Last week was a busy week in the NEM.

(A) Price Volatility

With the official start of summer fast approaching, it was not too much of a surprise to see some price volatility:

1) on Sunday 15th Nov (QLD),

2) followed by a bigger episode on Monday 16th Nov (QLD and NSW),

3) an event on Tuesday 17th Nov (QLD) at exactly the same time; and then

5) Plus there was some activity Sunday evening 22nd Nov (TAS).

(B) Other developments

Broader than direct price outcomes in pricing and dispatch in the NEM, there were many other developments – and I had time last week to note about three of them:

1) We took a quick look at the anticipated effect on SA demand in the short-lived COVID lockdown,

2) On Friday the AEMC’s published a draft rule change for Semi-Scheduled units,

3) Perhaps more obscure, the AEMO noted about the introduction of a new constraint (Constraint ID = ‘N^^N_NIL_3’) that seems likely to cause more pain to a range of different participants in south-western NSW and north-western VIC:

Note that Allan O’Neil expertly unpicked the ‘X5 Constraint’ yesterday, to provide a great explanation.

(C) A reminder of the need for fully functioning Demand Response

In addition to the price spikes experiences through the week, we were reminded through the week of the need to have a fully functioning method of Demand Response by virtue of:

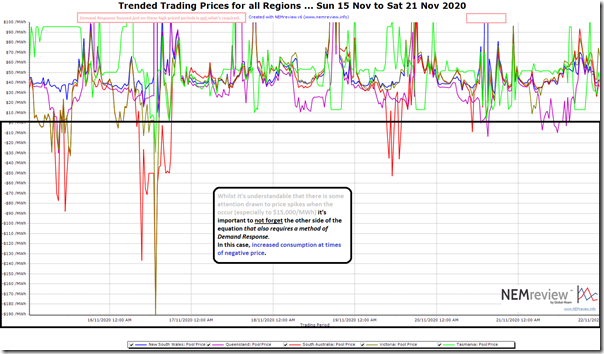

1) Even this close to summer, 4 of the 5 regions in the NEM experienced negative trading prices, as we can see in the following trend from NEMreview v6:

I’d noted in July that Q2 2020 saw much higher incidence of negative prices in all regions (and in the WEM) than had been the case in any prior equivalent period, and that trend is set to continue…

2) So it was not really a surprise on Friday to see Aaron Patrick and Brad Thompson write in the AFR that ‘WA pays business to consume surplus solar power’.

There are two sentences that sum up the situation:

“The huge flow of solar power on sunny days is threatening to destabilise Perth’s power grid, prompting state-owned operator Western Power to pay businesses to use electricity on weekends and solar farms to turn themselves off.”

and:

“Western Power, which declined to identify any of the 220 sites being paid to take power or stop generating it, said the scheme was focused on productive, not unnecessary, use of electricity.”

C1) ‘Blind Freddy’ could have seen this coming?!

Now, remembering that demand response is all about temporary changes in consumption in response to some incentive (typically commercial):

1) historically, much of the focus has been on reductions in consumption in relatively rare instances of tight supply/demand balance … and by extension very high prices like in the examples above.

2) however it’s worth reflecting on how it should have been obvious that we would need to incentivise increased consumption at times when supply of wind and solar is strong, but aggregate Underlying Consumption would otherwise be too low to allow for the ‘Keeping the Lights on Services’ to operate in parallel with the ‘Anytime/Anywhere Energy’ being supplied.

(a) Negative prices are just one manifestation of these times in which increased consumption would be beneficial … if it’s in the right place.

(b) I’ve deliberately capped the upper range of the chart above, as the (rare but) extremely high outcomes through the week would dominate provide an outsized focus on these few instances (and illustrate how – not just in the chart – policy development has been distracted from the frequent, persistent and growing need to also do something about the negative prices).

So why are we seemingly so surprised by what’s emerging? It boggles my mind.

C2) Recapping mechanisms for Demand Response in the NEM

In the west, the program that Aaron and Brad talk about in their AFR article is Western Power’s ‘100 Megawatt Industry Challenge’, and at least their program will work to effect some change.

Over east in the NEM, we have (with much fanfare) introduced what’s perhaps misleadingly labelled ‘the Wholesale Demand Response Mechanism’ (but perhaps should be less confusingly labelled as ‘a Negawatt Dispatch Mechanism’) that will commence on 1st October 2021:

1) and will (we hope) provide an additional tool to help address the less frequent, but critical, instances of tight supply/demand balance and hence high prices.

2) but, ironically (because of the way it is designed, despite large consultation including prior warnings from me, and probably from others) will do nothing to address the rapidly growing requirement to incentivise energy users to productively increase consumption when the sun and the wind are producing too much.

For the energy user readers here, it’s worth re-iterating that there are a couple different methods for participating in Demand Response, including these three Options.

| Option 1 Scheduled Load (works now) |

Option 2 Spot Exposure (works now) |

Option 3 Negawatt Dispatch Mechanism (from 1st October 2021 it starts … and might be phased out if a Two-Sided Market were phased in with ‘NEM 2.0’) |

|

‘Scheduled Loads’ are registered with the AEMO and participate in the dispatch process every 5 minutes. This dispatch process is operated by AEMO using the NEMDE dispatch algorithm and is described in some articles linked here. The Scheduled Loads operate just like Scheduled Generators, except in inverse (i.e. they bid to consume, rather than bid to supply). When dispatched by AEMO (i.e. when NEMDE accepts their bid price as economic), the Energy User ramps to consume that volume. |

This mode of participation in the NEM has been growing since the first few large energy users started operating in this way in the first years of the NEM. Some of these are ‘Wholesale Market Customers’ (i.e. purchasing directly from AEMO), but most of them tend to take some form of spot exposure (e.g. for some portion of their load and/or some periods of time) through their retail contract. In our role of a software supplier to these types of energy users, we have played a role in helping energy users understand it’s not as daunting (or scary) as they might have been led to believe. In this journey, we have encountered some real barriers (including from some unlikely sources). |

Just prior to the publication of the final rule by the AEMC (on Thu 11th June 2020) I posted this article that sought to provide an overview of how the new process will work.

|

|

For high prices, Scheduled Loads (who have presumably bid not to consume) are dispatched down to 0MW consumption, say. This scenario is notwithstanding the challenges of ‘the 5/30 issue’. |

When high prices occur, energy users who see these high prices can choose to curtail consumption (or switch on embedded generation to reduce net draw from the grid). Through our deSide® software, we help a number of large energy users located in every region of the NEM understand what the pricing in, and respond. As mentioned in our own case study, in our experience energy users are growing increasingly sophisticated in these approach (for instance, taking into account their order book in making curtailment Trigger Price decisions). This scenario is also notwithstanding the challenges of ‘the 5/30 issue’. |

For high prices, these energy users would operate similarly to Scheduled Loads – in that they (or an aggregator operating on their behalf) would be dispatched by NEMDE to deliver a bid reduction in consumption under a pre-determined baseline level. This scenario is also notwithstanding the challenges of ‘the 5/30 issue’. |

|

This method also works for negative prices For negative prices, Scheduled loads (who have bid to consume) are dispatched up to their bid consumption levels. Scheduled Loads currently are limited to the pumping/charging components of pumped hydro and batteries. In this case they are pumping/charging when prices are low in order to be able to discharge again later when prices are high. |

This method also works for negative prices For negative prices, the situation is very similar to the above. Energy users simply choose to consume more. Indeed, some have become quite sophisticated, because of the incentive to lower cost of consumption – in that they have shifted consumption (ahead of time) into periods where prices are likely to be low, or negative. Some energy users we have heard of invested capital in order to oversize parts of their plant to give them even more flexibility to shift load in this way. These are the kinds of decisions we need to be encouraging! |

This method does not work for negative prices Unfortunately, as I have noted before, the rule change that has been made provides no incentive for energy users to increase consumption where price outcomes are negative (or even just low). That’s a real shame, particularly given the great many hours of effort that have gone into getting this rule change (far from optimal, in its current form) passed. |

|

Currently in the NEM, the only Scheduled Loads that operate in the NEM are the pumping (charging) components of pumped storage hydro (batteries). In the early days of the NEM, the Victorian aluminium smelters were operated as Scheduled Loads, but that did not last very long. |

As outlined here, we’ve been working to facilitate an increased number of energy users participating in this method over more than 15 years. Over that time we’ve seen a fairly diverse range of approaches, and increasing sophistication being deployed. We’ve also seen the benefit of the flexibility conferred with this approach – whereby energy users can have periods of time where they are more engaged in demand response (e.g. when their order book is lighter) and periods of time where they financially hedge more to enable them to run more consistently (e.g. when their order book is fuller and they have less scope to alter production). I’ve not specifically heard (or sought) stories from our customers about their response to negative prices – but it stands to reason that they could be keenly involved in maximising consumption when these times (increasingly) occur. Note that I’m not claiming this is a panacea for everything – there are some ways in which this approach is challenged. At least it works with negative prices, though! |

As I warned on 21st Oct 2019 (and beforehand), we’re at the start of a sharp increase in the incidence of negative prices. It’s a real shame that this mechanism (implemented following a concerted investment of a great many hours by many people) leaves this obvious market requirement unaddressed. |

We’ll look forward with interest to seeing the activity of energy users in the market continue to evolve (and will keenly assist those, where and when we can).

Let me guess – retailers are making plenty out of negative prices, so the tariff reform that should follow the duck curve, is lagging… and lagging… until it becomes embarrassing for the retailers and they concede.

In QLD, the government owned DNSPs set peak tariffs between 6am and 9pm. They charge peak rates during periods of negative wholesale prices.

Of course some is hedged, but CFDs incentivise those generators to bid low, which results in very low wholesale prices.

Ben

I don’t think many retailers are enthusiastic about tariff reform – not least because they don’t see any evidence their customers want it. but it’s ridiculous to claim that they are the barrier here. Tariff reform is an orphan policy. Governments, policymakers, consumer reps – no-one has picked up this ball and run with it, and many have opposed it. For example, Victoria banned widespread tariff reform a few years ago. Some DNSPs have taken some steps as you note, but they don’t care about wholesale prices – they are doing it to manage network peaks, which may often overlap with wholesale price spikes but are not exactly coincident. Even they have limited interest – after all they’re on revenue caps so they get the same amount of money either way.

Despite the rhetoric there’s enough competition and innovation in the retail market that business and household customers can access wholesale price signals if they want to (eg via Flow Power or Amber respectively, there may be others).

Negative prices are endured by generators for only two reasons: because they have sold PPAs (or similar contracts) to naive buyers who don’t mind paying the strike price in their contract plus the negative price(!) for every MWh generated, or because a generating unit is not flexible enough to turn off and back on again later when prices are attractive. Surely, an increasing prevalence of negative prices is therefore both the symptom and the cure for this problem?