Yesterday I skipped over 2014 and 2015 in landing on 5th April 2016 for my 4th Case Study in what promises to be a long series.

In each of these Case Studies, I’m exploring specific details about how all of the Semi-Scheduled generators performed with respect to their Dispatch Targets (i.e. calculating out as the ‘Raw Off-Target’ metric) for a total of 98 dispatch intervals through until 31 December 2019 where Aggregate Raw Off-Target across all Semi-Scheduled units was in excess of 300MW – either:

(a) In most instances collectively under-performing; whilst

(b) On a small number of occasions collectively over-performing.

I’m doing this in order to work more broadly through the ‘unders and overs’ challenges with respect to the Semi-Scheduled mechanism of participation, to get a sense of what might need to be considered for NEM 2.0.

———————–

With this 5th Case Study today, there are only 93 more dispatch intervals to work through….

(A) Summary results for Wednesday 15th October 2014

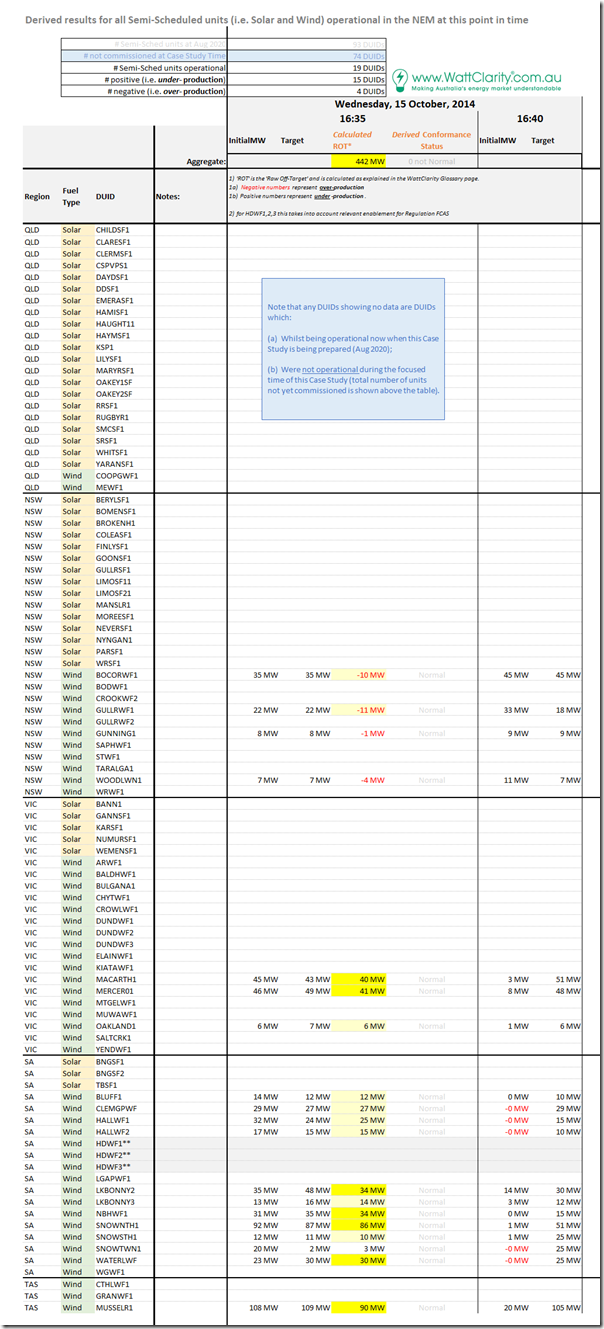

Again, we start with this summary table, highlighting the individual Raw Off-Target performance of all Semi-Scheduled units that were operational at the time:

There’s a few things that can be highlighted here:

1) This period is before any Solar Farms were operational – hence just Wind Farms being Semi-Scheduled;

2) The most striking thing that clearly jumps out is that:

(a) Every single wind farm across VIC and SA under-performed with respect to their targets in this dispatch interval; whilst

(b) All four of the wind farms operational in NSW at this time were over-performing, in contrast.

(c) There clearly seems to be some divide in performance at the VIC-to-NSW border. This smells to me like some broader disruption to the grid has driven in this outcome….

3) The sum total of this is that almost 4 times the number of wind farms were under-performing than those which under-performed … though this seems very likely due to their location.

(B) Looking at some specific DUIDs

Again we can show this specific dispatch interval clearly with ez2view, wound back 6 years ago through the powerful ‘Time Travel’ functionality. Out of curiosity, I added snapshots of particular units in here (the ones with largest Raw Off-Target) – however note that this seems to be more a case of where the wind farms have reacted to some external stimulus (e.g. frequency, perhaps?)

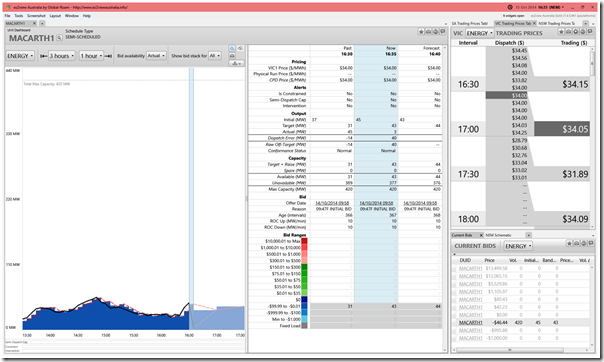

(B1) Macarthur Wind Farm in VIC

Working my way down the table, we first come to Macarthur Wind Farm in VIC:

We can see that output was quite low (metered at only 45MW at 16:30) but this dropped to 3MW at the end of the dispatch interval – hence +40MW Raw Off-Target compared to its Target of 43MW.

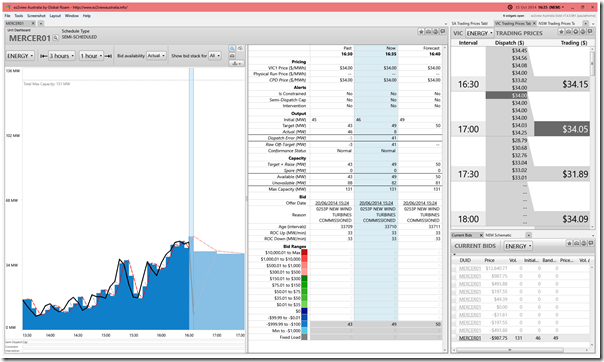

(B2) Mt Mercer Wind Farm in VIC

We see a very similar picture for Mt Mercer:

In this case, the Raw Off-target value was +41MW

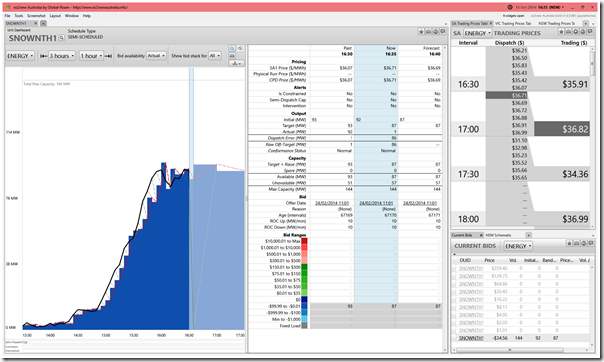

(B3) Snowtown 2 North Wind farm in SA

In South Australia, we see that the Snowtown 2 North Wind Farm tripped fully offline:

Hence there’s an Off-Target value of +86MW on this occasion.

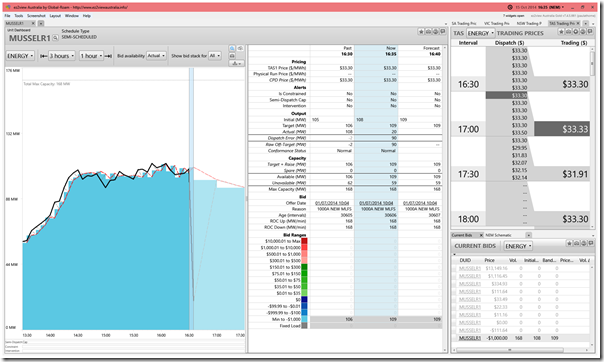

(B4) Musselroe Wind Farm in TAS

Over in Tasmania, the Musselroe Wind Farm showed the largest value for Raw Off-Target, at +90MW:

On this occasion, it ‘only’ tripped down to 20MW from its initial output of 108MW.

Please keep in mind that I’m trying to get through all of these Case Studies in a reasonable amount of time, and there are a fair number to do, so I don’t have time to explore each event as much as I would like. If you notice any errors, or misinterpretations in the following, please feel free to add a comment under the article to clarify/correct!

(C) Looking at the broader market

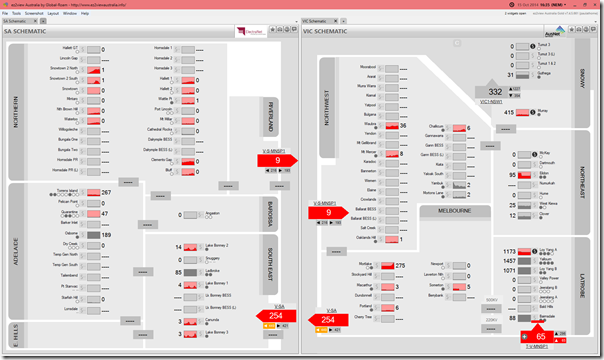

Adding VIC and SA regions together in this view of the current ‘Schematic’ widgets in ez2view shows (in the colour-coding, which currently alerts on percentage change, with red being >15%) a fair degree of movement:

Remember that, in these schematics:

1) Stations that were operational back then but are not now (like Northern in SA and Hazelwood in VIC) have been removed; and

2) Stations that are operational now, or at least in pre-production, are shown with blanks for data.

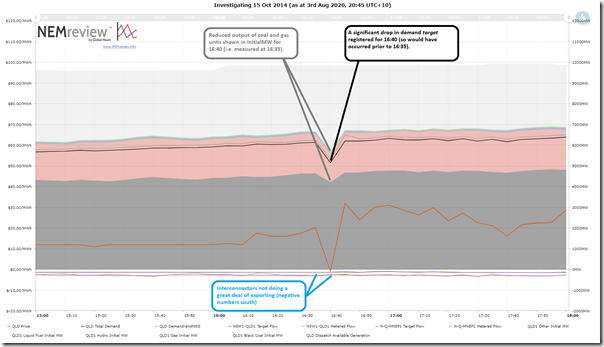

I wondered if there had been some interconnector trip, but that does not seem to be the case – in a quick scan I did see a large drop in demand in Queensland, though – as shown in this trend over 3 hours on the day from NEMreview v7:

Don’t have time to think through the details of how a large drop in demand in QLD (which might have been first) translated to wind farms in VIC and SA massively under-performing. Did quickly try to scan history:

Possible Source #1) Unfortunately, we did not post any article back in October 2014 to note what was happening on that day

Possible Source #2) I also there does not seem to be any AEMO Power System Incident Report for that day, either.

Possible Source #3) Anyone else remember what went on there? If so, it would be excellent if you could include a note at the bottom of the article (and doubly ideal if there is some public reference to link to)!

————

That’s all I have time to do now…

Leave a comment