Five-minute settlement (5MS) is coming to the NEM on the first of October this year. There’s been a lot written about what this may mean for dispatch and bidding behaviour, but what does it mean for the pre-dispatch forecasts? In working on updating our ez2view software for 5MS I’ve needed to understand what these forecasts now mean – most critically to identify which time interval the 30-minute pre-dispatch price forecast represents.

AEMO runs the pre-dispatch process to provide forecast information to help market participants make efficient decisions about operating their units. Essentially, AEMO runs the dispatch process using forecast instead of real-time inputs, with special handling of complexity including generator ramp rates and feedback constraints, among many other factors. The fundamental inputs are:

- Bids and offers as submitted by participants

- AEMO’s demand forecast

- AEMO’s intermittent generation forecasts (AWEFS/ASEFS)

- Constraints (including network conditions, FCAS requirements and interconnector limits)

The key outputs visible to the market are the regional prices (including FCAS) and the demand forecasts. Other outputs, some visible only to individual participants, include the dispatch (including FCAS enablement) of units, which constraints are binding, and what the interconnectors are doing. There’s lots more detail in AEMO’s document here, which will be current when 5-minute settlement commences.

Pre-dispatch comes in two resolutions – 5-minute and 30-minute, with the 5-minute provided for an hour, and the 30-minute to the end of the next trading day (till 4am). Paul gave a graphical explanation in his article yesterday about these.

I’m looking here at how the meaning of 30-minute pre-dispatch will change with 5MS, considering the key inputs listed above. The pre-dispatch procedure linked above gives some detail:

- Bids and offers: Last 5-minute bid for the 30-minute interval. Before 5MS all bids and offers were for a 30-minute period, other than when rebid within the current trading interval.

- Demand forecast: Average half-hour demand.

- Intermittent generation: This document doesn’t specifically say, but I understand the AWEFS/ASEFS forecasts in the pre-dispatch timeframe are of half-hour average generation.

- Constraints: There’s a lot more complexity than just “5-mins or half-hour” to consider here – so I won’t look at this.

So what does the price in the 30-minute pre-dispatch forecast represent? Simply speaking the dispatch process takes the “supply” (offers and intermittent generation forecasts) and matches it to “demand” (the load forecast and bids from scheduled load) to find the clearing price. Here we have the offers being taken as the last 5-minute offer of each 30-minute interval, but the demand taken from the half-hour average. Is the price a forecast for the last DI of the half-hour, or for an average price for the whole half-hour?

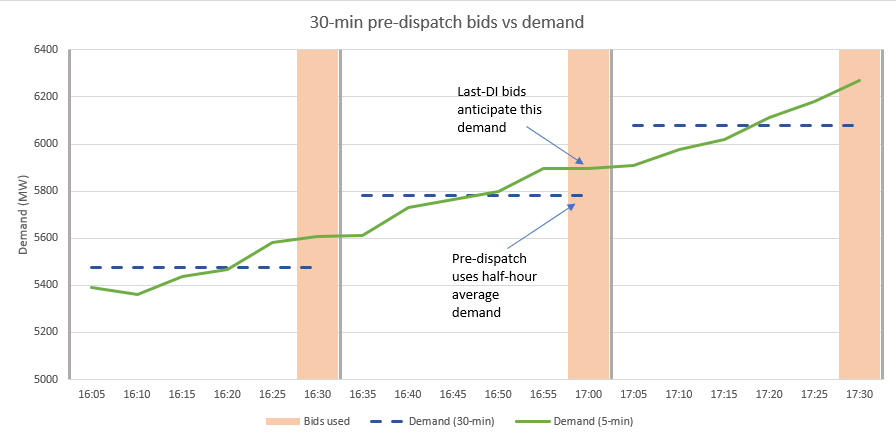

Many times this wouldn’t matter, but there are times of day when load and generation are ramping strongly where it could make a difference. This could have particular impact where some generators are profiling their offers across the half-hour in anticipation of a ramp in demand, such as in the early evening. For example, consider a demand forecast of 5,800 MW for 16:30-17:00, with generators making offers to suit anticipated higher demand of 5,900 MW at 16:55-17:00, and offering in more capacity as they ramp up for the evening. In this scenario the pre-dispatch price could be too low, with the market clearing lower in the supply stack for 16:55-17:00 as it matches the supply intended for one level of demand (5,900) with the lower half-hour average level of demand (5,800).

It could be argued that this is still better than what happens currently (pre-5MS), where the half-hour offers represent the intended offers for some point in the half-hour, with the expectation that rebids will happen in real-time for any ramping. One of the benefits of including 5-minute bidding resolution in the 5MS rule change is that ramping like this can be (for a first guess at least) bid in advance rather than only in real time. Getting the most value from this information requires interpreting it (such as in 30-minute pre-dispatch here) with other inputs aligned to the same time interval.

Using the bids and offers from only the last DI in the half-hour isn’t new or a snap decision – it was in AEMO’s draft implementation provided to the AEMC for the rule change process in 2017, and has progressed through the associated procedural changes in AEMO’s 5MS consultation process. It’s our understanding that AEMO is aware of this potential supply/demand mismatch issue in 30-minute pre-dispatch, but it hasn’t been as high a priority as getting the huge 5MS project across the line. I’ll write again on this topic if anything changes. In the meantime for a more accurate price forecast (for the next hour at least) there is 5-minute pre-dispatch forecast, where all inputs represent that 5-minute period.

Thanks Marcelle, handy diagram.