Finally finding a bit of time to crunch some numbers for the GenInsights Quarterly Update for 2023 Q4* and I’m looking particularly how NEM-wide IRPM has performed across the Quarter, and trended over the longer term as well. This is part of what’s collated in Appendix 1 for 2023 Q4.

* yep, we’re starting this process much later than we had hoped!

Those unfamiliar with Instantaneous Reserve Plant Margin as a measure of the balance between supply and demand should note that:

1) High percentages indicate plenty of surplus across the NEM … which should mean quite low (increasingly negative) prices; whereas

2) Lower percentages mean tight supply-demand balance, and hence likely to be high prices across most (if not all) regions.

(a) A general rule of thumb is that under 15% provides a good chance of volatility across multiple regions.

… some specific articles referencing ‘low IRPM’ are tagged here.

(b) In these Quarterly Updates we take a look at instances under 20%.

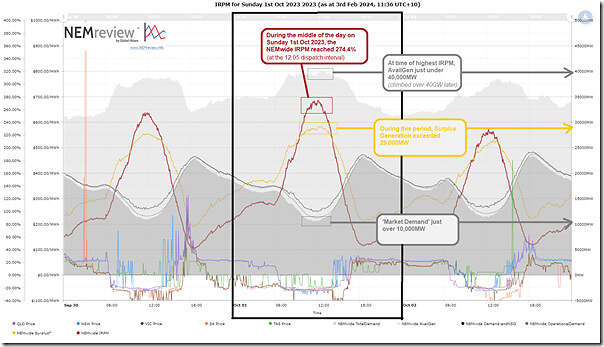

In this brief Case Study I’m just going to post this snapshot focused on a trend of IRPM across the day on Sunday 1st October 2023 (i.e. first day in Q4), with the days either side included for a bit more context.

This chart has been produced in NEMreview v7 … clients with a licence to the software can open their copy of this query here.

The highest point in the day (274.4% at 12:05 NEM time ) is an extremely high level … refer the GenInsights Quarterly Update for 2023 Q4 for more context.

Be the first to comment on "Sky-high IRPM in the middle of the day, Sunday 1st October 2023"