Two weeks ago (on Monday 5th May 2025, and at the start of the week in question) I’d written ‘Green shoots of pragmatism at the CEC’s Clean Energy Investor Forum in Sydney on 3rd April 2025?’ with respect to an earlier event organised by the Clean Energy Council.

As it turned out, a surprising number of people expressed their thanks to me for preparing that style of record, which has prompted me (along with some internal reasons) to prepare the same thing about ‘the week that was’ more recently …

| Clean Energy Council

(Onshore) Wind Industry Forum (AWIF 2025) Tue 6th May 2025 Melbourne |

EUAA

National Conference (2025) Wed 7th and Thu 8th May 2025 Melbourne |

Coincidentally, during the week… |

|---|---|---|

|

Up close to the MCG for a well-attended 1-day event was the Clean Energy Council’s (onshore) Wind Industry Forum. With respect to this conference: 1) One of the speakers on the day was Jonathon Dyson, who has subsequently written ‘Aligning business cases with the current, and future, reality’ to encapsulate some of his presentation. 2) There was one other presentation that particularly resonated with me, so we’ll see if that speaker is able to share their thoughts in an article soon … 3) Over on social media, there were plenty of updates from people during and after the event – for my future reference, worth noting a couple of them. LINKS STILL TO COME… |

Completely at the other end of town (at Marvel Stadium) on the following days was the very well attended EUAA National Conference for 2025. With respect to this conference: 1) I was involved in a panel session at the end of the first day of this conference … (a) as some pre-reading for some attendees, posted ‘A review of the traditional form of Demand Response (part 1)’ the evening before. (b) Part 2, and so on, will follow (time permitting) … 2) There are some other presentations that particularly resonated with me, so we’ll see if that speaker is able to share their thoughts here on WattClarity® soon… 3) Over on social media, there were plenty of updates from people during and after the event – for my future reference, worth noting a couple of them. LINKS STILL TO COME…

|

Amongst other things during the week … 1) It started off (on Sat 3rd May) with a win for the ALP in the Federal Election, which: (a) Could be taken to mean ‘more of the same’ in terms of energy policy; and (b) Consigned the possibility of nuclear power in Australia to the never-never. 2) On Wednesday 7th May both the AEMO and AER released their quarterlies; and 3) In terms of comings-and-goings, in amongst the general news we noticed that both: (a) Merryn York announced her retirement from AEMO; and (b) On the day after the AWIF, Kane Thornton announced he would step down from the CEC at the end of August 2025. 4) In terms of particular assets, we noted: (a) Callide C out of Administration; and (b) Also this update from CS Energy. |

Sort of an unofficial Energy Week … no, not the big branded thing that I’ve never managed to be able to attend, but still a useful period of out-and-about with another ~thousand people in and around different parts of the energy sector.

What follows are some highlights (and/or things I’d like to note for future reference).

… and never the twain shall meet?

I commented to several people over the week that there was a (probably unintended) irony that we had two events in one week in the same city, but the organisers were seemingly unable to bridge the gap between both ends of the energy supply chain:

1) At one end of town on Tuesday we had a well attended bunch of generation developers speaking about trying to get wind farm projects to FID and beyond

(a) noting comments made about earlier CEC Forums about there still being many shades of ‘engineers trying to sell products’, without really speaking with customers directly

(b) which is (my sense of partly) why some continue to speak of ‘there’s a role for Government’ (i.e. to avoid me needing to speaking with energy users directly about their actual needs).

2) At the other end of town on Wednesday and Thursday were almost 200 large energy users gathered together (as part of the larger audience) sharing their concerns about the energy transition path and their challenges in finding a match of both ‘Anytime/Anywhere Energy’ and ‘Keeping the Lights on Services’.

… and that seemed a metaphor for how there’s still a disconnect in this energy transition journey.

At least, from my point, they were not on concurrently!

I was reminded again during this week that Andrew Richards (CEO of the EUAA) has talked about how organisations like the Clean Energy Council (and similar) need to start thinking that they will just be the ‘Energy Council’ by 2030:

1) assuming the ALP’s legislated goal of ‘82% Renewables by 2030’ comes to fruition:

(a) Because it will need to deal with both the ‘Anytime/Anywhere Energy’ and also the ‘Keeping the Lights on Services’ that will both continue to be required

(b) And noting that there are a number (like me) who see that as a looooooong ‘stretch goal’ that’s increasingly butting up against the real world complexities of this transition.

2) So that’s why the ‘green shoots of pragmatism’ were very welcome a month earlier … though not without controversy.

3) Perhaps that future should be on the minds of the CEC Board Members when recruiting for the new CEO?

Electricity bills are going up, not down

This was a topic of conversation at both conferences during the week – though perhaps for different reasons:

1) At the CEC event, there was a big collective sigh of relief after the election result – mixed with a dose of optimism for the future. It was in this light in the first panel session that someone made a comment that I’ll paraphrase as follows:

‘We need to stop saying that electricity bills will go down … the energy transition path we’re on means that (according to the modelling) the cost to consumers will be cheaper than the alternative. That should be the message.’

… and that was another dose of fresh air

2) In the days that followed (at the other end of town) the energy users attending were at the very pointy end of this same question, sharing their own lived experiences of:

(a) how much energy prices actually paid had grown significantly in recent years; but also

(b) how attempts to procure contracts into the future were proving challenging.

Unfortunately no matter how many times the ALP repeated ‘cheapest form of energy’ as a slogan in the leadup to the election, energy users are living the experience of costs going up…

Coal, as ‘the elephant in the room’?

I’d already written with respect to ‘Speaking about Coal?’ at the CEC event of a month earlier in Sydney … comments still relevant at this (unofficial) Energy Week.

Given that we’d all just come off a thumping win by the ALP at the Federal Election, there was some atmosphere of optimism (particularly at the CEC event) in relation to the energy transition.

However, I found it particularly informative to listen in at the EUAA conference …

1) and in particular to the session titled ‘An update on the Engine room of the Energy transition’ where there was notably a pretty large disparity of views (even amongst members of the panel) about when coal will be substantially gone from the NEM:

(a) One of the panel members (can’t recall who specifically, from a network company) made some comment along the lines of ‘most coal gone by 2030’ …

(b) but this was met by strong disagreement from Richard Wrightson from Delta Electricity:

i. Who is CEO of Delta Electricity, which is owned by Sev.en Global Investments (which is now also the 50% owner of Callide C, now out of administration); and

ii. who noted strongly that ‘coal will not be gone by 2030’, in part because (words to the effect of) ‘nothing’s been built yet to get rid of the services that Vales Point provides’ (i.e. speaking back to Lens 4 here).

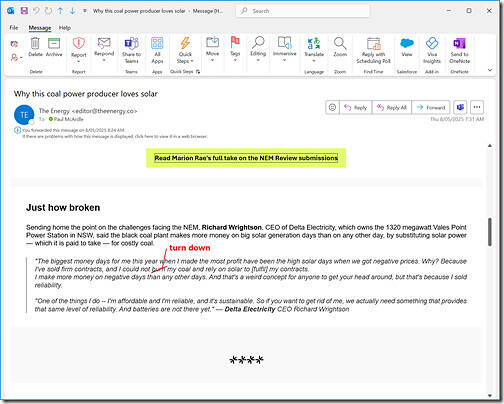

2) Richard Wrightson also made a comment about the difference between spot and contract that was written up in ‘The Energy’ newsletter the following day as follows:

Note that:

(a) I’ve tweaked the wording to (hopefully) make it clearer for readers, and might (time permitting) write a short little article as a follow-on to help illustrate…

(b) This also speaks back to what Anita Stadler wrote about in the topic of ‘The forgotten market and its critical role in Australia’s transition to clean energy’

i. … the focus on which also seemed to be missing at the CEC Onshore Wind event.

ii. which is a segue into …

… The need for (true) hybrids

This was discussed at the CEC event – such as in Jonathon Dyson’s presentation.

… though I also spoke to the need for fully Scheduled (VRE+Firmed) Hybrids to quickly become the default mode of deployment of more large-scale VRE in answer to a question from the floor at the EUAA Conference:

1) Readers here will recall we’ve been seriously wondering whether ‘the Semi-Scheduled Category is sustainable, or scalable’ for many years now, such as in GenInsights21.

2) More about that soon…

The key point to understand is that accelerating the development of fully-scheduled hybrids:

1) Yes, is clearly about capacity development (i.e. in terms of the types of kit we have on the ground);

2) But it’s also about capability development (i.e. in amongst all the organisations working to deliver the change-out of plant mix, and operational capability, in the energy transition). To paraphrase from James Tetlow’s analogy…

(a) We need many more organizations equipped to fly planes, with the full gamut of responsibilities that this entails that are critical to the energy transition….

(b) Rather than the many organizations currently geared only to fly gliders.

More about the Nelson Review

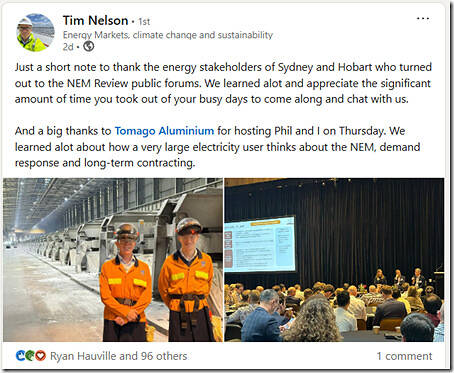

During that unofficial Energy Week, Dan noted here about developments on the Nelson Review:

1) The release of the many submissions made to the review; but also

2) Forums being held during May in the NEM Capital Cities:

(a) though strangely not Canberra?!

(b) and Tim Nelson has since noted that the forums in Sydney and Hobart have already come and gone:

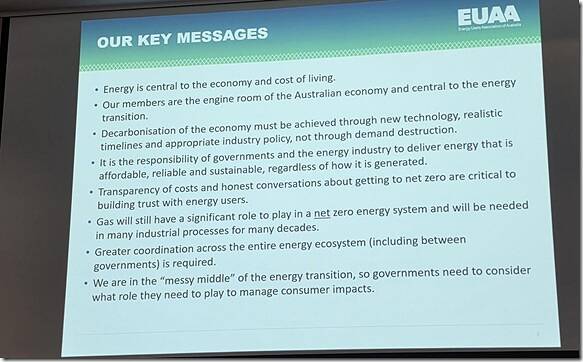

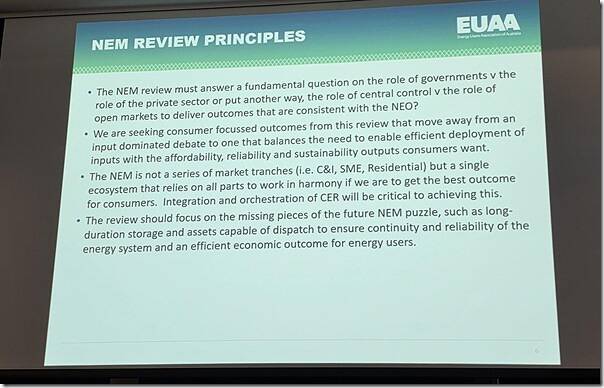

But back on the Wednesday 8th May we had the opportunity to hear from Phil Hirschhorn from the NEMreview panel who provided an update a month after I’d heard from Tim Nelson at the CEC’s CEIF in Sydney.

There were some Key Messages here that would have resonated with the EUAA audience:

… and also in these Principles:

I spoke with Phil afterwards with some suggestions, and undertook to share more here soon.

Why do the consultants get it so wrong?

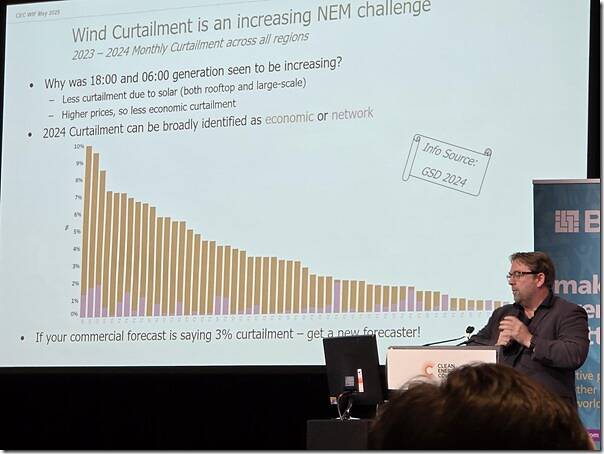

Also noted in Jonathon Dyson’s presentation was that curtailment rates of Wind Farms have been (in some cases) much higher than initially factored into business case assumptions prior to FID:

In response to the final line on the slide above (which also made it here on LinkedIn on the day, and which utilises data from the GSD2024), I noticed a question pop up on the Q&A app that the CEC was using, as seen here:

This is one that was not asked in the panel session (unless I missed it) but which we might take a stab at answering (in more detail) in a follow-on article on WattClarity at a later point in time. But let’s start by noting that there may well be two different factors involved:

Factor #1) Modelling is complex

There’s a growing collection of articles collated under the heading ‘About Market Modelling’ on WattClarity that speak to some of the underlying complexities of modelling. Specifically in that list:

(a) I’d point back to the article ‘Forecasting is a Mug’s Game’ from December 2016 that is still very relevant today; and

(b) Also worth highlighting that we invested time to write some thoughts on ‘What’s next for market modelling?’ as Key Observation #6 within Part 2 of GenInsights21 a couple years ago now.

… as one ‘for instance’ let’s note that (it’s my understanding that) the vast majority of modelling is still done at a 30-minute cadence, some years later:

i. despite the loose $billion we were required to collectively invest in migrating to 5MS (see Appendix 28) because it was sooo important that pricing reflect the more dynamic nature of supply-demand balance in this new world;

ii. yet in our collective wisdom we still think that 30-minute averaging within market models is enough?

Is it any wonder that some forecasts are pretty poor?

Factor #2) Bad news is not always welcome

Coupled with the above (and remembering the human nature in Flaw #3) we need to recognise that ‘bad news’, if delivered by a consultant (e.g. along the lines of ‘this project you’re looking to develop is not commercial’) is quite likely to be met by strong push-back, especially from developers who are more of the ‘get to FID and flip … to some poor schmuck who has the job of making it actually work’ model of operating.

So there might be pressure on the consultants used (e.g. in the choice of model, or input assumptions, or other levers) to deliver palatable news…

Discussions about Demand Response

The EUAA conference, in particular, included several different talks about different aspects of Demand Response:

1) I’ve noted above about how my brief presentation:

(a) touched on the AEMC review of the WDRM…

… including my wish that the AEMC review would help identify why the ‘rose coloured glasses’ expectation from several years ago (which was always wildly overly optimistic, in my view – and the view of others) held sway in making the rule in the first place.

(b) but focused mainly on the start of ‘A review of the traditional form of Demand Response’

2) In addition, we heard from several Energy Users directly about their journeys into Demand Response:

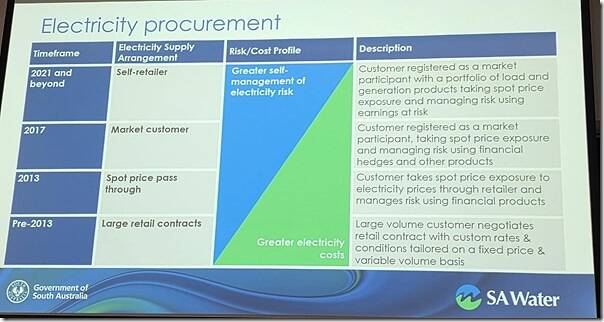

(a) We heard from Andrew Jackson at SA Water, who helped fill in a picture of how much further they have progressed since Robert May shared his thoughts via the article ‘Maximising the benefit of renewables with an intelligent energy management system’ in January 2021.

… including how their solar is switched off with negative prices (as a different flavour of aggregate Demand Response).

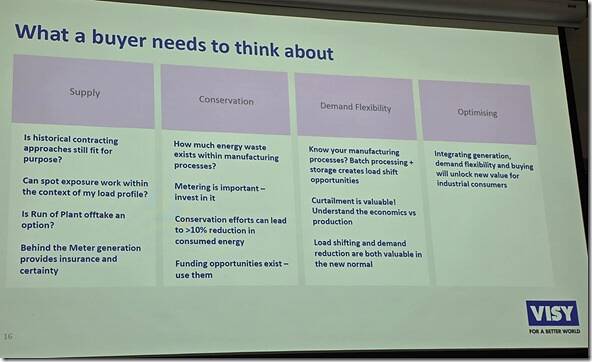

(b) We also heard from Ryan Santowski at Visy, who described some of their own energy journey (including with respect to Demand Response).

Time permitting, there’ll be more discussion about Demand Response here on WattClarity.

Data Centers

One of the DNSPs who spoke mentioned that they already had 750MW of Data Center load already connected to their network … when time permits, we’re going to take a broader look at the state of play in data centers across the NEM.

Information asymmetry

One of the comments repeated by energy users, particularly with respect to gas supply, is the large information asymmetry that exists across both ‘sides’ of an energy supply negotiation.

Averages are less, and less, useful

This was a comment made across the week (including at both events) by various people in different contexts:

1) At the CEC Wind Industry Forum, for instance:

(a) In the context of designing up a proper hybrid; and also

(b) It was mentioned in the context of ‘System Normal is less and less normal’

i. … in relation to the increased incidence of Network Outages and their outsized impact on dispatch, curtailment and price patterns.

ii. which is part of the reason for the AER decision to suspend MIC inside of STIPS

iii. and is another part of the answer to the ‘why do consultants get it so wrong?’ question above.

(c) It was also mentioned in the context of the number of interventions now used … now ‘up to almost five a day’, as Linton wrote.

2) But also at the EUAA with respect to security of supply concerns (in electricity and gas).

That’s the much more variable environment we’re moving into….

… and a dose of magic Pixie Dust?

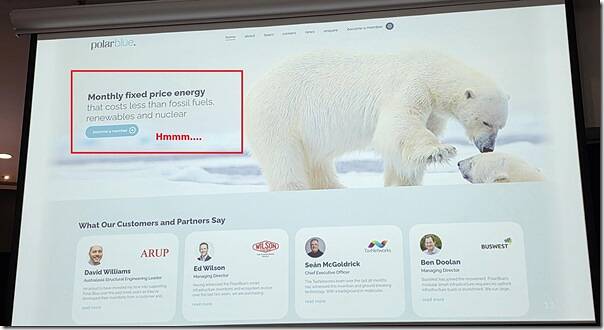

Can’t close this out without mentioning the ‘interesting’ announcement by Ed Wilson (of Wilson Transformers) during his presentation of the launch of a new business, Polar Blue, that has made some pretty big claims, highlighted here:

… and with an interesting team line up:

But what the heck is Polar Blue?

… I have no idea!

Worth noting that Ben Potter had written ‘Transformer maker pins future on big batteries and mystery energy company’ following the same presentation.

Leave a comment