a decline in Available Generation capacity through the afternoon … which will be another challenge to manage.

9) AEMO negotiations

The AEMO needed to dispatch RERT today, and is actively exploring the possibility of doing the same tomorrow, as noted in the Market Notice 94411 published at 20:13:01 this evening:

——————————————————————-

MARKET NOTICE

——————————————————————-

From : AEMO

To : NEMITWEB1

Creation Date : 01/02/2022 20:13:01

——————————————————————-

Notice ID : 94411

Notice Type ID : MARKET INTERVENTION

Notice Type Description : Reserve Contract / Direction / Instruction

Issue Date : 01/02/2022

External Reference : INTENTION TO COMMENCE RERT CONTRACT NEGOTIATIONS

——————————————————————-

Reason :

AEMO ELECTRICITY MARKET NOTICE.

Reliability and Emergency Reserve Trader (RERT) Intention to negotiate for additional reserve – QLD1 Region- 02/02/2022

Refer to AEMO Electricity Market Notice no. 94398.

AEMO intends to commence negotiations with RERT Panel members for the provision of additional reserve by issuing requests for tender for the following period of time;

16:00 to 21:30 hrs 02/02/2022

If reserve is required, the period of activation or dispatch will be within this period but may not be for the entire period.

AEMO will issue a further advice if reserve is contracted.

Manager NEM Real Time Operations

——————————————————————-

END OF REPORT

——————————————————————-

We’re not out of the woods yet…!

Leave a comment