This is the third of a series of case studies we’ll be preparing looking at instances identified of large values for aggregate Raw Off-Target across all Semi-Scheduled units.

It follows from the table of detailed results posted at the bottom of the article ‘Extrapolating from the trend of ‘Aggregated Raw Off-Target’ results, to yield some clues to what the future might hold … and one challenge for NEM 2.0’, which was posted on Monday 27th July, partly in response to the AER Issues Paper relating to Semi-Scheduled units.

——————-

This case is a little more complex than the first case study (4th July) and the second case study (14th August) from the same year.

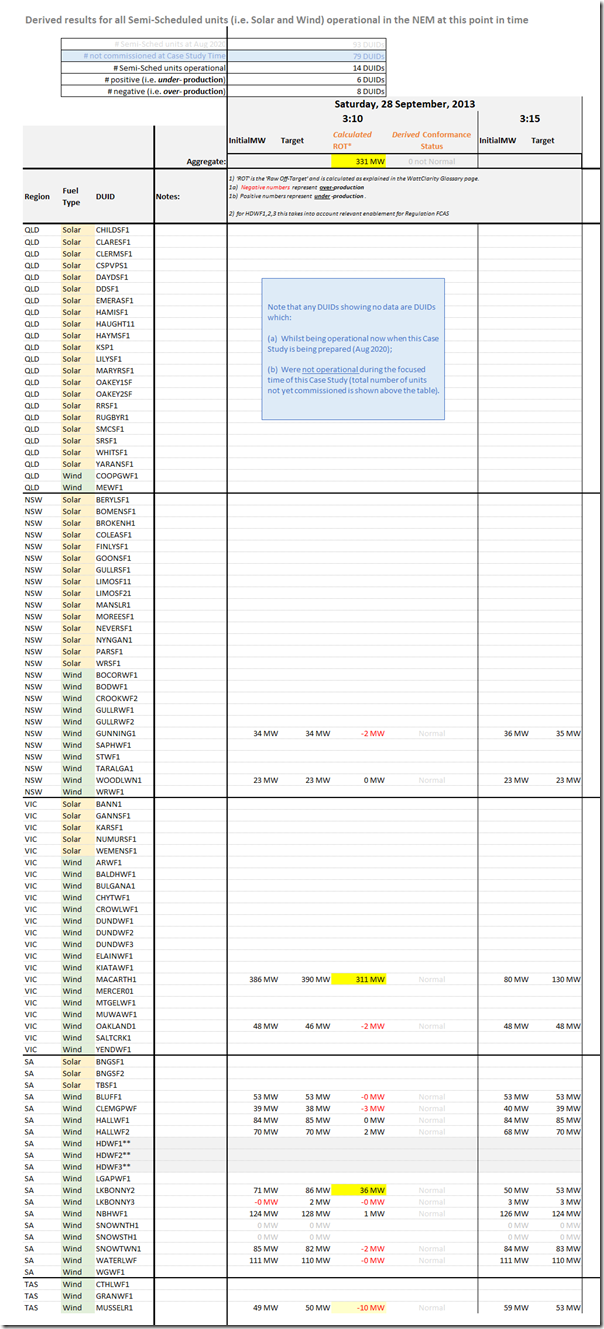

(A) Summary results for Saturday 28th September 2013 at 03:10

Again, we start with this summary table, highlighting the individual Raw Off-Target performance of all Semi-Scheduled units that were operational at the time:

This case is a little different to the earlier two posted today (also for 2013) in that:

1) Whilst there are still only 14 units registered and operational;

2) In this case, slightly more units were over-producing (8) than under-producing (6). This is the reverse of the pattern on 4th July or 14th August.

3) Furthermore there are three particular outcomes flagged in the colour coding in the cells above – 2 large under-generation and one somewhat significant over-generation.

(B) Results for three Wind Farms

Again we can show this specific dispatch interval clearly with the current ‘Unit Dashboard’ widget in ez2view, wound back 7 years ago through the powerful ‘Time Travel’ functionality:

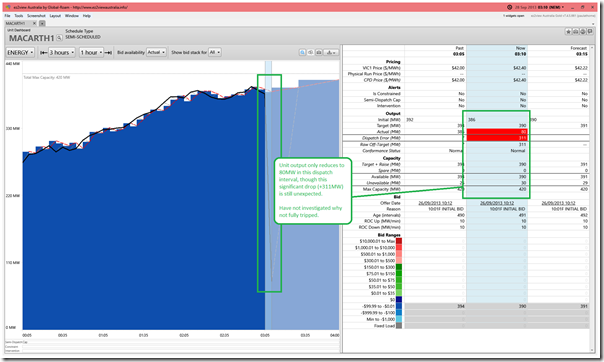

(B1) Under-generation at Macarthur Wind Farm (+311MW)

The Macarthur Wind Farm (easily largest wind farm in the NEM at that time) was the focus of both the first case study (4th July) and the second case study (14th August) earlier in 2013. On both of those instances the unit tripped to 0MW.

On this occasion, the unit does appear to trip, but only down to 80MW.

This means that the Raw Off-Target value (+311MW), whilst still easily the largest of all 14 units, is not as large as on 4th July or 14th August .

I have not investigated why the unit did not trip all the way to 0MW, or what the underlying reason was for the trip. If you can help us understand more, feel free to add a comment underneath the article?

More generally, I suspect that three trips in consecutive months would not have made the owners happy.

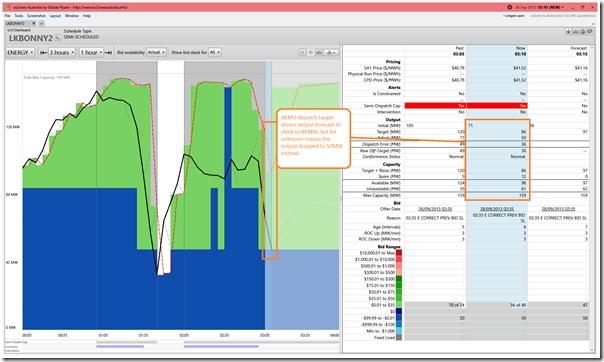

(B2) Under-generation at Lake Bonney 2 Wind Farm (+36MW)

We see an aggregate Raw Off-Target value of +36MW returned for Lake Bonney 2 Wind Farm:

As noted on the image, the expectation was that the output could rise (from 71MW to 86MW), but for reasons unknown it went the other way – a reduction down to 50MW, which just happened to be the limit of the capacity that had been offered in the bid bands down below $0/MWh.

Was this a coincidence? Not going to invest time to explore more, but please feel free to add a comment below if you can help explain further?

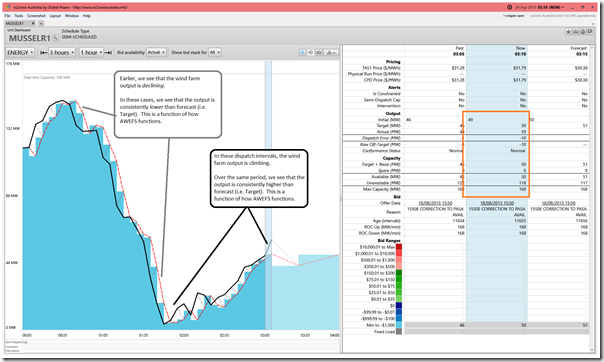

(B3) Over-generation at Musselroe Wind Farm (-10MW)

Down in Tasmania, we see that Musselroe increased its generation more quickly than was anticipated in its dispatch target:

As highlighted in the image, this had been the pattern for a number of dispatch intervals up until this time (03:10) whilst the growth in output consistently outpaced the forecasts (i.e. Targets).

This is a known function of how AWEFS functions – because it uses persistence forecasts (at least in part) when the Semi-Dispatch Cap does not apply. The same effect (though reversed) can also be seen in the ‘Output dropping more rapidly than Target’ earlier in the chart.

Leave a comment