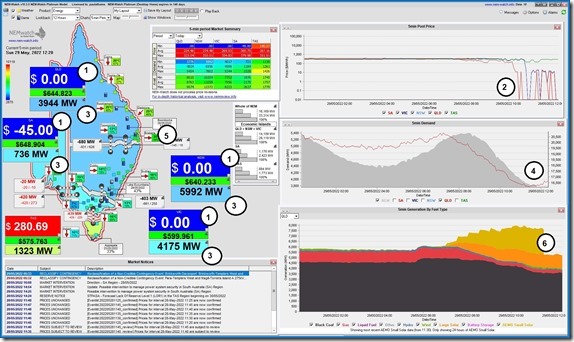

Given the amount of discussion about high electricity and gas prices (wholesale spot, wholesale contract and retail) in the media and on social media in recent weeks and months, it’s worth posting this snapshot from NEMwatch at the 12:20 dispatch interval today:

With reference to the numbering on the image:

1) Spot prices in QLD, NSW, VIC and SA are all at $0/MWh or below … which (as I noted on Twitter and on LinkedIn earlier) seems to have been ages since I’ve seen something like this!

2) We can see that the price drop occurred first in QLD from 10:15 (i.e. first DI below $100/MWh) – with NSW and VIC and SA following later … but this means it’s a couple hours elapsed with prices in the blue zone at the time of writing.

3) Another thing to note (and one of the drivers of the lower prices) is that the ‘Market Demand’ for the mainland regions is coloured down in the ‘blue zone’ in the mainland regions.

4) The QLD region is perhaps the ‘bluest’ in terms of its historical range:

(a) At 11:25 this morning, the QLD ‘Market Demand’ hit a low point for the day (at least thus far) of 3,776MW

(b) This level is ‘only’ 104MW above the all-time ‘normal time’ low point (3,672MW) set on 3rd October 2021:

(c) see all the records in this table updated to the end of October 2021 …

(d) … if memory serves me correct, I don’t believe anything has gone lower since that time.

5) One of the main reasons for this, I suspect, is the ‘goldilocks-like’ temperature in the middle of the day in Queensland

(a) not hot enough to drive space cooling, and not low enough for space heating requirements.

(b) meaning lower ‘Underlying Demand’

6) Couple this with over 2,000MW of rooftop solar injection and we see two big reasons for low ‘Market Demand’

(a) This rooftop PV is supply that AEMO can’t ‘see’ in real time (i.e. it’s behind the wholesale meters)

(b) It subtracts off ‘Underlying Demand’ to give us ‘Grid Demand’ (which is eaten into further by other factors to give us ‘Market Demand’ )

A big question, obviously, is how long-lived this pricing reprieve will be…

Be the first to comment on "A (temporary?) reprieve from the incessant high prices on Sunday 29th May 2022"