It seems that our speculation yesterday afternoon is fairly close to the mark.

A number of WattClarity readers have pointed me to this morning’s ABC article noting that ‘Yallourn power station evacuates mine due to potential flooding in Victoria’s Latrobe Valley’, which provides more flavour to what’s been going on. Thanks everyone!

(A) Down to one unit … for how long?

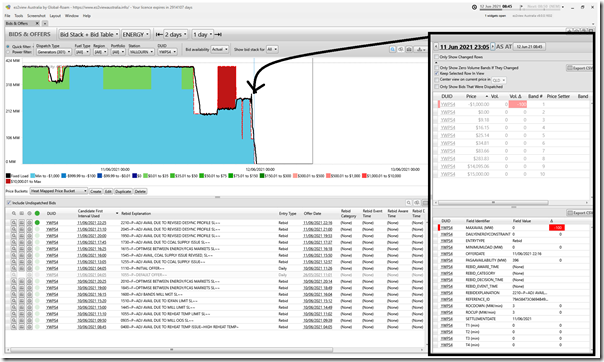

This morning we also have access to yesterday’s bid data from the Yallourn plant, so let’s take a quick look to see what we can see (using a pre-release copy of ez2view version 9, which we’re preparing for Five Minute Settlement).

(A1) Yallourn Station

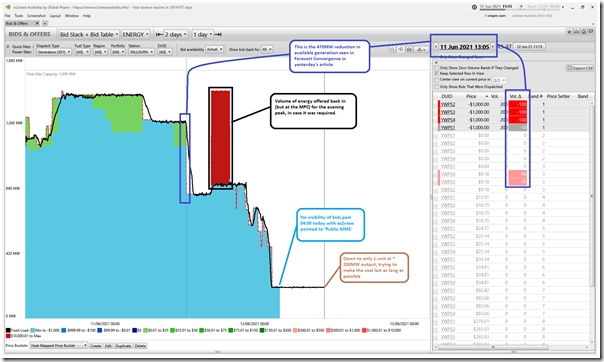

Here’s an aggregate view of bids for the four units at the Yallourn site using the ‘Bids & Offers’ widget:

A couple points from this view:

Observation 1) This morning we’re down to only a single unit, outputting approximately 200MW

Observation 2) I’ve annotated the 470MW reduction in capacity for the 13:05 dispatch interval across all 4 units … confirming some speculation yesterday that it might be related to Yallourn when we saw it in the ‘Forecast Convergence’ widget.

Observation 3) Capacity offered to the market has been progressively reduced since that time

Observation 4) From 17:05 until 20:00 (i.e. the period of yesterday evening’s volatility) capacity was added back in, but at $15,000/MWh, just in case the market required additional help. This was not called on to generate … hence conserving the dwindling storage of coal in the unit bunkers that’s unable to be replenished at present.

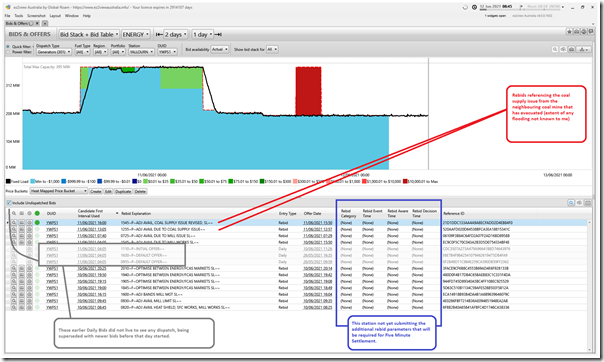

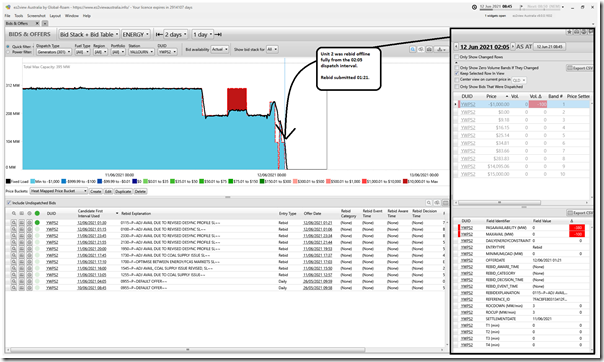

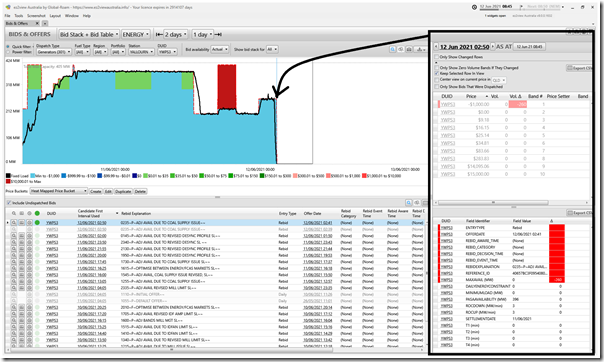

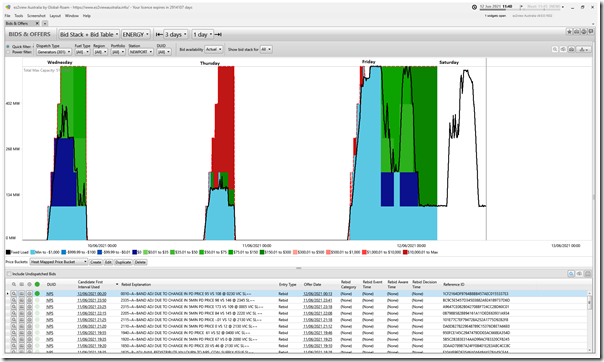

Flipping quickly across each unit (and including the rebid reasons) we can see a few additional things:

Observation 5) We see unit 1 is the unit still operational.

Observation 6) Above, we see unit 2 was taken offline around 02:00 this morning.

Observation 7) Above we see unit 3 was offline about an hour after unit 2.

Observation 8) Above we see unit 4 was the first unit offline, approaching midnight last night:.

(A2) Newport Station

In our speculation yesterday afternoon, I noted Newport was ramping up at the same time as Yallourn had begun ramping down. So it’s worth having a look at how it ran, compared to the two preceding days:

Observation 9) Newport ran much more heavily Friday evening … and also ran strongly this morning and is still running now!

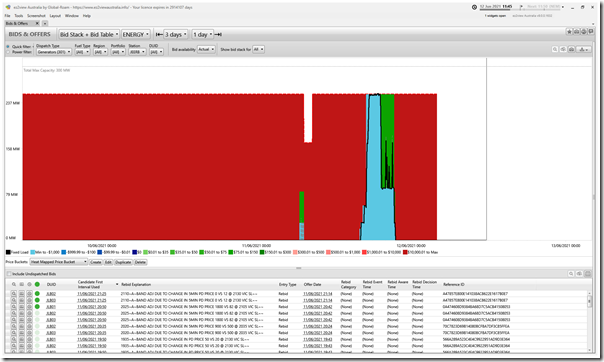

(A3) Jeeralang B

Worth also having a quick look at Jeeralang, also in the portfolio:

Observation 10) Three units at Jeeralang B ran close to flat out yesterday evening (up at 252MW compared with MaxCap of 300MW).

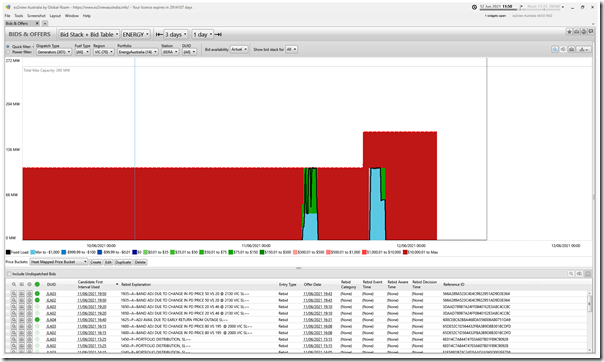

(A4) Jeeralang A

Rounding out the (thermal) portfolio in Victoria was Jeeralang A:

Observation 11) We see that two of the four units (JLA2 and JLA3) ran strongly, with JLA4 also offering volume last night.

(B) Impact on the broader market last night?

A few quick notes:

(B1) The broader VIC market

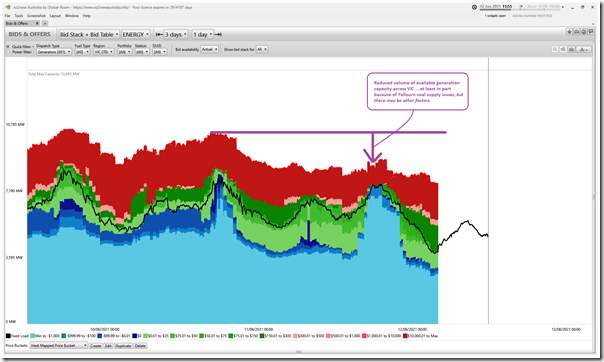

With ‘Bids & Offers’ widget in ez2view still open and looking back 3 days, here’s a view of the entire Victorian region (remembering that this is showing ‘Actual’ bids for Wind Farms and Solar Farms … i.e. what they can actually deliver, due to energy limitations):

Observation 12) Compared to the preceding (i.e. Thursday) evening we can see a noticeable drop in Available Generation capacity across all units in the state:

12a) This was at least in part because of what happened at Yallourn

12b) However there are also other factors, as the ~1,500MW drop in capacity at the time of the evening peak is in excess of the drop in capacity from Yallourn at that time (remembering that they offered all their volume in for that 2 hour ‘evening peak’ period)

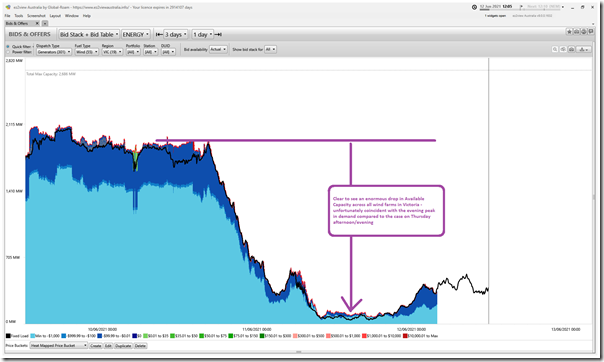

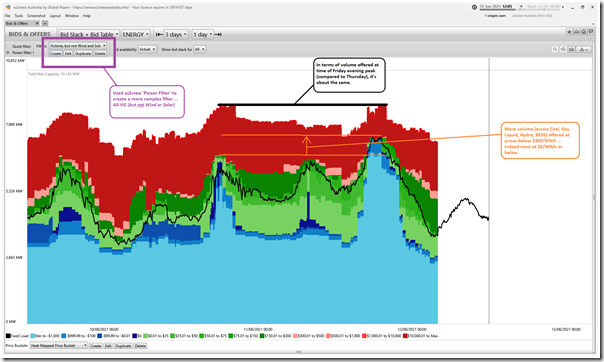

Observation 13) Creating a more complex filter of bid data for Victoria supply-side* (i.e. anything in VIC, except for Wind or Solar), we see a more nuanced picture:

* and casing my mind to Potential Tripwire #3 here, which Linton Corbet will discuss next week!

Observation 14) In terms of aggregate supply offered across all fully dispatchable plant (i.e. coal, gas, liquid, hydro and batteries):

14a) There was about the same amount of capacity offered at any price for Friday’s peak compared to Thursday’s

14b) Significantly more of this volume was offered at $300/MWh or below … indeed most at $0/MWh or below.

14c) And the volume dispatched was substantially higher (the black line shows aggregate target).

Observation 15) So if you wanted a headline, it might be that ‘Dispatchable plant rallied to meet the challenges at Yallourn and the disappearance of wind, to meet demand on the evening’.

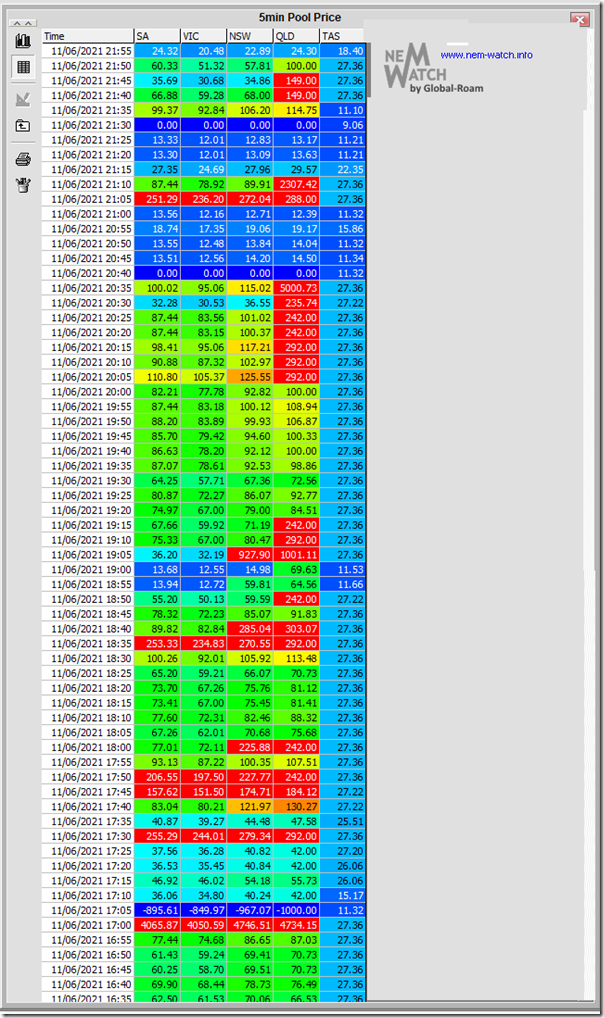

(B2) Price Outcomes on Friday 11th June evening

So the price outcomes in Victoria were fairly modest, as shown in this table extracted from NEMwatch just now:

(C) What about this evening?

That’s a logical question … indeed to be interested in the next couple days

(C1) Available Generation, and Price Expectations

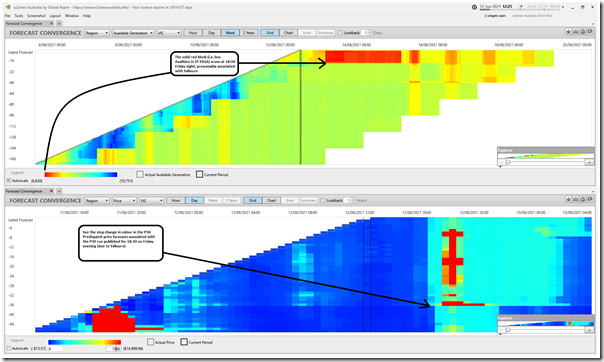

Here’s two copies of the ‘Forecast Convergence’ widget in ez2view as at 12:25 on Saturday 12th June … the top one being a week-ahead view of Available Generation in VIC (i.e. incorporating P30 predispatch and ST PASA), with the bottom one being a day-ahead view of Trading Price expectations (incorporating P30 predispatch … before Tripwires 1 and 2 impact on it with 5MS!).

Observation 16) Available Generation in Victoria has dropped (at least in part because of Yallourn being severely restricted) and is forecast to remain low until the morning of Tuesday 15th June (i.e. the end of the red block on the top chart).

Observation 17) The removal of Yallourn did cause a jump in price expectations, but the most recent P30 Predispatch price forecast shows no prices >$1000/MWh…. so we will wait to see.

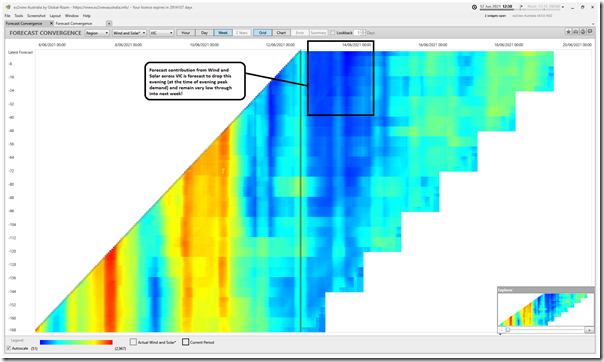

(C2) Expectation for Wind + Solar

Unfortunately (given it played such a significant role in the tight supply/demand balance in VIC yesterday evening, flipping forecast convergence to show ‘AvailGen for Wind and Solar’ the picture is still blue:

Observation 18) The blue colour (literally, and metaphorically) is because the forecast combined contribution from wind and solar in VIC is forecast to drop further this evening around the time of evening peak in demand, and remain at a very low level through until Monday morning.

Let’s hope for no more nasty surprises over the weekend!

Leave a comment